Best Dwolla alternative for payouts

Go beyond US-only payouts & unlock global scale

Dwolla is designed for local US transfers, leaving global platforms to patch together multiple payout providers just to reach recipients abroad. Trolley is built for global scale, unifying payouts across 210+ countries and territories, with tax compliance and risk management baked into every workflow.

- Reach recipients in 210+ countries and 135+ currencies via bank transfers, PayPal, e-wallets, and checks.

- Automate tax compliance with form collection, generation, and year-end filing.

- Build trust with integrated IDV/KYC/KYB, sanctions checks, and proactive fraud monitoring.

Book a 30-min Trolley demo

Trusted by industry leaders—billions paid to over 5 million recipients

The payouts experience: Dwolla vs. Trolley

Where Dwolla falls short:

- “Only available in the United States, so you can not make global transactions through it.” (G2)

- Payout methods are limited to instant payments and ACH transfers only.

- ACH processing times are lengthy, and shortening them can increase costs. (Capterra)

With Trolley, you can:

- Expand globally by sending payouts to over 210 countries and territories.

- Offer flexible payout methods, including ACH, virtual bank accounts, digital wallets, checks, and more.

- Deliver payouts faster through optimized rails and flexible routing options at no extra cost.

Make the right choice for global payouts

What you’ll take away:

- Understand and overcome the challenges of global payouts

- Evaluate modern payout platform capabilities

- Avoid compliance and tax pitfalls

- Align finance, product, engineering, and legal teams

- Compare platforms with a checklist of must-haves

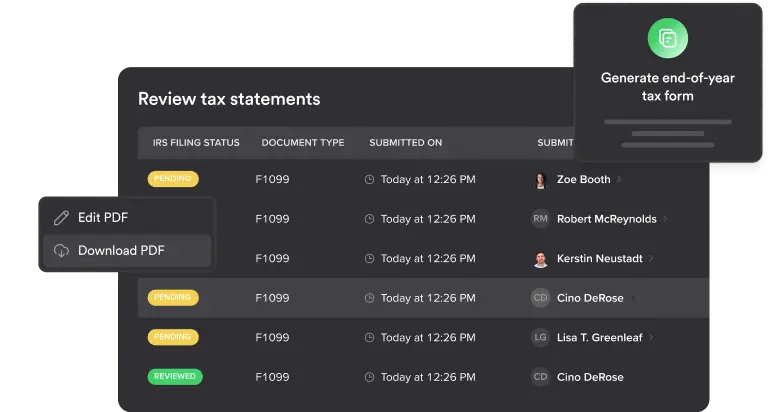

End-of-year tax handling: Dwolla vs. Trolley

Where Dwolla falls short:

- IRS support is limited to Forms 1099-K , leaving businesses to handle other essential filings manually.

- No built-in digital platform reporting for DAC7, making EU compliance a fully manual process.

- Without payout and tax data integration, year-end reporting is cumbersome and time-consuming.

With Trolley, you can:

- Automate US tax compliance by applying withholding, collecting Forms W-8/W-9, generating Forms 1099/1042-S, and e-filing directly with the IRS.

- Stay globally compliant with automated, built-in DAC7 and OECD reporting in the EU, UK, CA, AU, and NZ.

- Sync payout and tax data to automate filings and reclaim hours of manual work.

Risk management capabilities: Dwolla vs. Trolley

Where Dwolla falls short:

- No built-in compliance for AML/CTF screening against global watchlists.

- No native IDV/KYC/KYB functionality for recipient verification.

- Lacks controls to flag and block fraudulent accounts before payouts are released.

With Trolley, you can:

- Simplify compliance with built-in global AML and CFT screening.

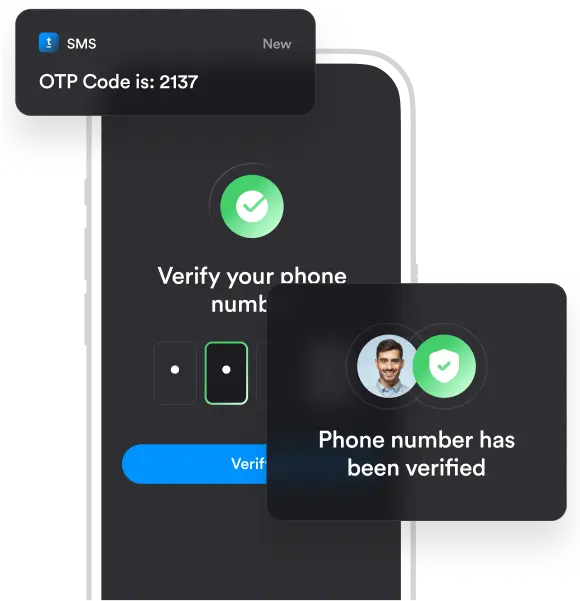

- Verify recipients globally during onboarding with integrated IDV/KYC/KYB workflows.

- Detect and stop fraudulent activities with built-in monitoring, blocklists, and real-time alerts.

Dwolla vs. Trolley feature comparison

Trolley

Dwolla

Pay:

Global payout reach

210+ countries & territories

US only

Currency support

135+ currencies

USD only

Payout methods

ACH, wires, virtual bank accounts, digital wallets, checks

Limited

Workflow automation

Multiple workflows

Fee transparency

Variable pricing

Processing speed

Tax:

IRS tax for US-sourced payouts

Native support for W-8, W-9, 1099, 1042-S

Limited to 1099-K only

Digital platform reporting

EU, UK, CA, AU, NZ

Year-end reporting

Supports IRS & digital platform reporting

Trust:

Recipient-level assessment

Integrated KYC/KYB

Regional risk screening

200+ countries & territories

Identity & business verification

Continuous risk monitoring

Built-in INFORM Act, DSA, AML/CTF tools

Compliance automation

Sync:

Data connectors

Direct integrations

Recipient management

Supported languages

36 languages

English only

Full UX customization

Tired of Dwolla’s US-only payouts holding back your global growth?

FAQs about Dwolla vs Trolley

How do Trolley and Dwolla compare on pricing?

With Dwolla, pricing is tied to US payment rails like ACH and RTP, with costs that vary by speed and provider.

With Trolley, payouts start at $49/month. This includes customization features like white-labeling. Pricing is clear and usage-based, allowing for predictable, flexible fees. Start with a free trial and test in a forever-free sandbox.

What’s the #1 reason businesses choose Trolley over Dwolla?

Businesses switch for scaling and compliance.

Trolley goes beyond Dwolla’s limitation to US-only payouts with global coverage and broader payout methods, global tax automation, and customizable risk controls—all within one platform.

Which countries and currencies do you support?

Trolley supports payouts to 210+ countries & territories and 135+ local currencies.

What kind of companies/industries use Trolley?

Any business that pays global individuals at scale. Most of our customers are creator economy platforms, like:

- Music and streaming royalties (e.g. Soundcloud, Bandcamp, CD Baby)

- Freelance platforms and expert networks (e.g. Bugcrowd, Storetasker)

- Ad networks, publishers and affiliate platforms (e.g. NitroPay)

- Creator and influencer platforms (e.g. Canva, Envato)

- Marketplaces and online retailers (e.g. ArtStation)

- Video games and eSports (e.g. Nexus)

How secure is Trolley? How long have you been around?

Trolley was founded in 2015 and we’ve since processed billions in payouts to over 5 million individuals across 210+ countries and territories.

Trolley is PCI-DSS Level 1 compliant. More security details:

- Hosted on AWS (SOC 1, 2, & 3 + ISO 27001/27018).

- End-to-end 256-bit SSL bank-level security.

- Mandatory 2FA.

- Compliant with GDPR, CCPA,

- PIPEDA, DPA and the EU-U.S.

- Privacy Shield Framework.

How easy is it to reconcile payouts and taxes with our GL?

Customers rate Trolley’s reconciliation features higher on G2:

- Trolley = 9.3 out of 10

- Tipalti = 8.2 out of 10

Trolley automatically tracks every payout, fee and tax event – which directly syncs with your general ledger.

You can also automate reconciliation by integrating Trolley with your accounting system (like QuickBooks). Or build your own sync using Trolley’s API.

What’s your customer support like?

We offer quick support via phone, email, in-product chat, and product documentation.

Trolley’s customer support offers one of the best response times across global fintech systems.

Here’s what customers say:

“We were trying to track down a payment that went to a closed bank account for a client. The client’s bank kept telling them they had rejected the payment. Trolley’s associate helped us contact the bank and get the money back and into the proper account. Lifesaver!”

– Beth W., Head of Vendor Partnerships

“I don’t think we waited more than 6 hours on any email we sent to the Trolley team ever. The quality and speed of support are unlike any other financial system provider we’ve worked with.”

– Sam Wilcoxon, CEO of Storetasker

“The live chat saves me so much headache. Being able to log on and have a friendly person there and answering questions is invaluable; just knowing someone is working on it helps me with my workflow. Plus, I appreciate that that line of communication is kept open – in fact, I even got to know some of Trolley’s Customer Support Team by name!”

– Ted Jackson, Operations Manager at Multilingual Connections

“Our customers are directed to the right screens when they needs support via Trolley’s chat option.”

– Shivang Shekhar, Product Manager at egen.ai

“Using the help chat and the support team at Trolley, I got very quick, live responses, and they continue to support us when any questions arise.”

– Nelson Truong, Product Manager at Draft

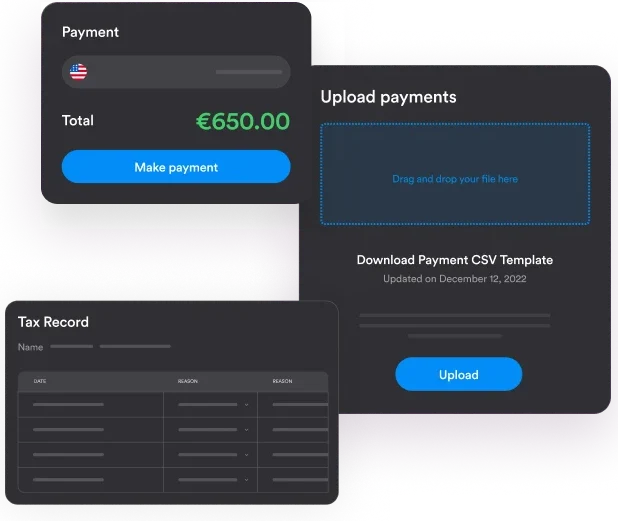

Move to Trolley in 3 clear steps

Step 1: Test out our free sandbox

Access help guides, REST API and SDK documentation. Create recipients, run payments and test tax workflows – without using live money.

Step 2: Import your payout data

Use API or CSV upload to import payee details and past payouts. Trolley will check for any invalid data, e.g. faulty tax forms.

Step 3: Start sending compliant payouts

Set up integrations and role-based access. You can roll out Trolley in gradual phases or make a full migration – whatever you prefer.

Trolley is rated higher than Dwolla on:

How does Trolley stack up to Dwolla?

With Trolley you get more:

- Wider global reach with payouts to 210+ countries and territories in 135+ currencies.

- Comprehensive tax compliance covering W-8, W-9, 1099, 1042-S, OECD digital platform reporting, including DAC7, and more.

- Verify every recipient via KYC, KYB, ID verification, AML, and sanctions screening.

- Clear, predictable pricing with transfer fees shown upfront and no additional costs.

- Flexible payout choices including bank transfers, PayPal, Venmo, e-wallets, and checks.

- Enterprise-grade support — dedicated success teams plus self-serve recipient portals.

We can show you Trolley’s workflows and customize a quote for you. Let’s hop on a 30-min call – walk away with more clarity on your steps forward.