Transform how you handle 1099-MISC forms

Automate high-volume EOY filings and reduce compliance risks with Trolley’s seamless 1099-MISC solution. From royalty payments to legal settlements, healthcare suppliers to property management, streamline your operations and meet IRS requirements.

Implement an automated 1099-MISC processing solution

Trolley offers a complete 1099-MISC solution that reduces the operational load of end-of-year taxes across multiple internal teams. By automating data collection, validation, and filing, Trolley eliminates manual workflows, reduces errors, and gives you the confidence to manage high volumes of tax forms with ease.

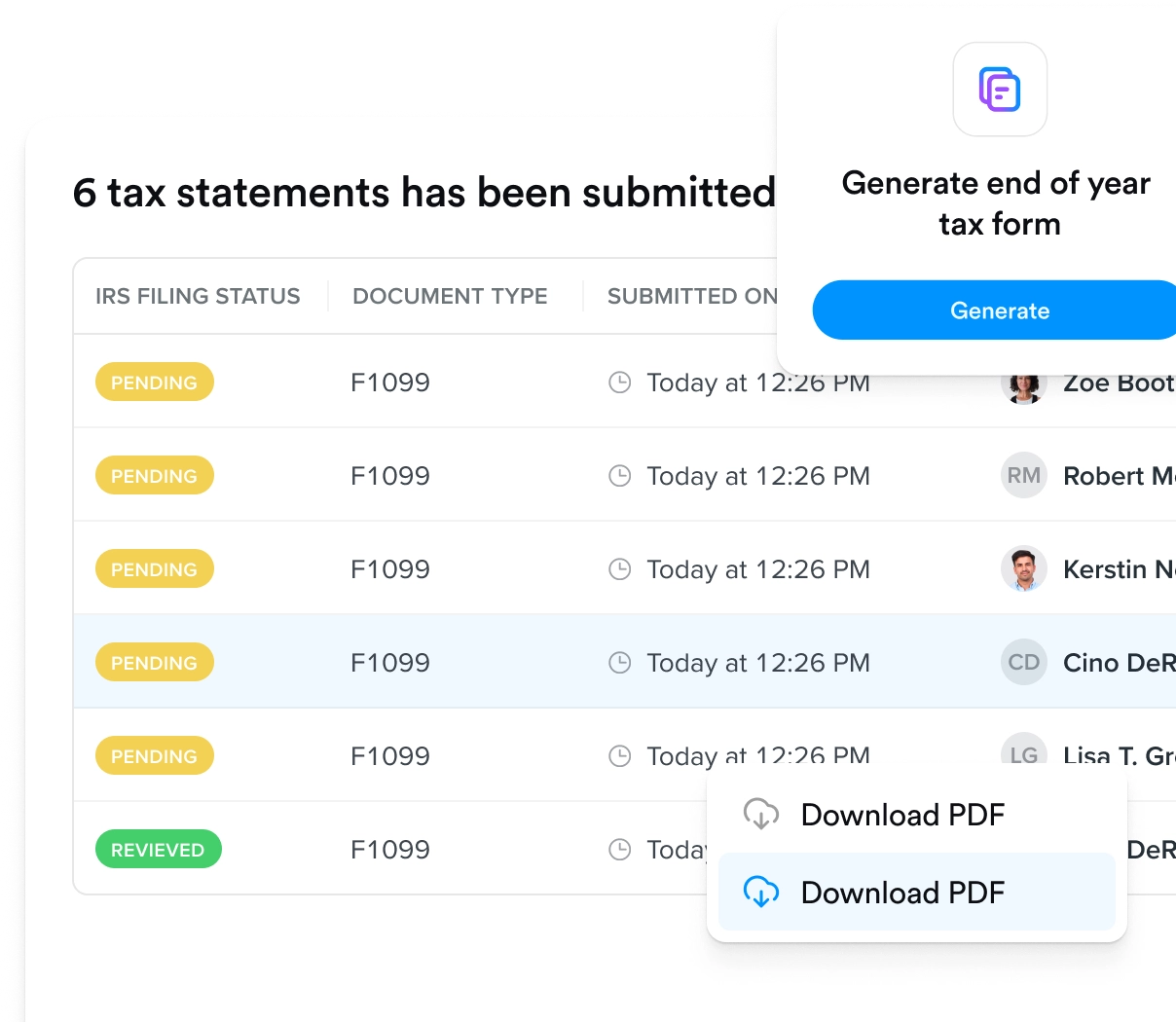

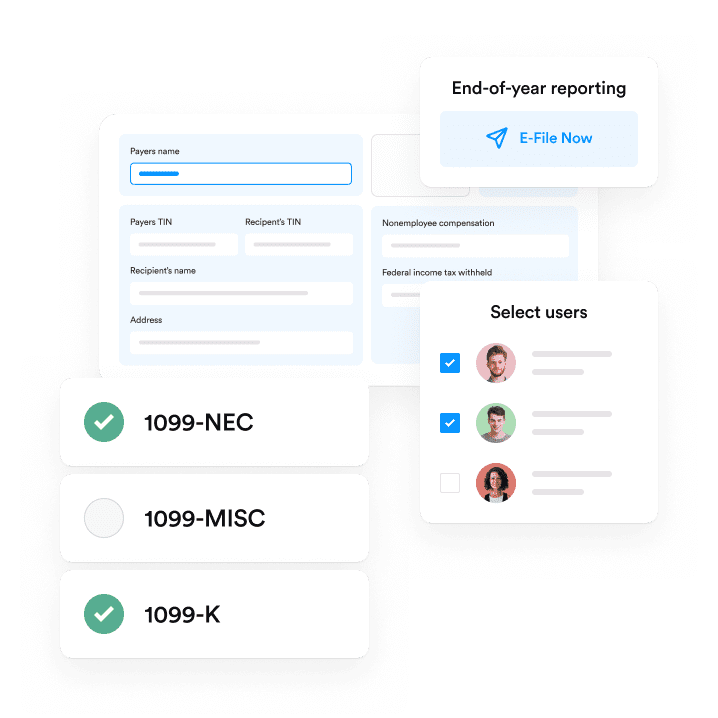

Automate your 1099-MISC workflow

Collect, validate, and e-file 1099-MISCs automatically, saving time and skipping the hassle of manual work. File for a handful or a few hundred thousand recipients via the same powerful platform.

Ensure compliance with IRS mandates

Easily meet new e-filing rules and manage low-threshold royalty payouts without breaking a sweat. We track the IRS’s changes and update our platform accordingly, reducing your compliance risks and helping you avoid penalties.

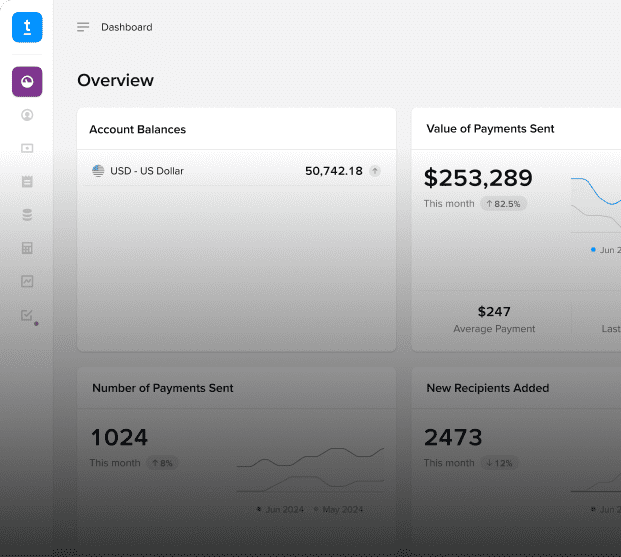

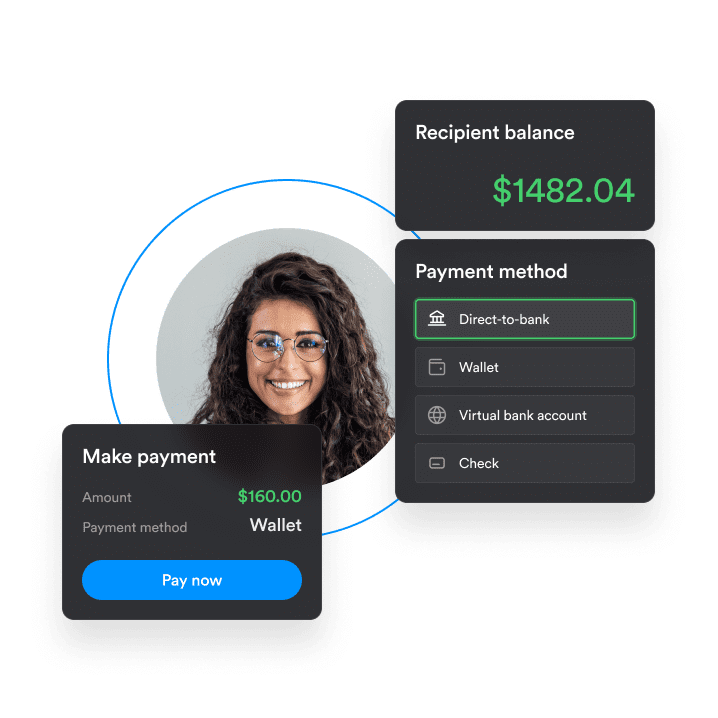

Track payments and stay organized all year long

Track payouts as they happen so you’re always ready for tax season—no last-minute scrambles or missing info. Tie payment purposes to each payout to ensure complete and accurate reporting when it’s time to file.

Streamline data accuracy and validation

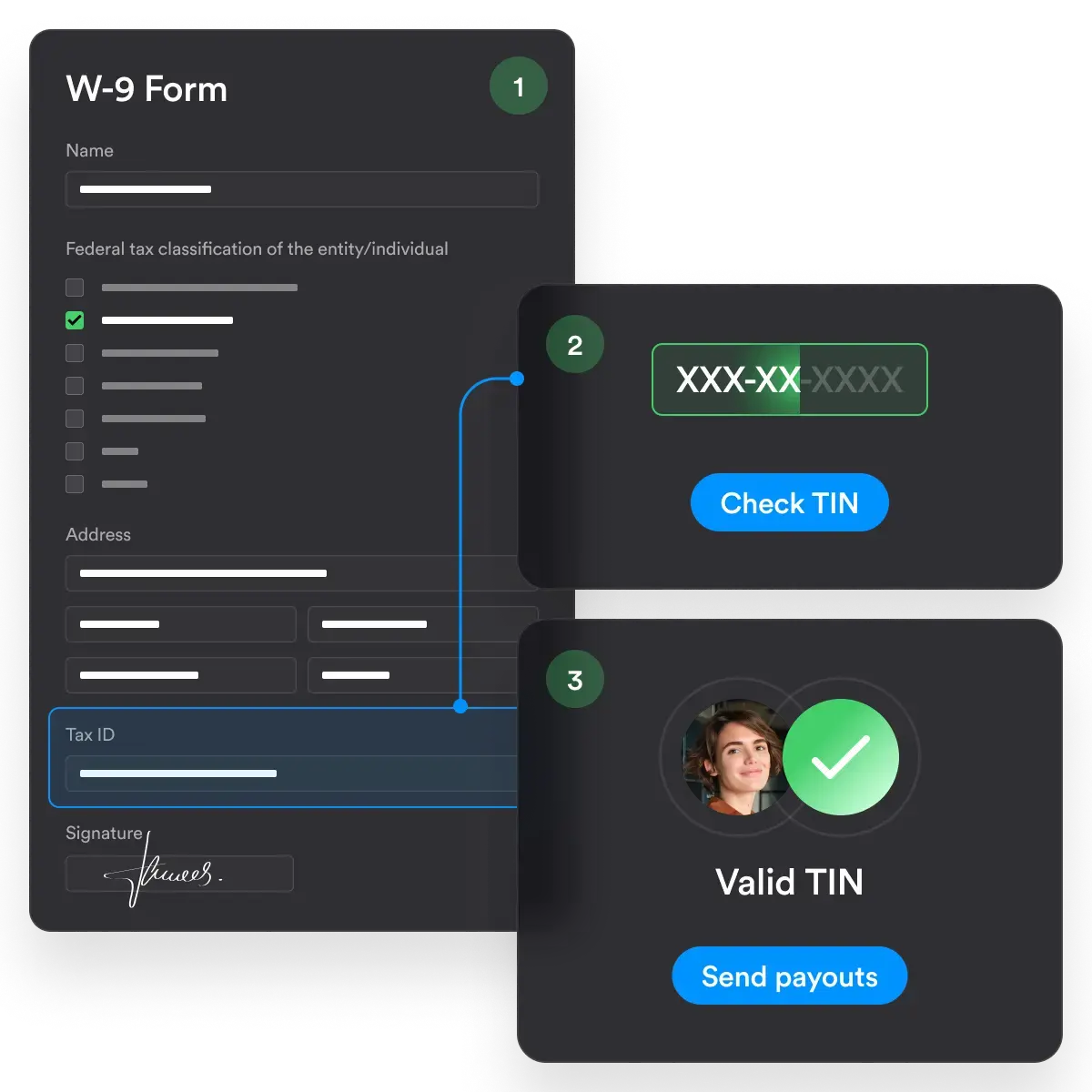

When recipients are onboarded with Trolley, we verify their information and run TIN validation checks, eliminating entry errors, reducing IRS notices, and saving time across teams.

Generate 1099-MISCs for Actors Attorneys Producers Consultants Songwriters Rightsholders Event Planners Recording Artists Real Estate Agents Healthcare Providers

Unlock more than just 1099-MISC See what else Trolley Tax can do

Digital W-8 & W-9 collection and earnings allocation

- Securely collect and store Forms W-8 and W-9 following IRS requirements.

- Validate TINs including SSN, EIN & FTIN.

- Every three years, W-8 forms expire, and a new one is automatically requested.

1099-MISC & 1099-K: Comply with the IRS’s changing thresholds

- Generate & file Form 1099-MISC for royalties, insurance, medical and other types of payouts

- Manage high volumes of Form 1099-K with automated onboarding, payment tracking, and EoY filing.

1042-S: Stay compliant for non-US contractor payments

- Automate the correct tax withholding rates based on W-8 info and relevant tax treaties

- Prepare and distribute 1042-S forms to recipients, no matter which country they reside in

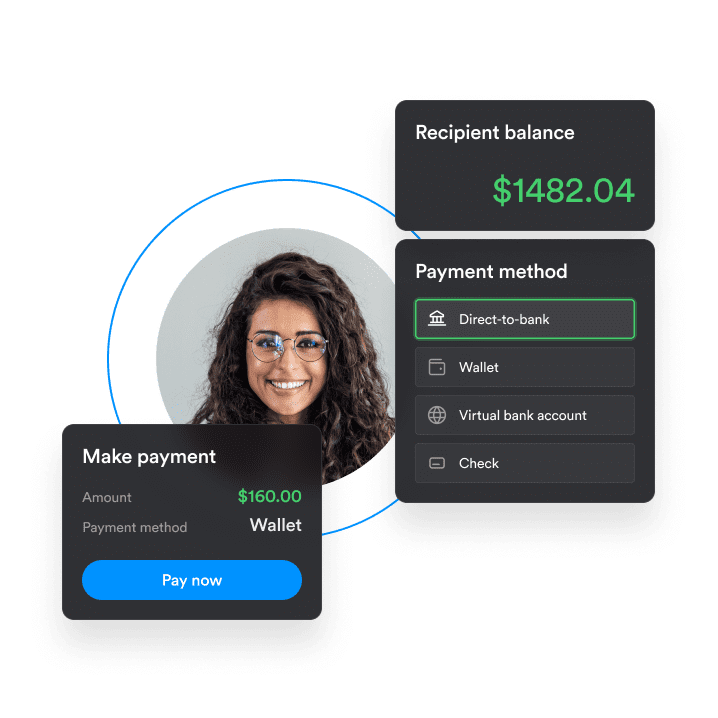

An all-in-one payout solution for the internet economy

- Send same-day domestic payouts via ACH transfer, PayPal, and Vemno

- Make global payouts to 210+ countries and territories.

- Built-in identity verification, KYC, and fraud prevention.

- Sync data with your ERP and other tools.

Ready to simplify your 1099-MISC process?

Book a call to see how Trolley can transform your tax season.

- 1099-K walkthrough: Explore Trolley’s end-to-end solution and seamless integration.

- Tailored insights: Address your specific challenges in contractor payments and tax filings.

- Scalable solution: Learn how Trolley adapts to your growing business needs.