If your U.S. company pays foreign contractors and freelancers, you have an obligation to report their earnings to the IRS and withhold the appropriate amount of taxes on each payment. This information is recorded and reported each tax year with IRS Form 1042-S. This article will cover the who, what, and why of Form 1042-S and detail the penalties for not filing.

Form 1042-S is an IRS form used to report income paid to non-resident aliens (NRAs) of the United States (individuals who are not U.S. citizens or U.S. nationals who have not passed the green card test or the substantial presence test). If you are a withholding agent required to file Form 1042-S for NRAs doing work for you, it is essential that you file accurately and on time, as failure to do so can result in penalties and other consequences.

But fret not: In this guide, we’ll discuss the filing deadlines for Form 1042-S and the penalties for not filing, and provide tips to help you avoid these penalties.

What we cover

What is Form 1042-S?

Form 1042-S is a tax form used to report income paid to non-resident aliens, including certain types of income that are subject to withholding. Some examples of payments that may be reported on Form 1042-S include:

- Wages or salaries

- Scholarships or fellowships

- Royalties

- Rents

- Prizes and awards

Form 1042-S is used by withholding agents, such as employers or universities, to report these payments to the IRS and the non-resident alien. This form helps the IRS ensure that non-resident aliens are paying the correct amount of taxes on their income.

Who needs to file Form 1042-S?

If you are a withholding agent who has made payments subject to withholding to a non-resident alien, you are required to file Form 1042-S. This includes businesses, universities, and other institutions that make payments to non-resident aliens.

Aside from non-resident aliens, you must file Form 1042-S if your company makes a payment to:

- Foreign partnerships

- Foreign businesses

- Foreign estates

- Foreign trusts

It’s important to note that even if the payment is tax-exempt under a tax treaty or other provision, you still need to file Form 1042-S to report the payment.

What types of payments are subject to withholding?

Form 1042-S is used for reporting payments that are subject to withholding under Chapter 3 of the Internal Revenue Code. This includes most types of income paid to non-resident aliens, with some exceptions.

Some common types of payments that may be subject to withholding and require Form 1042-S include:

- Wages or salaries for services performed in the United States

- Scholarships and fellowships for non-resident aliens studying in the United States

- Royalties from U.S. sources, including copyrights, patents, and trademarks

- Rents paid to non-resident aliens for property located in the United States

- Dividends paid by American corporations

- Income from real estate

- Gambling winnings

- Pension income

- Insurance premiums

Some payments are not subject to withholding and do not require Form 1042-S, such as:

- Payments made to U.S. citizens or residents

- Tax-exempt interest income

- Certain payments of compensation for personal services performed outside the United States

- Insurance premiums paid on a contract issued by a foreign insurer

Filing deadlines for Form 1042-S

Form 1042-S must be filed by March 15th of the year after the relevant payment was made, whether electronically or on paper. A copy must be furnished to the income receiver by this same date.

Note that the IRS has reduced the 250-return threshold for electronic filing to just 10 or more returns as of calendar year 2024, tax year 2023.

It is important to note that you will need to submit a separate form for the following:

- Each recipient, regardless of whether or not tax was withheld

- Each tax rate of a specific type of income that you paid to the same recipient

- Each type of income paid to the same recipient

Penalties for not filing Form 1042-S

Now that we’ve discussed what Form 1042-S is and who needs to file it, let’s get into the penalties for not filing.

Failure to file

If you fail to file Form 1042-S by the required deadline or file with incorrect data, you may be subject to a penalty of up to $310 per form. The penalty amount is based on how long past the deadline you file the form.

The IRS has laid out the following penalties for failure to file correct information returns due in 2024:

- Forms submitted up to 30 days late – $60 penalty per form

- Forms submitted more than 30 days late – $120 penalty per form

- Forms submitted After August 1st – $310 penalty per form

The annual maximum penalties differ depending on the size of the business, and all penalty amounts may change year by year.

The penalty can also be assessed if your filing is incomplete or contains incorrect information, so it’s crucial to make sure all information on the form is accurate and complete before submitting it.

Deliberate failure to file

If the IRS determines that you deliberately failed to file Form(s) 1042-S, the penalty can be increased to $630 per form or 10% of the total amount of tax required to be reported on the form, whichever is greater.

Late production to recipients

In addition to the penalties for not filing Form 1042-S with the IRS, there can also be consequences for late production of the form to recipients. If you fail to provide a copy of Form 1042-S to a recipient by the required deadline, there is a penalty of up to $310 per form.

There is no upper limit for this penalty, and, should the IRS determine intentional non-compliance, an additional penalty of $630 per form, or 10% of the amount of the forms to be submitted, can be added to the amount due.

Failure to file electronically

If you are required to file Form 1042-S electronically (10 or more returns) but fail to do so, and you do not have an approved waiver on record, you may be subject to penalties. The penalty applies separately to original returns and corrected returns.

Interest on taxes

In addition to the set penalties for not filing Form 1042-S, you may also be subject to interest on the taxes due. According to the IRS, the penalty for not filing Form 1042 when due (including extensions) is 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25% of the unpaid tax.

You may also be charged interest on any unpaid or underpaid tax as a result of not filing Form 1042-S. This is usually charged at a rate of one-half of 1% of the unpaid tax for each month or part of a month the tax is unpaid, up to a maximum of 25% of the total unpaid tax.

How to apply for an extension

If you are unable to file Form 1042-S by the required deadline, you can apply for a 1042-S extension by filing Form 8809, Application for Extension of Time to File Information Returns with the IRS. This form must be submitted by March 15th for electronic filing and February 28th for paper filing.

However, it’s important to note that an extension does not relieve you from paying any tax due on time. You may still be subject to penalties and interest for any unpaid or underpaid tax.

Tips to help you avoid 1042-S penalties

To avoid penalties for not filing or furnishing Form 1042-S, it’s crucial to file accurately and on time. Here are some tips to help you stay on top of your filing requirements:

- Keep track of payments made to non-resident aliens throughout the year. This is most easily accomplished by using an end-to-end platform that collects W-8s and W-9s during recipient onboarding and facilitates both payouts and tax filing—that way your data is all already in the right place.

- Familiarize yourself with tax treaties and other exceptions that may affect whether or not withholding is required for certain types of income.

- Use the correct code for each type of payment being reported on Form 1042-S.

- Double-check all information before submitting the form to avoid errors.

- Familiarize yourself with the filing deadlines and make sure to submit on time.

- Partner with a reputable tax professional or service provider to ensure compliance with all filing requirements.

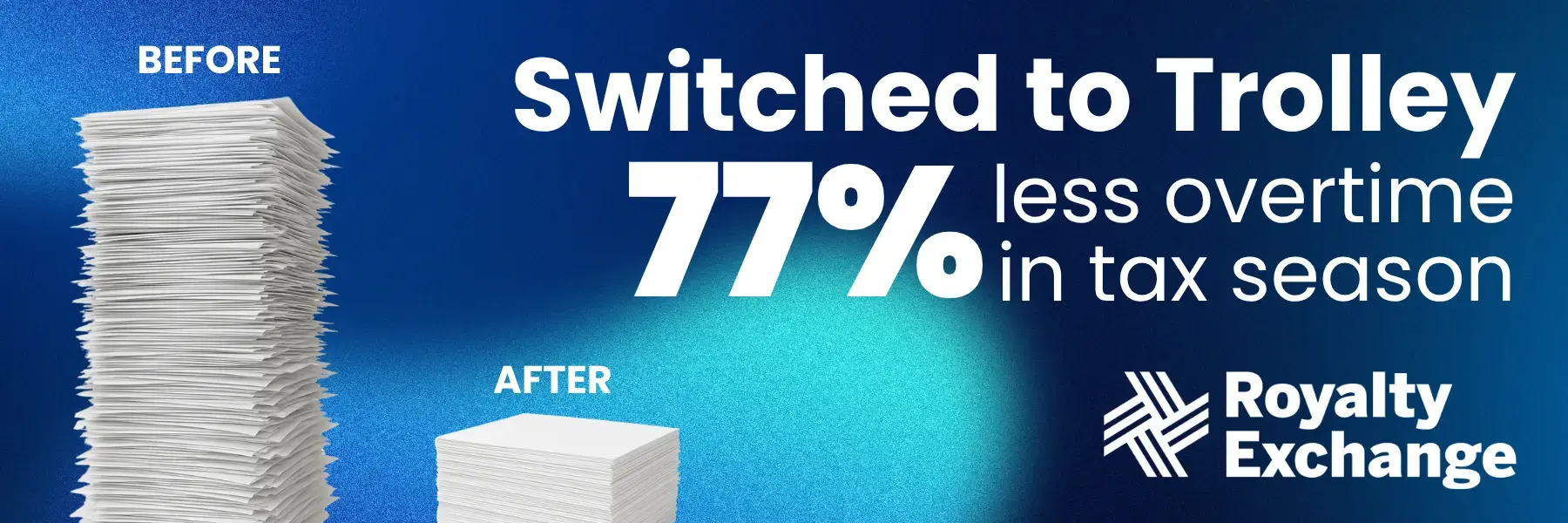

Choose Trolley as your tax compliance partner

Staying compliant with the IRS and avoiding Form 1042-S penalties can be a major headache—but it doesn’t have to be. Partnering with Trolley, an all-in-one payout and tax solution, can make your tax season a breeze. Our team of experts keeps up-to-date with relevant tax laws and regulations to ensure that you can file all necessary forms accurately and timely.

With Trolley, you can have peace of mind knowing that your tax compliance needs are taken care of. With built-in e-filing, Trolley makes producing and filing Forms 1042-S seamless—it only takes a few clicks. Here’s how Trolley helps you stay compliant:

- Automated Form W-8 Collection: Our self-serve tools let foreign contractors and freelancers provide necessary details for Forms W-8 and W-8 BEN, ensuring accuracy and IRS compliance.

- Automated Tax Documentation and Withholding: Trolley automatically generates tax records and manages withholding for each payout, considering tax treaties and W-8 form information.

- Income Classification and Payment Allocation: We automatically categorize income types and allocate payments, crucial for accurate tax reporting on forms like 1042-S.

- Form 1042-S Generation: Trolley efficiently generates and sends Form 1042-S for foreign recipients, including withheld tax details, ensuring U.S. tax law compliance.

- Efficient E-Filing with the IRS: Our platform enables direct e-filing of Form 1042-S with the IRS, saving time and minimizing errors.

Don’t risk penalties for non-compliance. Choose Trolley as your trusted payouts and tax compliance partner today. Contact us to learn more about our platform and how we can help you stay compliant with contractor and freelancer tax filing requirements.

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.