Trusted across industries by finance & compliance teams

Make your tax process safe & compliant with Trolley Tax

Flexible onboarding & earnings allocation

Whether you use Trolley’s white-label portal or embedded widget, it’s easy to securely collect payee identification and tax information.

- Digital collection and completion of tax forms following IRS & DAC7 requirements.

- Collect W-8 & W-9 forms directly in the platform.

- Witholdings automatically updated as tax regulations change.

- Support for multiple income types: services, rent, royalties, tax exempt, etc.

- Simple tax-info collection with our self-serve tool, tailored for EU sellers.

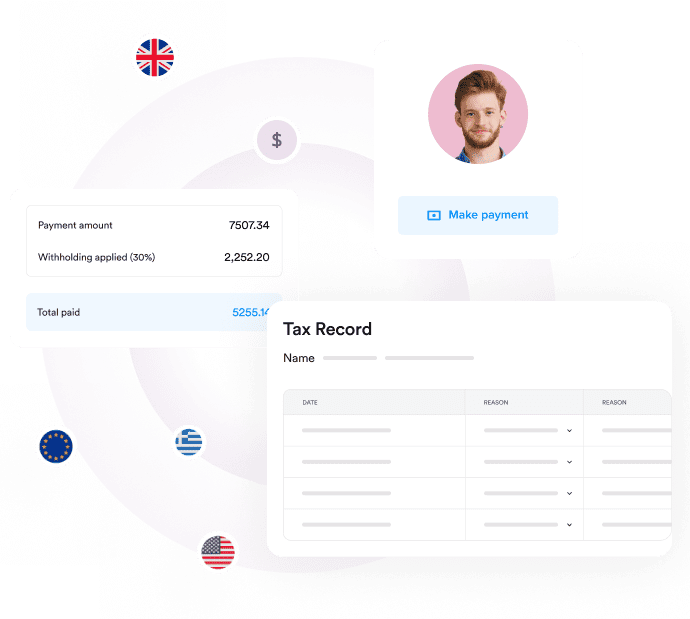

Stay compliant with IRS 1099/1042 regulations

Streamline supplier tax onboarding (W-9 & W-8 BEN) and filing (1099 & 1042-S) with automated form collection, validation, withholding calculations, payouts, and year-end tax reporting.

- EOY reporting with 1099-MISC, 1099-NEC, 1042-S, & 1099-K (coming soon) statements delivered with a click

- Generate year-end 1099 and 1042-S for E-FILE Reporting

- Validate TINs including SSN, EIN & FTIN

- Every three years, W-8 forms automatically expire, and a new one is requested.

- FATCA compliant to correctly complete tax withholding calculations

Boost efficiency & save money

With Trolley, your teams can save nearly 80% of their time by automating administrative tasks. Plus, we offer tax statement generation & distribution (postal mail & digital) directly from our platform with transparent per-statement pricing.

- Simplified, per-statement pricing

- No-code setup and fast integration

- Print and mail statements with integrated service

- Support team ready to assist

Grow across geographies without worrying about compliance hurdles

Today’s fast-growing connected business want to scale without geographic barriers. Trolley Tax helps you stay compliant in the US and the EU without any additional work required for your team.

IRS compliance for US-sourced payouts

Keep your friends at the IRS happy. Enhance your process with digital W8/W9 collection, automated withholding, and 1099/1042 e-filing.

Digital platform reporting for EU, UK, AU, & NZ

Grow globally and meet OECD global reporting requirements. Collect required seller data, link payouts to reportable activities, and generate XML files required for all 30 jurisdictions.

Reach out to see how Trolley Tax can meet your payout & tax compliance needs.

Trolley links every payment you make to a contractor tax record, automatically generating and e-filing required forms for your non-employee workforce. With Trolley, next year's tax prep will be as simple as a few clicks.