BEST STRIPE ALTERNATIVE FOR PAYOUTS

Stripe Connect slowing you down? Go live faster with Trolley

When every workflow requires complex custom code, global teams struggle to scale. Trolley simplifies onboarding, payouts, and tax compliance, so you can launch faster, with no extra dev lift.

- Access more markets with better payout coverage in 210+ regions and 135+ currencies

- Go-live and scale faster with prebuilt dev tools, no- & low-code setups, and flexible workflows with built-in data syncing

- Stay compliant with tax reporting in 30+ jurisdictions, supporting both individual & business payees

Book a 30-min Trolley demo

Trolley has paid out billions to over 5 million recipients on top creator and gig platforms

The payouts experience: Stripe Connect vs. Trolley

Where Stripe Connect falls short:

- “Several hidden fees appear over time without transparency.” (Capterra)

- “Currently available in a limited number of countries, and businesses operating outside of these countries may not be able to use the platform.” (G2)

- “Some functionalities like subscriptions can be extremely tricky to set up for even for simple scenarios.” (Capterra)

With Trolley, you can:

- Avoid surprise fees with a transparent, pay-as-you-go pricing model you can plan around.

- Scale payouts globally to 210+ countries & territories and 135+ currencies.

- Ditch the engineering backlog and launch faster with prebuilt, no-code payout workflows.

Make the right choice for global payouts

Cut through the complexity of the payouts decisions process with a clear, practical guide. Learn what to look for, what to avoid, and how to future-proof your payout operations.

What you’ll take away:

- Understand and overcome the challenges of global payouts

- Evaluate modern payout platform capabilities

- Avoid compliance and tax pitfalls

- Align finance, product, engineering, and legal teams

- Compare platforms with a checklist of must-haves

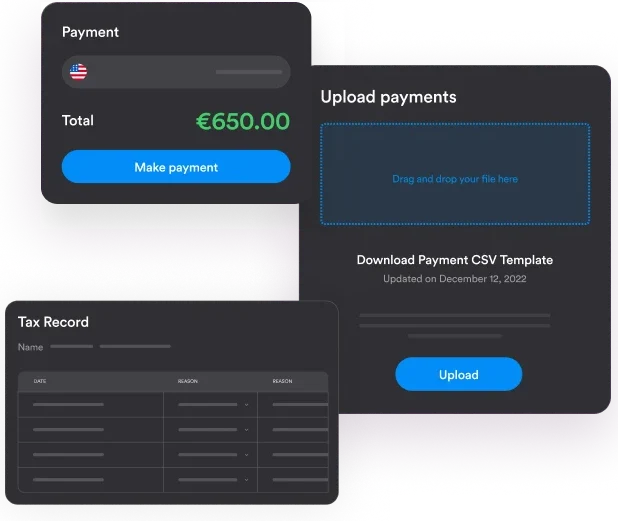

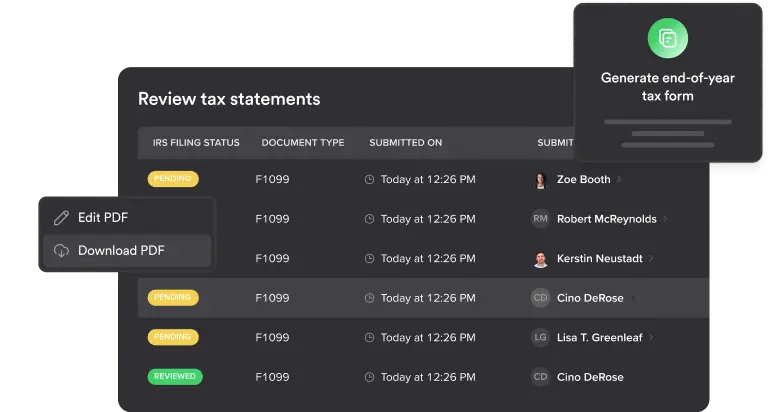

End-of-year tax handling: Stripe Connect vs. Trolley

Where Stripe Connect falls short:

- Core tax functionality is U.S.-centric, creating complexity for platforms with international payees.

- “No automatic tax support… your software team must build out the software to support proper collection.” (Trust Radius)

- Lack of 1042-S and W-8BEN support forces platforms to fill Stripe’s tax gaps with manual effort.

With Trolley, you can:

- Collect, validate, and file tax forms across multiple jurisdictions (IRS + digital platform reporting in the EU, UK, CA, AU, NZ).

- Automate tax form collection, validation, and withholding all in one system. No switching tools, no tax season chaos.

- Support tax filing for international businesses via W‑8 BEN‑E and 1042‑S.

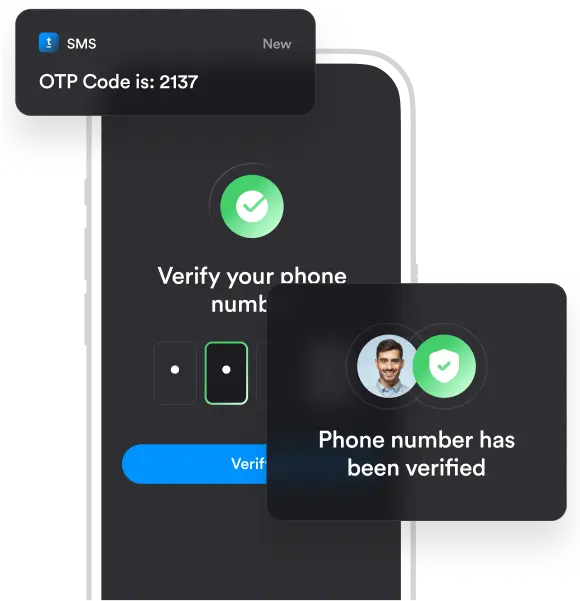

Risk management capabilities: Stripe Connect vs. Trolley

Where Stripe Connect falls short:

- “Countless re-verification requests with no favorable response after sending business registration and several forms of IDs.” (Capterra)

- “Warnings come with so little information or context that they're nearly impossible to act on.” (Trust Radius)

- “Took OVER 14 calls, emails, chats to support to resolve a single verification issue.” (Capterra)

With Trolley, you can:

- Reduce false positives and verify more accurately with region-specific ID document support across 200+ countries & territories and 11k+ documents.

- Receive detailed insights about profile inconsistencies and high-risk changes.

- Avoid unnecessary KYC re-verification—Trolley uses risk-based logic to assess changes.

Stripe Connect vs. Trolley feature comparison

Trolley

Stripe Connect

Pay:

Global payout reach

210+ countries & territories

118+ countries & territories

Returned payment handling

Manual handling

Revenue stream

Requires custom dev

Payout method support

Supports wallets like PayPal, Venmo, and other virtual accounts

Does not support wallets and virtual accounts

Tax:

IRS tax for US-sourced payouts

1099 (NEC, MISC, & K), 1042-S, W-8/W-9

1042-S not supported

Digital platform reporting

EU, UK, CA, AU, NZ

Basic/limited

Business payee support

Trust:

Regional risk screening

200+ countries & territories

Error-prone due to regional limitations

Business verification

Limited

Phone verification

Address verification

Sync:

Data connectors

Requires custom dev

Direct integrations

Requires custom-dev/3rd-party APIs

Recipient management:

Customization

No-code branded setup

Low via Custom Connect

Language support

36 languages

34 languages

Real-time event-based data integration

Built-in connectors

Requires custom exports or 3rd-party middleware

API:

Ready-to-go modular widget

Customer support

Fragmented

Tired of the dev work Stripe Connect requires?

FAQs about Stripe Connect vs. Trolley

How do Trolley and Stripe Connect compare on pricing?

Stripe Connect uses a per-user fee model plus transaction-based charges and additional fees for different onboarding tiers, which can quickly stack up.

With Trolley, payouts start at $49/month. This includes customization features like white-labeling. Pricing is clear and usage-based, allowing for predictable, flexible fees. Start with a free trial and test in a forever-free sandbox.

What’s the #1 reason businesses choose Trolley over Stripe Connect?

The #1 reason is ease of use, followed closely by global coverage. Trolley lets Finance, Ops, and Compliance teams manage global payouts, taxes, and KYC without depending entirely on Engineering for a significant dev lift.

Which countries and currencies do you support?

Trolley supports payouts to 210+ countries & territories and 135+ local currencies.

What kind of companies/industries use Trolley?

Any business that pays global individuals at scale. Most of our customers are creator economy platforms, like:

- Music and streaming royalties (e.g. Soundcloud, Bandcamp, CD Baby)

- Freelance platforms and expert networks (e.g. Bugcrowd, Storetasker)

- Ad networks, publishers and affiliate platforms (e.g. NitroPay)

- Creator and influencer platforms (e.g. Canva, Envato)

- Marketplaces and online retailers (e.g. ArtStation)

- Video games and eSports (e.g. Nexus)

How secure is Trolley? How long have you been around?

Trolley was founded in 2015 and we’ve since processed billions in payouts to over 5 million individuals across 210+ countries and territories.

Trolley is PCI-DSS compliant. More security details:

- Hosted on AWS (SOC 1, 2, & 3 + ISO 27001/27018).

- End-to-end 256-bit SSL bank-level security.

- Mandatory 2FA.

- Compliant with GDPR, CCPA,

- PIPEDA, DPA and the EU-U.S.

- Privacy Shield Framework.

How easy is it to reconcile payouts and taxes with our GL?

Trolley automatically tracks every payout, fee and tax event – which directly syncs with your general ledger.

You can also automate reconciliation by integrating Trolley with your accounting system (like QuickBooks). Or build your own sync using Trolley’s API.

What’s your customer support like?

We offer quick support via phone, email, in-product chat and product documentation.

Customers rate Trolley’s quality of support higher on G2:

- Trolley = 9.4 out of 10

- Stripe Connect = 8.3 out of 10

Trolley’s customer support offers one of the best response times across global fintech systems.

Here’s what customers say:

“We were trying to track down a payment that went to a closed bank account for a client. The client’s bank kept telling them they had rejected the payment. Trolley’s associate helped us contact the bank and get the money back and into the proper account. Lifesaver!”

– Beth W., Head of Vendor Partnerships

“I don’t think we waited more than 6 hours on any email we sent to the Trolley team ever. The quality and speed of support are unlike any other financial system provider we’ve worked with.”

– Sam Wilcoxon, CEO of Storetasker

“The live chat saves me so much headache. Being able to log on and have a friendly person there and answering questions is invaluable; just knowing someone is working on it helps me with my workflow. Plus, I appreciate that that line of communication is kept open – in fact, I even got to know some of Trolley’s Customer Support Team by name!”

– Ted Jackson, Operations Manager at Multilingual Connections

“Our customers are directed to the right screens when they needs support via Trolley’s chat option.”

– Shivang Shekhar, Product Manager at egen.ai

“Using the help chat and the support team at Trolley, I got very quick, live responses, and they continue to support us when any questions arise.”

– Nelson Truong, Product Manager at Draft

Move to Trolley in 3 clear steps

Step 1: Test out our free sandbox

Access help guides, REST API and SDK documentation. Create recipients, run payments and test tax workflows – without using live money.

Step 2: Import your payout data

Use API or CSV upload to import payee details and past payouts. Trolley will check for any invalid data, e.g. faulty tax forms.

Step 3: Start sending compliant payouts

Set up integrations and role-based access. You can roll out Trolley in gradual phases or make a full migration – whatever you prefer.

Trolley is rated higher than Stripe Connect on:

How does Trolley stack up to Stripe Connect?

With Trolley you get more:

- Global payout coverage: 210+ countries and territories in 135+ currencies

- Full visibility: Track payout status, issues, and compliance blocks

- White-labeled onboarding: Hosted or embedded, fully branded

- Global tax tools: Collect and file with the IRS, DAC7, & more

- Ops-ready UX: Built for Finance and Compliance, not just devs

- Modular pricing: No per-user fees, no bundled bloat

We can show you Trolley’s workflows and customize a quote for you. Let’s hop on a 30-min call – walk away with more clarity on your steps forward.