Securely collecting your contractor’s tax data is a massive undertaking, so it’s completely understandable if the thought of moving it between systems (or maybe even to the digital world from a paper format) gives you cold sweats. But there are major benefits to conducting a W-8/W-9 migration and having that recipient data living in a platform where everything from payments to data management to end-of-year taxes can be managed and automated.

We’ve been thinking about how to manage and work with sensitive tax data for years now, and some of the biggest names in the internet economy trust us to manage hundreds of thousands of their contractors’ forms every year.

Collecting and managing your contractors’ Forms W-8 and Forms W-9 can be a real hassle. The information on these forms is necessary for completing end-of-year forms like 1099s and 1042-S, but this process is more taxing (excuse the pun) if your pay and tax data are siloed in separate systems.

The following guide will help you to a) understand what’s actually involved with moving all that data, b) plan the move for your particular circumstances, and then c) action it.

In the end, we think that with the right tools and planning, your W-8/W-9 migration can be fairly easy and you’ll reap benefits almost immediately.

What we cover

Linking sensitive info: Payout data meets tax data

Housing your tax data in one system and payout data in another can make administrative processes unnecessarily long, increase the risk of errors associated with managing and transferring information between multiple systems, and make ensuring compliance with ever-evolving tax regulations more difficult.

When your recipients’ data is stored in one secure platform, you can spend less time dealing with information collection and end-of-year filing, and have peace of mind knowing that your data integrity is intact.

Plus, the more your business grows, the more you benefit—a centralized platform can scale with you to accommodate a growing number of contractors, so your pay and tax processes never get out of hand (and you never get stung by “B” notices or other IRS penalties).

Planning your W-8/W-9 import

Moving existing recipient data can be a challenge. If your recipients’ tax data is stored in third-party software, you may need to work with your existing vendor to get your data out and ready to be imported into an all-in-one platform.

The quality of your data will depend on how much validation it has gone through before being added into your existing system. Have recipients’ TINs been validated? Their addresses?

- If in doubt, it’s best to re-collect this information from your recipients. Forms W-8 expire every three years, anyway, so you’ll have to do this eventually for W-8 holders.

Ensuring that your data has a high level of integrity is vital in avoiding IRS penalties at end-of-year filing time. Solving problems upfront by validating TINs and zip codes, for example, can significantly lighten the burden of tax season.

Note: It’s always best to inform your recipients that their data is moving from one system to another—tax information is sensitive, and keeping recipients in the loop about how and where their data is moving is an important part of fostering trust with your contractors.

Why trust Trolley with your W-8/W-9s?

So you’ve decided to consolidate your pay and tax flows into one platform. Why should you choose Trolley?

Because we can make your pay and tax processes soooo much easier—and then you can focus on your core business operations. Here’s how:

Self-service Forms W-8 and W-9 generation during recipient onboarding

With our white-label portal or our embedded widget—depending on your preference—recipients self-fill out all the information necessary to generate Forms W-8 and W-9 during onboarding.

Then, Trolley automatically creates and stores these forms in our platform so they’re ready for your end-of-year reporting.

And, with end-to-end 256-bit bank-level security, you can trust that your recipients’ most important personal data is encrypted and well-protected.

Data integrity and continual compliance

When recipients fill out their W-8 or W-9 information during onboarding, we’ll automatically run it through multiple different validation checks.

- We validate TINs, including SSNs, EINs, and FTINs, so you never get hit with a “B” notice, for example.

- Zip code validation ensures that we have a valid address to send details to if a recipient chooses to receive their documents via physical mail.

- Other character-limit verifications and error-flagging help to ensure that problems are solved upfront, so you can remain compliant throughout the year, and it’s not a scramble during tax season.

If you’re thinking of importing data from another system and are unsure about the quality of your recipients’ W-8 and W-9 data, you can always have them re-enter their data when they are onboarding with your now Trolley-powered platform. That way, you can leave questions about the quality of the data in the past.

Automatic updates in accordance with tax regulations

Our tax experts keep our platform up to date with the IRS’ ever-changing regulations, so you don’t have to worry about them. For example, when tax treaties are adjusted, withholding rates are automatically updated to match the changing regulations.

And, similarly, since Forms W-8 expire every three years, we request new ones from the recipient automatically—meaning no interruptions in service.

Support for Forms 1099-K, 1099-NEC, 1099-MISC, & 1042-S

With Trolley, you can generate tax records for each payout and withhold appropriate taxes as needed.

Our platform supports multiple income types, including services, rent, royalties, tax-exempt, and more. And, single payments can be split and allocated into multiple income types.

With automatic income classification and payment allocation, generating Forms 1099-K, 1099-NEC, 1099-MISC, and 1042-S at the end of the year is seamless.

Direct e-filing with the IRS

End-of-year filing with the IRS is made easy with Trolley. After automatically generating all the relevant forms for each recipient, filing takes just a couple of clicks and mere minutes—and you can do it all directly in Trolley.

Deliver recipient statements digitally or through physical mail, as per IRS guidelines, and get support for any returned payments or statement corrections.

Your end-of-year tax processes can be that much more manageable.

Managing a W-8/W-9 migration with Trolley

Now that we’ve covered the why, let’s dive into the how: Here’s how to migrate your W-8/W-9 data to Trolley.

Trolley’s W-8/W-9 upload capabilities support the migration of current forms—each recipient should have one tax form associated with them.

Getting started

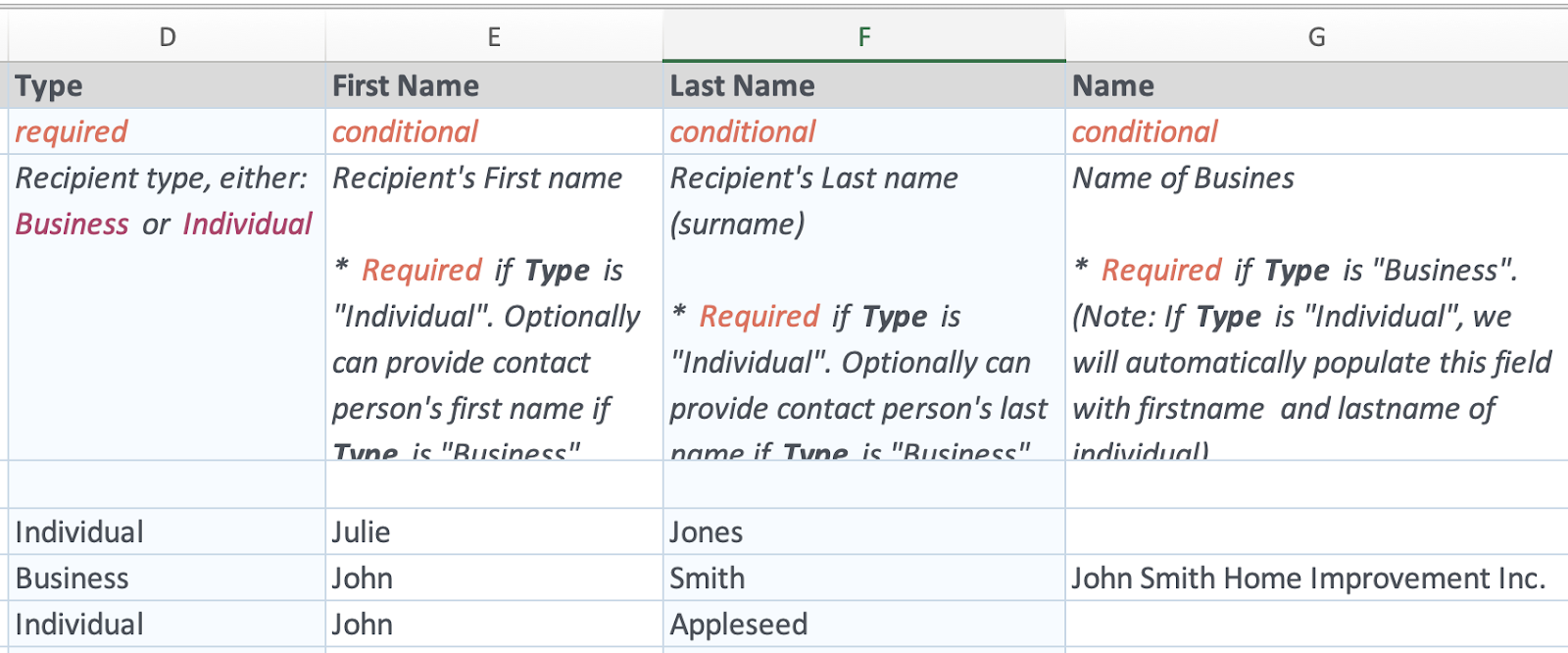

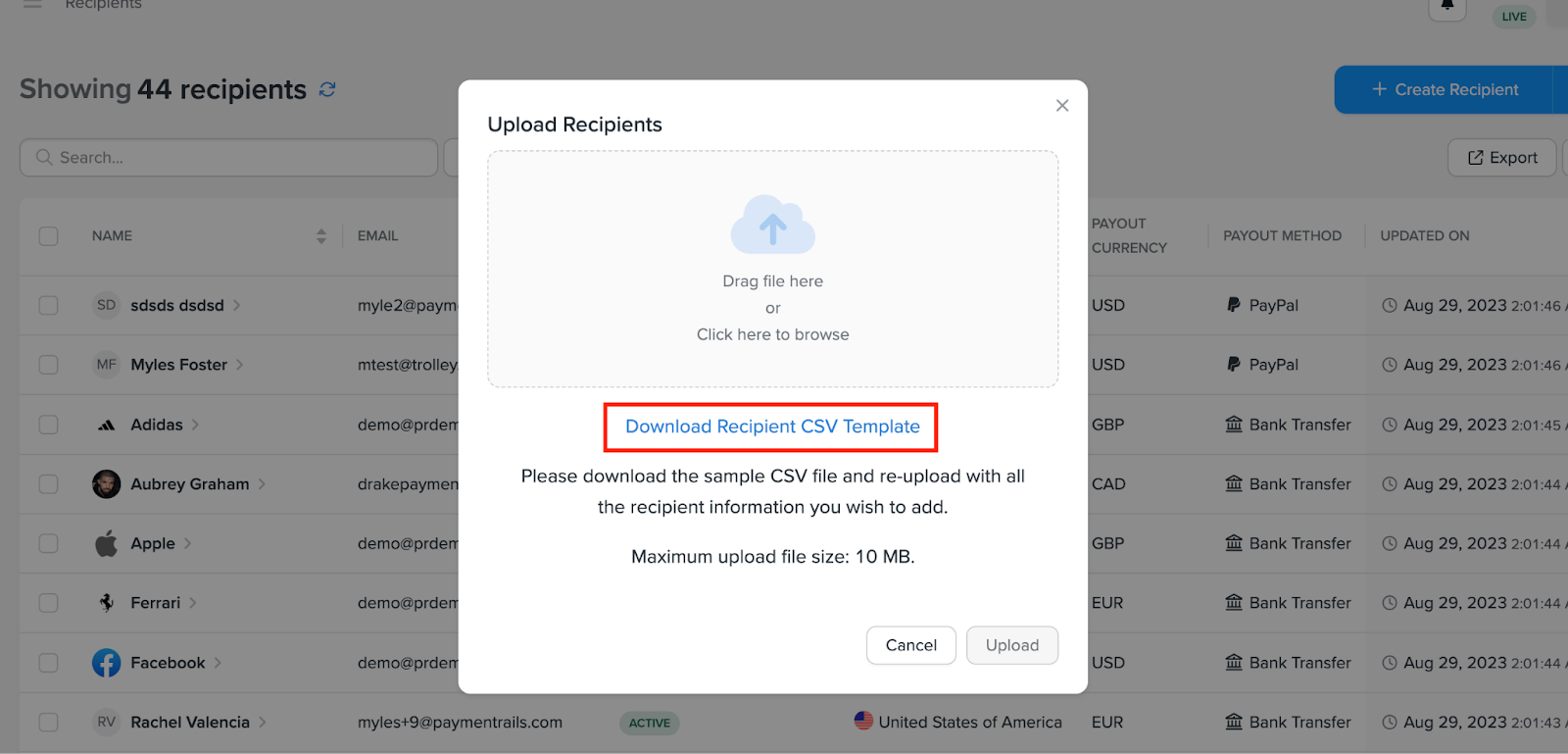

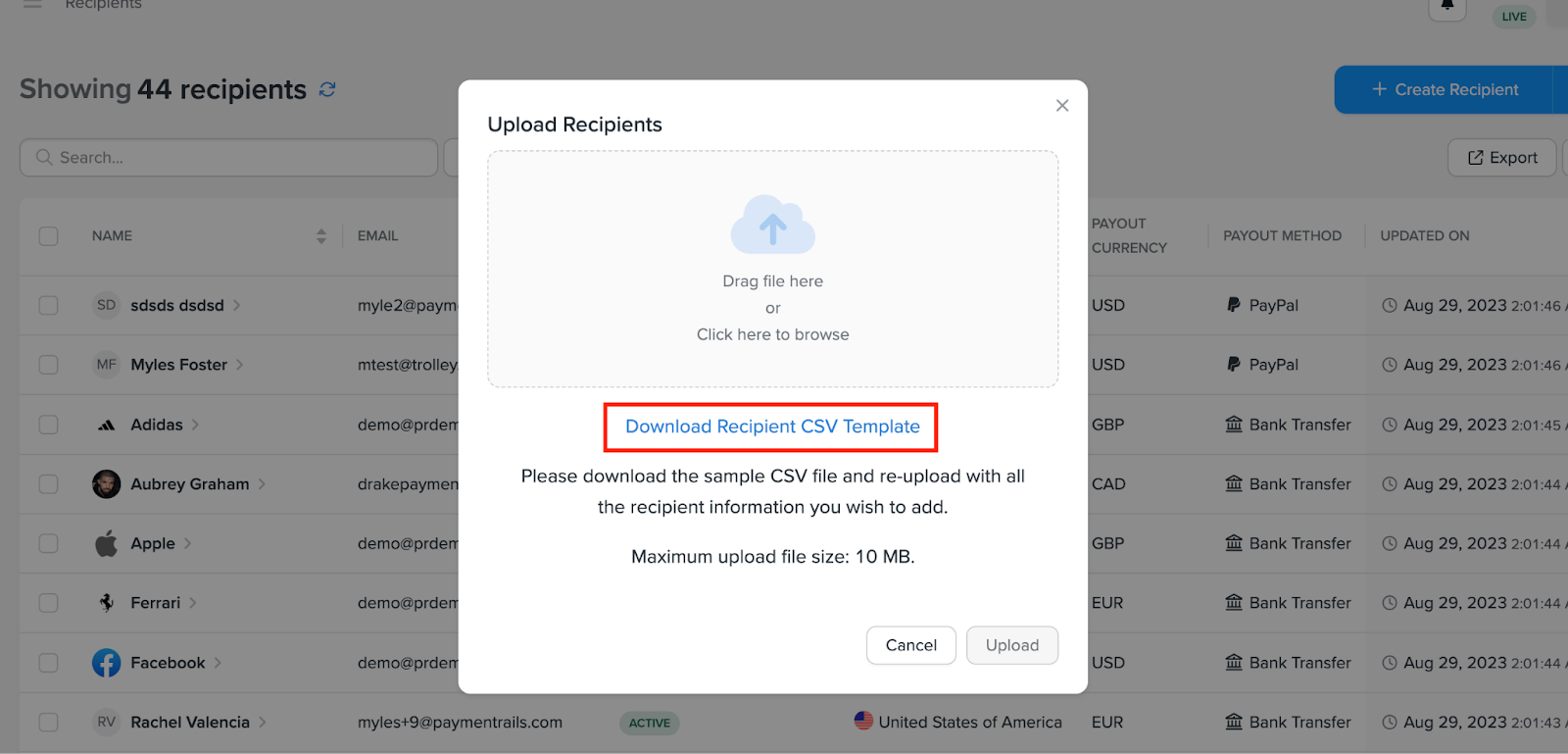

To get started, head over to the Tax Center, and download the CSV template/sample file for the uploads via the Dashboard. In the sample file, you will find guidance on the data formats and required fields for the upload file.

To import W-8 and W-9 data, you’ll first need to import your recipients and their bank details. Each import has the same basic steps.

- Step 1: Download the latest sample file and template file from your Trolley dashboard

- Step 2: Read the sample file and field descriptions/rules

- Step 3: Export data from your existing system

- Step 4: Prepare the data for import (formatting into Trolley-accepted formats)

- Step 5: Upload the data into Trolley

- Step 6: Review the uploaded file and address any errors

- Step 7: Confirm the import

Import recipients and bank details

Importing recipients allows customers who are using an existing payment provider to bring all of their data to Trolley with them. This way, recipients don’t have to re-enter data that has already been collected.

Recipients and their bank details can be imported via API or CSV upload. CSV uploads are more non-technical and user-friendly, but the API route is recommended for companies adding 10,000+ records.

As recipient data and banking details are imported, Trolley will run validations to confirm the data and will notify you of any errors that emerge.

Import Forms W-8 & W-9

After you’ve imported your recipients and their bank details, your Trolley instance is ready for their W-8 and W-9 data. Each recipient should have one tax form associated with them.

Using the provided sample file and template file, simply follow the same steps outlined above to import your W-8s and W-9s. The whole process is outlined through helpful prompts, however, our dedicated customer support specialists are also available to answer any questions and help with any issues you may have throughout this process.

Note: You can also opt to collect new W-8s and W-9s from your recipients at this stage if you have concerns about your previous data’s integrity and you’d like to start with a fresh slate.

And that’s it! It’s time to sit back, relax, and enjoy the benefits of having all your pay and tax data in one secure platform.

Putting it all together

Streamlining W-8/W-9 data into Trolley not only simplifies the complex process of collecting and managing contractor tax information but also offers significant advantages when it comes to making payouts and filing at the end of the year.

By consolidating payout and tax data in one secure platform, businesses can enhance efficiency, reduce administrative burdens, and ensure compliance with evolving tax regulations. Embracing this centralized approach ensures data integrity, minimizes errors, and ultimately saves time and brings peace of mind to the entire tax management process.

Trolley provides immediate benefits and scalability as your business grows. More information about managing a W-8/W-9 migration, as well as getting started with Trolley, is available in our help center.

And, if you’re ready to make the switch to an all-in-one payout and tax platform, we’re always happy to chat!