Accurate, automated 1099-K filing

Transform the challenging task of 1099-K compliance into a manageable, efficient process for your teams. Trolley manages all your recipient, payout, and tax data from a single platform, allowing teams to focus on strategic initiatives instead of year-end tax scrambles.

Effortless 1099-K reporting for growing online platforms

Trolley offers a streamlined, automated solution for 1099-K production and distribution that reduces the operational complexity of these new reporting requirements. By automating data collection, validation, and form generation, Trolley helps businesses meet compliance deadlines effortlessly, and seamlessly scales with you as the volume of forms grows alongside your business.

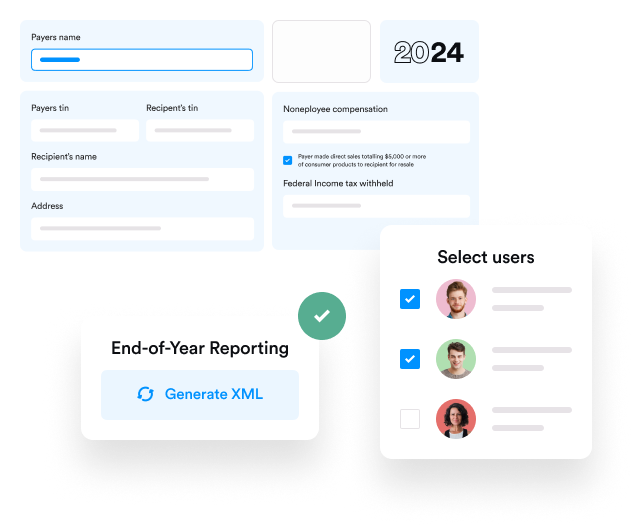

Automate your 1099-K reporting process

Trolley automates the production, validation, and e-filing of Forms 1099-K, ensuring accuracy and compliance with IRS mandates. Seamlessly handle transactions at any scale, whether processing tax forms for hundreds or hundreds of thousands of recipients

Stay ahead of changing regulations

Effortlessly manage high volumes of 1099-K filings with Trolley, even as new reporting thresholds come into effect. Our platform adapts to IRS changes, helping you stay compliant and reduce the risk of penalties.

Streamline seller data collection and form distribution

Trolley simplifies the seller onboarding process by capturing and validating all required info upfront when sellers join your platform. With payments tied to accurate data, the generation and distribution of year-end forms becomes even easier, reducing your workload and ensuring accuracy.

Integrated compliance for online platforms

Trolley effortlessly plugs into your existing systems via powerful APIs and developer-friendly tools. Our scalable solution grows with your business, keeping you ready to face new reporting and compliance challenges as they arise.

Unlock more than just 1099-K See what else Trolley Tax can do

Digital W-8 & W-9 collection and earnings allocation

- Securely collect and store Forms W-8 and W-9 following IRS requirements.

- Validate TINs including SSN, EIN & FTIN.

- Every three years, W-8 forms expire, and a new one is automatically requested.

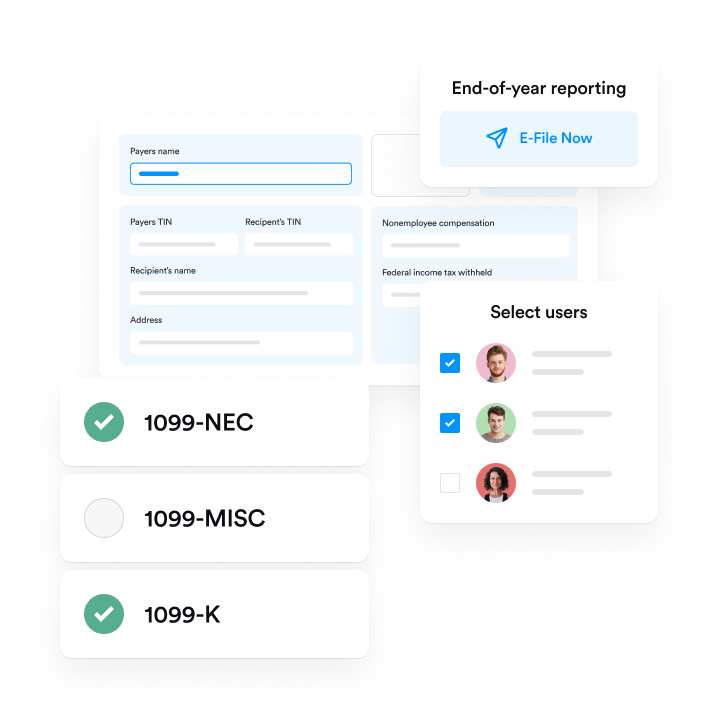

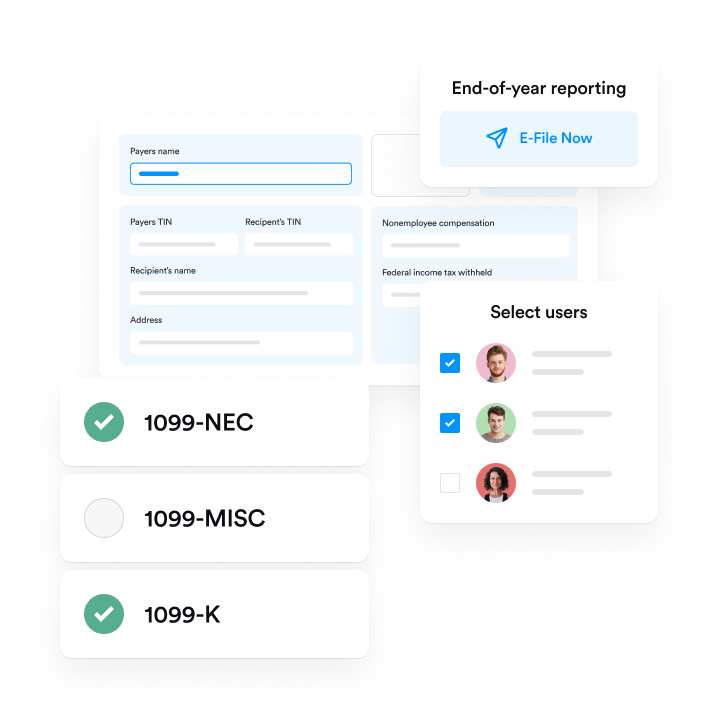

1099-NEC & 1099-MISC: Comply with the IRS’s regulations for various types of work

- Generate and file Forms 1099-NEC for nonemployee compensation, including payments to independent contractors, consultants, and freelancers.

- Manage high volumes of Form 1099-MISC for royalties, insurance, medical, and other payouts.

1042-S: Stay compliant for non-US contractor payments

- Automate the correct tax withholding rates based on W-8 info and relevant tax treaties

- Prepare and distribute 1042-S forms to recipients, no matter which country they reside in

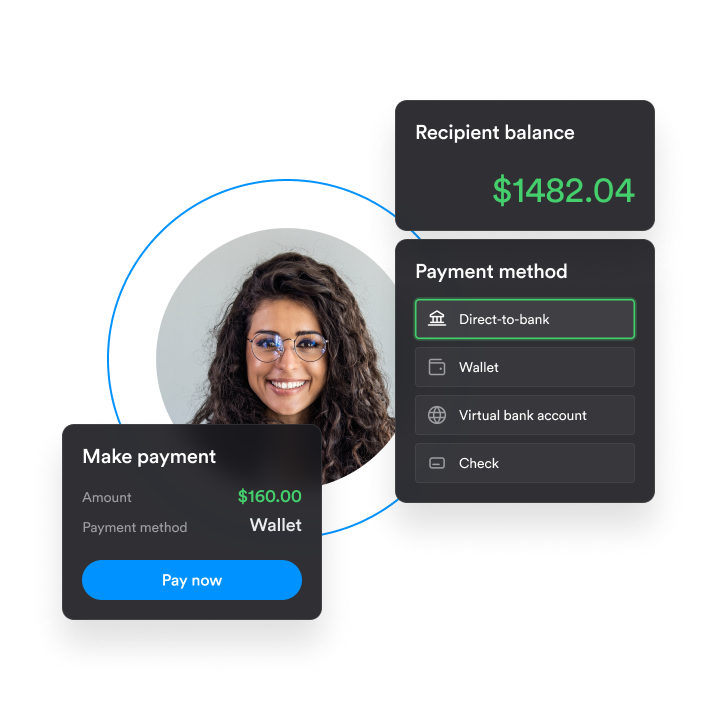

An all-in-one payout solution for the internet economy

- Send same-day domestic payouts via ACH transfer, PayPal, and Vemno

- Make global payouts to 210+ countries and territories.

- Built-in identity verification, KYC, and fraud prevention.

- Sync data with your ERP and other tools.

Ready to simplify your 1099-K process?

Book a call to see how Trolley can transform your tax season.

- 1099-K walkthrough: Explore Trolley’s end-to-end solution and seamless integration.

- Tailored insights: Address your specific challenges in contractor payments and tax filings.

- Scalable solution: Learn how Trolley adapts to your growing business needs.