Pay your recipients, anywhere

Fast, efficient, automated payouts

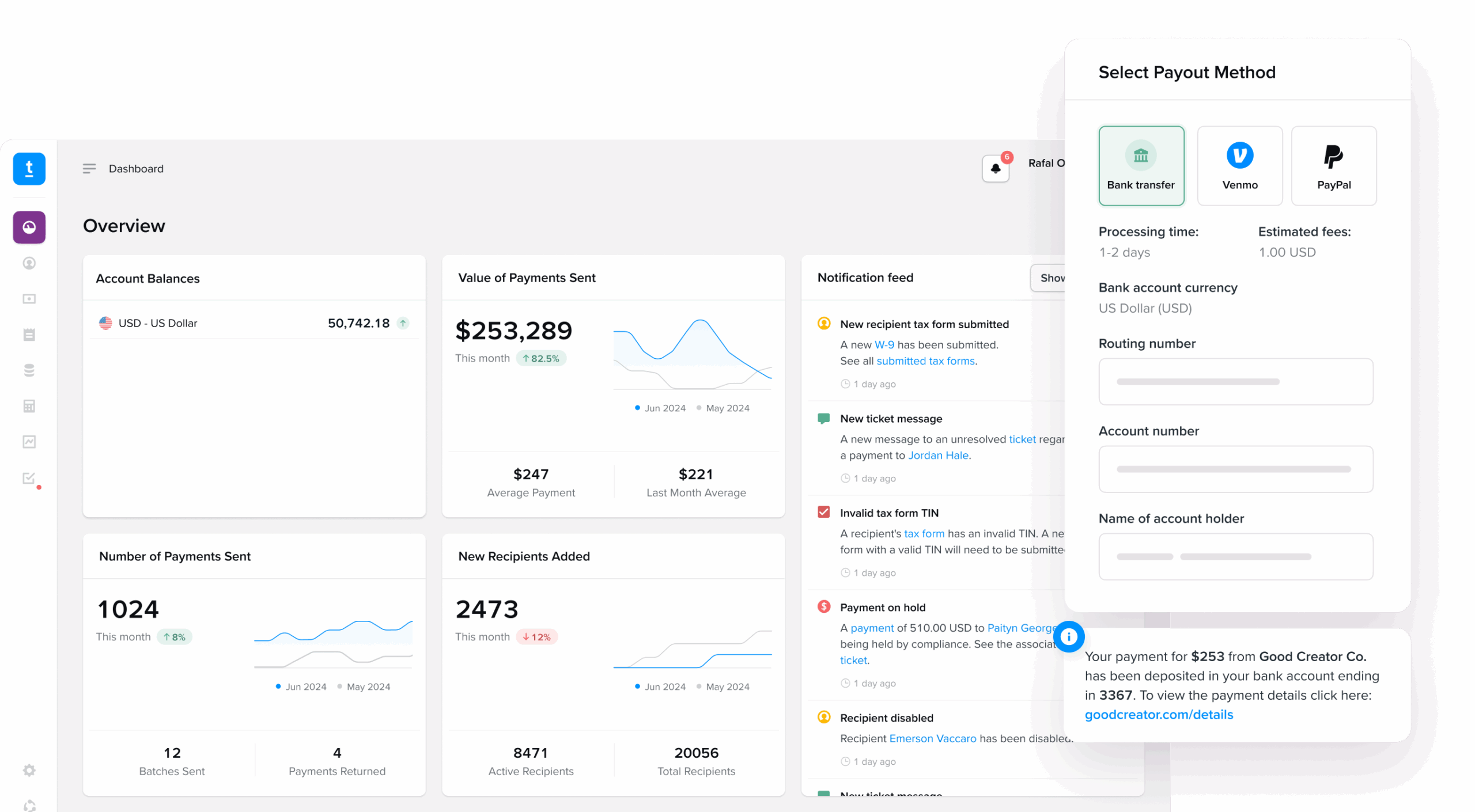

Trolley is a modern payouts platform designed for the internet economy. One set of integrated tools offering end-to-end payouts automation.

End-to-end payouts automation

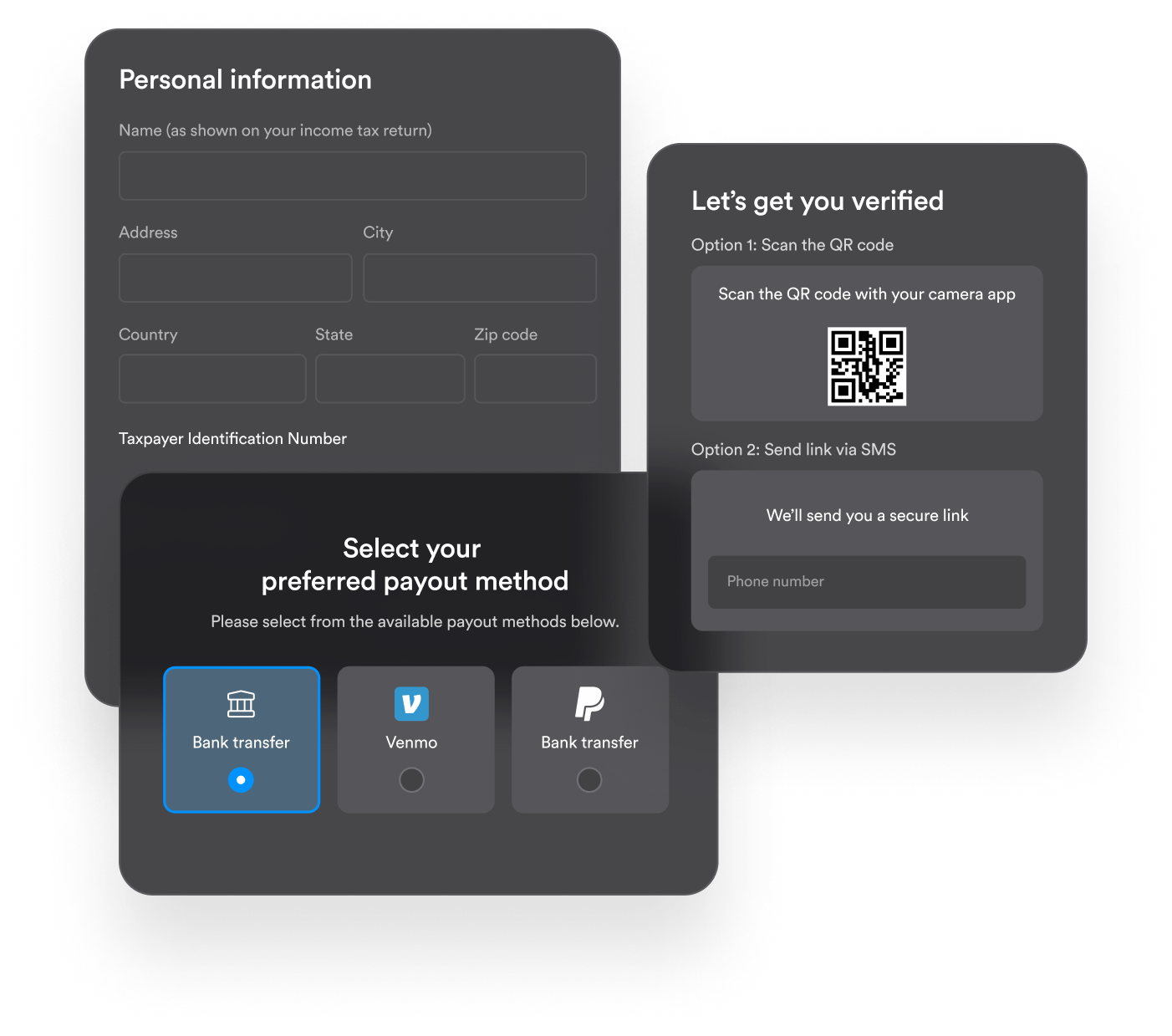

Verify identity and build a best-in-class recipient experience

Streamline onboarding, KYC compliance, and automate communication to recipients with a self-service, white-label solution.

- Verify recipients identity and collect government IDs digitally

- Comply with KYC in 210+ countries and territories

- Efficient, secure bank and tax information collection

- Automated payment status, tax form updates and notifications

- Out-of-the-box support for 36 languages

- Simplified recipient dashboard with real-time statuses

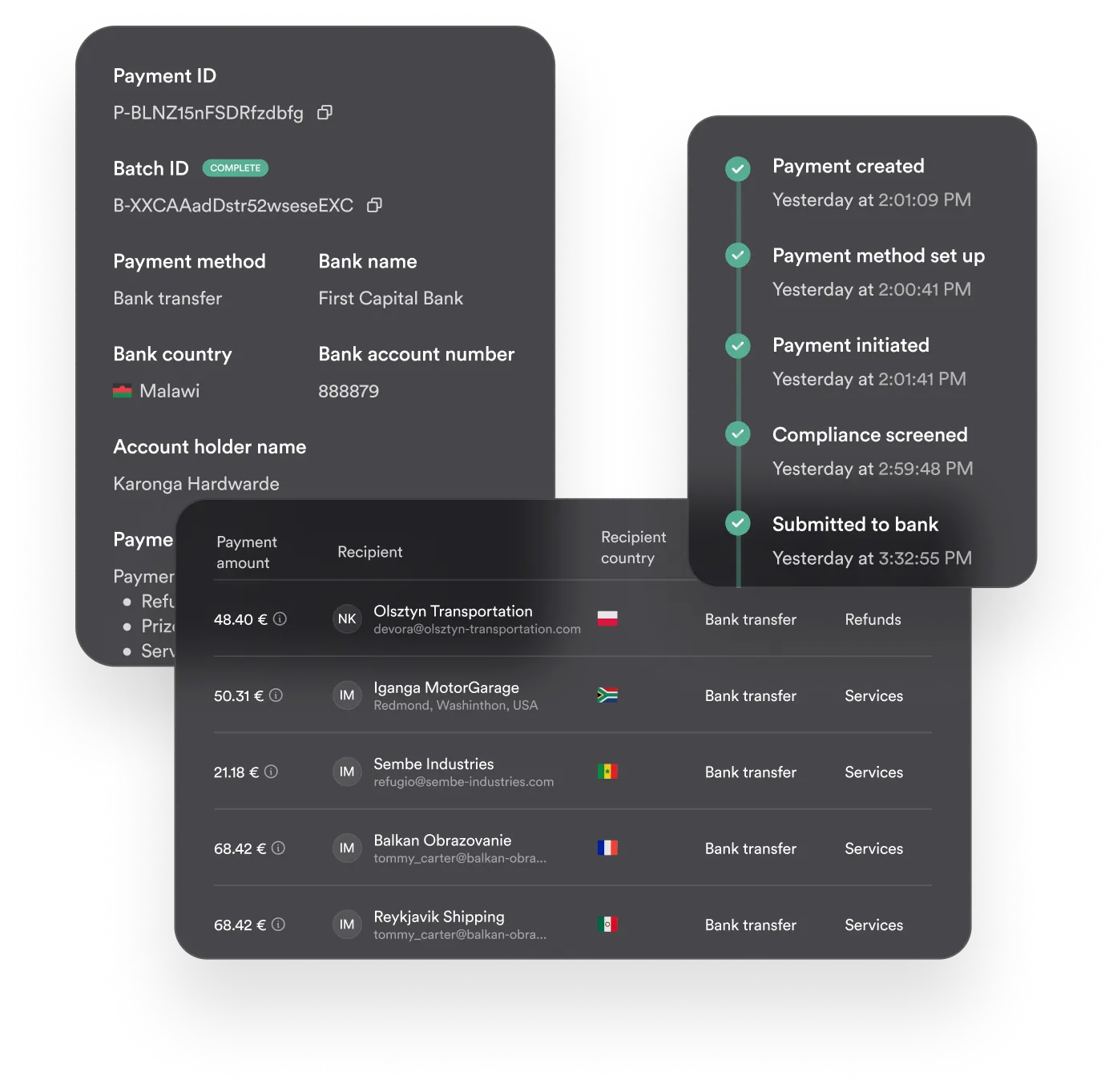

Quickly send payouts anywhere in the world

Gain access to one of the broadest global payment networks, offering flexible payout options to recipients, and making payouts faster than ever.

- Send funds to 210+ countries and territories

- Offer the payout methods your recipients prefer (including wallets, EFTs, local and international bank transfers, PayPal, Venmo, and more)

- Bypass fees from wallet services and intermediaries with direct-to-bank transfers

- Trigger payouts using API or send manually via dashboard and CSV uploads

- Automated handling of returned payments

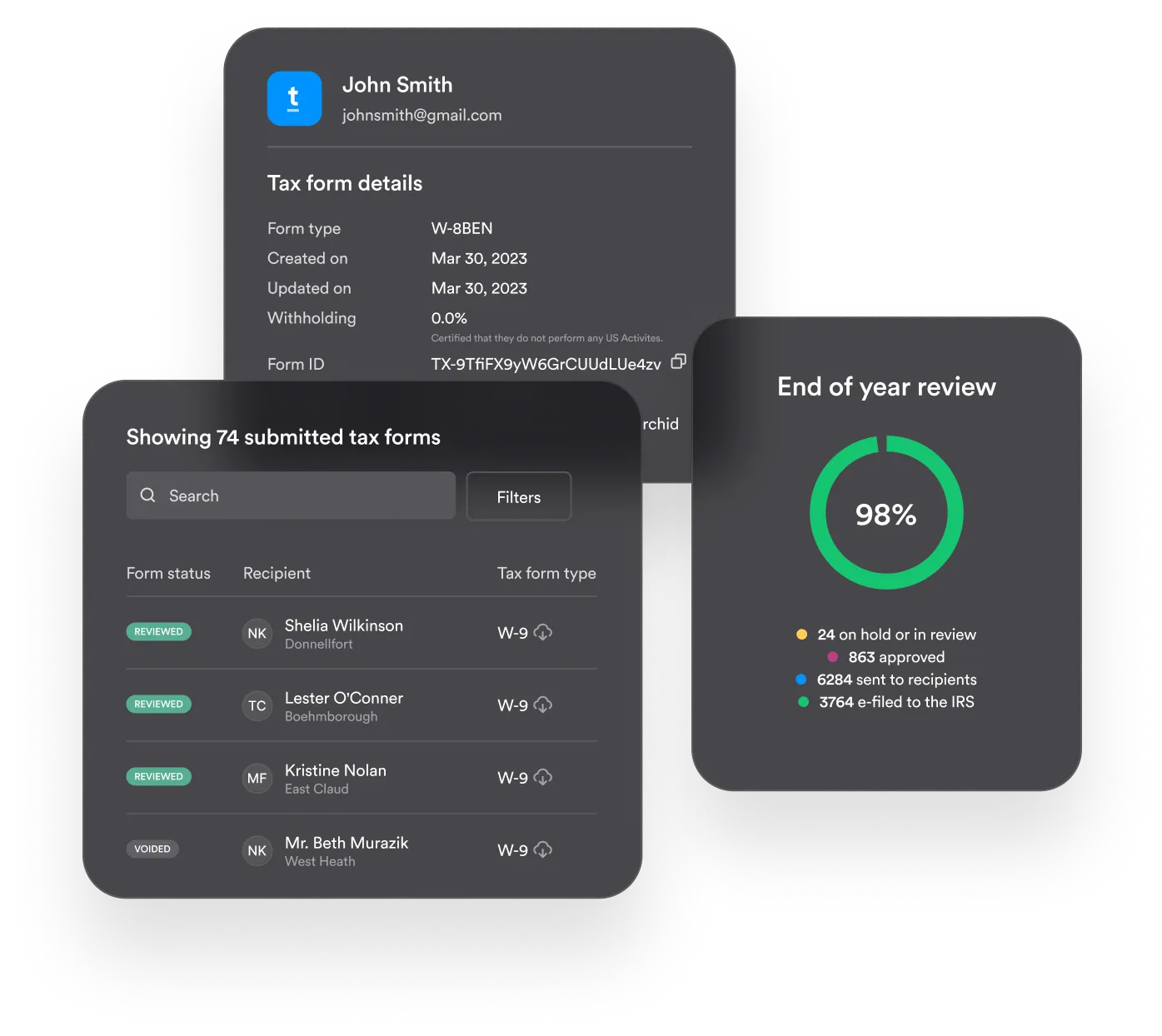

Simplified end-of-year tax filing

Close tax season in minutes. Replace weeks of recipient data collection, withholding calculations, report production, and rushed end-of-year statement generation.

- Secure and seamless all-digital collection and completion of information forms in a fully-brandable platform

- Automatic withholding (as necessary) based on tax treaty rules updated as regulations change

- Multi-jurisdiction support: IRS for US and DAC7 for 27 EU member states

- Support for multiple income types: services, rent, royalties, tax-exempt, etc

- Splitting and allocation of single payments across multiple income types

Sync your existing systems

Trolley’s built-in integrations reduce manual data reconciliation, prevent duplication errors and provide the visibility needed to make faster business decisions.

- Create bills and vendors automatically from within your ERP

- Mark bills as paid across platforms as payments are sent

- Full reconciliation with your accounting systems

- Connect with all your systems via our Zapier integrations

Build a powerful payouts stack

Build a tailored payout experience with Trolley’s ready-to-use API. Trigger payouts automatically, maintain up-to-date payout data in your platform, build self-serve capabilities for your users, or get to market faster with a ready-to-implement stack.

- Fully scalable and extendable to any/all payout requirements

- Employ our full range of dev-tool options (REST Payout API, JS Widget, Webhooks, Web Dashboard)

- Experiment in developer sandbox

- Supported by full API documentation

- Leverage curl, JavaScript, Ruby, PHP, Python, and C# SDKs

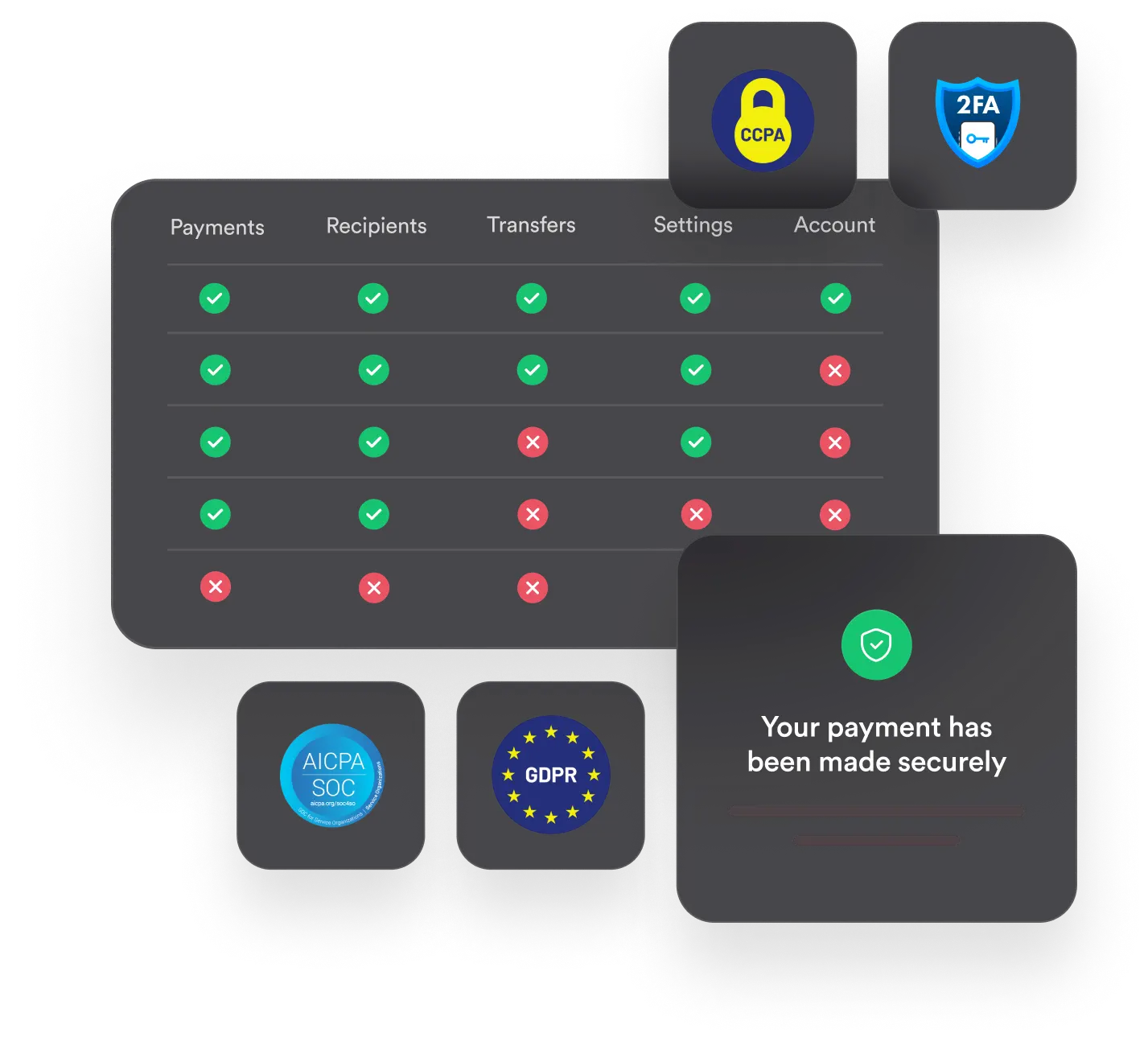

Trust & security baked in at every step

Sleep easy knowing we’re following the highest global standards for managing customer funds and data. Trolley operates with the utmost sensitivity and we are continuously optimizing our policies to understand and prevent fraud.

- A robust toolkit including global watchlists, risk scores, 2FA access, and user roles & permission management systems

- Bank-level security and encryption, tokenized data, and secure servers

- SOC2® Type II, GDPR, EU-US Privacy Shield, and CCPA compliant

- License coverage in the USA, regulated in Canada, UK, Australia, and New Zealand

End-to-end payouts stack

Powerful, ready-to-deploy dev tools and fully flexible APIs: the preferred choice of developers and product managers. Trolley can be integrated in your platform with one-line of code or with API-level-customization.

Our wins are measured in customer success

Finance, accounts payables, and support teams scale their operations globally with no additional resources. Trolley removes manual tasks, streamlines processes across teams, and centralizes recipient data and management with one end-to-end platform.

Renowned customer support

It's stressful when your money is in motion—we totally get it. Trolley's customer support team actually responds when you reach out and is ready to help resolve issues.

Take the next step toward payout automation

Book time with us for a personalized demo and answers to all your questions, or take our interactive product tour.