1099-NEC Filing for Any Contractor Workforce

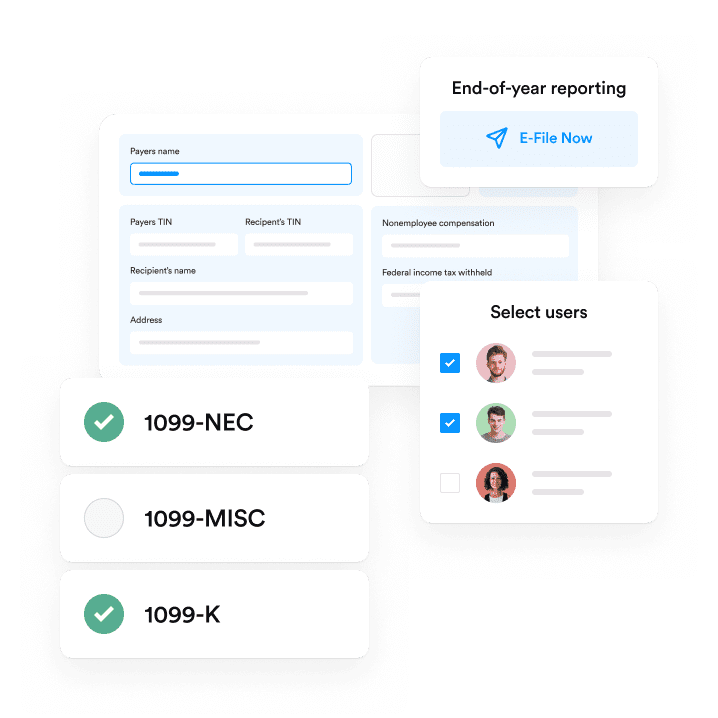

Streamline the 1099-NEC process: manage data, distribute forms, and e-file seamlessly within a single software platform built for all types of contract workers.

Everything you need for 1099-NECs, all in one place

No matter the type of freelancer or contractors you work with, Trolley simplifies the complex 1099-NEC process and reduces the effort as the reporting deadline approaches. In one platform we securely store tax and payment data, manage form distribution, and handle e-filing so your teams don't need to.

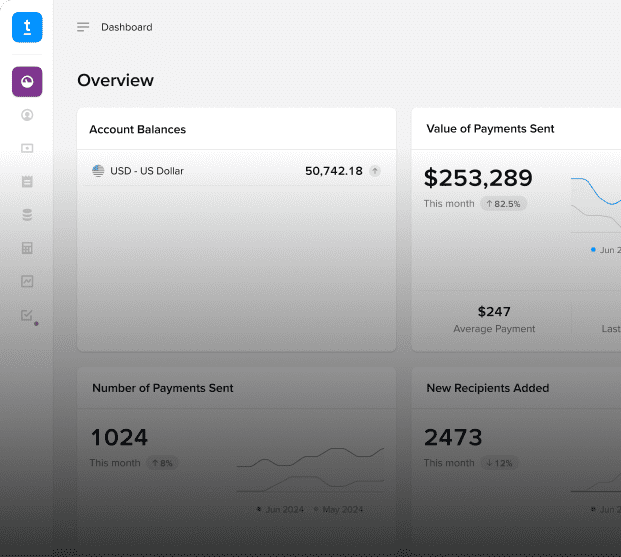

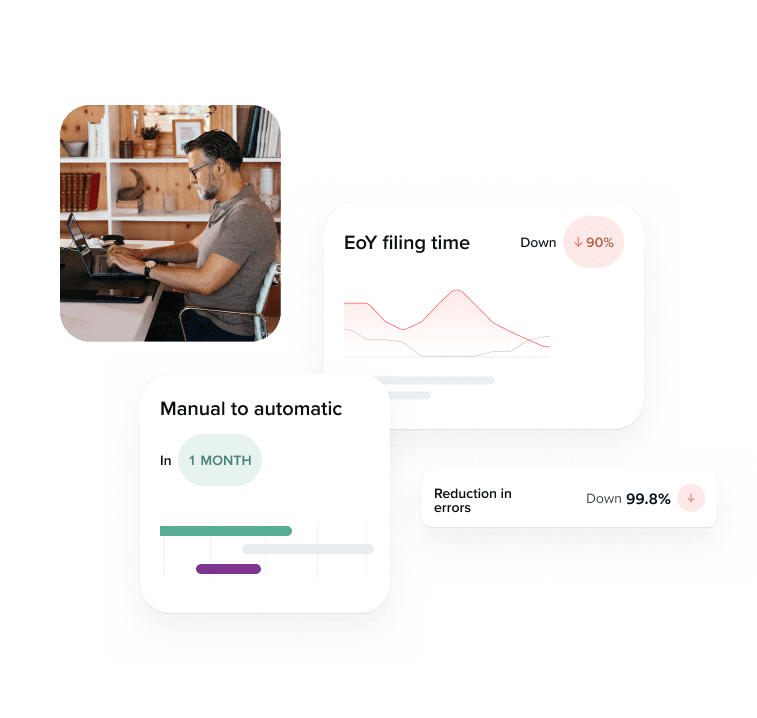

Reduce 1099-NEC time and effort at EOY

Import data once, then easily verify recipients from a shared dashboard. Approve forms with a click, automate distribution, and e-file directly with the IRS.

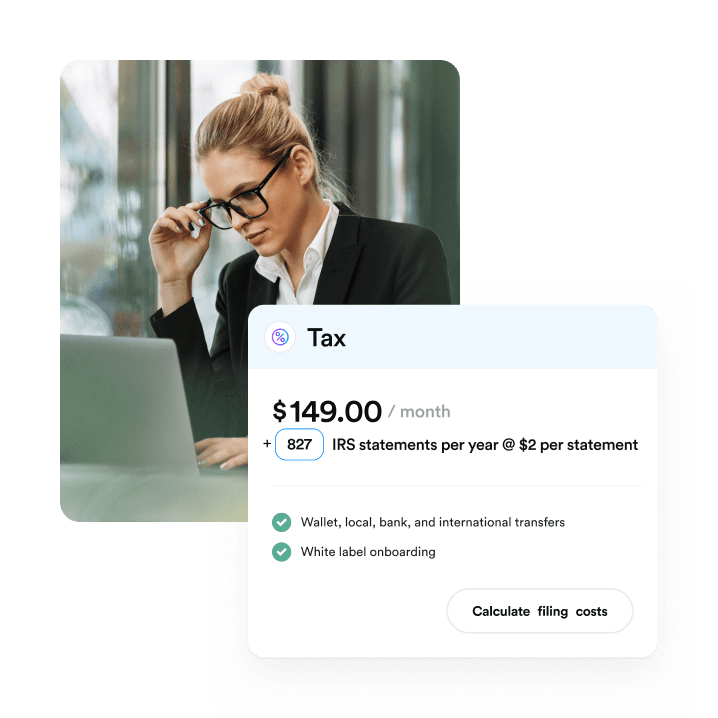

Save on fees with per-filing pricing

Price is based on active customers you're filing for this year—no extra fees for W9s, TIN validation, e-filing, electronic distribution or multiple users. If you need forms printed and mailed, you do need to pay for the paper and stamps.

Stay ahead of the tax curve

Trolley stays current, updating our systems with any changes to 1099-NEC regulations. Integrate with your existing systems one time, and we'll keep up to date from there.

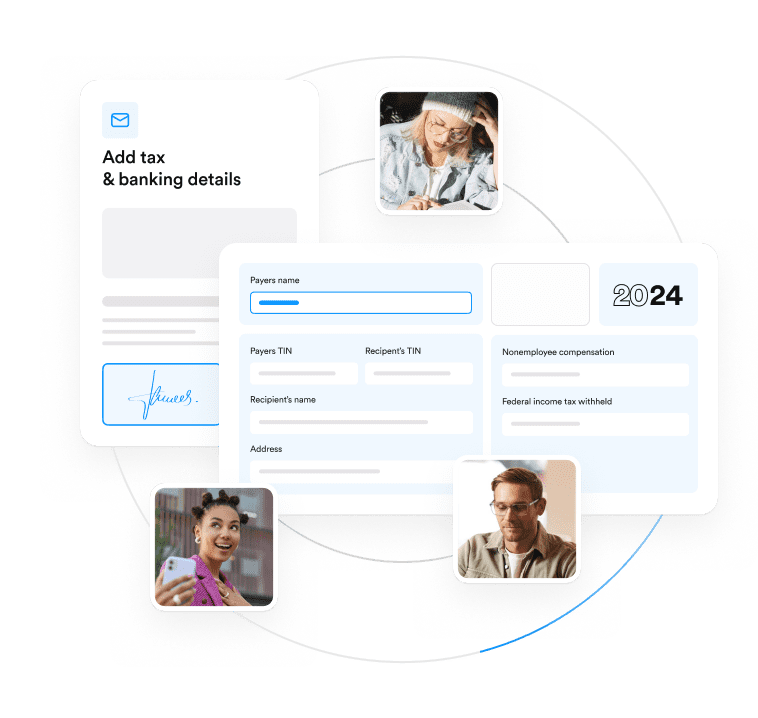

Integrate payouts for full automation

Adding Trolley Pay effectively removes any need for manual data collection and import, freeing up your teams to focus on more impactful work while 1099-NECs are being built in the background.

Our customers count on Trolley to handle 1099-NECs for Gig Workers Content Creators Event Coordinators Nurses Writers Doctors Hackers Musicians Therapists Influencers Translators Freelancers Contractors

Unlock more than just 1099-NECs See what else Trolley can do

Digital W-8 & W-9 collection and earnings allocation

- Securely collect and store Forms W-8 and W-9 following IRS requirements.

- Validate TINs including SSN, EIN & FTIN.

- Every three years, W-8 forms expire, and a new one is automatically requested.

1099-MISC & 1099-K: Comply with the IRS’s changing thresholds

- Generate & file Form 1099-MISC for royalties, insurance, medical and other types of payouts

- Manage high volumes of Form 1099-K with automated onboarding, payment tracking, and EoY filing.

1042-S: Stay compliant for non-US contractor payments

- Automate the correct tax withholding rates based on W-8 info and relevant tax treaties

- Prepare and distribute 1042-S forms to recipients, no matter which country they reside in

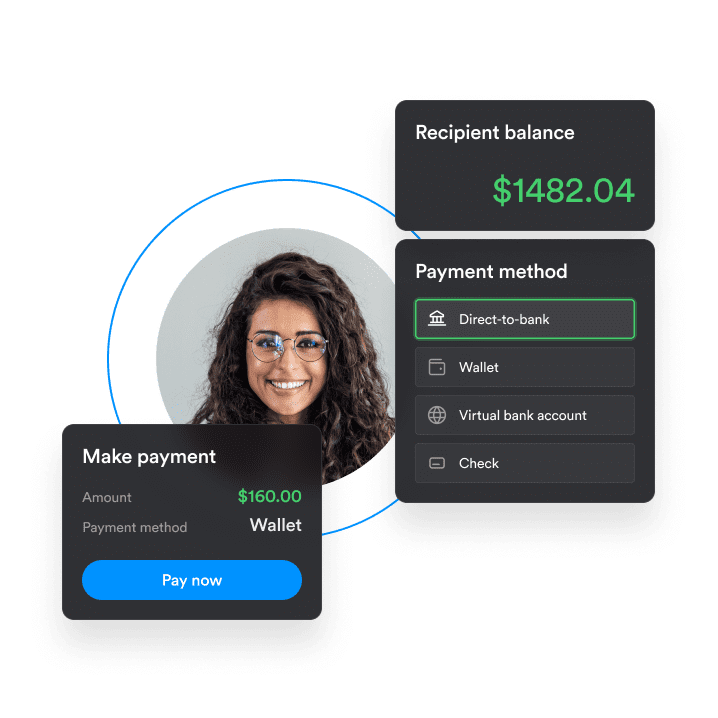

An all-in-one payout solution for the internet economy

- Send same-day domestic payouts via ACH transfer, PayPal, and Vemno

- Make global payouts to 210+ countries and territories.

- Built-in identity verification, KYC, and fraud prevention.

- Sync data with your ERP and other tools.

Ready to simplify your 1099-NEC process?

Book a call to see how Trolley can transform your tax season.

- 1099-NEC walkthrough: Explore Trolley’s end-to-end solution and seamless integration.

- Tailored insights: Address your specific challenges in contractor payments and tax filings.

- Efficiency & compliance: Save time, reduce errors, and stay IRS-compliant with our automated tools.

- Scalable solution: Learn how Trolley adapts to your growing business needs.