In this product update blog, we’re covering a range of enhancements including major updates to Trolley Trust, new functionalities in our Verification API, and improved operational features for trust management. Additionally, we’re introducing flexibility at the UI level with modular widgets and expanded event emitters, ensuring a seamless integration experience for both developers and operations teams.

As cybercrime becomes more sophisticated, governments worldwide are introducing new regulations to protect people and manage risk, fraud, and compliance on online platforms. At Trolley, we’re committed to staying ahead of these changes to help you maintain trust and safety on your platform.

Today, we are thrilled to announce the beta launch of several new features designed to build trust, enhance safety, and de-risk your platform. These features are now available for activation in your Trolley account.

You can enable these in your Trolley account or get in touch with your CSM.

Let’s dive into the details of what these latest enhancements mean and how they can benefit your operations.

What we cover

To get started now, log in to the Trolley platform. If you’re looking for more details, keep reading or book a demo of any features you think will add value to your payout workflow.

Major updates to Trolley Trust

Business verification

Ensure you’re working with the correct entity by verifying their provided business documents.

Trolley accepts government-certified or -issued documents from all regions worldwide, verifying details such as entity name, address, and business registration number.

Be aware, this process includes a human review, so results may take up to a day to become available.

Phone verification

Activate phone number verification to enable a feature where your recipients will confirm their phone number using a code sent to their phone during onboarding.

This added layer of security helps ensure the authenticity of your recipients.

DSA/INFORM support

With identity verification, business verification, and phone verification integrated into the Trolley platform, you’ll be equipped to comply with the EU’s Digital Services Act (DSA) and the US INFORM Act, ensuring your operations are aligned with the latest regulatory requirements.

Check out the Trolley blog to learn more about DSA or INFORM.

Easing integration of Trolley Trust into your tech stack

Verification API

Our identity verification, business verification, and phone verification endpoints are now packaged and available in a dedicated API.

Developers can use this to pull verification data and build customized workflows that enhance trust and allow you to manage risk on your platform.

Detailed documentation for the Verification API is available to help you get started.

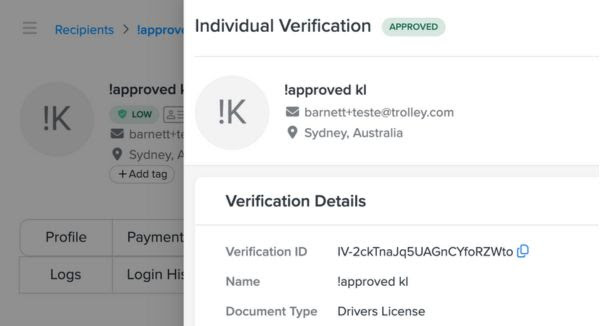

Sandbox mock verification testing

As with payouts and taxes, our Trust product meets our high platform standards, allowing you to integrate and test before deploying into your production environment. All the features mentioned above are available in the Trolley Sandbox.

To force verification to a specific state, set the first name of an individual or the business name to !approved or !rejected.

You will still need to provide the document or video, but it will push to the designated state regardless of the provided materials.

Adopt and operationalize Trust with ease

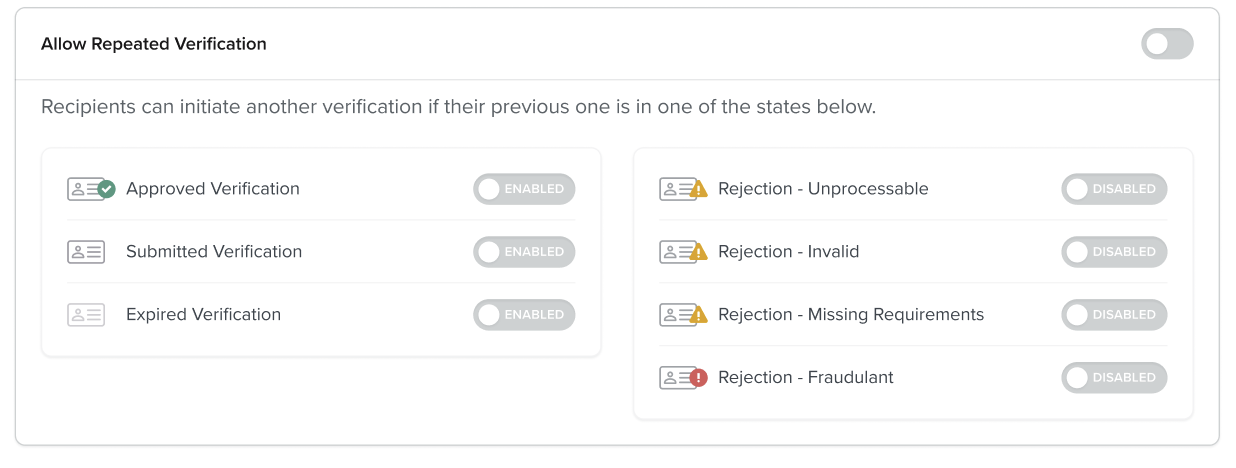

Re-verifications

We understand that verifications are needed not only during onboarding but also continuously based on the recipient’s risk profile.

We have created customizable settings to ensure the identity, phone, and business verification processes better mirror your workflow and policy requirements.

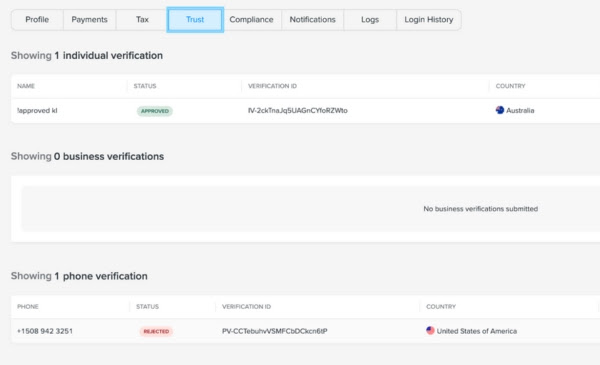

Trust merchant dashboard

With these major upgrades to the Trust product, you now have a consolidated view of all recipient data (Pay, Tax, Trust) on the recipient details page. This unified approach streamlines your operations and makes it easier to manage recipient information.

Trust settings

In August 2024, we will enable you to require verifications from recipients before they become active or before a payment is sent.

This proactive measure ensures higher compliance and reduces the risk of fraudulent activities.

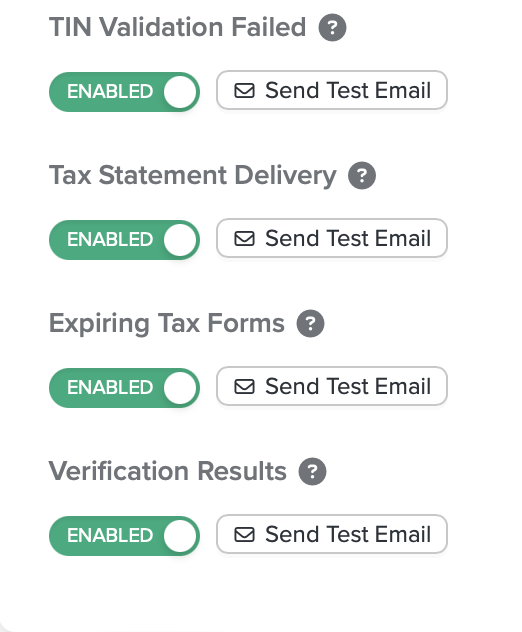

Recipient communications

To improve approval rates and lighten the load on your support team, we provide recipients with their verification history and error messages to assist with re-verification.

Automated white-labeled emails for verification results will be available out of the box as of August 2024.

You can easily customize the brand and domain in settings and get started with no additional operational work.

More flexibility at the UI level

Modular widget

Trolley empowers you to deliver the best UX for your recipients and align your existing workflows.

Our white-labeled widget is now modular, allowing you to choose when and how to implement Pay, Tax, or Trust modules in your workflows or UI.

Detailed documentation is available to help you make the most of this powerful re-work of one of our more popular features.

Event emitter expansion

We’ve added more events to the Trolley API’s event emitter, letting you create even more customized workflows based on granular user or recipient actions, for example, when a module is loaded or when a recipient successfully submits their information.

The event emitter reacts instantly to any changes, unlike webhooks or APIs, which may have some delays.

You can test drive all these new features in your sandbox or reach out to your Customer Success Manager for more information.

Interested in Trolley? Book a demo

Trolley is a full-featured payout and contractor tax solution that can automate your workflows. If you have questions about how we can help you streamline and enhance your existing processes, reach out to Trolley’s sales team or your Customer Success Manager to learn more.