Paying international contractors shouldn’t drain your time, or hurt your margins. Whether you’re sending $500 to a video editor in Argentina or $50,000 to a development team in India, every payment method (ACH, wire, PayPal, or digital wallet) comes with trade-offs. This guide breaks down the real costs, speed, and ideal use cases for each option, so you can avoid hidden fees, keep contractors happy, and scale global payouts without the guesswork.

There is so much undeniable talent on the planet; you’d be missing out if you only looked close to home. Your next software engineer might be working out of India. Your marketing genius could be crafting strategies from Brazil. A customer support legend might be answering tickets from the Philippines.

But while sourcing talent across borders is easy, paying your global team? That’s where things get complicated.

Different countries. Different currencies. Different regulations. And let’s not forget about those sneaky fees that can turn a $1,000 payment into $950 by the time it reaches your contractor’s account.

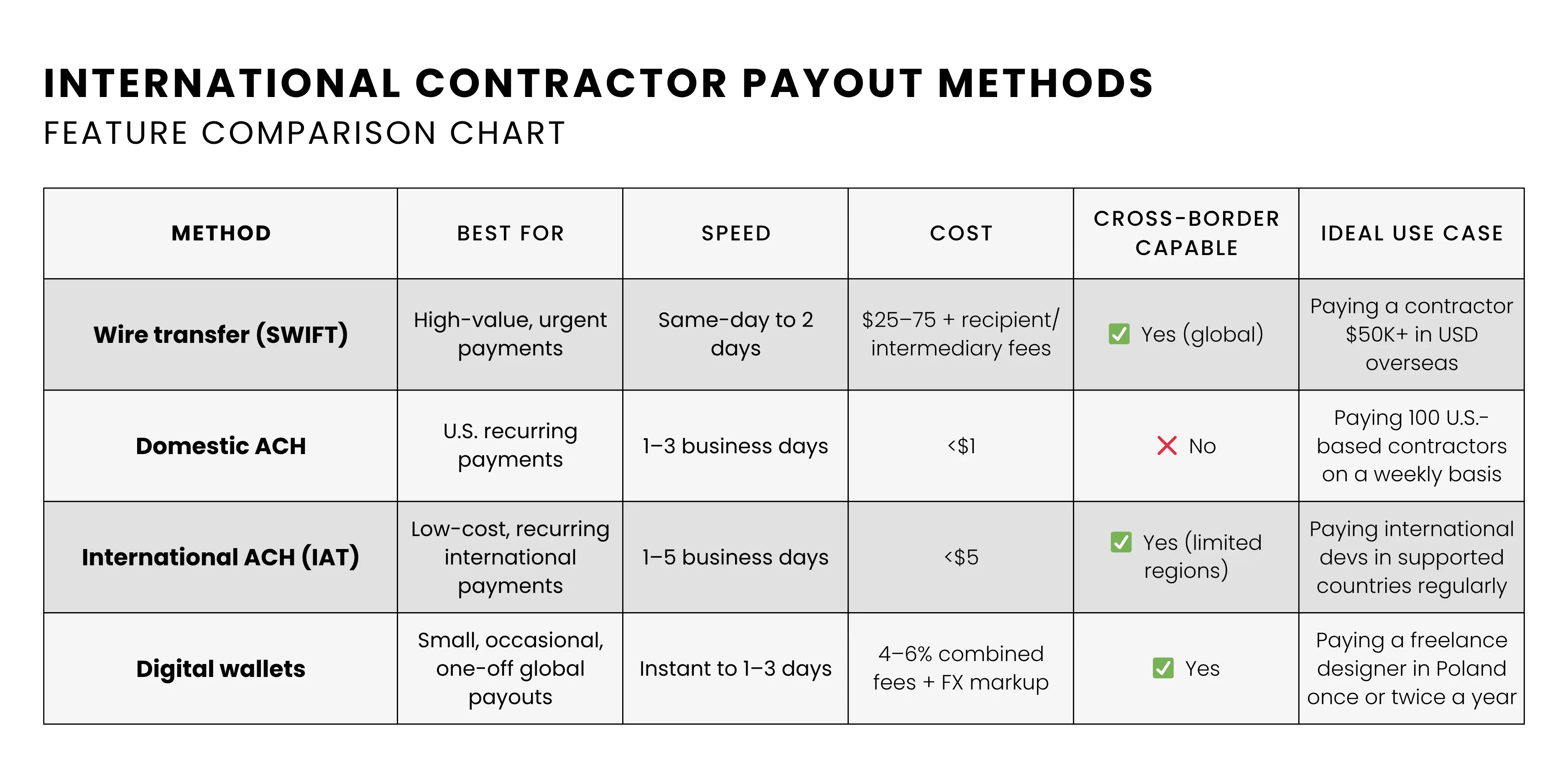

To reward these contractors fairly and keep their finance teams sane, businesses often rely on four main methods: international ACH, wire transfers, PayPal, and digital wallets. Each comes with trade-offs. This guide breaks down each method, so you can choose the smartest option for your team, your budget, and your bottom line.

Before you dive in

If you’re evaluating payout platforms or exploring how to future-proof your operations, download our Payout Platform Buyer’s Guide—a practical resource to help finance, product, and compliance teams reduce costs, avoid risk, and align on the right solution.

What we cover

Understanding ACH, wallets, & wires in cross-border contractor payments

For cross-border payouts, it’s essential to understand that ACH, wallets, and wire transfers each serve different functions. When you link a U.S. bank account to platforms like PayPal or Venmo, moving funds into or out of the wallet uses the domestic ACH network, typically taking 1–3 business days at very low cost. However, once funds are inside a wallet, sending money to another user on the same platform is handled internally, via ledger updates (not ACH or wire transfers) and happens almost instantly.

For direct bank-to-bank global payments, you face a choice between International ACH Transactions (IATs) and wire transfers via SWIFT (or Fedwire). IATs are a low-cost, regulated way to send money overseas and typically take 1–5 business days, while wire transfers are faster—usually same-day to 1–2 days—but significantly more expensive. Ultimately, the right route depends on your priorities: cost and predictability (IAT) versus speed and availability (wire).

What’s a wire (SWIFT) transfer?

When you send a wire transfer, your bank talks directly to the recipient’s bank. No middlemen or detours, just a straight shot from point A to point B.

The magic happens through something called SWIFT—a global messaging network that banks use to communicate. Note that SWIFT messages are just instructions. They tell banks what to do. The actual wire transfer is the money moving between accounts.

Once your bank gets the SWIFT message, it debits your account and credits the recipient’s account. The whole process can happen near-instantly. That speed makes wire transfers perfect when your contractor in Tokyo needs payment before their rent is due tomorrow.

Of course, speed comes at a price—literally. Banks charge hefty fees for wire transfers. You might pay $25 to $45 just to send the wire. And that’s not the end of it. Your contractor gets hit, too. Their bank often charges “lifting” fees to receive the money. These fees can eat up another $15 to $30. Suddenly, that $1,000 payment becomes $945 in your contractor’s pocket.

What’s an ACH transfer?

The Automated Clearing House (ACH) network is the workhorse of American banking. Every day, it processes millions of transactions, from direct deposits to bill payments. Unlike the express lane of wire transfers, ACH is more like a city bus. It makes scheduled stops and picks up multiple passengers along the way.

Instead of sending payments one by one, ACH bundles them together. Your payment joins thousands of others heading in the same direction. These bundles get processed four times each business day. Banks sort through them, figure out who gets what, and distribute the funds accordingly.

Unlike the instant nature of wire transfers, ACH moves money in bundles, typically taking one to three business days to complete. Since the ACH network processes payments together, costs are kept incredibly low—often just a few cents per transaction.

There are two types of ACH transfers: credits and debits. A credit pushes money into an account, like when you pay your contractor. A debit pulls money from an account, like when a contractor charges your company card for approved expenses.

What are International ACHs (IAT)?

For cross-border payments that touch U.S. rails, the International ACH Transaction (IAT) standard is used. Developed by NACHA in collaboration with OFAC, IATs include enhanced data fields to meet international compliance and anti-money laundering requirements.

These payments are routed through the U.S. ACH network and onward to foreign banks, often via intermediary institutions or partner systems like SEPA. Typically, IATs take 1–5 business days, cost under $5 per transaction, and ensure global traceability. However, they are limited to certain countries and do not support same-day settlement.

For paying international contractors, IATs are cheaper than wire transfers, but slower and less globally universal. If you’re paying multiple contractors regularly across borders, IAT offers a cost-effective, traceable path—just be prepared for a few days’ wait and limited country coverage.

How can I pay globally using PayPal and other digital wallets?

Digital wallets like PayPal, Venmo, and Xoom often rely on ACH only for funding or withdrawing money to and from a U.S. bank account, which typically takes 1–3 business days and is very cost-efficient. However, transfers between users on the same platform (e.g., PayPal-to-PayPal) are internal ledger updates, meaning they happen almost instantly and bypass ACH or wire networks entirely.

When it comes to sending money internationally, these platforms don’t rely on ACH. Instead, they use internal routing systems, foreign exchange infrastructure, and often wire transfers behind the scenes. Services like Xoom, powered by PayPal, may integrate tools such as PayPal USD (PYUSD)—a stablecoin settlement layer—to speed up transfers and reduce cost.

These cross-border payouts are structured to offer a seamless user experience, but convenience comes at a cost. PayPal and peers apply cross-border fees and currency conversion margins, and may place holds of up to 21 days on funds—especially for new accounts or unusual transaction patterns. They also impose transfer limits (e.g., Venmo’s $5,000 weekly cap), which can create constraints for businesses paying international contractors.

When to use each method

As you evaluate how to pay contractors, your choice should align with payment size, urgency, and location. Different scenarios warrant different methods:

Wire transfer

Ideal for large, time-sensitive payments—typically over $25,000. At this scale, fixed wire fees (often $25–50) represent a small portion of the total amount. Wires typically settle same-day or in 1–2 business days internationally, making them the go-to option for urgent, high-value payments and when delivering U.S. dollars directly into a contractor’s dollar-denominated account.

The downsides inclide high costs (including intermediary and receiving fees), irreversible transactions, and a dependency on precise bank details like SWIFT/BIC and account numbers.

ACH

Best for recurring or predictable payments under around $25,000. Domestic ACH costs range from a few cents to about $5, and schedule-driven batching minimizes manual effort. U.S.-based businesses and contractors benefit most—100 contractor payments can be processed for less than the cost of one wire.

Thanks to Same-Day ACH, urgent domestic payments are possible for a small fee (limits apply). For international payouts, International ACH Transactions (IATs) offer a slower (1–5 days), low-cost route in supported regions, though coverage and speed are not as robust as wires.

PayPal and digital wallets

Perfect for small, occasional cross-border payouts when convenience matters more than cost. Wallets like PayPal eliminate the need for bank info and allow instant transfers between users.

However, cross-border withdrawals rely on their internal FX and wire systems, not ACH, and can come with 4–6% combined fees and FX margins. They also impose transfer caps (e.g., $5,000/week on Venmo) and may hold funds up to 21 days on new accounts.

How to determine the right international payout option for you

Now that you know how each payment method works and its relative strengths, you need to evaluate your specific situation.

Start by asking yourself some key questions: How many contractors do you pay regularly? What’s the average payment size? Are your contractors domestic or international? How quickly do they need their funds? Your answers will point you toward the most appropriate solution.

Here are the three pillars to consider.

Payout volume

High-volume businesses need efficient systems. If you pay 50+ contractors monthly, transaction fees matter more than convenience. ACH becomes your best friend for domestic payments. The difference between $0.50 and $30 per payment, multiplied by 50 contractors, equals $1,475 in monthly savings.

Low-volume businesses can prioritize convenience. Paying five contractors occasionally? PayPal’s higher fees might be worth the simplicity. The time saved on collecting banking details and filling out wire forms offsets the extra cost.

Destination countries

Domestic contractors open up ACH options. U.S.-based businesses paying U.S.-based contractors should default to ACH for most payments. It’s cheap, reliable, and widely accepted.

International contractors require more thought. Wire transfers work for large amounts to established contractors. Digital wallets handle smaller payments to diverse locations. Some countries prefer specific platforms—research what your contractors actually use.

Frequency of payment

Regular payments benefit from automation. Weekly or monthly contractor payments are well-suited to ACH. Set up recurring transfers and eliminate manual work. Your contractors appreciate predictable payment schedules.

Irregular payments need flexibility. Wire transfers or digital wallets are the better options for project-based work with variable timing. Pay instantly when projects are complete rather than waiting for the next ACH cycle.

Why most businesses use a mix of payout methods

The reality is, there’s rarely a one-size-fits-all payment method.

You might use ACH for U.S.-based developers, wire transfers for high-value overseas projects, and digital wallets for one-off international freelancers. Each method serves a specific purpose, but managing them all separately can become a full-time job… one reason many companies consolidate into a single global payouts platform.

As your contractor network grows in size or complexity, juggling multiple payout methods and platforms can quickly become a headache. Managing wires, ACH, and digital wallets separately adds operational overhead, increases the risk of errors, and complicates tax reporting.

That’s where a unified payouts solution like Trolley comes in: one platform to handle global payments, tax compliance, and recipient onboarding, no matter where your contractors live or how often you pay them.

Here’s how that plays out in practice:

Scenario 1: Growing creator platform in the U.S.

You run a platform that pays 80 content moderators and video editors in the U.S. every two weeks. Each payment is $500–$1,000. Using domestic ACH saves you thousands in fees each month compared to wire or PayPal, and automated batch payments help you avoid manual errors.

But now you’re onboarding creators in the Philippines, Argentina, and Nigeria. Wires are expensive, wallets are inconsistent, and regional regulations are tricky. That’s when switching to a platform like Trolley—with smart routing, local coverage, and built-in tax workflows—makes all the difference.

Scenario 2: Global product studio paying on-demand talent

You hire freelance designers, voice actors, and engineers from 12 countries. Some prefer PayPal, while others want USD via wire. Some projects are one-time, others are retainer-based. Managing this mix through separate systems is time-consuming and risky.

With Trolley, you can pay freelancers via local bank transfer, e-wallet, or wire from one platform—routing each payment according to preference, region, and compliance needs—without chasing down forms or encountering exchange rate surprises.

Choosing the right path forward

No single payment method is perfect for every situation—ACH, wires, PayPal, and digital wallets each serve their purpose. The real challenge is knowing when to use which, how to balance speed against cost, and how to scale as your contractor network grows.

If you’re looking for a deeper dive into these trade-offs—and how leading companies bring it all together into one strategy—explore our article on Global Payouts Platforms: Challenges, Solutions & Best Practices or dive into our Payout Platform Buyer’s Guide.

These are the perfect next steps if you want to connect the dots between payment methods, compliance, and long-term scalability.