Moving money between payment processors, banks, and payout platforms often adds days of delay and layers of complexity. With Trolley Pay’s new direct funding, businesses can now route funds straight from their payment processor to Trolley—eliminating extra transfers, accelerating payouts by days, and giving finance teams real-time visibility into cash flow.

If you’ve ever watched funds crawl from one system to another—customer payments waiting to clear, settlements landing days later, payouts delayed—you know how much operational drag that can create.

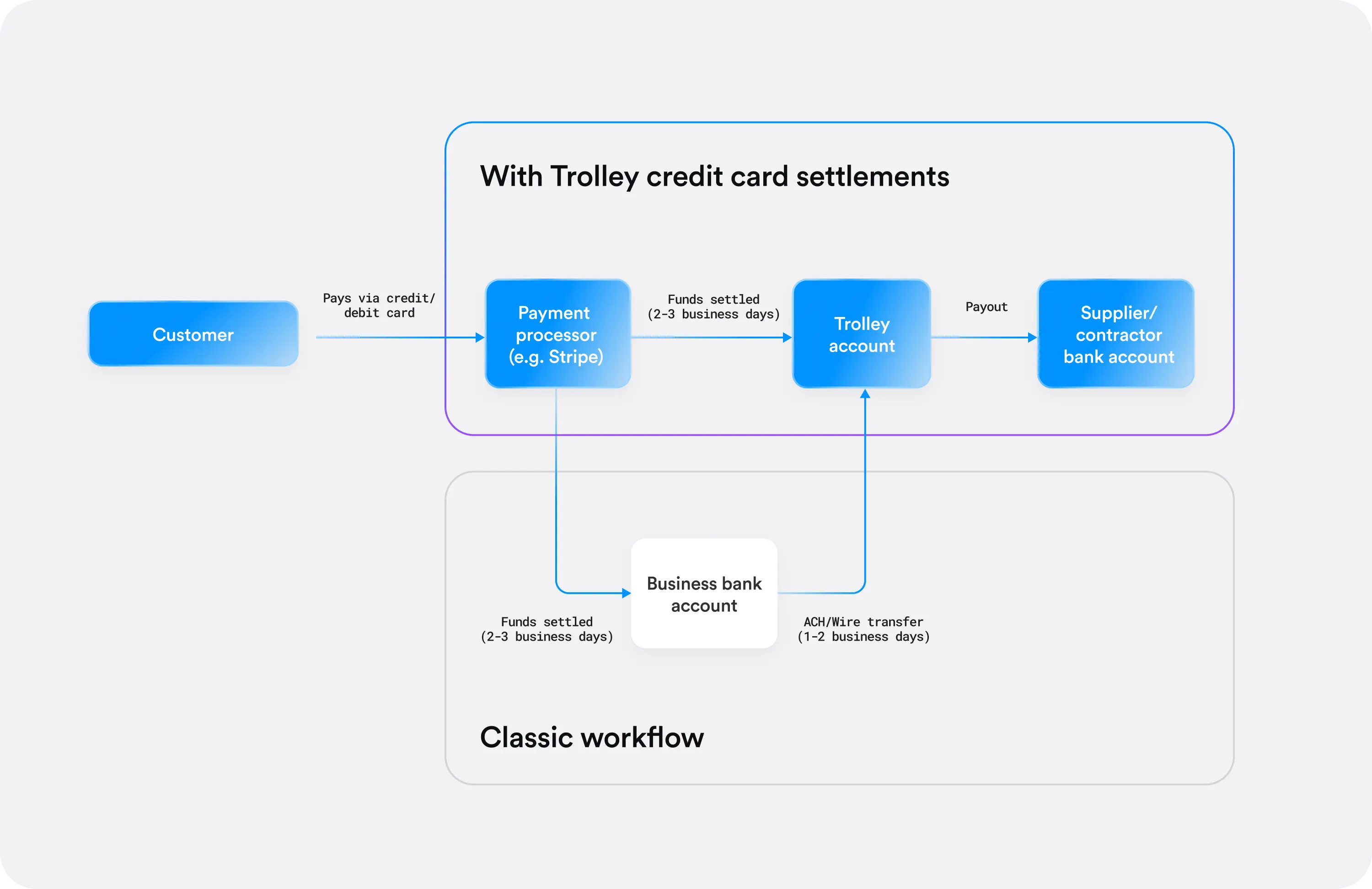

For most businesses, the flow of funds is anything but smooth. A customer pays by card, the processor holds the funds for a few days, it gets sent to the merchant’s bank account, and then another transfer is needed to move that money into a payout provider before you can pay your recipients. What should take hours often stretches into nearly a week.

Each time money moves, it’s slow, manual, and full of potential errors. And for marketplaces or platforms, where the flow of funds is regulated and carefully monitored, there’s also an added complexity of not wanting to touch or hold the funds at all.

With this update to Trolley Pay, we’re closing the gap between how businesses collect money and how they pay it out, creating a smoother, faster, and more connected flow of funds from start to finish.

What we cover

The friction between pay-ins and payouts

In payments, every transfer point adds friction: time, reconciliation effort, compliance review, and risk.

A typical “classic” payout workflow looks like this:

- A customer pays via card.

- The payment processor (for example, Stripe, Adyen, or Braintree) authorizes and captures that payment.

- Settlement occurs (usually within 2–3 business days) and the processor transfers the money into your business bank account.

- You then initiate an ACH or wire from your bank to fund your Trolley account, which takes another 1–2 business days, depending on cutoff times.

- Finally, once funds arrive in Trolley, you can pay out your recipients—typically within 1–2 business days, or instantly when using Trolley’s instant payouts to debit cards.

Even in the best-case scenario, it can take four to five days before funds from a customer purchase are paid to the appropriate supplier or contractor. That’s before factoring in weekends, holidays, or reconciliation delays.

This isn’t just slow, it’s difficult, error-prone, and often misaligned with how modern businesses want to operate.

Each transfer requires coordination between multiple systems and teams. Finance needs to reconcile transactions, operations needs to confirm balances, and compliance needs to make sure the flow meets regulatory requirements.

And for many platforms, especially those that facilitate payments between customers and third-party sellers, handling the funds directly can create unwanted liability.

In short, the old way of moving money doesn’t match the pace of the modern economy.

A smoother flow: funding Trolley directly from your payment processor

Trolley’s new direct funding capability for Trolley Pay removes that friction entirely.

Instead of routing funds through your business bank account, you can now fund your Trolley account directly from your payment processor.

By skipping the step of landing funds in your bank account and forwarding to Trolley, you eliminate an entire layer of manual reconciliation and anywhere from 1-3 business days from the cycle.

Funds that would typically arrive in your bank mid-week can now land in your Trolley account almost as soon as your processor settles them. That means you can initiate payouts faster, and your recipients get paid days earlier than before.

For high-volume businesses or marketplaces that rely on trust and timeliness, those days matter.

Why it matters

When funds move without friction, your business, in general, runs more smoothly. Finance teams spend less time managing transfers and more time analyzing performance. Operations teams can focus on recipients instead of reconciliation. And the people you pay (suppliers, freelancers, artists, or creators) feel the benefit of faster, more predictable payments.

Let’s break down the value:

Save time and reduce complexity

Funding directly from your payment processor cuts out a full bank transfer step. No more logging into your bank portal, scheduling ACHs, or waiting for funds to clear. Fewer moving parts mean fewer things to go wrong.

Accelerate payouts

With typical settlement times ranging from 2–3 business days for credit card payments and another 1–2 days for bank transfers, many businesses wait nearly a week before they can fund payouts. Direct funding shortens that cycle dramatically, helping you pay sooner, reconcile faster, and move on with confidence.

Improve cash flow visibility

Because funds flow directly into your Trolley account, your payout-ready balance reflects your processor settlements in near real time. Finance teams gain clearer insight into available liquidity and can forecast disbursements with precision.

Stay out of the flow of funds

Many marketplaces prefer not to handle money directly for regulatory or operational reasons. By routing settlements straight from your payment processor to Trolley, you maintain separation between pay-ins and payouts, helping you stay compliant and reducing exposure.

Enhance recipient trust

Ultimately, your reputation depends on timely, reliable payments. When contractors or sellers know that payouts arrive faster, it builds confidence and loyalty.

How it works

Once enabled, your payment processor (such as Stripe, Checkout.com, Adyen, Braintree, or Nuvei) will settle funds directly into your Trolley account.

You’ll still collect payments from customers the same way as before. The difference is where those settled funds go once the processor releases them.

From there, everything in Trolley stays the same: you can use those funds immediately to send payouts, schedule automated transfers, or hold a balance for future disbursements.

How to enable direct funding

NOTE: This capability is currently in beta for select US merchants and supports only USD settlements.

Before getting started, here’s what you need to know:

- Eligibility: Available for merchants sending payouts domestically within the United States.

- Coming early 2026: Available to most Trolley U.S. customers, including those handling cross-border payouts.

- Coming early 2026: Available to most Trolley U.S. customers, including those handling cross-border payouts.

- Supported processors: Stripe, Checkout.com, Adyen, Braintree, and Nuvei.

- Compliance approval required: You must receive explicit approval from Trolley’s compliance team before setup.

Here’s how to roll it out in your account:

1. Request compliance approval

Contact your Trolley account manager or support team. You’ll be asked to confirm your payment processor and share documentation proving that your processor account belongs to the same legal entity you onboarded with Trolley.

2. Obtain your settlement destination account details

Once approved, Trolley will provide the account details you’ll need to share with your payment processor. These details identify your Trolley funding account as the destination for settled funds.

⚠️ Note: Settlement account details are updated on a monthly cycle, so setup timing may vary slightly. While you wait, you can continue funding your Trolley account via ACH or wire.

3. Configure your processor

- For Stripe: Navigate to payout settings and add the Trolley bank details as your new settlement destination.

- For others: Follow your processor’s documentation for adding a settlement account.

4. Verify your setup

After configuring your processor, share a screenshot showing your new settlement destination with Trolley’s support team. Once verified, you’ll be ready to fund directly.

Built with compliance and security in mind

Connecting your payment processor directly to Trolley doesn’t mean cutting corners. Every setup goes through Trolley’s compliance approval process to confirm account ownership and ensure alignment with AML and KYC requirements.

Funds continue to move through regulated banking channels, and once settled, they remain protected under the same safeguards that apply to all Trolley balances.

You get faster movement, without compromising trust.

Looking ahead: the evolution of Trolley Pay

Direct funding is another step in Trolley’s mission to help businesses simplify payout operations (PayoutOps) and manage every part of their global payments flow with less friction.

In the coming months, this feature will expand to more US customers and additional currencies. Over time, it will become part of a broader vision: a fully connected ecosystem that bridges the gap between pay-ins, payouts, and compliance.

From collection to payout, in one motion

Managing payments shouldn’t require juggling systems, chasing transfers, or waiting days for funds to clear.

With direct funding from your payment processor, Trolley Pay brings everything closer together. The money your customers send can move straight into your Trolley account, ready to power the next payout.

It’s faster, cleaner, and more reliable. And for the teams who’ve been waiting for a smoother way to move money, it’s one less thing to worry about.

Talk to your Trolley account team to enable direct funding and start paying your recipients faster.