Add Trolley, stay compliant with IRS regulations

Stay on top of changing thresholds for forms 1099 & 1042 production and delivery.

With Trolley, you can automate your IRS compliance management process when paying within the US and anywhere else globally. Save time with our self-service approach to generating recipient W-8s and W-9s, automatic activity allocation, and EoY filing.

Key features of our IRS compliance product

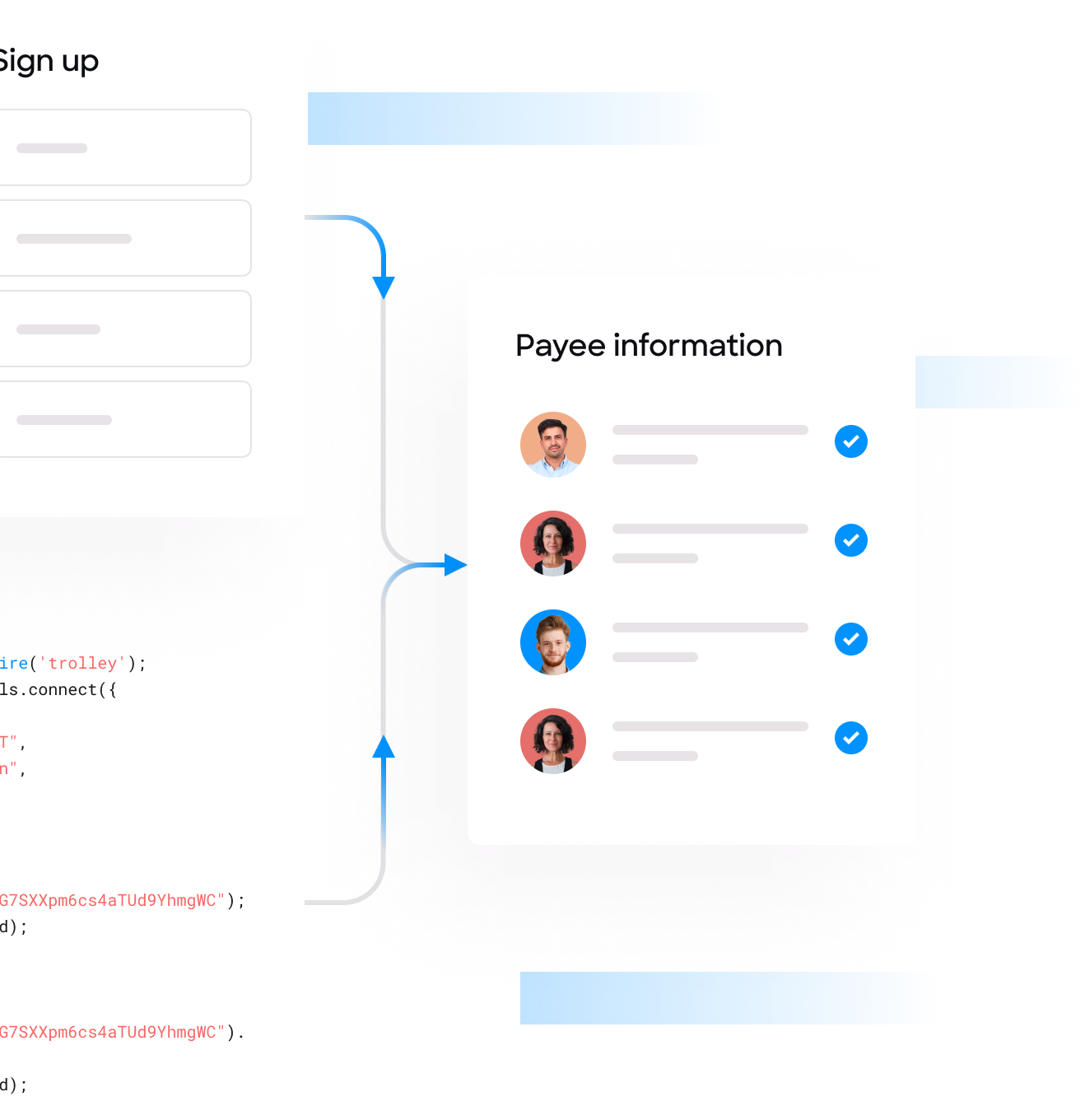

Digital W-8 & W-9 collection and earnings allocation

Whether you use Trolley’s white-label portal or embedded widget, it’s easy to securely collect payee identification and tax information.

- Securely collect and store Forms W-8 and W-9 following IRS requirements.

- Validate TINs including SSN, EIN & FTIN.

- Every three years, W-8 forms expire, and a new one is automatically requested.

- Withholdings are automatically updated as tax regulations change.

- Multiple income types are supported: services, rent, royalties, tax exempt, etc.

- Single payments can be split and allocated to multiple income types.

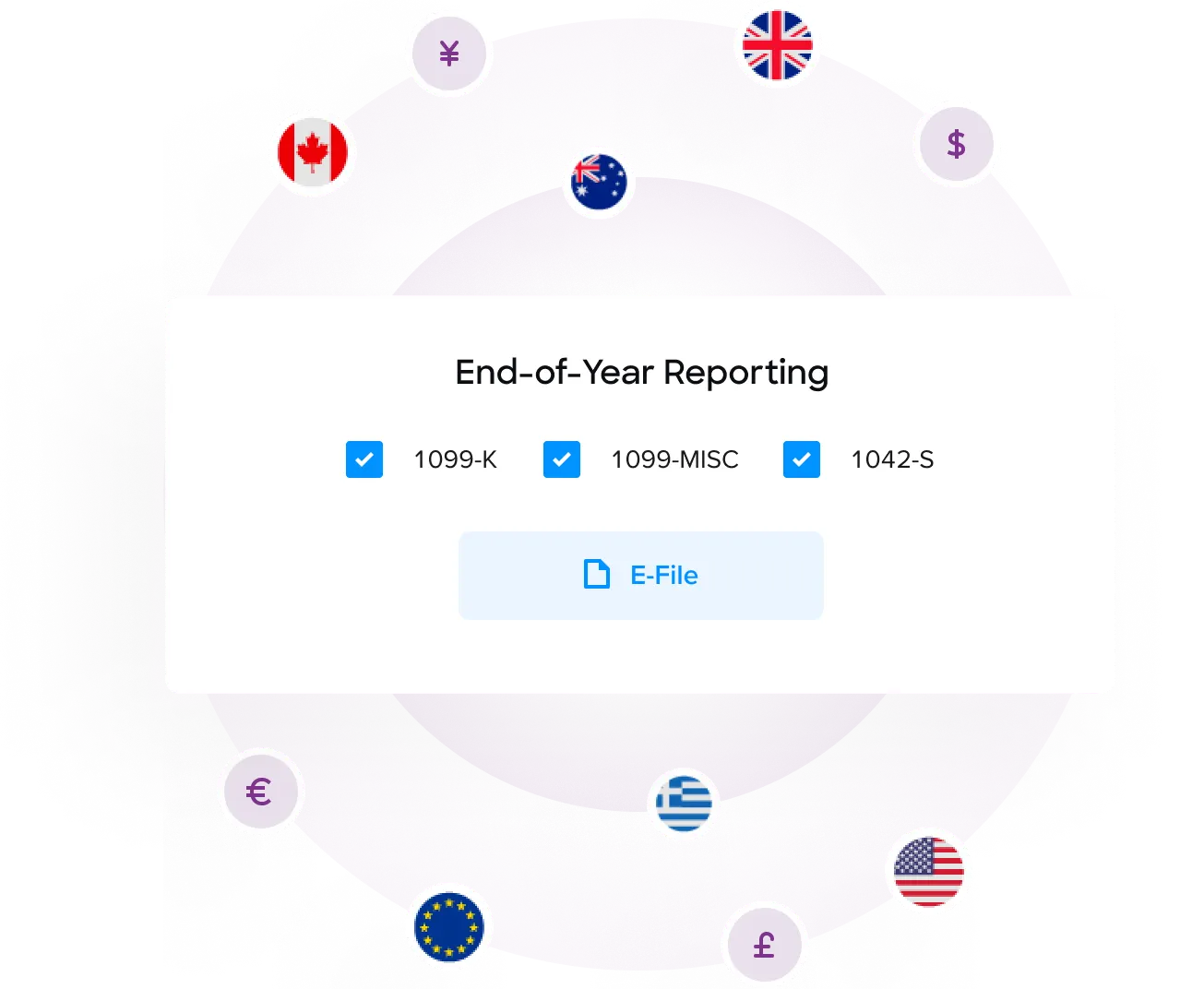

Generate EoY reports in minutes and e-file with the IRS

Streamline statement generation and filing (1099 & 1042-S) with automated year-end tax reporting. Comply with the IRS's regulations for contractor, non-employee, royalty, and other forms of income.

- Central hub to maintain completed tax forms for IRS audits.

- Generate year-end Forms 1099 and Form 1042-S for e-filing.

- EoY 1099-MISC, 1099-NEC, 1042-S, & 1099-K reporting with statements delivered via a click.

- Deliver recipient statements digitally or through physical mail.

- Support for returned payments and statement correction.

1099-K: Comply with the IRS’s changing thresholds

With gross payment and transaction thresholds changing over the next few years, EoY tax statements for your US-based marketplace should increase exponentially. Trolley's payouts solution offers native tax support for IRS Form 1099-K.

- Manage higher volumes of Form 1099-K with automated onboarding, payment tracking, and EoY filing.

- Consolidate pay and tax workflows.

- Say goodbye to the worries of constant updates, maintenance, and tech debt.

- Manage all your recipient data, payouts data, and tax data from a single platform and reduce errors across your systems.

Keep up with regulations without the dev work

With ever-changing regulations, keeping up with an in-house tax product can distract from your core offering. Trolley Tax ensures you are always up to date and those ever-changing regulations never affect your business continuity.

Scale your business globally

Expand across borders without the headache of global regulations. Trolley’s Tax product also supports DAC7 compliance for EU-based sellers. Collect tax information, make regular payments, and generate EoY reports ready to submit to authorities in any of the 27 EU member states.

- Simple tax info collection with our self-serve tool, tailored for EU sellers.

- Support for all four activities reportable under DAC7.

- Per-payout tax records, for efficient EoY processes.

- XML reporting file generation in line with cross-Europe DAC7 standards.

- Navigate US and EU regulatory landscapes from a single platform. [Coming soon]

An all-in-one solution for the internet economy

With Trolley, your teams can save nearly 80% of the time spent managing administrative tasks related to contractor payouts and taxes. Plus, our simple-to-understand pricing means fewer fees and FX surprises.

- Send global payouts to 210+ countries and territories.

- Save time with self-service vendor onboarding.

- Built-in identity verification, KYC, and fraud prevention.

- Automatic contractor tax management and filing for the US and EU.

- Sync data with your ERP and other tools.

- An all-in-one toolkit of enterprise-grade features and volume-based advantages.

More tax-related content to explore

Send fast payouts, simplify your tax process, and sync your tools with one platform

Let Trolley take care of payouts, so you can focus on what really matters: growing your business.