BEST TIPALTI ALTERNATIVE FOR PAYOUTS

Modern product & finance teams have outgrown Tipalti

Stop wrestling with separate vendors for payments, reporting, and verification. Trolley unifies onboarding, global payouts, and year‑ end tax filing into a single, frictionless solution built for tomorrow’s digital economy.

- Automate payouts in 210+ regions. Forget rigid invoice workflows.

- Handle end-of-year tax forms in the platform. No 3rd-party tools.

- Verify and KYC recipients from 200+ countries & territories—not just the US.

Book a 30-min Trolley demo

Trolley has paid out billions to over 5 million recipients on top creator and gig platforms

The payouts experience: Tipalti vs. Trolley

Tipalti customer reviews:

- "Currency exchanges can be tricky to calculate." (G2)

- “Unfortunately we don't get alerts when a payment for a specific vendor doesn't go through.” (Capterra)

- "Would love to have one profile portal so our agencies can see all of their payees at once." (TrustRadius)

With Trolley, you can:

- Send local-to-local payouts with transparent FX rates.

- Track payout status, including clear reasons for return.

- Set up multi-user and multi-entity access with customizable roles. View payees in a single portal.

Make the right choice for global payouts

Cut through the complexity of the payouts decisions process with a clear, practical guide. Learn what to look for, what to avoid, and how to future-proof your payout operations.

What you’ll take away:

- Understand and overcome the challenges of global payouts

- Evaluate modern payout platform capabilities

- Avoid compliance and tax pitfalls

- Align finance, product, engineering, and legal teams

- Compare platforms with a checklist of must-haves

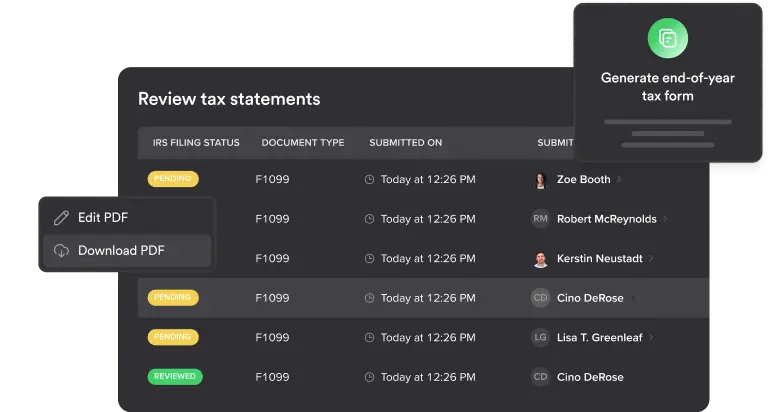

End-of-year tax handling: Tipalti vs. Trolley

Tipalti limitations & customer reviews:

- "Tipalti does not provide 1099's. It is VERY inconvenient to pull a report and send payment info to another company to create 1099's." (G2)

- "Most common error we encounter is with the W-8BEN form, our users skip entering in the FTIN." (TrustRadius)

- Rather than providing out-of-the-box tax interviews, Tipalti leaves platforms to build their own, even for straightforward cases like determining a user’s UK tax residency.

With Trolley, you can:

- Generate and e-file forms 1099 and 1042-S in one click from Trolley. No exports or 3rd-party tools required.

- Collect forms W-8, W-8 BEN and W-9 – with automatic field validation to catch errors. Available in 36 languages.

- Ensure DAC7 and OECD compliance in the EU, UK, AUS, NZ and CAN. Collect tax data and generate EOY reports.

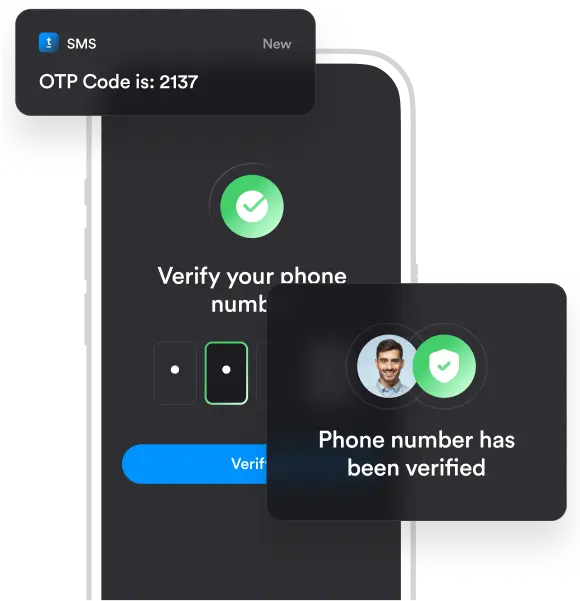

Risk management capabilities: Tipalti vs. Trolley

Tipalti limitations & customer reviews:

- Tipalti only covers basic KYC on the business and its new clients. But effective KYC should go further—helping platforms actually detect and prevent bad actors.

- "When some of my affiliates try to change billing details, it can trigger issues that make them temporarily non-payable." (G2)

- "Every time I change a payee name, the system requires their passport/company registration. We get a lot of complaints from payees." (Capterra)

With Trolley, you can:

- Verify payee IDs against 11,000+ official government ID templates from 200+ countries and territories. Automatically flag high-risk profiles. Track logins and account changes.

- Let payees securely update their details via the embedded portal – without disrupting payouts.

- Avoid unnecessary KYC resubmissions – Trolley assesses payee ID changes by risk level.

Tipalti vs. Trolley feature comparison

Tipalti vs Trolley G2 ratings

Ratings out of 10, from Tipalti and Trolley customers on G2.

Trolley

Tipalti

Pay:

Global payout reach

210+ regions,

135+ currencies

200+ regions,

120+ currencies

Returned payment handling

Manual tracking

Multi-entity and sub-merchant model

Revenue sharing

Tax:

W-9/W-8 collection

IRS e-filing built-in

3rd-party tools or manual exports needed

Digital platform reporting

DAC7, UK, CA, AU, NZ

Limited outside DAC7

Trust:

Global identity verification

Limited outside the US

Business verification

Phone verification

Address verification

Global risk management

Limited to OFAC (US-based) and AML

Customizable risk logic

Sync:

Native data connectors

Direct integrations

Error-prone

Payee UX:

Full UX customization

Supported languages

36 languages

27 languages

API:

REST API

Tested at scale

Newly launched

SDK availability

6 SDKs

Event-based payout triggers

Purpose-built for user and platform events

Not purpose-built

Trolley

Tipalti

General:

Global payout reach

9.3

8.6

Quality of support

9.4

8.5

‘Has the product been a good partner in doing business?’

9.2

8.6

Ease of Use

9.3

8.7

Ease of Setup

8.2

8.0

Ease of Admin

9.0

8.5

Enterprise Payment:

ACH

9.6

7.9

Plugins and APIs

8.8

9.3

Wire Transfer

9.7

8.8

Payments scheduling

9.7

9.0

Automated workflows

9.9

8.7

Payment tracking

9.8

8.6

Reconciliation

9.3

8.2

AP Automation:

Overall

9.0

8.1

Invoice capture

9.4

8.6

Payments

9.7

8.4

Tax compliance

9.1

8.0

Risk & fraud:

Risk identification

9.0

8.1

Risk scoring

8.7

7.3

Vendor checks

9.1

8.5

Fraud monitoring

9.3

7.7

Integration:

Accounting

8.3

8.2

ERP Integration

8.1

7.8

Payments

8.6

8.3

Outgrown Tipalti? Trolley’s flexible payouts can scale with you.

FAQs about Tipalti vs Trolley

How do Trolley and Tipalti compare on pricing?

Trolley:

- Pricing starts at $49/month and includes customization features such as white-labeling.

- Transparent, usage-based pricing allows for predictable and flexible fees.

- A free trial is available, along with a forever-free sandbox for testing.

Tipalti:

- Contracts are typically bundled with high minimum commitments (e.g., $10,000+/month).

- Pricing is less transparent and typically requires direct contact for a custom quote.

- No free trial or forever-free sandbox is offered.

What’s the #1 reason businesses choose Trolley over Tipalti?

The #1 reason is flexibility. Especially for high-volume, API-driven payouts to global individuals.

Trolley offers wide control over the recipient experience, tax compliance and developer integration.

Which countries and currencies do you support?

Trolley supports payouts to 210+ countries & territories and 135+ local currencies.

What kind of companies/industries use Trolley?

Any business that pays global individuals at scale. Most of our customers are creator economy platforms, like:

- Music and streaming royalties (e.g. Soundcloud, Bandcamp, CD Baby)

- Freelance platforms and expert networks (e.g. Bugcrowd, Storetasker)

- Ad networks, publishers and affiliate platforms (e.g. NitroPay)

- Creator and influencer platforms (e.g. Canva, Envato)

- Marketplaces and online retailers (e.g. ArtStation)

- Video games and eSports (e.g. Nexus)

How secure is Trolley? How long have you been around?

Trolley was founded in 2015 and we’ve since processed billions in payouts to over 5 million individuals across 210+ countries and territories.

Trolley is PCI-DSS compliant. More security details:

- Hosted on AWS (SOC 1, 2, & 3 + ISO 27001/27018).

- End-to-end 256-bit SSL bank-level security.

- Mandatory 2FA.

- Compliant with GDPR, CCPA,

- PIPEDA, DPA and the EU-U.S.

- Privacy Shield Framework.

How easy is it to reconcile payouts and taxes with our GL?

Customers rate Trolley’s reconciliation features higher on G2:

- Trolley = 9.3 out of 10

- Tipalti = 8.2 out of 10

Trolley automatically tracks every payout, fee and tax event – which directly syncs with your general ledger.

You can also automate reconciliation by integrating Trolley with your accounting system (like QuickBooks). Or build your own sync using Trolley’s API.

What’s your customer support like?

We offer quick support via phone, email, in-product chat and product documentation.

Customers rate Trolley’s quality of support higher on G2:

- Trolley = 9.4 out of 10

- Tipalti = 8.6 out of 10

Trolley’s customer support offers one of the best response times across global fintech systems.

Here’s what customers say:

“We were trying to track down a payment that went to a closed bank account for a client. The client’s bank kept telling them they had rejected the payment. Trolley’s associate helped us contact the bank and get the money back and into the proper account. Lifesaver!”

– Beth W., Head of Vendor Partnerships

“I don’t think we waited more than 6 hours on any email we sent to the Trolley team ever. The quality and speed of support are unlike any other financial system provider we’ve worked with.”

– Sam Wilcoxon, CEO of Storetasker

“The live chat saves me so much headache. Being able to log on and have a friendly person there and answering questions is invaluable; just knowing someone is working on it helps me with my workflow. Plus, I appreciate that that line of communication is kept open – in fact, I even got to know some of Trolley’s Customer Support Team by name!”

– Ted Jackson, Operations Manager at Multilingual Connections

“Our customers are directed to the right screens when they needs support via Trolley’s chat option.”

– Shivang Shekhar, Product Manager at egen.ai

“Using the help chat and the support team at Trolley, I got very quick, live responses, and they continue to support us when any questions arise.”

– Nelson Truong, Product Manager at Draft

Move to Trolley in 3 clear steps

Step 1: Test out our free sandbox

Access help guides, REST API and SDK documentation. Create recipients, run payments and test tax workflows – without using live money.

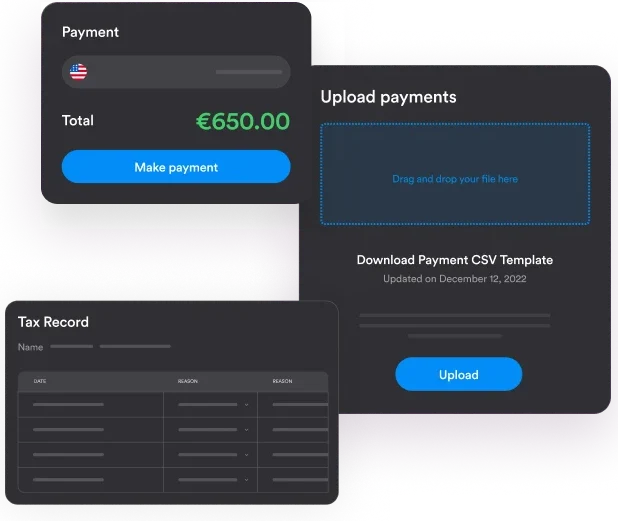

Step 2: Import your payout data

Use API or CSV upload to import payee details and past payouts. Trolley will check for any invalid data, e.g. faulty tax forms.

Step 3: Start sending compliant payouts

Set up integrations and role-based access. You can roll out Trolley in gradual phases or make a full migration – whatever you prefer.

Trolley is rated higher than Tipalti on:

How does Trolley stack up vs. Tipalti?

With Trolley you get more:

- Customizable, trigger-based payouts (vs invoice-driven flows).

- Visibility into payee status, issues and compliance blocks.

- White-labeled payee onboarding flows that feel like your product.

- API-first design – built for platforms, not just finance teams.

- Flexibility to use only what you need – payouts, tax, ID verification.

- Transparent, predictable pricing without bundled bloat.

We can show you Trolley’s workflows and customize a quote for you. Let’s hop on a 30-min call – walk away with more clarity on your steps forward.