Your end-to-end solution for DAC7 compliant payouts

For online platforms with hundreds or thousands of non-employee sellers, complying with ever-changing global tax regulations can be challenging at scale.

Trolley’s DAC7 Compliance product is an all-in-one solution to maintain continual compliance when paying EU-based sellers. Collect tax information, make regular payments, and generate EOY reports ready to submit to authorities in any of the 27 EU member states.

Key features of our DAC7 compliance product

Get Compliant with the EU's DAC7 Regulation in Minutes

Avoid the major data-management processes expected when reporting end-of-year seller data.

Trolley offers a 100% DAC7-compliant solution for platforms based in the EU and those who are paying EU-based sellers. Capture seller data during onboarding, attach activity data with every payment, and then generate the required XML submission file in just a few clicks at the end of the year.

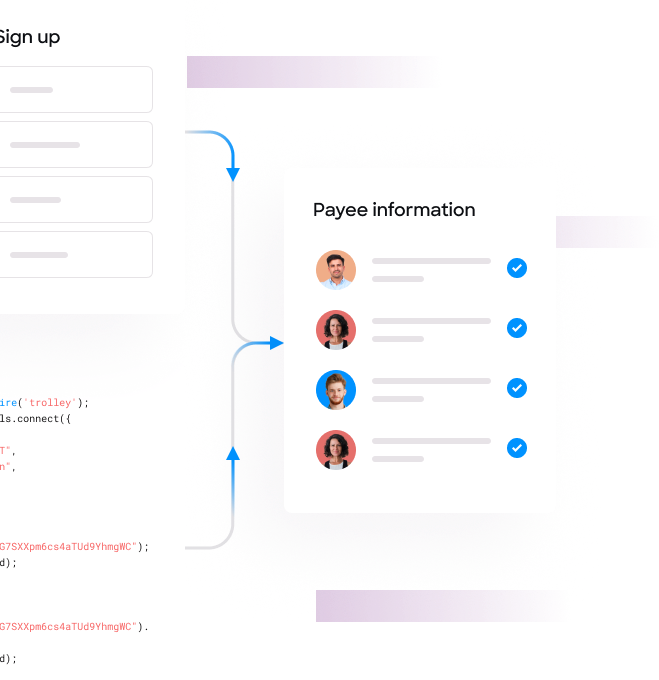

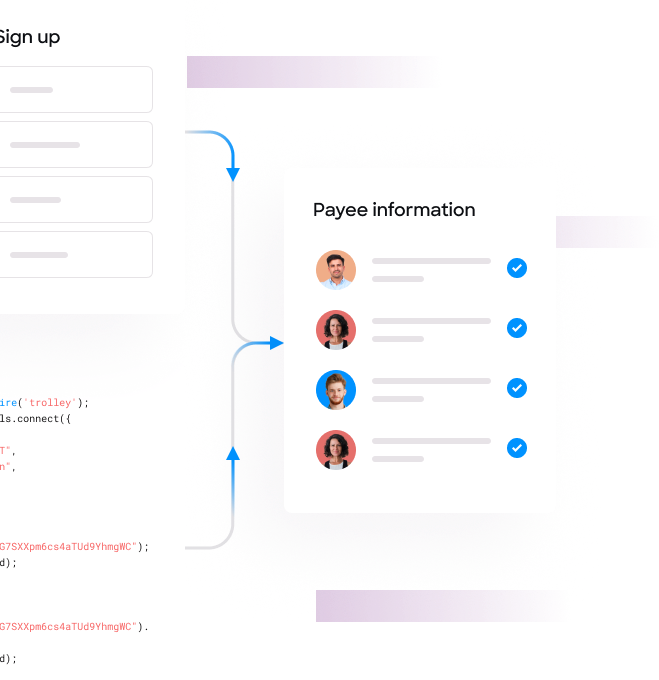

Seamlessly Build DAC7 Data Collection into Onboarding

With Trolley, it doesn't matter which country you or your sellers operate in, because we collect all the information required for DAC7 compliance during our exceptional recipient onboarding process.

As your sellers jump onto your platform for the first time, we securely collect all necessary tax ID, location, and banking data, making sure they're ready to be paid, and you have what you need for proper EOY filing. All this is deployed 100% branded in your company details, so you can take full credit with Trolley under the hood.

Generate EOY Reporting Files in Minutes, Not Weeks

The average tax/finance team needs to dedicate 4 full weeks to generate end-of-year reports.

With Trolley's Tax product, replace complicated manual processes, programming of XML reporting files, and/or form filing with a single tool.

- Support for all four income generating activity types reportable under DAC7: Sale of Goods, Provision of Services, Sale of a Means of Transportation, and Property Rental

- Set payments as taxable or tax-exempt when creating tax records for each payment

- Easy end-of-year report generation, and tax statement production for your sellers

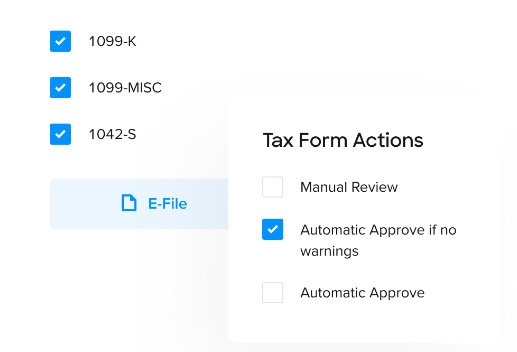

Stay Compliant With US Regulations

Trolley can also help you manage taxes and comply with the IRS's regulations on contractor, non-employee, royalty, and other forms of income. Streamline supplier tax onboarding (W-9 & W-8 BEN) and filing (1099 & 1042-S) with automated form collection, validation, withholding calculations, payouts, and year-end tax reporting.

More DAC7-related content to explore

Nov 2023 Update: 1099-K, ID Verification, Migration Toolkit, & more

Tax Break – Volume 002: Finding a Trusted Tax Compliance Partner