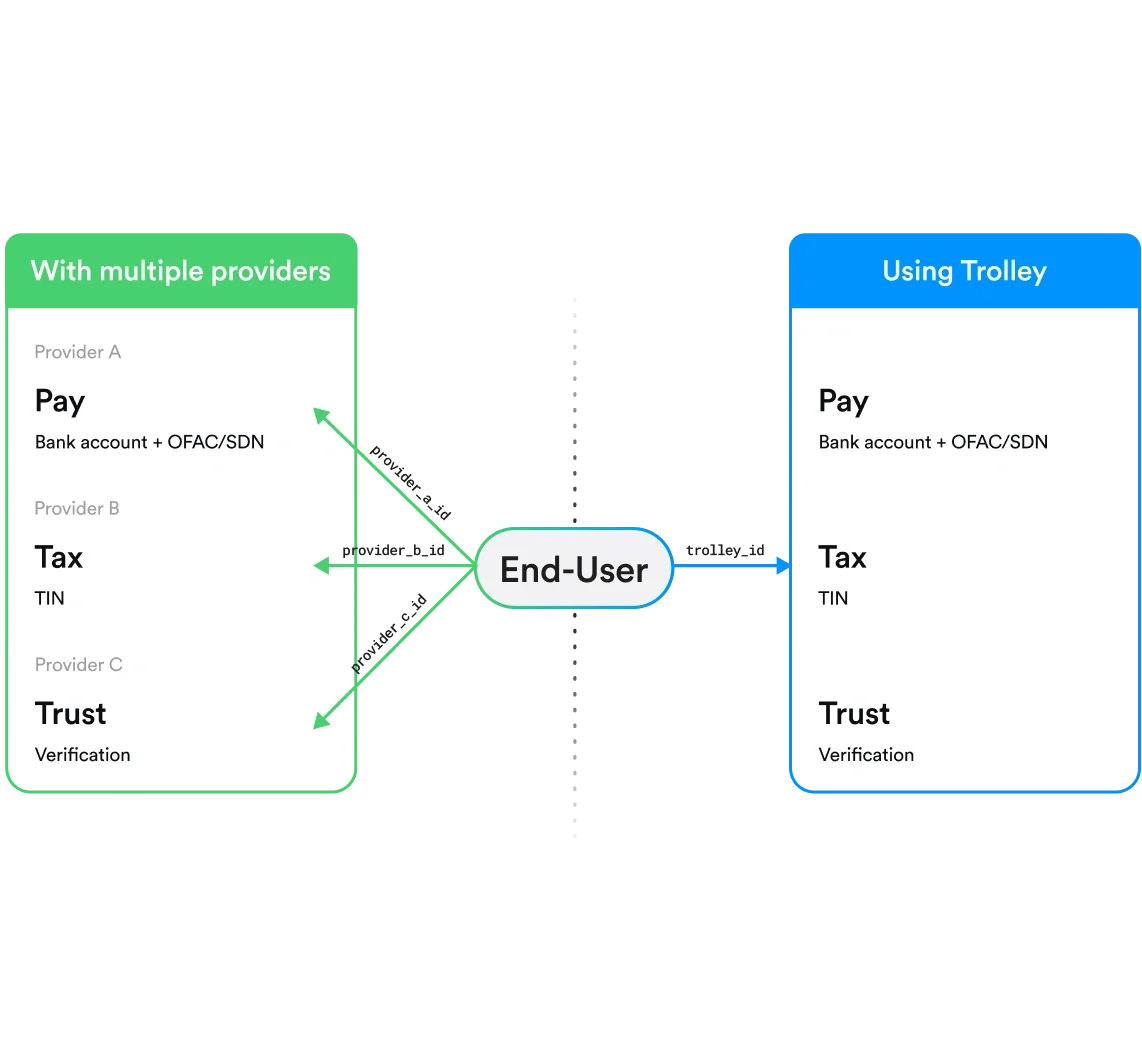

A lot goes into every payout. Trolley takes care of it all.

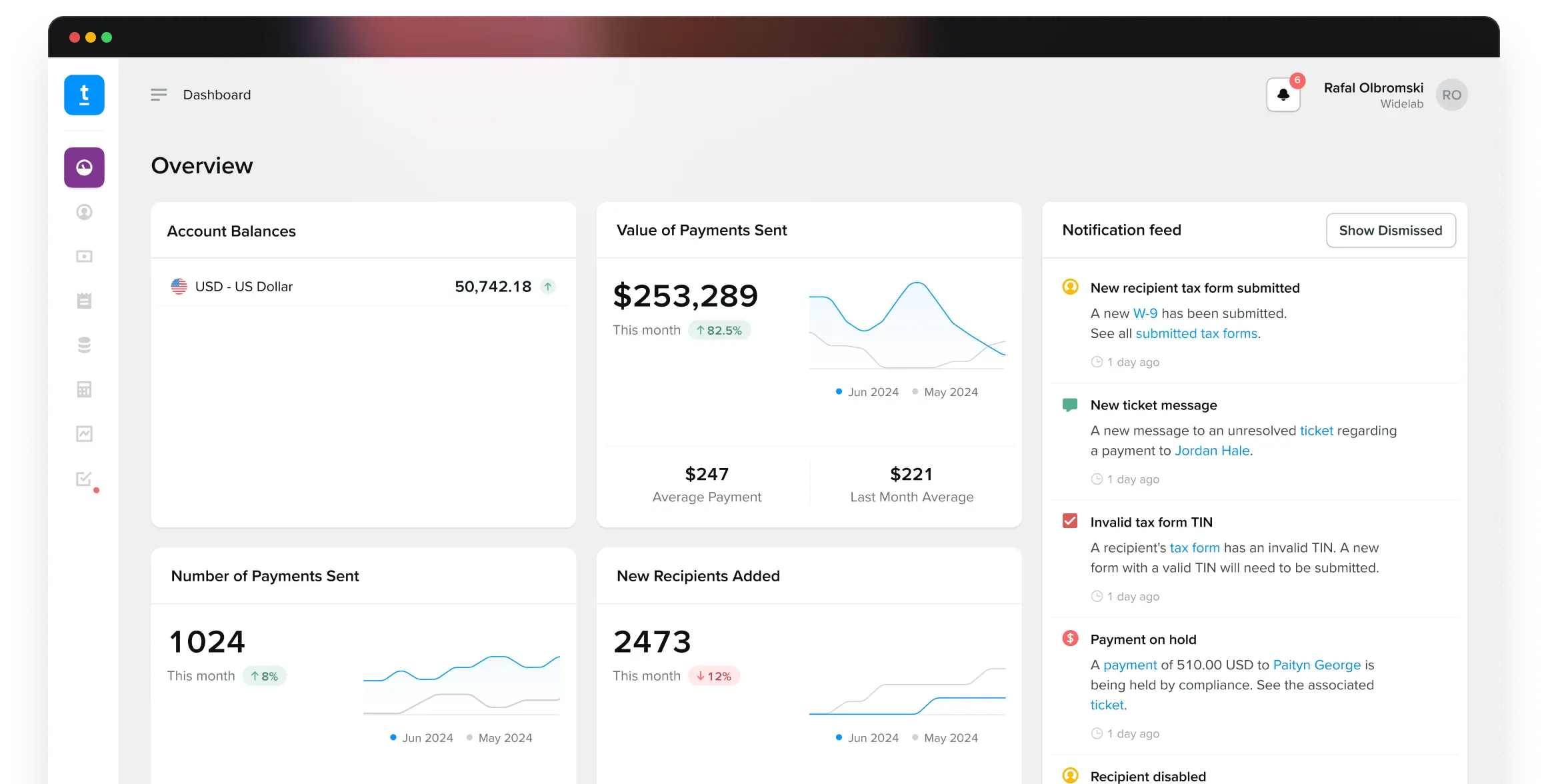

Remove manual work and streamline end-to-end payout, recipient tax, and digital platform compliance workflows in one platform.

Trolley automates tasks across the recipient journey, reducing payout times by up to 90%

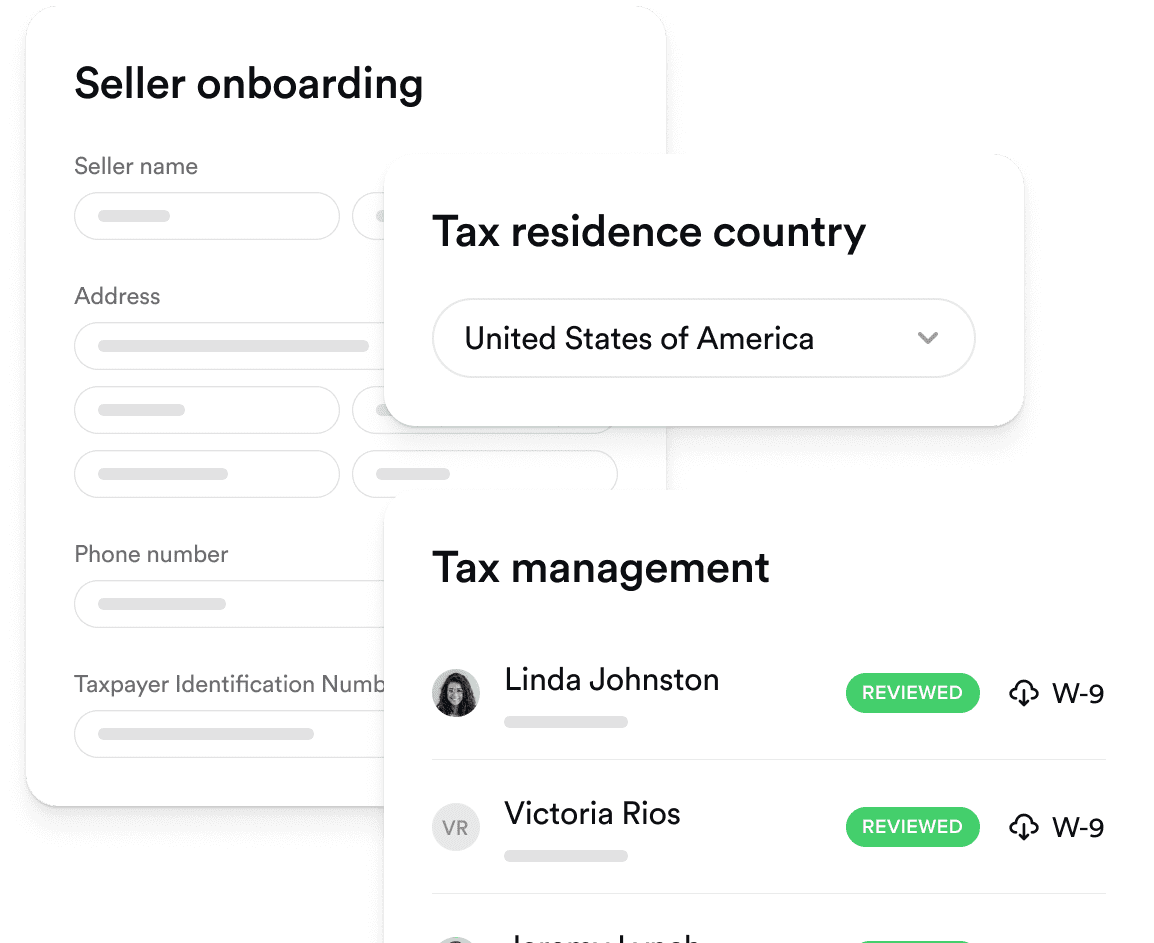

Collect & verify recipient info ensuring compliant onboarding

Communicate updates in 36 languages

Ingest invoice data directly to Trolley and convert them into payments

Send global payouts, define workflows & sync with your ERP

Withhold taxes where needed, generate & e-file end-of-year tax forms

Flag & stop suspicious account activity with built-in risk management

Delight recipients and meet global compliance needs

In today’s internet economy, user experience can make or break your business. Trolley enables you to give the best onboarding experience to your recipients while building trust and automating back-office work behind the scenes.

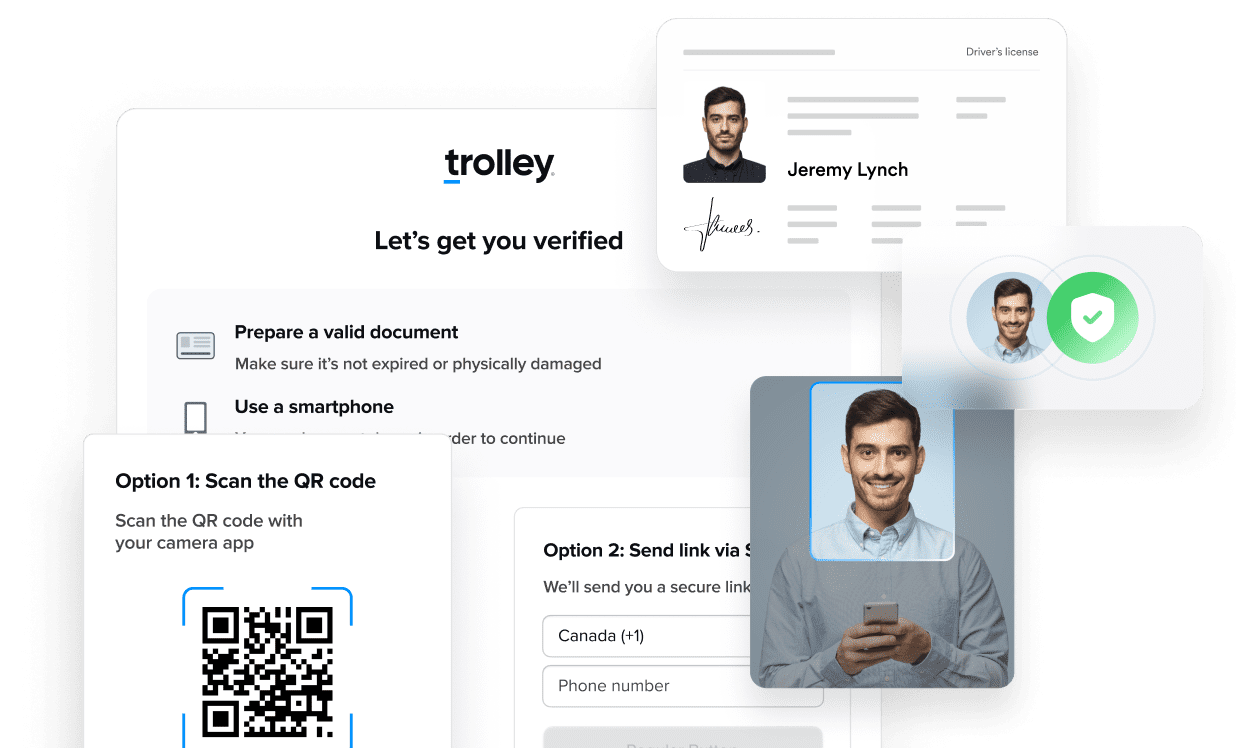

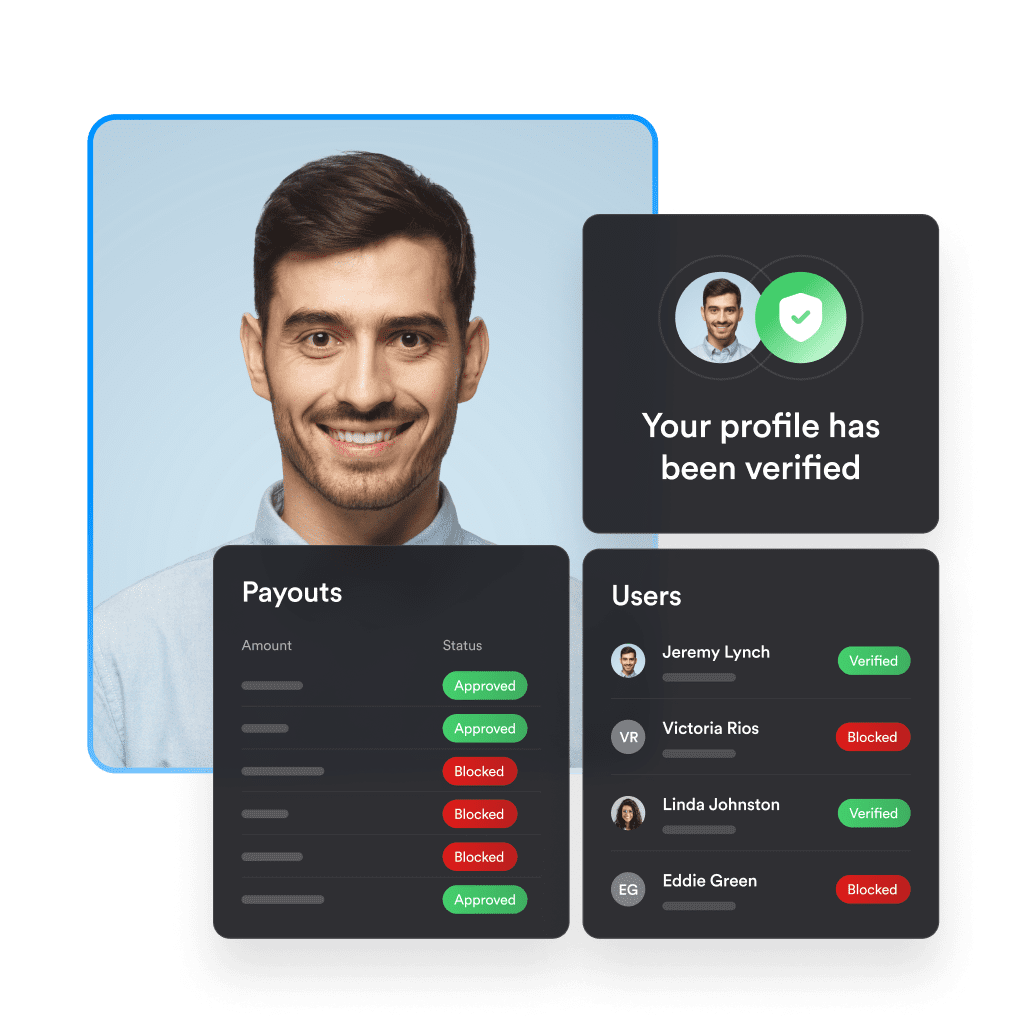

Verify identity and collect documents

Ensure recipients' authenticity, build trust, and prevent account takeovers with built-in identity & business verification and document collection.

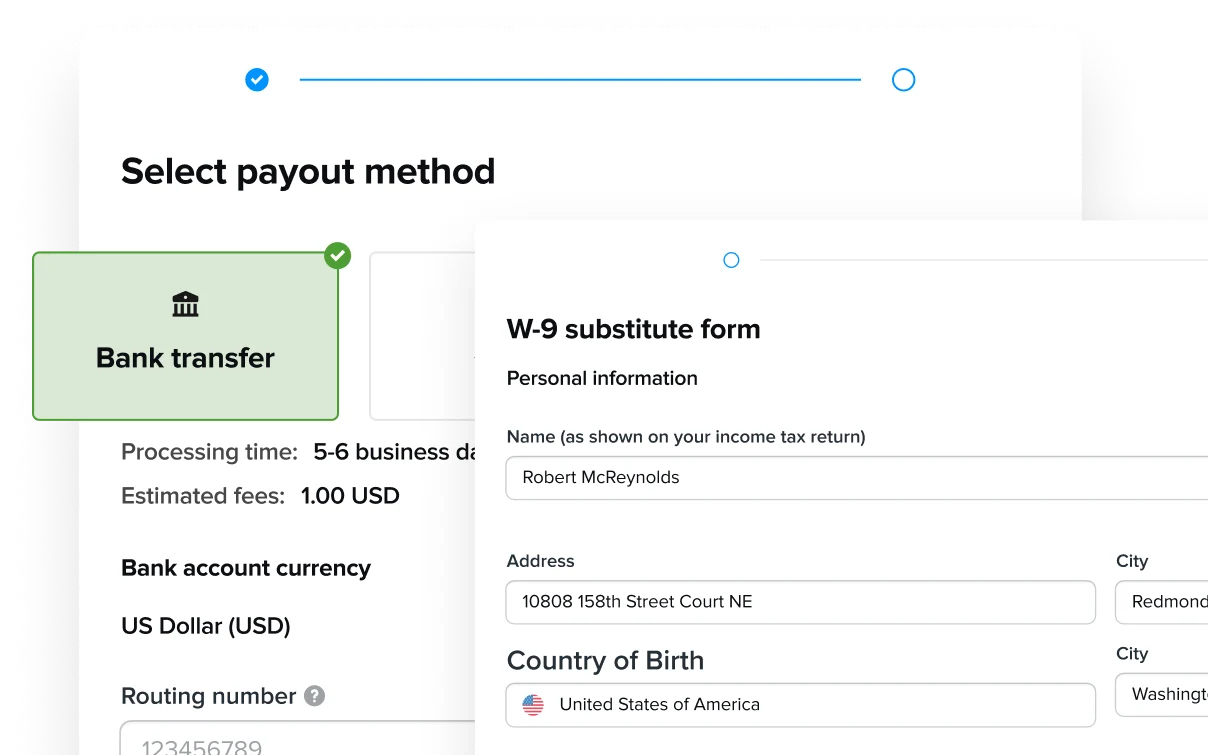

Automate tax

and bank info collection

Through the Trolley portal, API & modular widget, it’s easy to add onboarding to your platform– and make collecting recipient data a breeze.

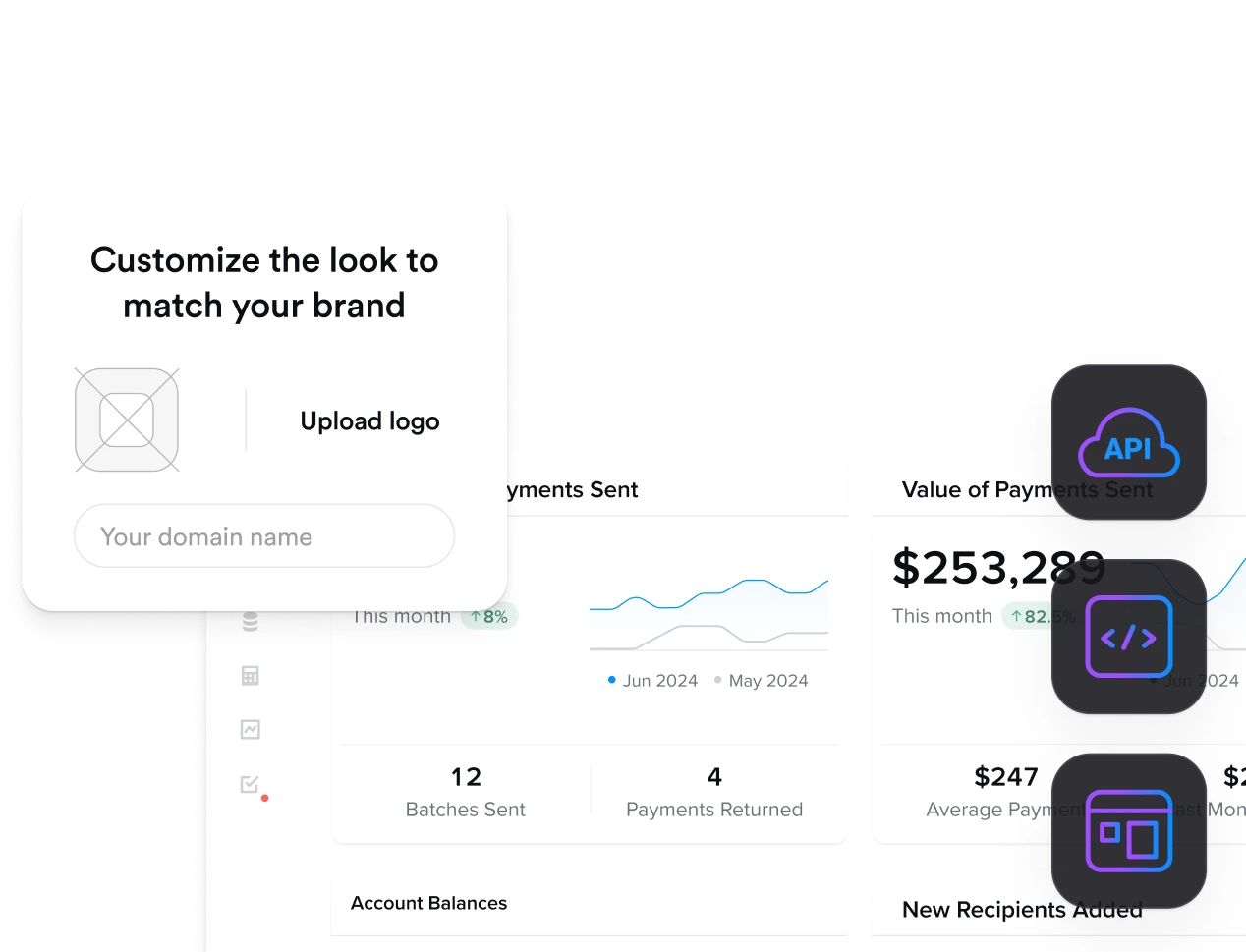

Built for businesses big or small

- Manage end-to-end within Trolley dashboard

- White-label with your logo and domain

- Embed in your app or website using API, SDKs, & dev tools

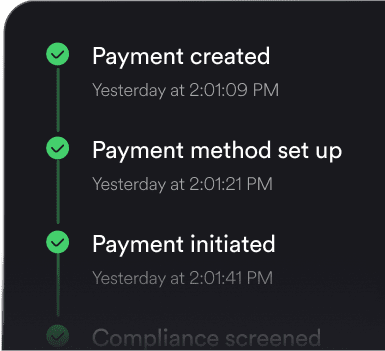

Send fast, flexible payments and scale payout operations

Consolidate all your payout operations under one platform and build the most optimized workflows that suit your business needs: today or in the future.

Direct-to-bank payouts in 210+

countries and territories

Bypass intermediaries and send payouts directly to your recipients' bank account using the cheapest route options available.

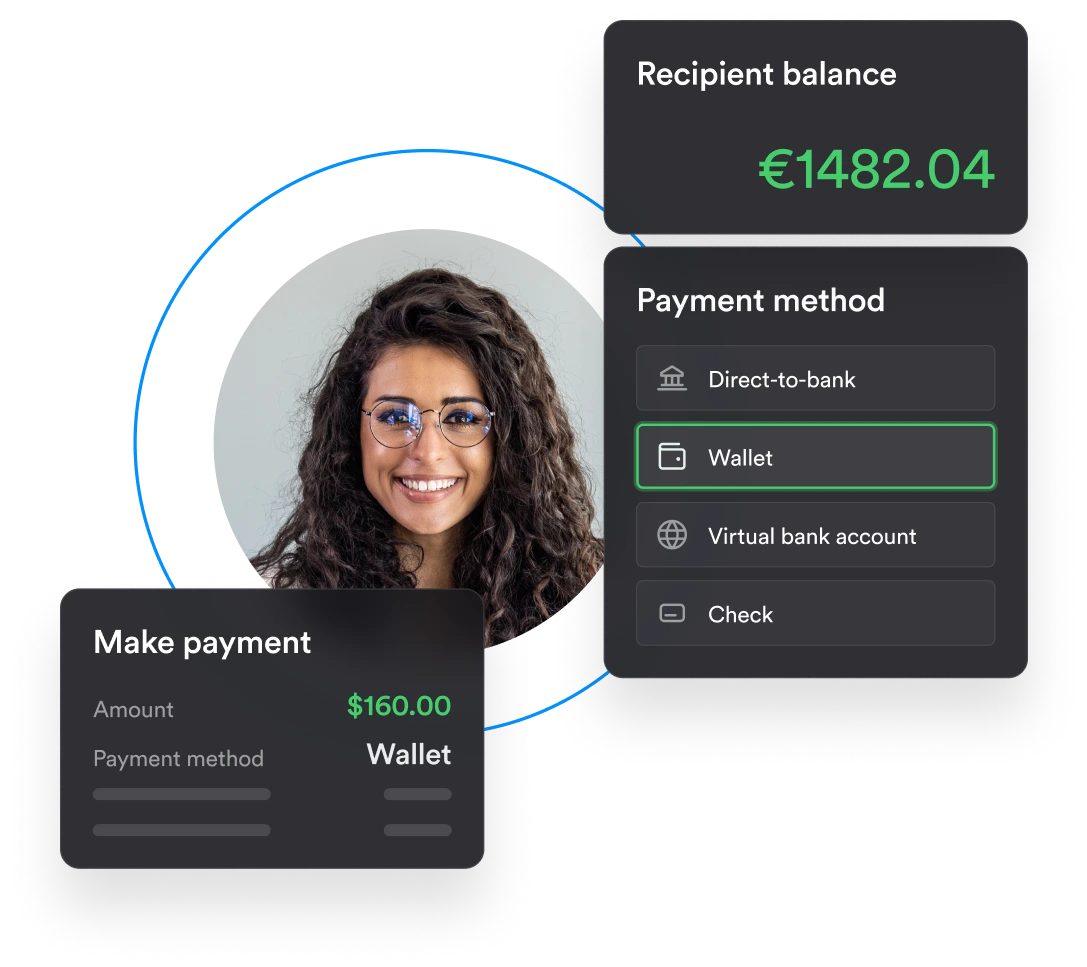

Recipients' payment method of choice: wallets, bank accounts, checks, and more

Give multiple options for payouts to your recipients and make payouts your competitive advantage.

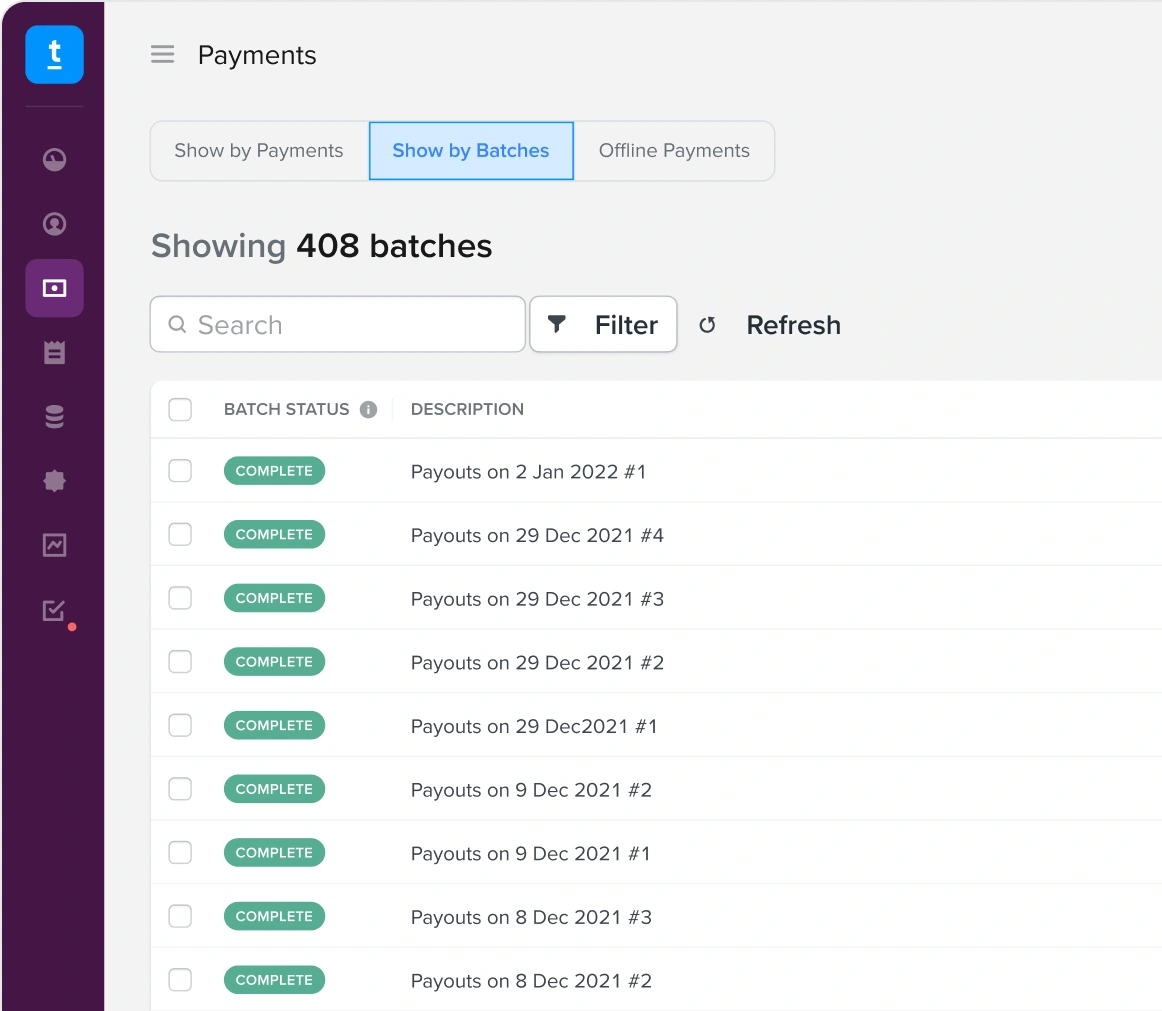

Scale your operations with invoice management and batch payments

Create invoices and consolidate to save on transaction fees: manually, from ERPs, CSVs, or using APIs.

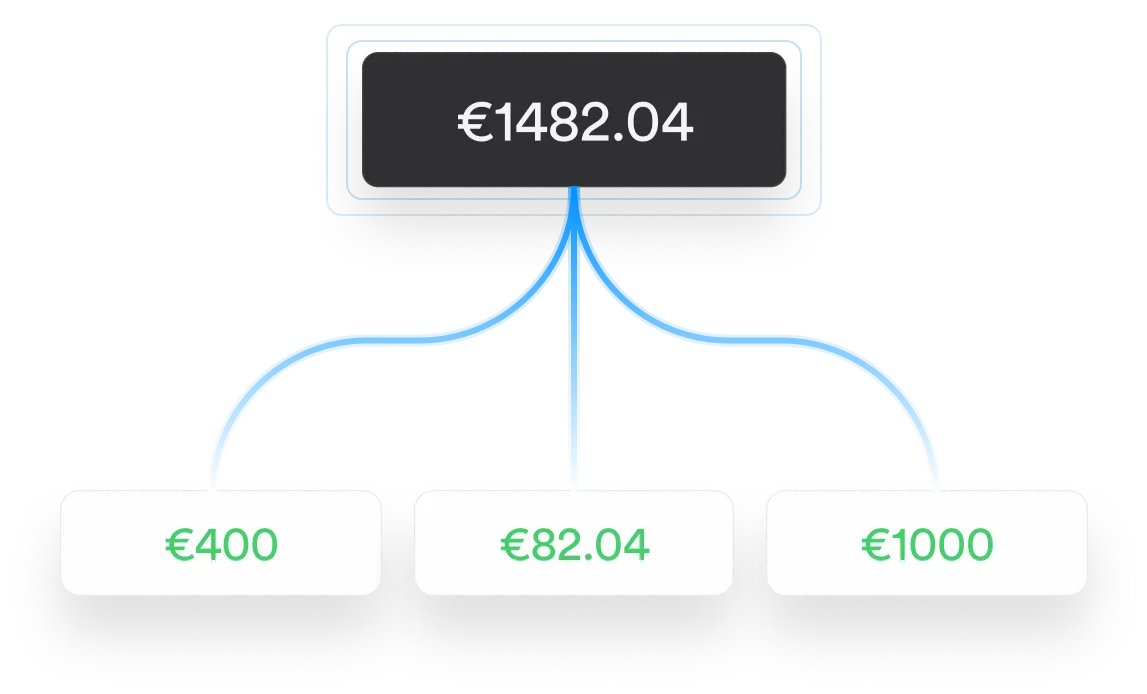

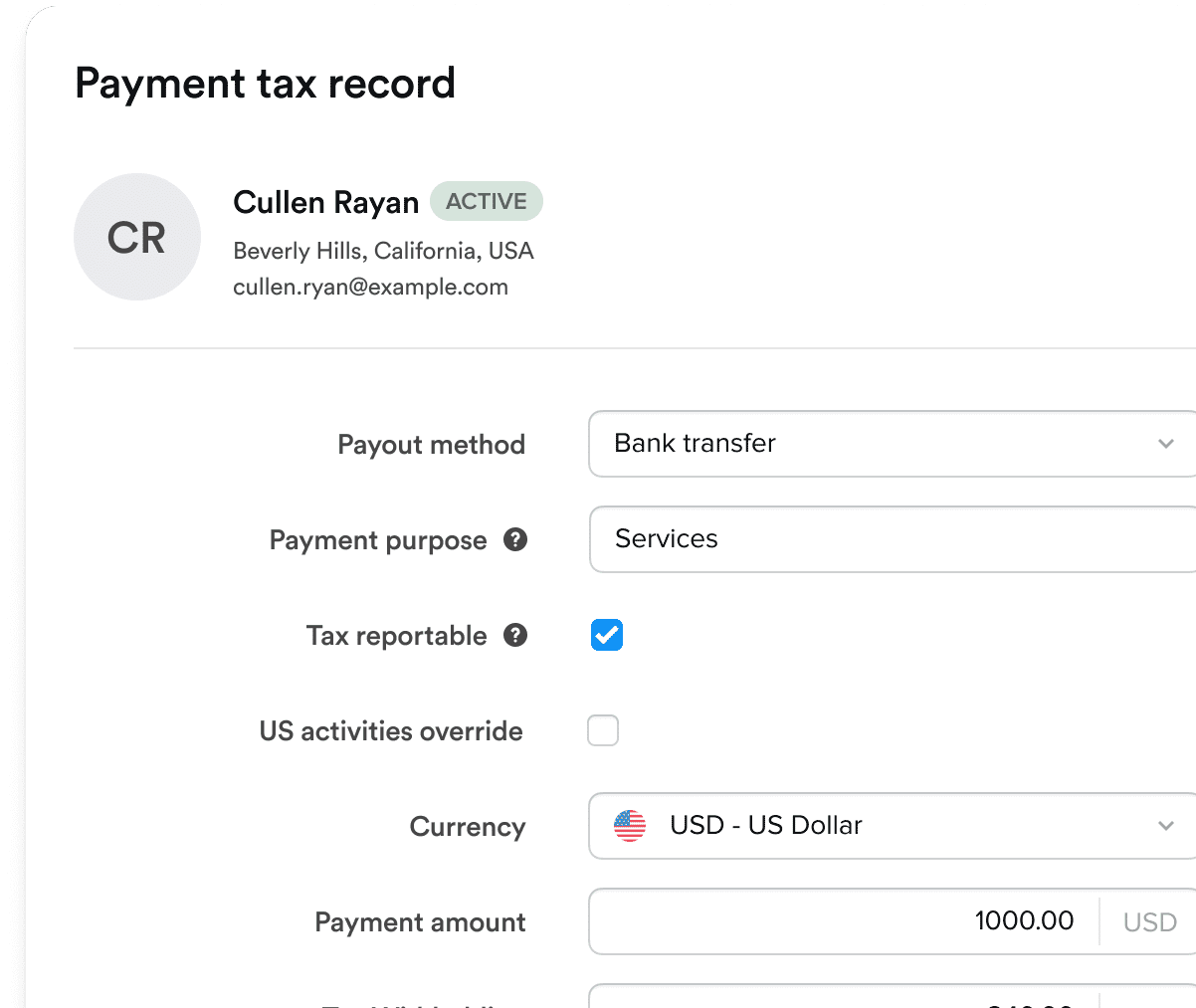

Split transaction costs per

your business model

Whether you absorb the fee, pass it on, or split it, Trolley Pay allows you to set this uniquely for every transaction.

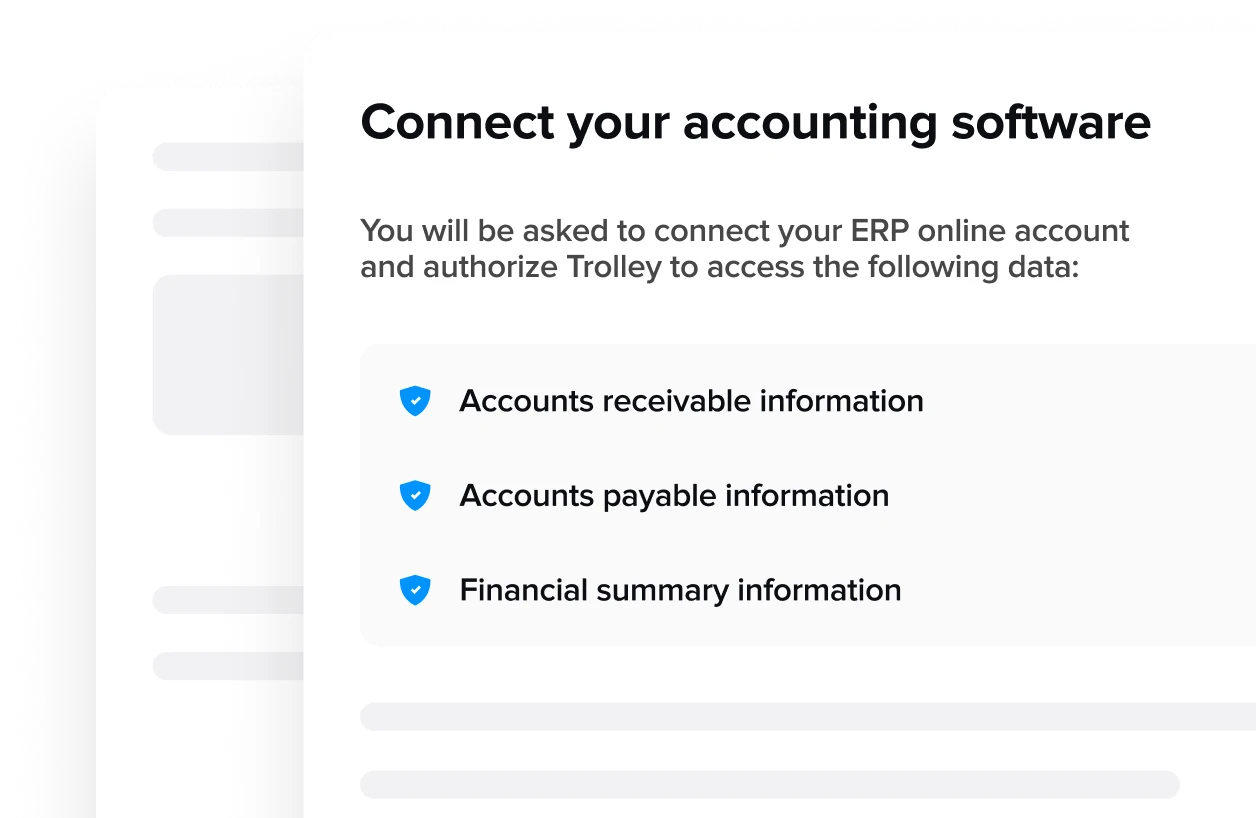

Sync data across systems

From accounting systems to data warehouses, Trolley is designed to remove manual work and automate workflows and reporting.

Improve productivity

and centralize operations

Simplify and set up workflow automations as per your business processes and get your whole team to collaborate on one platform.

Built-in IRS tax and digital platform reporting

Every payout comes with compliance requirements, so Trolley has built these workflows directly into your payout process. No need to switch systems or scramble at year-end—we’ve got you covered.

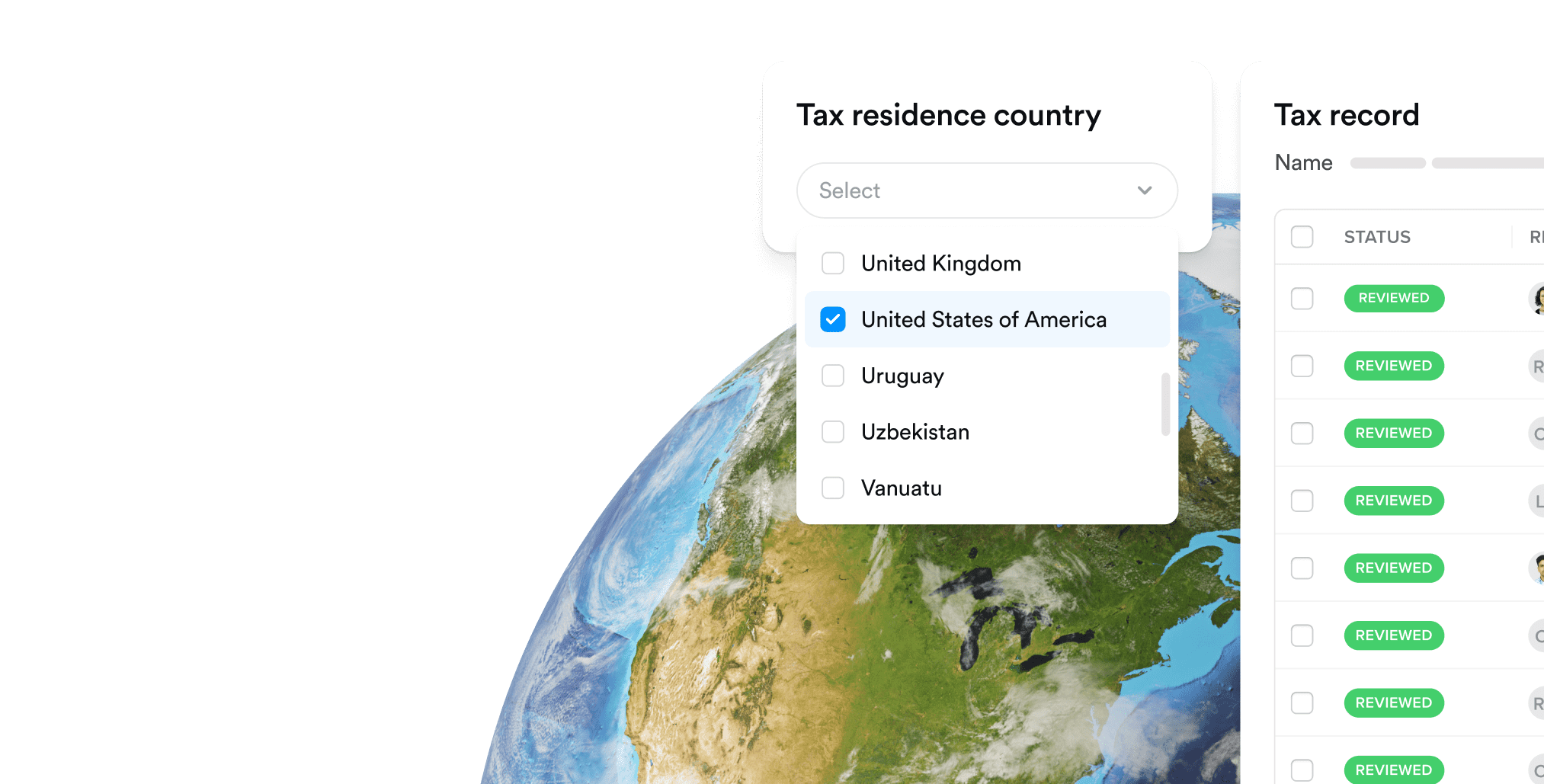

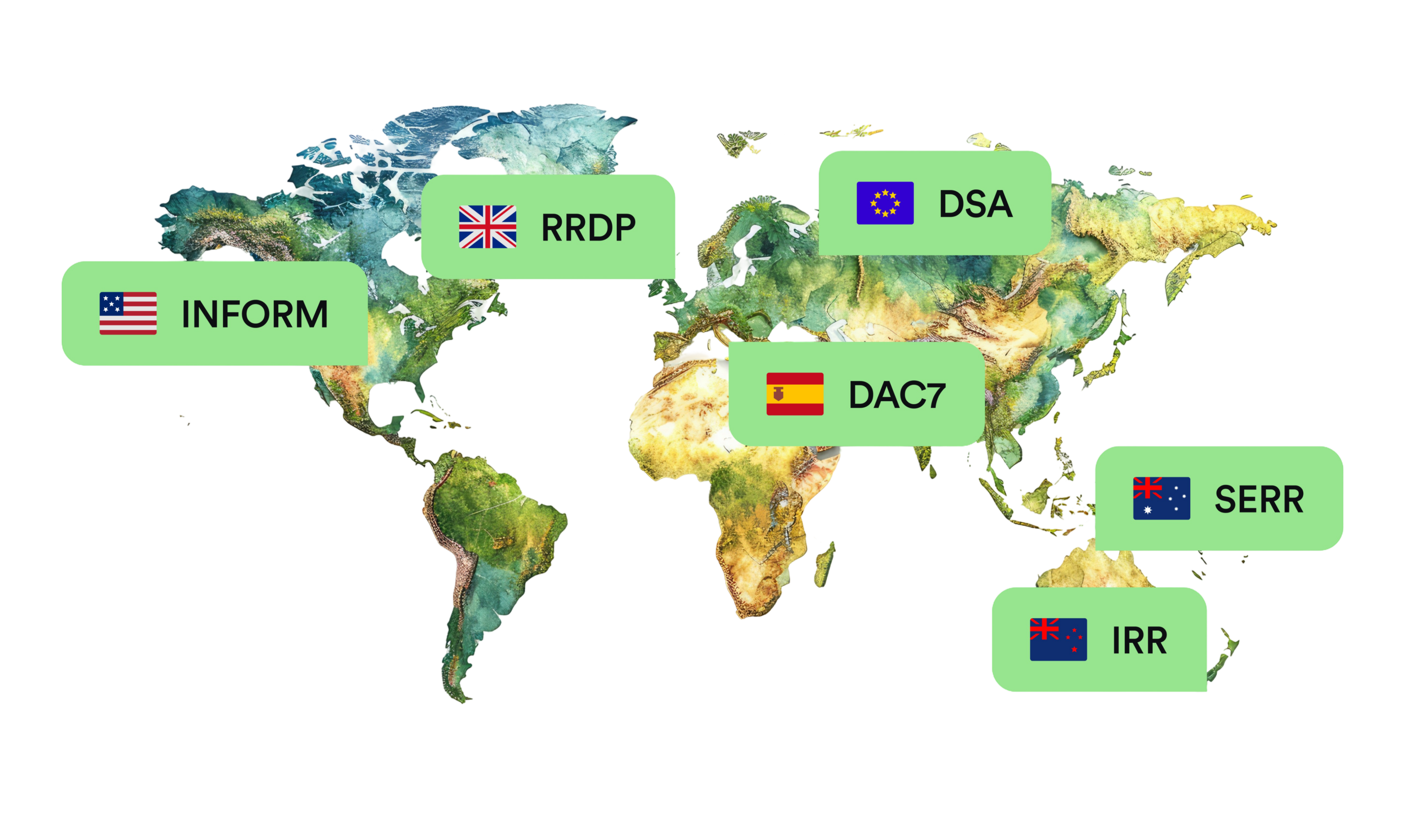

Digital platform reporting for the EU, UK, AU & NZ

As the internet economy becomes mainstream, governments worldwide are introducing new compliance requirements. Trolley stays ahead of the curve, automating these processes as they roll out.

- DAC7 for the 27 member states of the European Union

- Platform Operators Reporting for the United Kingdom

- Sharing Economy Reporting Regime for Australia

- Income Reporting Rules for New Zealand

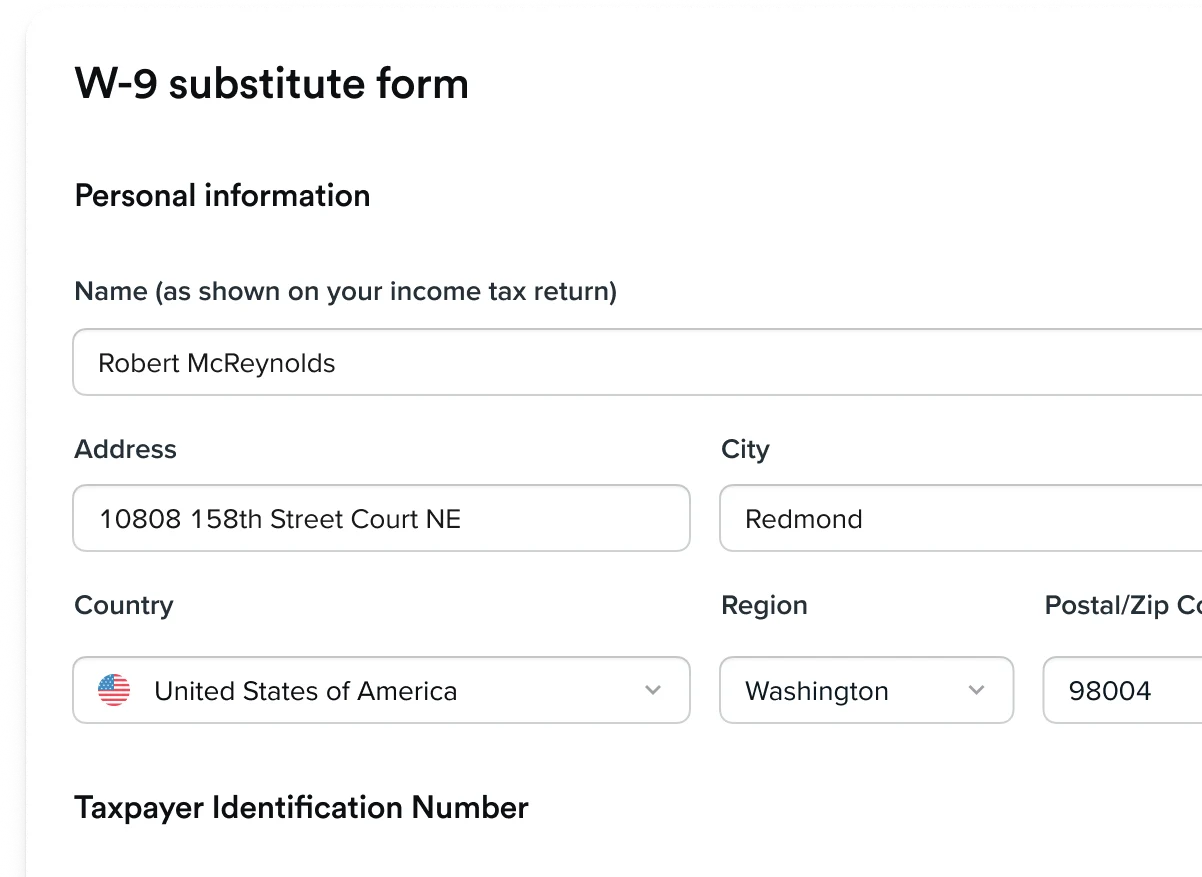

IRS tax compliance for US-sourced payments

Automate Forms W-9, W-8 collection and year-round withholdings (if required) and say goodbye to the year-end grunt work of tax filing.

Collect and sign off on the right tax forms based on recipients' jurisdiction

Eliminate manual work and endless email exchanges by allowing recipients to self-serve their onboarding compliance.

Apply witholdings automatically and consolidate tax records

Avoid the hassle of manually calculating withholdings—Trolley automatically applies the correct amounts year-round, factoring in the type of work, applicable treaties, and other key details.

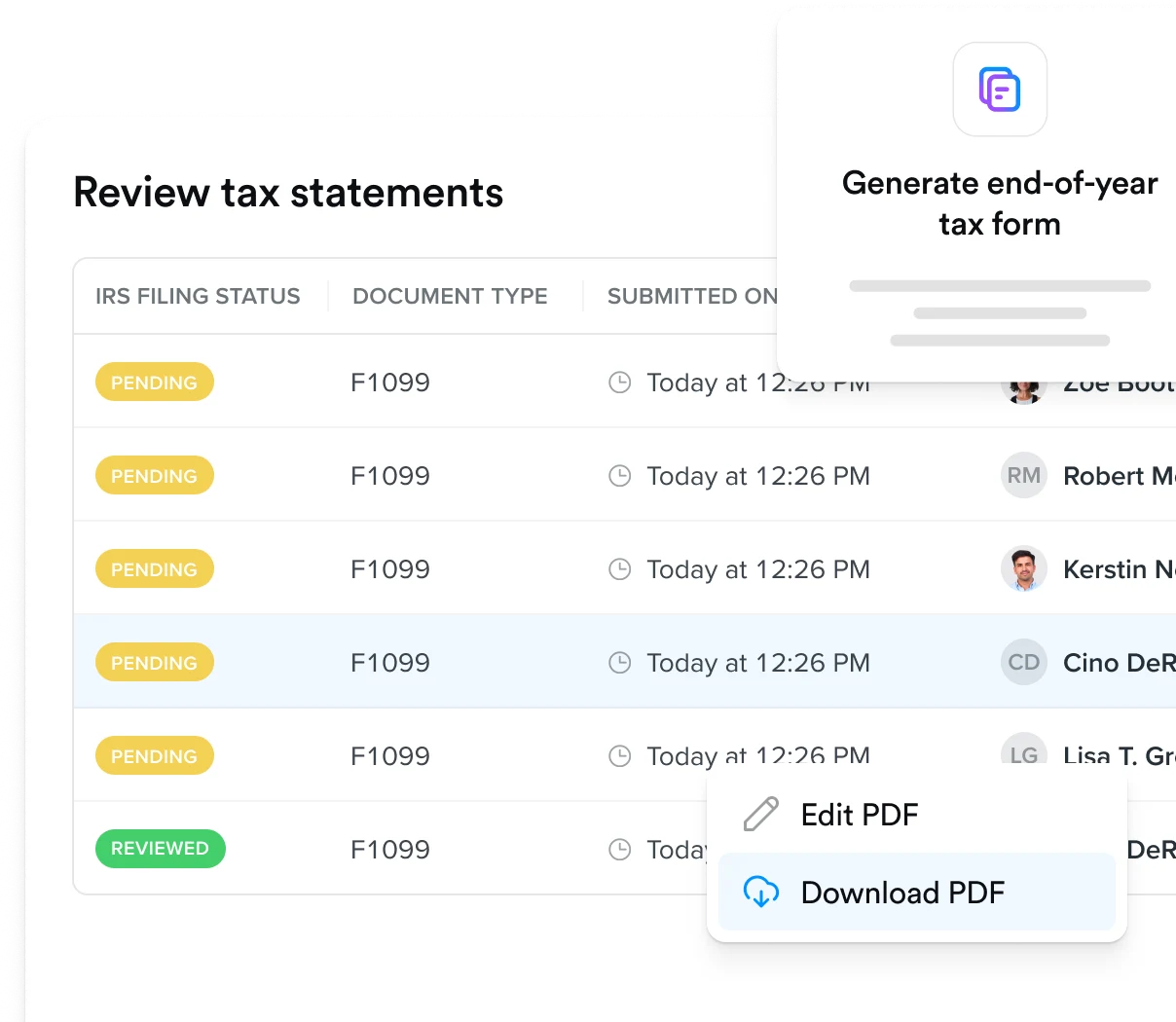

Generate end-of-year tax forms in minutes

Review and approve all earnings at year-end, then e-file directly with the relevant authorities through Trolley—or download the files for manual upload.

Build trust and safety

on your platform

Managing risk is a critical challenge for growing businesses and platforms, especially when payouts are involved. Trolley equips you with the tools to build recipient trust, prevent account takeovers, and mitigate operational risks.

Manage growing internet regulations

As global governments adapt to the rise of “internet work,” Trolley simplifies launching or conducting business in new geographies without regulatory and compliance hurdles.

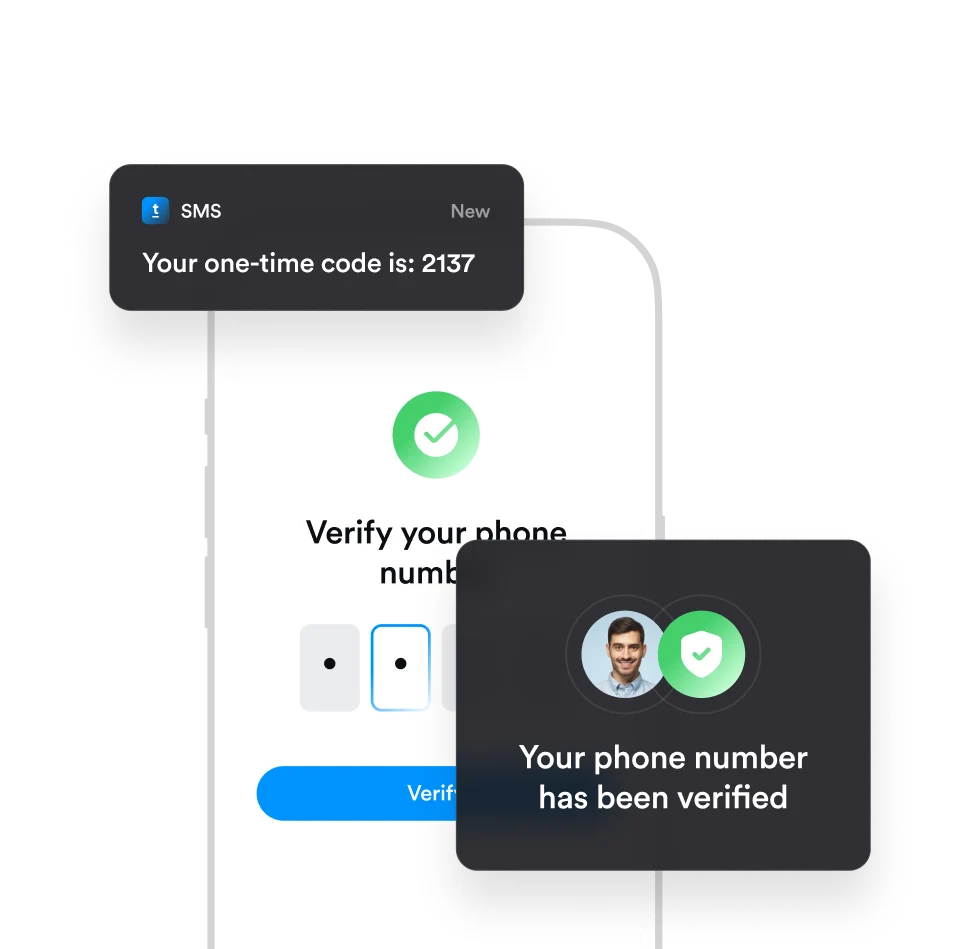

Verify phone numbers, addresses, and TINs

Incorporate phone number, address, and TIN verification in a single streamlined workflow.

An array of tools for risk profiling

Scale your risk management operations with tools like riskscores, OFAC watchlist screening, and login, IP, and geolocation tracking.

Build business logic based on risk data

Shape the user journey based on the completion of activities that signify low risk and protect your business against fraud.

Built for developers

Hop into production faster with pre-built tools or get granular with workflow customization using detailed API. Build with ease using best-in-class documentation and a forever-free sandbox environment.

Trust & bank-level security baked in at every step

Sleep easy knowing we’re following the highest global standards for managing customer funds and data.

Take the next step toward payout automation

Book time with us for a personalized demo and answers to all your questions, or take our interactive product tour.