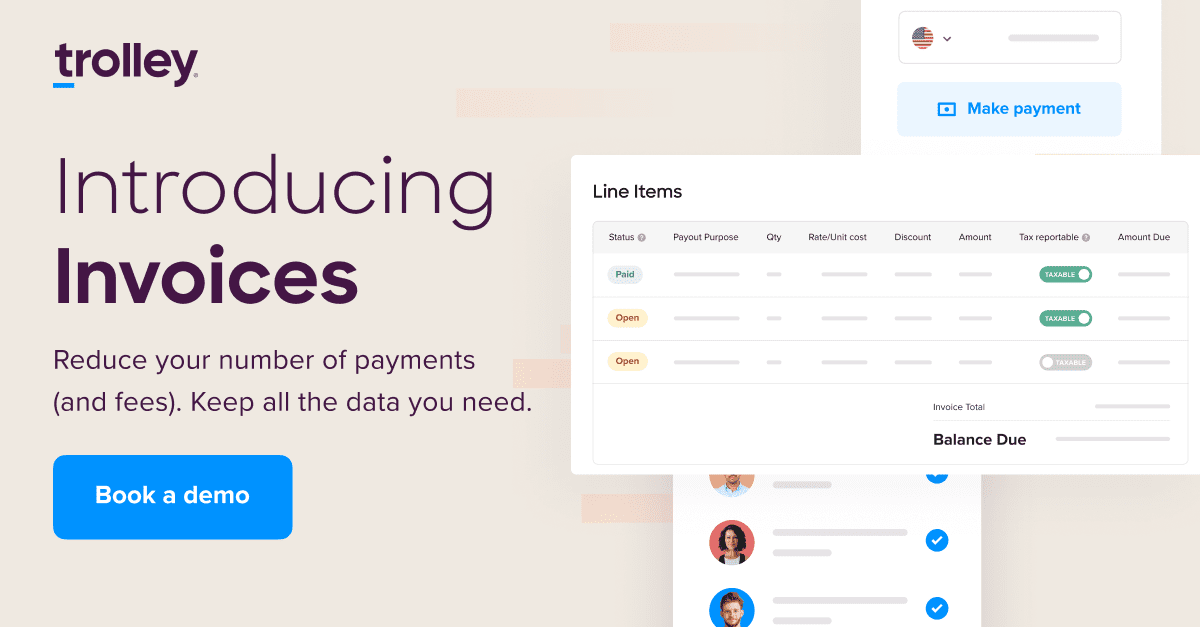

Payments are never one-size-fits-all, and tax rules are evolving in a way that’s driving a need for more and more granular tracking of payment purposes. To simplify payments while embedding them with the details that drive efficient tax filing, we’re introducing a new major feature in Trolley, Invoices.

There’s something very clean and simple about a single payout being tied to a single payout reason. It’s why this has become the industry standard for payout platforms.

However, businesses have long tracked their payout relationship via multi-line invoices where they can maintain visibility over each dollar and both where and why it was spent.

For those businesses that have complex, multi-category, multi-project relationships with their partners, the one-reason-per-payment nature of many payment systems has been cumbersome, leading to multiple payouts to each partner in order to keep data clean.

Table of contents

Invoices, Trolley’s line-by-line payout categorization and consolidation tool

Trolley aims to make the payout process fast and efficient for businesses across the internet economy.

As we learned more about our customers’ needs and how they were handling payouts, we realized that in many cases, the 1:1 nature of many payouts platforms wasn’t efficient or ideal.

Take music royalties for example. Often there are multiple payments moving from a label to its artists each month. Streaming royalties for individual tracks, physical/digital sales of albums, advances on future works, and contractor fees for studio work could mean multiple payments to the same artist in a given month. Each payment would need to be categorized for a different type of earning and each category potentially has different tax implications.

However, each payout can only be linked to one reason to pay. This meant that a label may be sending funds to the same artist multiple times in order to keep their data clean. And this could mean a fee per transfer, something that could add up, especially in scaling international businesses.

This is why we revamped our payout system and added Invoices, so our payouts could act more like the invoices customers already using.

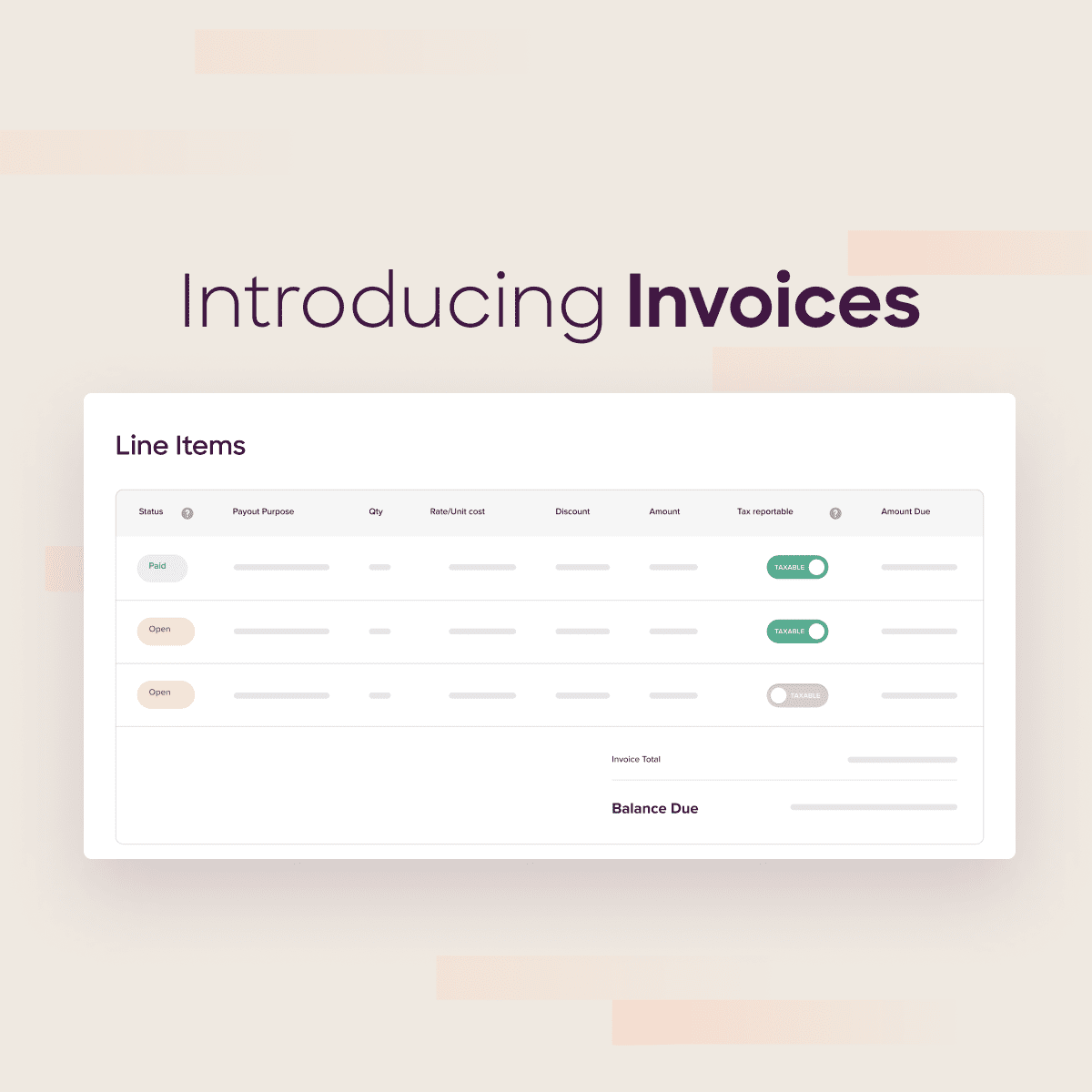

With Invoices, you can create multiple “line items” each with its own categorization, that can be bundled together to make a single payment. We call it invoices, because it does exactly that, it matches payouts to your existing invoices.

That means that payouts can be more cost-effective, and Trolley has all the information you’ll need to create your 1099s & 1042s at the end of the year.

How Invoices benefits for you

Invoices are payment transaction records that give you more control over how payments are recorded, segmented, and sent out, allowing you to process payments more efficiently and reduce payment costs.

Save on transaction fees

By bundling multiple “line items” into one invoice-based payment, you can save yourself/your recipients multiple transaction fees. When you’re dealing with international recipients, this could be quite substantial, especially when dealing with SWIFT wires.

Offer payment flexibility

Invoices allow ultimate flexibility whether splitting an invoice to be paid over two separate payments, multiple invoices under a single payment, or simply a single payment for an invoice.

Maintain granular tax compliance

By linking income reasons and other metadata to each “line item,” the details required to create 1099s and 1042-Ss is there at your end of year, allowing you to leverage the Trolley Tax Center to quickly produce and distribute recipient tax forms.

Accrue earnings for your recipients

For online marketplaces and other businesses that accrue earnings for their recipients and payout on a fixed schedule (weekly, bi-weekly, etc), Invoices provides you with a tool to accrue earnings to be paid later.

How to create an invoice

The Trolley Customer Success team has created a complete step-by-step guide to creating invoices. We’ve simplified it a bit to show you how easy it can be:

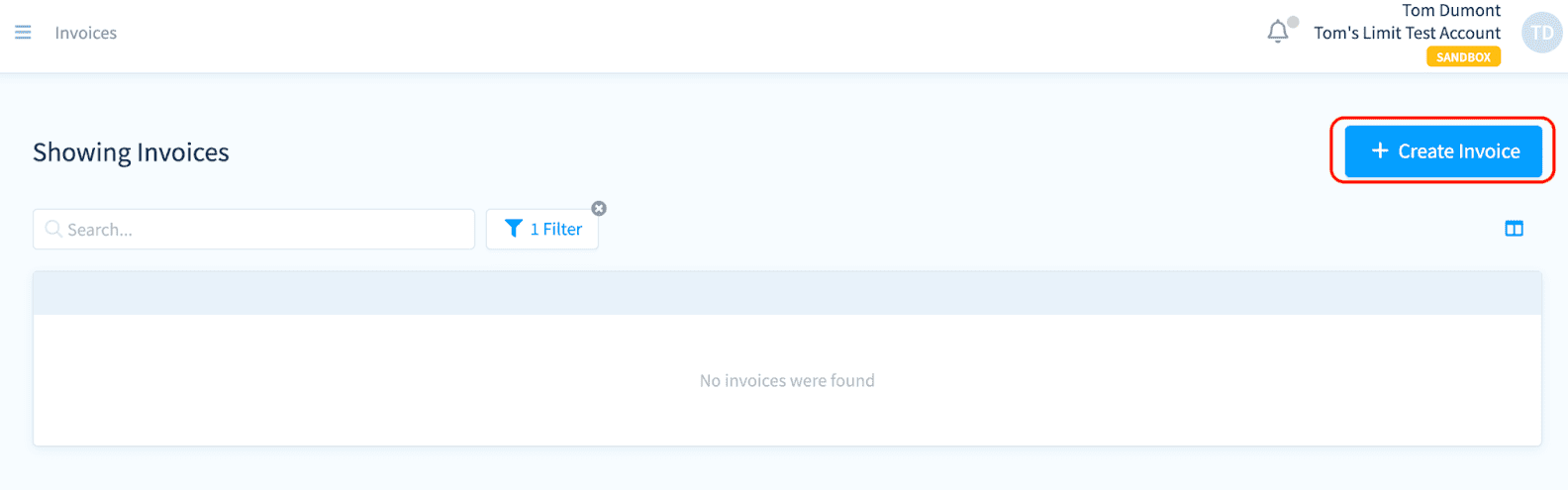

1. Open the Invoices page from the sidebar of your Trolley dashboard. To create a new invoice, click on the blue “Create Invoice” button.

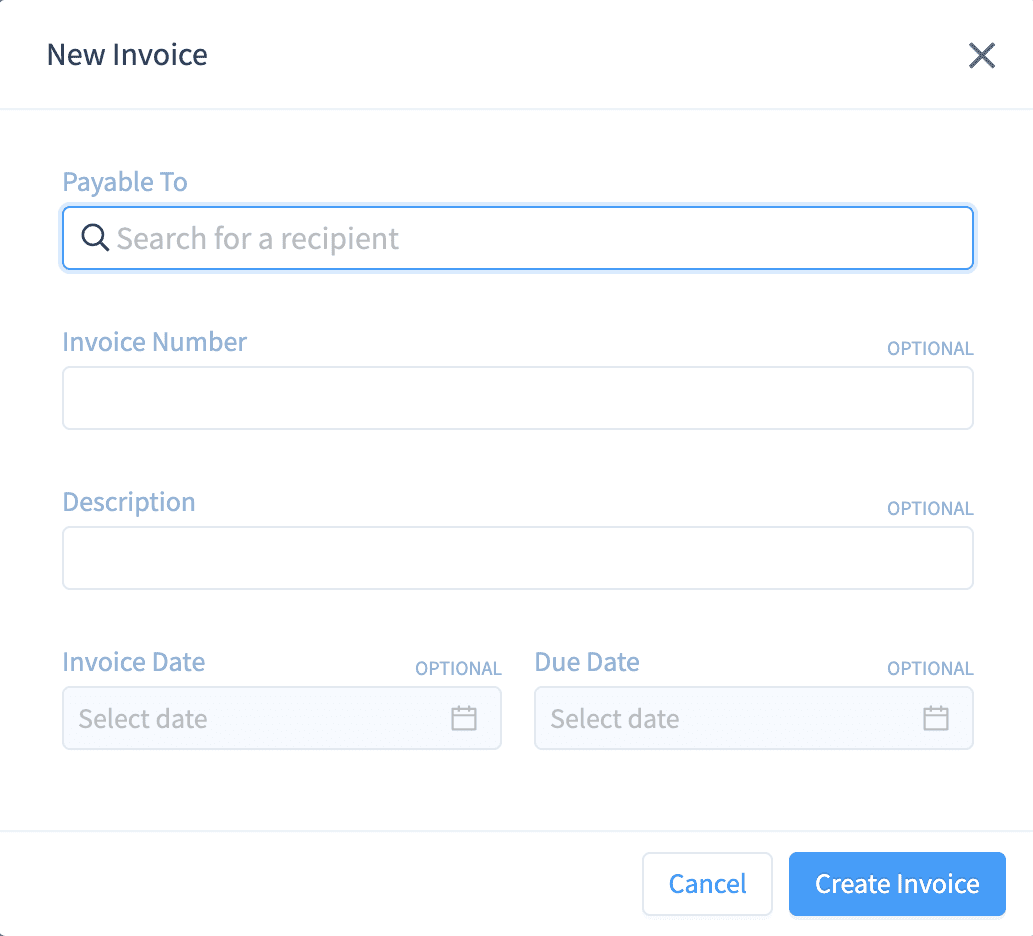

2. Search for your recipient (by name or recipient ID) that will be paid via this invoice. You can also add other optional details.

3. This “Open” invoice will appear in your Invoices page. To add line items, click on the new invoice, and then click on “Add New Line”

Note: Individual Invoice line items may be negative, but the subtotal of the invoice must be positive

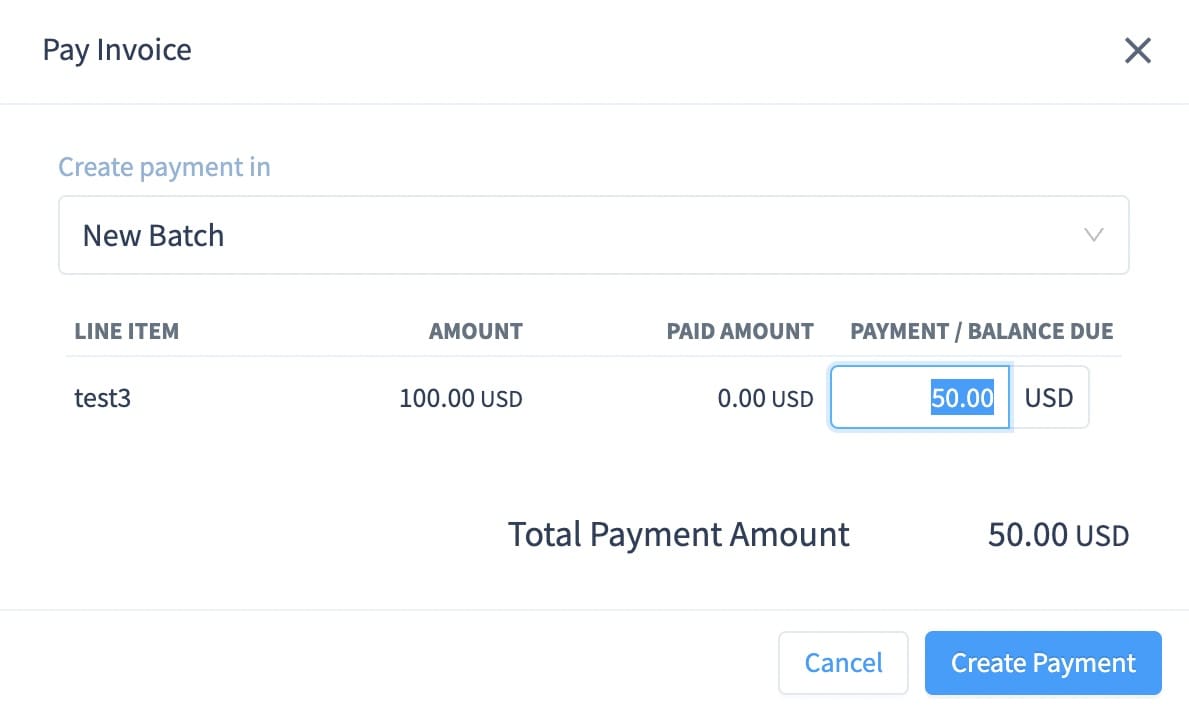

4. Once the invoice is complete and ready to be turned into a payment, click on “Pay Invoice”.

Optional: To partially pay an invoice, click on “Show Details” in the “Pay Invoice” pop-out window shown above, and adjust the “Payment/Balance Due” amount:

5. The Payment created by the invoice will look identical to non-invoice payments, however you’ll be able to see related invoices in the sidebar that appears when clicking on the payment.

Note: If you are using the Trolley API integration—or are interested in API-level control—you can find details on the API endpoints for Invoices in the Trolley API documentation.

Want to move to line-by-line payout categorization?

Invoices gives you the power to consolidate multiple payments into one payout, reducing the number of payments made and saving you money while adding more tax-relevant data to each line item you pay out. Don’t compromise on the details. Trolley now lets you offer unique payouts that match the diverse situations that are found across the internet economy.

If you’ve got a unique use case that Invoices could help you with, email [email protected] to arrange a demo of this powerful feature.