Rights-holder friendly payouts

Finding the next big hit is challenging—keeping your global hitmakers happy shouldn't be.

Trolley streamlines workflows in an easy-to-use, end-to-end royalty payouts platform: artist onboarding, identity verification, global payouts, and tax compliance all in one place.

The best in music trust Trolley to handle payouts

We pay over 1.5 million rights holders, send over 150,000 royalty payouts every month, & file more than 200,000 artist tax forms annually.

Redefining SoundCloud’s payout infrastructure for a new era

“Trolley enables SoundCloud to have confidence that royalties will be handled with the care that they deserve.”

Stephen Shirley

Product Director, Soundcloud

Trolley automates tasks across the royalty journey, reducing payout times by up to 90%

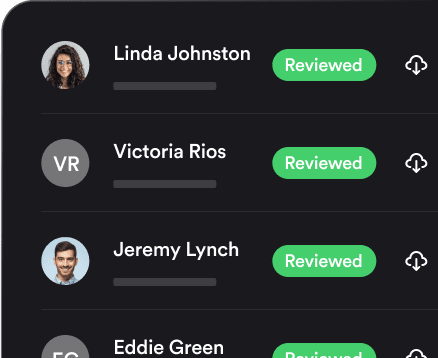

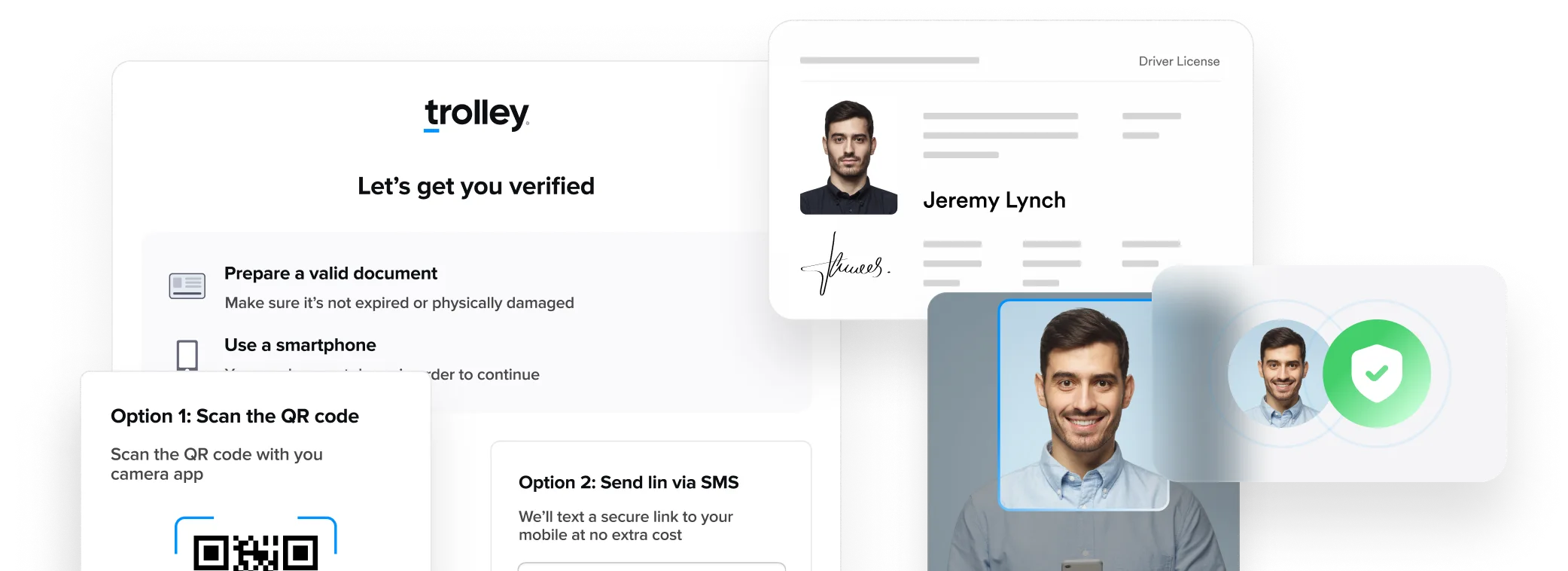

Collect & verify artist info ensuring compliant onboarding

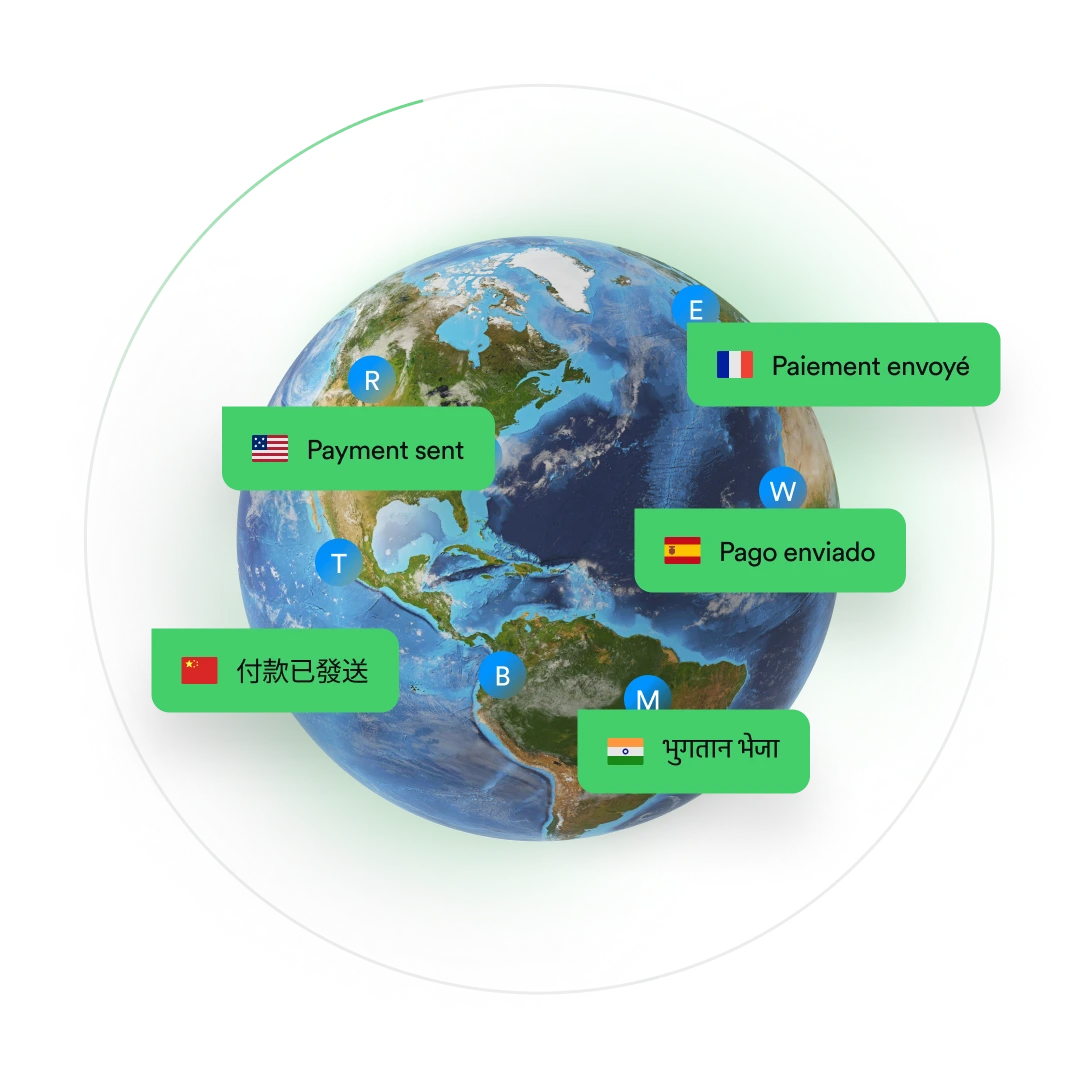

Communicate updates in 36 languages

Ingest royalties data directly to Trolley and convert them into payments

Send global payouts, define workflows & sync with your ERP

Withhold taxes where needed, generate & e-file end-of-year tax forms

Flag & stop suspicious account activity with built-in risk management

Make onboarding artists & rights holders a breeze

Meet global compliance requirements and collect information in a single streamlined flow.

Protect your royalty payouts against fraud

Know Your Artist (KYA) protections combine ID verification, watchlist screening, and adaptive risk-based workflows to stop fraud before it’s paid out.

Automated tax and bank info collection

Through the Trolley portal, API & modular widget, it’s easy to add onboarding to your platform and make collecting recipient data a breeze.

Communicate with recipients in 36 languages

Strengthen relationships with artists & rights holders anywhere with automatic payments and status updates and notifications.

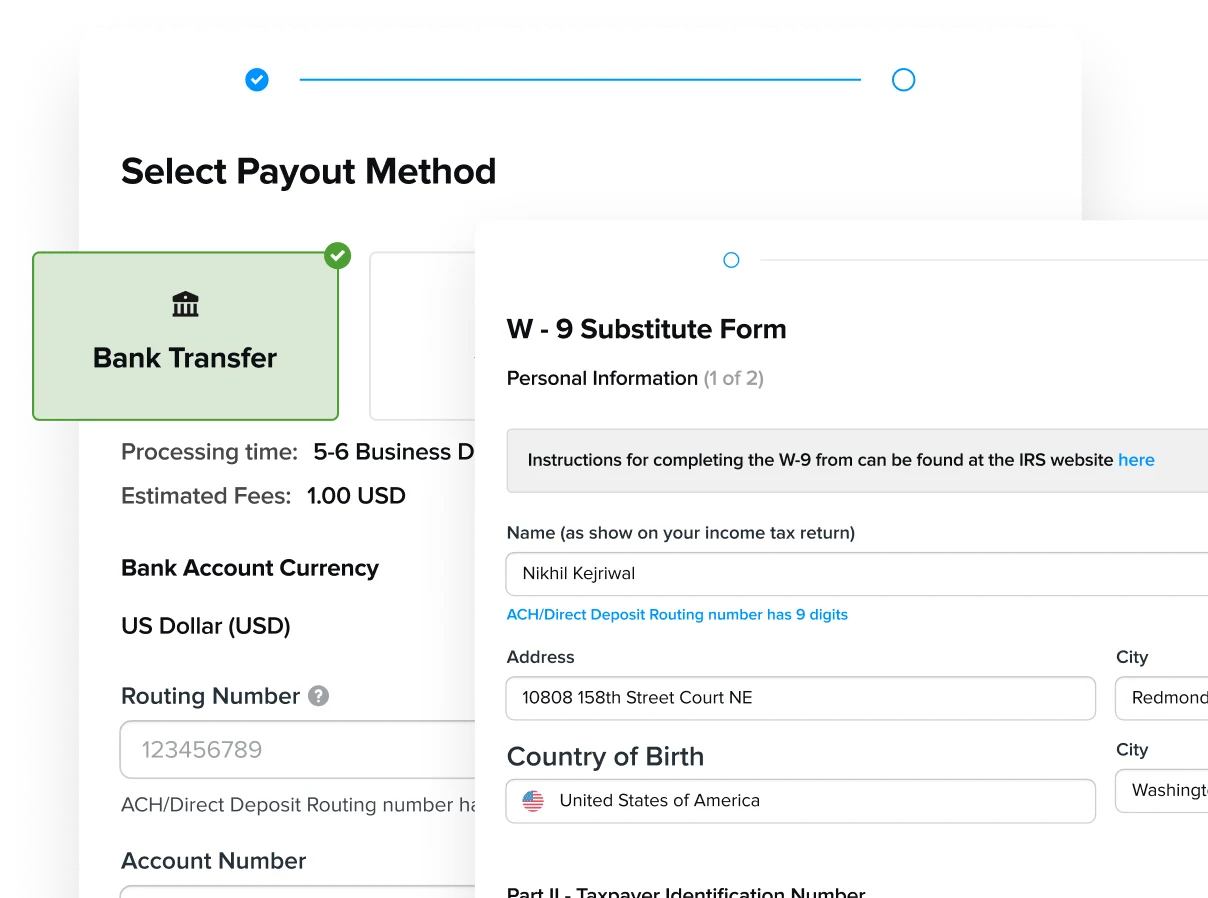

Send fast, flexible payments with integrated royalty workflows

Send faster payouts to 210+ countries & territories and stay compliant with taxes on those payouts. All while removing the manual work of transferring data between different systems.

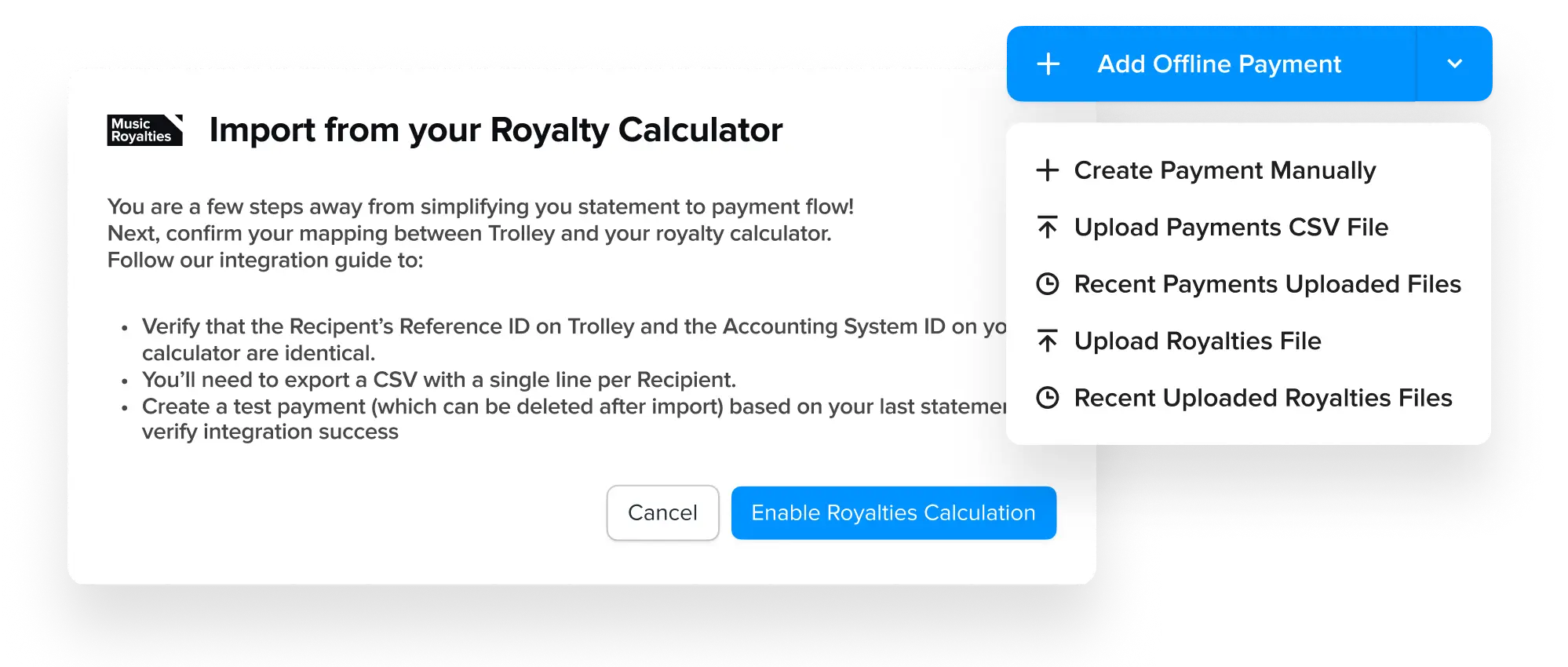

Ingest data directly

from your royalty calculators

Speed up royalty processing, reduce errors, and consolidate multiple payments into a single batch by directly importing data from your royalty systems.

Automate tax withholding

and IRS compliance

Generate end-of-year tax forms (like 1099-MISC or 1099-NEC) in minutes and e-file directly with the IRS. Don’t let ever-changing compliance rules be the friction that limits your growth.

Send fast, global,

direct-to-bank payments

Consolidate all payout methods in one platform, streamline your operations, and save on transaction costs.

Sync transaction

data directly with your ERP

Maintain data integrity and reconcile with the ERP you use today to maintain a fool-proof end-to-end flow of data.

Empower your partners and business managers with the tools and access they need

Aggregate payout systems across all your businesses, partners, agencies, and managers within one platform. Leverage your scale to reduce costs or even earn additional revenues.

- Simplify flow of funds from an administrative perspective

- Create and manage sub-merchant accounts with ease

- Get high-volume discounts by aggregating payouts

- Aggregate and automate reporting into one dashboard

- Unlock new revenue streams by creating additional services for your artists or share payment transfer costs as per your business model

A dev-friendly platform to

build advanced royalty tools on

Trolley can work within your tech stack, scales with your business, and lets you build a payout experience tailored to your artists.

Trust & bank-level security baked in at every step

Sleep easy knowing we’re following the highest global standards for managing customer funds and data.

Try the platform that pays over 1.5 million musicians worldwide

Learn why the industry’s best trust Trolley.

Explore our products

Trolley blog

Royalty payout FAQs

How do music royalty payments work in Trolley?

Trolley makes paying royalties easy. Simply import your artist payment details from your royalty management software, ERP, or create recipients manually. Then, you can generate single and batch payments manually, with CSV imports, ERP imports, or API integrations and pay your artists in the method of their choice. With our payment network spanning over 210 countries and territories, you can pay deserving artists around the world in 135+ currencies.

How do I set up royalty payments in Trolley?

- First, you’ll need to activate your Trolley account.

- Once your account is active, add funds to your account.

- Lastly, import recipient and payment details or just enter your recipients’ email addresses and let them provide their own details.

Are royalty payments taxable?

Royalty payments are typically taxable income in most jurisdictions. Whether you’re sending royalties from intellectual property, such as patents, copyrights, or trademarks, or from resources like oil, gas, or minerals, they’re generally subject to taxation. The tax treatment can vary depending on your country’s tax laws and the specific circumstances of the royalty payment.

US-sourced royalty income must be reported to the IRS, regardless of the recipient’s country of residence. Trolley Tax automates the collection of recipient info, generation of jurisdiction-specific forms, and makes e-filing with the IRS a breeze, reducing your burden of compliance.

For a deeper explanation of IRS taxation for music payouts, check out IRS royalties blog post.

How are royalty payments taxed?

The taxation of royalty payments can vary depending on several factors, including the type of royalty income, the jurisdiction, and any relevant tax treaties.

Here’s a general overview:

- Income tax: Royalty income is often considered ordinary income and is subject to income tax at the applicable tax rate.

- Withholding tax: Some jurisdictions impose withholding tax on royalty payments made to non-residents. The withholding rate can vary depending on tax treaties between countries.

- Capital gains tax: If your artist sells the rights to an intellectual property and realizes a capital gain, the gain may be subject to capital gains tax instead of ordinary income tax. The tax treatment of capital gains can be different from ordinary income tax rates.

Does Trolley issue Forms 1099 for royalty payments?

Yes. If you are subscribed to our Tax product, Trolley will generate tax forms accounting for all the payments you have made through the financial year. These include Forms 1099-MISC, 1099-NEC, and 1042-S. When it comes times to e-file with the IRS, you can do so directly in Trolley with just a few clicks.

Can I import my existing royalty payments into Trolley?

Yes, you can import your existing royalty payments into Trolley. You can also import your rights holders’ banking details so you don’t have to ask them to fill out the same forms again.

Can I issue checks for my royalty payments?

Yes, Trolley lets you mail paper checks to your artists for their royalty payouts. We also offer solutions to help you move your artists from physical checks to online bank transfers as their preferred payout method.

Does Trolley track royalty payments?

Trolley comes with built-in payment tracking so you can pinpoint exactly where the payment is and by when it will hit the artist’s account. We also have automatic return handling to give you total peace of mind over the money in motion.

How do splits work in the royalty payout workflow?

Splits are calculated in advance using royalty calculators or CSV files. Trolley then uses the data from these files to determine the amounts to be paid out. Additionally, we provide a memo field for each payment line item, allowing you to display the split calculation for your artist.

Does Trolley generate royalty statements?

Trolley doesn't create royalty statements; we receive royalty data through royalty calculators or manual CSV uploads. However, we do send payment notifications, and for Tax subscribers, we generate consolidated earning tax forms for your artists at the end of the year.

Which countries does Trolley Tax cover for royalty payouts?

Trolley Tax covers all countries for payouts sourced from the US. When a new recipient onboards, we collect all the necessary info for jurisdiction-specific tax forms before you’ve even made a payment. Tax forms are auto-validated and re-triggered whenever forms expire.