In this product update blog, we’re highlighting significant enhancements, including the launch of royalty calculator integrations, new functionalities in our Invoice Payment API, and improved operational features like enhanced webhooks documentation. Additionally, we’re introducing greater flexibility with revamped widget modules and expanded event types, ensuring a seamless integration experience for developers.

This month, we’re excited to share some major updates that will simplify your workflows and ensure error-free payments, especially for musicians and rights holders.

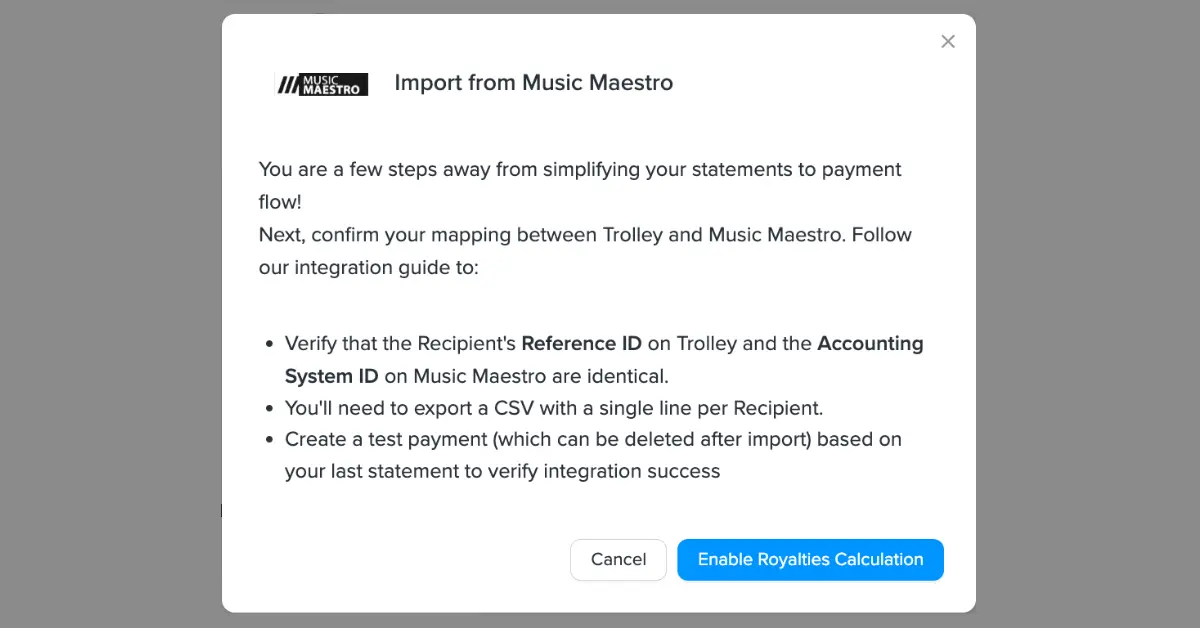

One of the most critical updates is our new royalty calculator integrations. You can now directly import royalty data from leading royalty calculators, streamlining your payment processes and reducing the chance of errors. This integration is just the beginning as we continue to expand our support for more royalty systems.

We’ll also cover updates to our developer tools, including enhanced webhooks documentation, a more intuitive Invoice Payment API, and revamped widget modules. Plus, offer a sneak peek at upcoming capabilities that will further improve your experience with Trolley.

Let’s dive into the details of what these latest enhancements mean and how they can benefit your operations.

What we cover

To get started now, log in to the Trolley platform. If you’re looking for more details, keep reading or book a demo of any features you think will add value to your payout workflow.

Major updates for music customers

Royalty calculator integrations

You can now directly import royalty data from your preferred royalty calculator software by uploading CSV or XLSX files, ensuring accurate and timely payments to your artists and rights holders. Take it for a spin in your sandbox account.

Optimize your developer experience

New developer blog

We’ve launched a dedicated developer blog to provide you with the technical guides and insights you need. From implementing Trolley to understanding API architecture, our blog is your go-to resource for in-depth technical content. We’re also open to suggestions—let us know what topics you want covered.

Enhanced webhooks documentation

Our updated Webhooks documentation now includes comprehensive details on integrating and verifying webhooks, along with IP whitelisting.

Trolley Trust and Tax webhook documentation has also been updated, and we’ve also added new samples of webhook bodies for various models and actions, making it easier to implement and troubleshoot.

Invoice payment API update

We’ve made it simpler to add payment-related fields like externalId or tags directly in the Create Invoice Payment API call. This update eliminates the need for an additional call, streamlining the payment process and saving you time.

More information about this update can be found in our developer documentation.

Widget modules and error handling

Our revamped Widget documentation now provides detailed guidance on different Widget modules, new event types in Events Emitter, and how to handle errors effectively. This update is designed to give you a comprehensive understanding of working with Widgets from start to finish.

New capabilities launching in September

Marketplace recipient onboarding for UK, AU, NZ

To help you stay compliant with evolving digital platform reporting rules, Trolley is expanding its marketplace reporting capabilities.

Starting in September, we’ll support new reporting requirements for the UK, Australia, and New Zealand, in addition to the 28 EU countries covered under DAC7.

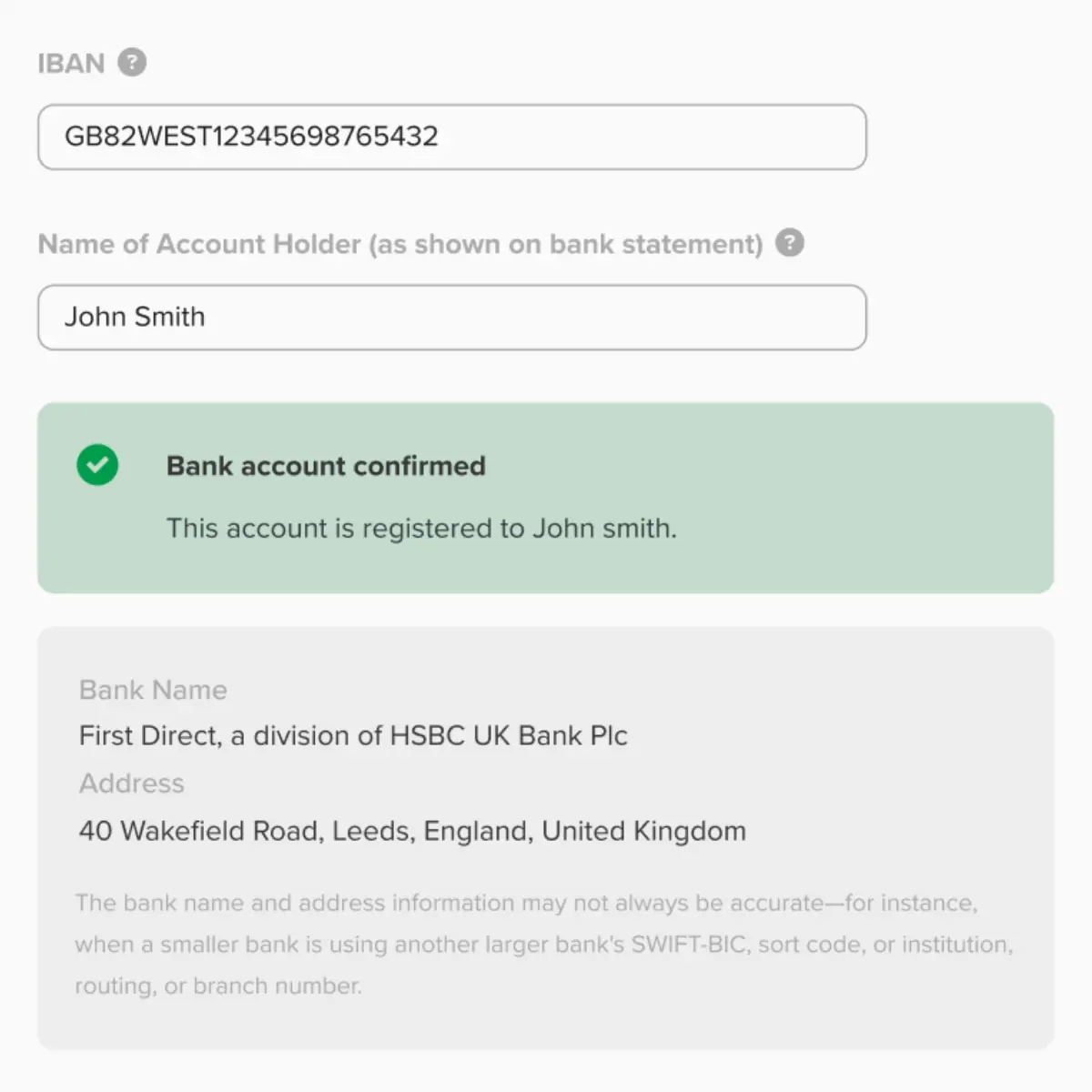

Bank-level account verification for the UK

Starting next month, Trolley will enable real-time account verification of UK-based recipients for merchants based in the UK and EU. This feature will ensure that the recipient’s name matches the name on their bank account by checking against a real-time database, helping you meet new regulatory standards in the UK.

Expand your data integration with new connectors

We’re enhancing our Sync product with managed data connectors, allowing you to build deep, automated data flows across all your systems. This major expansion eliminates the need for manual development, providing out-of-the-box syncing straight to your database.

Add these new & updated features today

We are signing up beta customers for these upcoming features, so if you are interested in getting early access simply reach out to your Customer Success Manager and we will get you started.

As always, we appreciate your continued enthusiasm for Trolley. Remember, we’re always just an email or phone call away if you have any questions or feedback about the latest updates.

Interested in Trolley? Book a demo

Trolley is a full-featured payout and contractor tax solution that can automate your workflows. If you have questions about how we can help you streamline and enhance your existing processes, reach out to Trolley’s sales team to learn more.