For businesses managing non-resident alien (NRA) employees in the U.S., this guide explains Form 8233, essential for individuals to claim tax exemptions on personal service compensation. Aiming to help businesses ensure precise tax withholding, it covers eligibility, differences from Form W-8, stresses accurate form completion, and outlines a simple submission process to the IRS.

Tax withholding and managing exemptions is a vital aspect of working with non-resident employees, and it is essential to understand the forms used to report income and withhold taxes.

One such form is Form 8233, also known as “Exemption from Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Non-resident Alien Individual.” This form is used to claim exemptions from withholding for non-resident aliens who are performing personal services within the United States.

Both the person providing services and their employers use Form 8233. The service provider (or payment recipient) uses this form to claim exemption from withholding on compensation for personal services, while their employer (or withholding agent) uses it to report the payments made and withhold taxes accordingly.

This guide will discuss everything you need to know about Form 8233, including what it is, who needs to use it, how it differs from Form W-8, how to fill it out correctly, and what happens after the form is submitted.

What we cover

What is Form 8233?

Form 8233 is an IRS-administered tax form used by non-resident aliens to claim exemption or a reduced rate of withholding on compensation earned from providing personal services in the United States.

Tax withholding is necessary for non-resident aliens as they are not subject to the same tax laws as U.S. citizens and residents. They may have different deductions, exemptions, and credits available, which can affect their overall tax liability.

Form 8233 is commonly used for various types of income, such as independent personal services, pensions, and other fixed or determinable annual or periodic gains, profits, or income.

To be eligible for an exemption, the individual must be a resident of a country with which the United States has an income tax treaty, and they must meet the specific requirements outlined in the treaty.

The form is generally provided to the withholding agent (such as an employer or payer) by the non-resident alien. The withholding agent reviews the form and, if the individual qualifies, may reduce or eliminate the withholding tax on the specified income.

Note: The form must be submitted to the withholding agent before the income is paid or credited.

What is an exemption from withholding?

The U.S. Government has a number of income tax treaties with foreign countries to promote trade and investment between the United States and these countries. These treaties allow for exemptions from tax withholding for certain types of income earned by non-resident aliens in the United States.

In addition, some visa statuses provide a personal exemption amount that can be claimed on Form 8233 to reduce or eliminate tax withholding. This exemption is only applicable to certain types of income and must be properly claimed on Form 8233 to avoid over or under-withholding.

Understanding the specific criteria for exemption from tax withholding is crucial for non-resident aliens working in the United States. Whether through an income tax treaty or personal exemption amount, it is essential to file Form 8233 accurately and timely to ensure proper tax withholding.

Who needs to use Form 8233?

Form 8233 is required for non-resident aliens working in the United States who need an exemption from tax withholding. This includes individuals who are employed under a visa or individuals who are self-employed and providing services in the United States.

Here are some common scenarios in which individuals may use IRS Form 8233:

- Foreign employees: Non-resident aliens working in the United States may use Form 8233 to claim treaty benefits and reduce the withholding on their wages.

- Independent contractors: Non-resident aliens who provide independent personal services (such as consulting or professional services) in the U.S. may use the form to claim treaty benefits and reduce withholding.

- Pension recipients: Non-resident aliens who receive pension income from U.S. sources may use Form 8233 to claim treaty benefits on that income.

- Artists and athletes: Non-resident aliens who earn income in the U.S. from performances or competitions may use the form to claim treaty benefits and reduce withholding on such income.

- Scholars and researchers: Non-resident aliens receiving payments for scholarly or research activities in the U.S. may use Form 8233 to claim treaty benefits.

If an individual is unsure if they qualify for an exemption, it is recommended that they consult with a tax professional or the IRS. It is crucial to accurately determine if Form 8233 is needed, as failure to withhold taxes correctly can result in penalties and interest.

Form 8233 vs Form W-8

Forms 8233 and W-8 both are implicated in the reporting of income and claiming of exemptions for non-resident aliens, but they serve distinct purposes with specific use cases. Here’s a brief comparison:

- Purpose of the forms:

- Form 8233: This form is specifically designed for individuals (non-resident aliens) performing services within the United States. It is used to claim an exemption from withholding on compensation for independent and dependent personal services.

- Form W-8: The various versions of Form W-8, such as W-8 BEN, W-8 BEN-E, W-8 ECI, and others, are generally used by foreign individuals, entities, or businesses to declare their status as non-U.S. persons and claim certain tax treaty benefits or exemptions. These forms are not limited to individuals providing personal services within the U.S.

- Nature of exemption:

- Form 8233: It specifically addresses exemptions from withholding on compensation for personal services, ensuring that non-resident aliens are not subject to excessive tax withholding on their income earned in the U.S.

- Form W-8: The various W-8 forms are more versatile, allowing individuals or entities to claim a variety of exemptions or reduced withholding rates based on their specific circumstances, tax residency, and treaty eligibility.

- Scope of use:

- Form 8233: Primarily used by non-resident aliens who are individuals performing personal services in the U.S.

- Form W-8: Used by a broader range of entities and individuals, including foreign individuals, corporations, partnerships, and others, who may receive certain types of income from U.S. sources.

- Content and information:

- Form 8233: Focuses on personal services income and related details specific to the individual’s situation.

- Form W-8: Captures a broader array of information, including details about the individual or entity’s tax status, country of residence, and eligibility for specific treaty benefits.

In summary, while both forms deal with tax withholding and exemptions for non-U.S. persons, Form 8233 is more specialized, catering specifically to non-resident aliens providing personal services within the United States, while Form W-8 is a family of forms used for a wider range of situations involving foreign entities and individuals.

How to fill out Form 8233 correctly?

Filling out Form 8233 correctly ensures that an individual’s payments have an appropriate level of withholding applied to them. The form requires personal information such as name, address, and tax identification number. It also asks for visa status, income type and amount, and the reason for claiming an exemption from withholding.

It is crucial to provide all necessary information accurately and completely to avoid any delays in processing the form. Failure to include all required information can result in the form being rejected, and taxes will then be withheld as if no exemption was claimed.

It is also important to note that Form 8233 must be renewed each year. If an individual’s circumstances change or their visa status is updated, they must submit a new form with the updated information.

It is also worth noting that any in-kind payments or third-party payments, including airfare, hotel accommodations, and other costs, are considered compensation when it comes to tax withholding for non-resident aliens and, as such, will need to be reported on Form 8233.

What is a TIN?

A Tax Identification Number (TIN) is a unique identifier assigned to individuals and businesses for tax purposes. For non-resident aliens, this number can be either an Individual Taxpayer Identification Number (ITIN) or an Employer Identification Number (EIN).

Non-resident aliens who do not have a Social Security Number must obtain an ITIN from the IRS before filing any tax forms.

What is an ITIN?

As mentioned above, an Individual Taxpayer Identification Number (ITIN) is a tax identification number assigned to individuals who are not eligible for a Social Security Number but need to file taxes. This includes non-resident aliens and their dependents who require an ITIN to claim exemptions from withholding on Form 8233.

To obtain an ITIN, the individual must submit Form W-7, Application for IRS Individual Taxpayer Identification Number. This form can be filed with a tax return or separately by mail to the IRS. The ITIN is then used for identification and reporting purposes on all subsequent tax forms.

How to submit Form 8233 to the IRS

The process for submitting Form 8233 to the IRS is straightforward, and we’ve broken it down into three steps:

- The non-resident alien fills out the form with all necessary information, including personal details, visa status, income type and amount, and reason for claiming an exemption from withholding. This includes their SSN or ITIN.

- The completed form is then submitted to the employer or third-party payer (also known as a withholding agent) who will be making payments to the non-resident alien. The withholding agent will review the form and make any necessary adjustments to tax withholding based on the information provided.

- The withholding agent then submits the completed and signed form to the IRS according to their filing method, which can be through mail, fax, or electronically. It is essential for the employer to keep a copy of the form in case it needs to be referenced in the future.

- Form 8233 should be submitted in advance of any payments made, as the exemption only comes into effect ten days after the form is mailed to the IRS.

Once the form has been submitted and processed by the IRS, the non-resident alien can expect any necessary adjustments to their tax withholding will be applied on future payments. It is important to note that Form 8233 must be renewed each year and updated if there are any changes in circumstances or visa status.

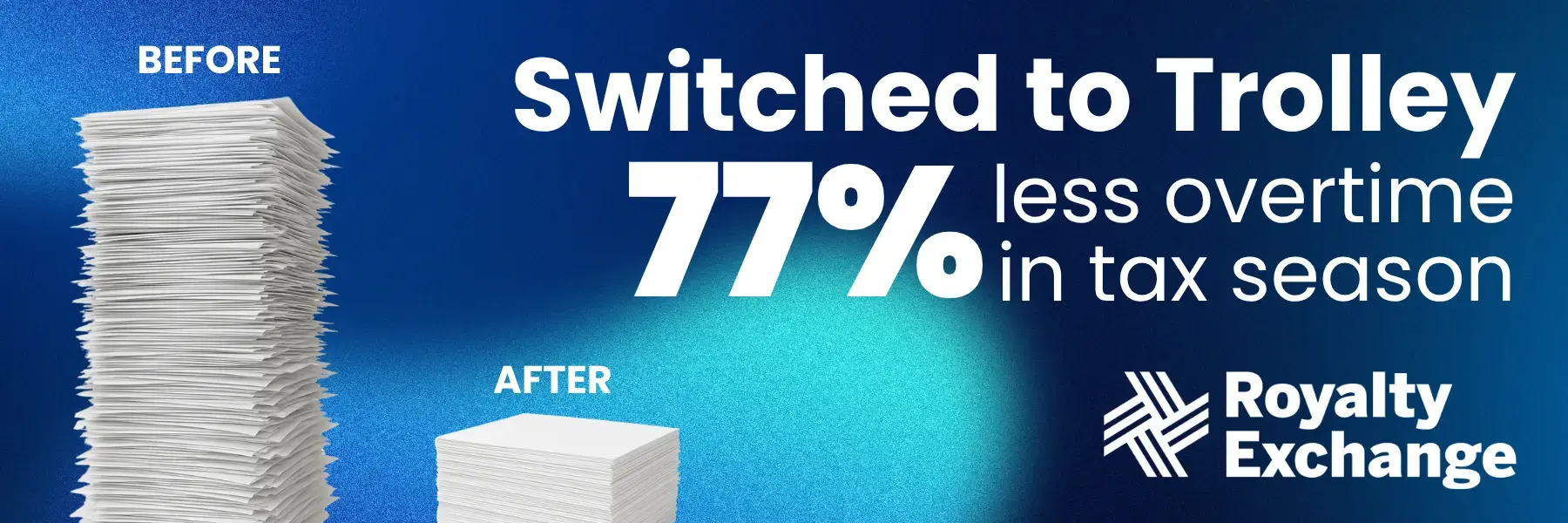

Navigating IRS tax compliance with Trolley: Your resource for e-filing and withholding solutions

Form 8233 plays a pivotal role in claiming exemptions from tax withholding on compensation for personal services provided by non-resident aliens within the United States.

It’s essential to note the distinctions between Form 8233 and Form W-8 to ensure the correct application of each form based on specific use cases. Whether you are working with foreign employees, independent contractors, pension recipients, artists, athletes, scholars, or researchers, understanding the nuances of these forms is critical to fulfilling your reporting obligations accurately.

While Trolley offers 8233 PDF-upload support for edge cases among our customers, we primarily support digital services businesses, and our commitment to facilitating IRS tax compliance aligns with the broader landscape of tax reporting. We specialize in helping you collect Forms W-8 BEN and W-9, withholding taxes on payments to non-residents, as well as producing and e-filing Forms 1099 and 1042-S.

For those navigating the intricacies of IRS tax requirements, we encourage you to explore our dedicated IRS Tax Compliance page to learn how Trolley’s Tax product can make your tax season easier.

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.