We’re thrilled to announce that Trolley has once again been recognized among Canada fastest-growing technology companies, ranking 41st on Deloitte’s 2024 Technology Fast 50 list with an impressive 484% growth over the past three years.

Today we’re excited to celebrate an important milestone in our journey—our second consecutive year on Deloitte’s Technology Fast 50 list.

With an impressive three-year growth rate of 484%, we’re thrilled to rank 41st overall.

This recognition highlights our position as one of Canada’s fastest-growing technology companies and reflects our relentless commitment to excellence in the payouts and compliance sectors.

As we reflect on this achievement, it’s clear that our growth is more than just a measure of numbers—it’s a testament to the value we bring to our clients, who trust us to simplify their payment and compliance processes every day.

This recognition inspires us to continue pushing boundaries, creating solutions that not only meet current demands but also anticipate the evolving needs of the global economy.

Our journey is rooted in innovation, and each step forward strengthens our resolve to empower businesses with tools that drive efficiency, accuracy, and trust across borders.

What we cover

Expanding solutions to meet global compliance needs

With this back-to-back recognition, Trolley is proving that our commitment to transforming how businesses manage payouts and tax compliance goes beyond meeting today’s needs; we’re actively building solutions for the future.

From the launch of Trolley Tax in 2020 and Trolley Sync in 2023 to releasing Trolley Trust earlier this year, our suite of products is expanding in ways that empower our clients to streamline their operations globally—from a single platform.

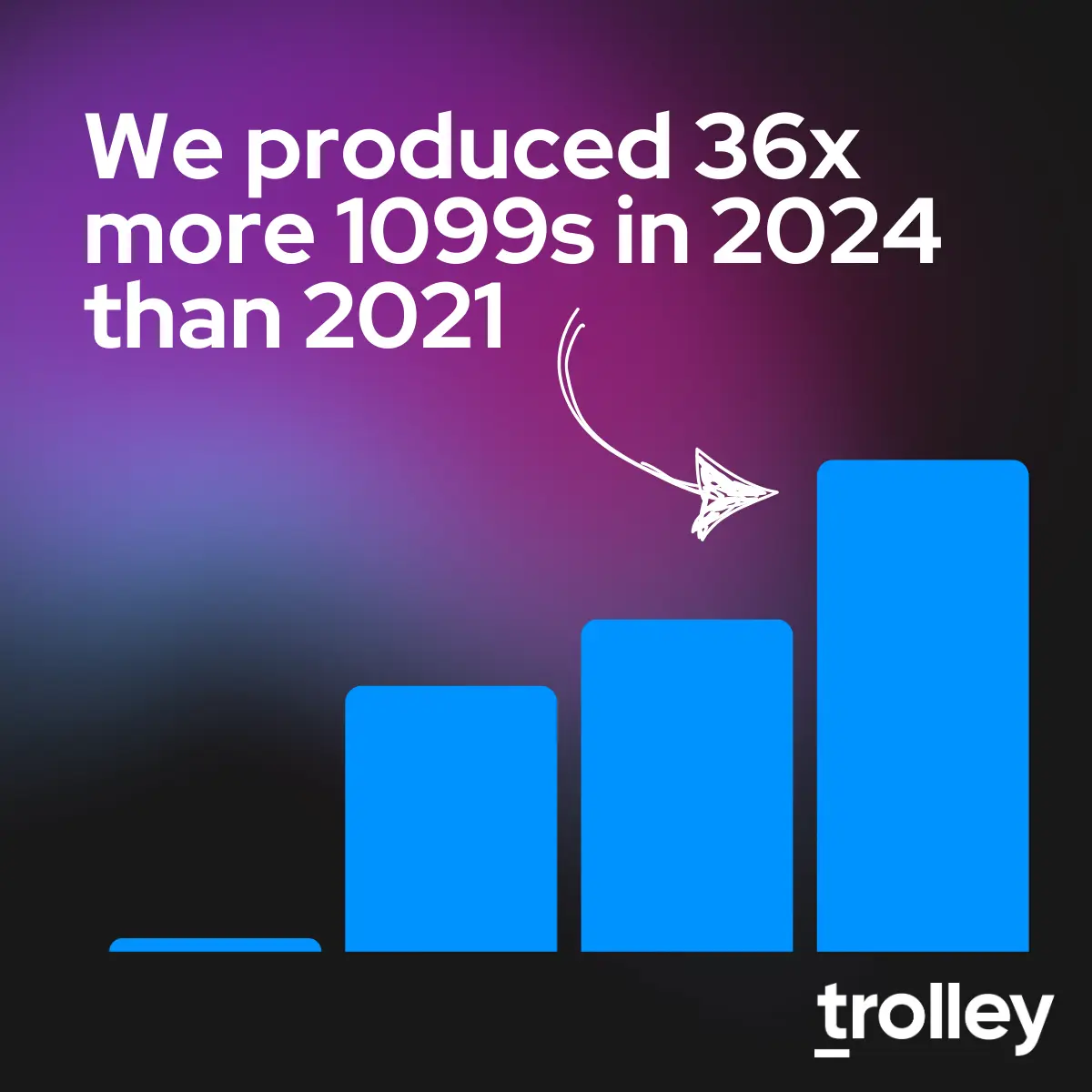

For example, with ever-changing IRS regulations and global reporting rules around freelancers and digital platforms, the number of tax statements filed through Trolley has surged by an impressive 3617.1% since 2020.

Foresight like this is one reason why our customers are choosing Trolley to manage multiple workflows, with 1 out of every 2 Trolley customers now being multi-product users.

Marking leadership through milestones

Since our founding, Trolley has been dedicated to helping businesses manage payments and compliance efficiently, securely, and globally—to date, we have made payments to 198 countries and territories worldwide.

Each new milestone is a testament to our objective to lead in the payouts industry—creating the most user-centric and innovative payment solutions for today’s global economy.

As CEO Tim Nixon remarked, “This recognition from Deloitte reflects Trolley’s unwavering focus on innovation and our ambition to become a global leader in payouts and related compliance solutions. We see tremendous growth opportunities in international payments, where we will continue to work to make cross-border transactions seamless for businesses and the freelancers, contractors, sellers, artists, or any other type of recipient they need to pay.”

A good place to grow, a great place to work

On top of revenues and customer growth, our company is also being recognized for our contribution to workplace culture in Canada and beyond.

Trolley’s inclusion in the 2024 Best Workplaces™ for Start-Ups and as one of Quebec’s Best Workplaces in 2023 is a recognition of our commitment to nurturing a positive workplace culture.

Our recent listing as one of Canada’s Top Growing Companies by The Globe and Mail shows that we’ve been able to maintain a balance between high growth and a positive culture that values our team’s well-being.

We’re focused on creating a workplace where our team feels supported, can grow professionally, and can achieve great things together.

Looking ahead to 2025

Trolley’s placements on Deloitte’s Fast 50, The Globe and Mail’s Top Growing Companies, and the 2024 Best Workplaces™ for Start-Ups lists are more than milestones—they’re catalysts.

Our journey of growth and innovation is only just beginning, as we continue developing the technology that helps businesses, freelancers, and creators achieve success in an increasingly interconnected world.

We’re grateful to our team, customers, and partners for being part of this incredible journey, and we’re excited about the path ahead.

Wondering who’s in our league? Explore this year’s Fast 50 list to see the trailblazing Canadian companies we’re honoured to be among.

Ready to take your growth further? Discover how Trolley can power your vision—schedule a demo with us today.

While we celebrate this milestone, our sights are set on the future. Trolley is more than a payout platform; we’re your partner for tomorrow’s growth. Here’s to driving innovation and achieving more together.