Payout fraud is one of the most costly—and least visible—risks facing platforms today. Trolley’s new guard blocklist proactively detects and blocks fraudulent recipients before a single dollar leaves your account, using deep data analysis and industry watchlists like the MFFA to identify repeat offenders and hidden fraud rings—protecting your business, your creators, and the integrity of your entire payout ecosystem.

Building an online platform is tough. Between generating user demand, attracting a steady supply of creators and or merchants, and building the infrastructure that connects the two, most teams are already stretched thin. Every new feature, every payout cycle, every compliance update competes for the same limited time and resources.

And when priorities pile up, teams don’t want to spend their time investigating recipients deeply, especially when verifications increase friction and decrease onboarding rates. That’s where the cracks appear. Without robust recipient checks, platforms expose themselves to both pay-in and payout fraud.

The first one, pay-in fraud, is familiar territory. Chargebacks, stolen cards, fake buyers… there’s an entire ecosystem of tools built to fight it.

But payout fraud? That’s the blind spot. It’s been poorly understood, rarely detected, and, until now, nearly impossible to defend against. It hides behind “verified” profiles, familiar names, and plausible recipients. Until you pull back the curtain, you might not even realise the damage.

That’s why we built the guard blocklist, to close the gap where payout fraud slips through.

What we cover

The hidden cost of fraudulent payouts

When payout fraud slips through the cracks, it doesn’t just cost money; it reshapes the ecosystem that real people rely on to get paid.

At Trolley, we’ve seen it up close. When bad actors operate unchecked, they create ripple effects that reach far beyond a few fraudulent transactions, such as:

- A broken monetization model. Fraudsters who fake streams, clone content, or duplicate copyrighted works tap into a limited pool of payouts — meaning every dollar lost to a bad actor is a dollar taken from a genuine creator. The result? Unfair competition, shrinking earnings for legitimate artists, and growing frustration with how payouts are managed.

- A lower-quality ecosystem. The rise of low-effort, AI-generated “slop”, or stolen content floods platforms with noise, making it harder for audiences to distinguish authentic work and pushing talented creators out of view.

- Hijacked accounts and stolen earnings. When fraudsters compromise trusted accounts or exploit weak verification checks, real users wake up to find their earnings diverted elsewhere.

It’s not just small sums adding up; it’s structural. Fraud at the payout level can quietly undermine the very model that keeps people earning.

And in the broader payments landscape, this isn’t unique. 79% of organisations reported being victims of payment fraud attempts in 2024. And global e-commerce losses due to fraud are estimated at tens of billions of dollars annually.

The message is clear: this isn’t a “nice-to-fix” problem. It’s an existential one.

What we found when we looked closer

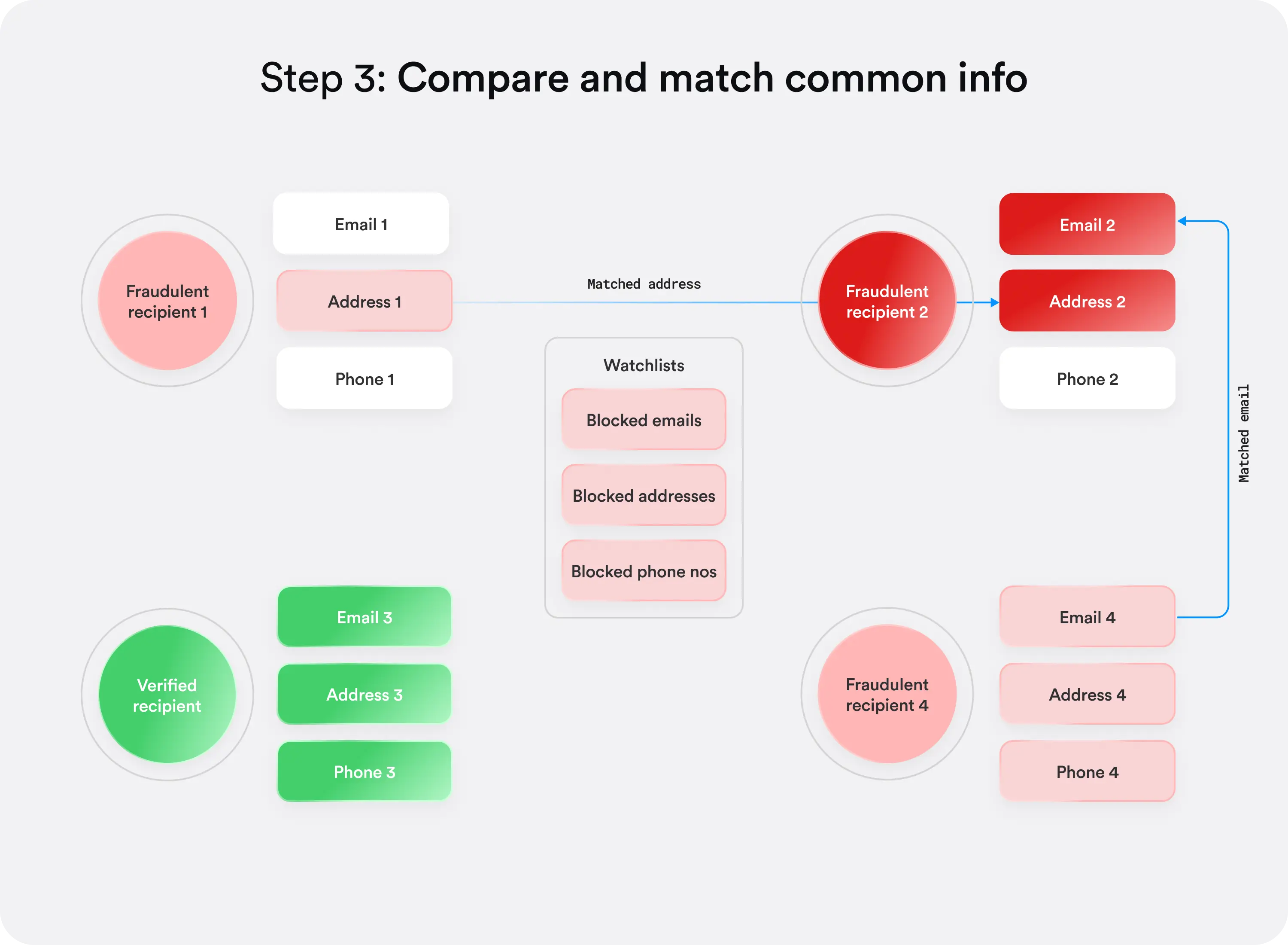

During our investigations, we discovered that payout fraud follows clear and repeatable patterns, and understanding them is the key to stopping them. Here’s what stood out:

- Small population. On average, just 1% of fraudsters are responsible for over 40% of total fraud on a platform. By focusing detection on this small group, platforms can dramatically reduce risk with minimal friction for legitimate users.

- Multiple accounts. Bad actors don’t rely on a single profile. They maintain a web of prebuilt “sleeper” accounts, ready to activate whenever one gets blocked. Traditional systems catch one account but miss the duplicates, allowing fraud to persist.

- Fraud rings. These actors rarely work alone. They collaborate across multiple accounts—sometimes dozens—launching coordinated attacks in short bursts. Without the ability to identify these clusters quickly, platforms often lose funds before they even realize what’s happening.

These patterns echo what we heard from other industries. In marketplaces, for instance, fraud costs “upwards of $10 million a year” for many platforms. And in e-commerce, fraudulent orders cost far more than the sale price once you factor in fulfilment, returns, and chargebacks.

These patterns highlight an uncomfortable truth: fraud isn’t random. It’s repeatable, measurable, and predictable, if you have the right data.

That realization is what led us to evolve Trolley Trust beyond verification into a full fraud-prevention platform built to help our customers block bad actors before a single payout goes out the door.

Meet Trolley’s guard blocklist: The engine behind smarter fraud defense

Recognizing the problem is one thing; solving it is another.

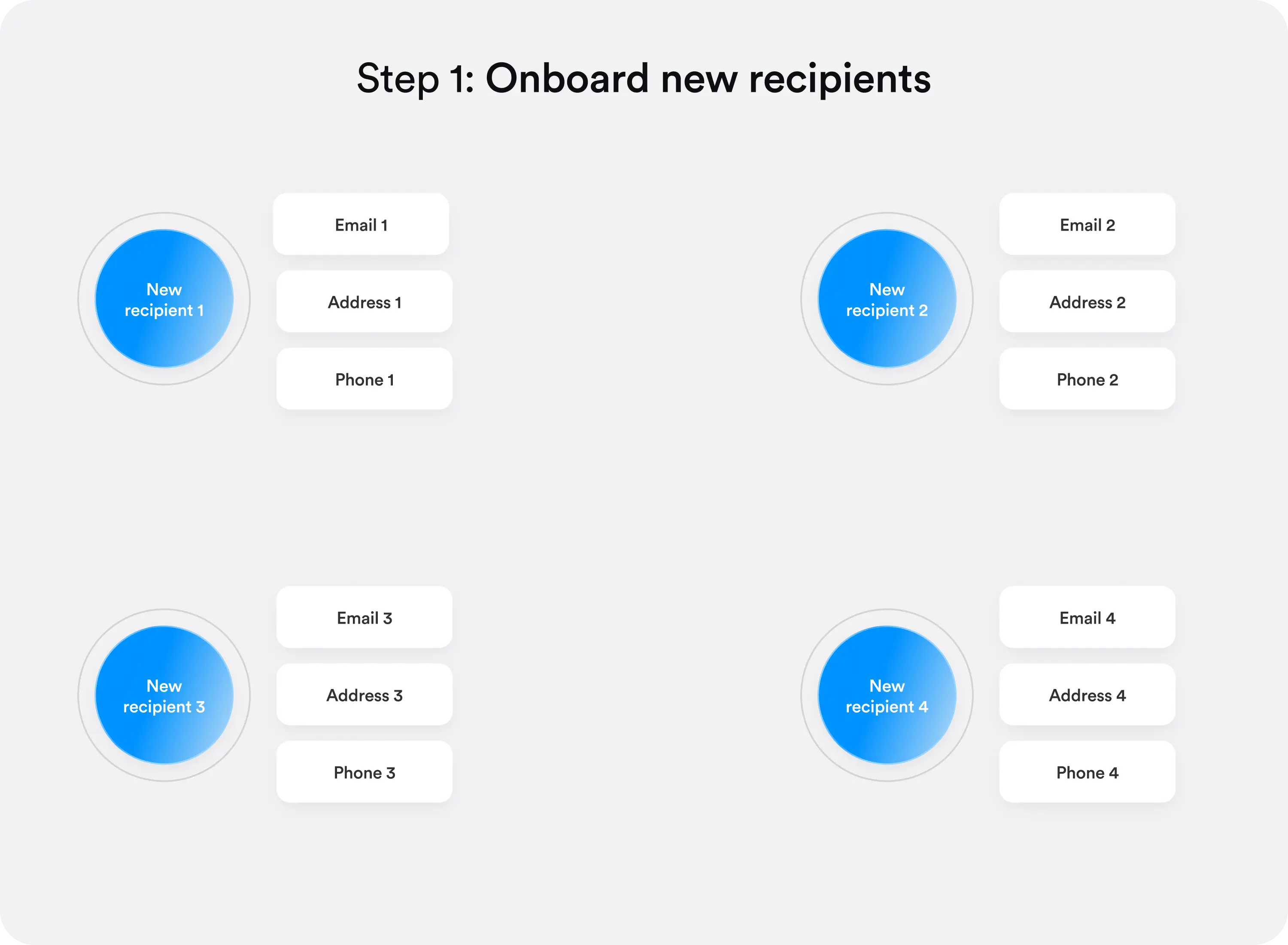

Meet the guard blocklist, a new fraud-prevention engine and analytics layer purpose-built for payout systems. It helps platforms track, flag, and block bad actors by analyzing attributes that can’t easily be replicated—no matter how many fake names, burner emails, or new accounts they spin up.

The guard blocklist works in two major ways:

- Intelligently blocks recipients on your platform. It looks beyond surface-level identifiers, tracking deeper signals that fraudsters can’t disguise.

- Cross-checks against global watchlists. Integrated data sources like the Music Fights Fraud Alliance (MFFA) and other industry registries let platforms automatically block known offenders before a payout even starts.

Here’s what that looks like in practice.

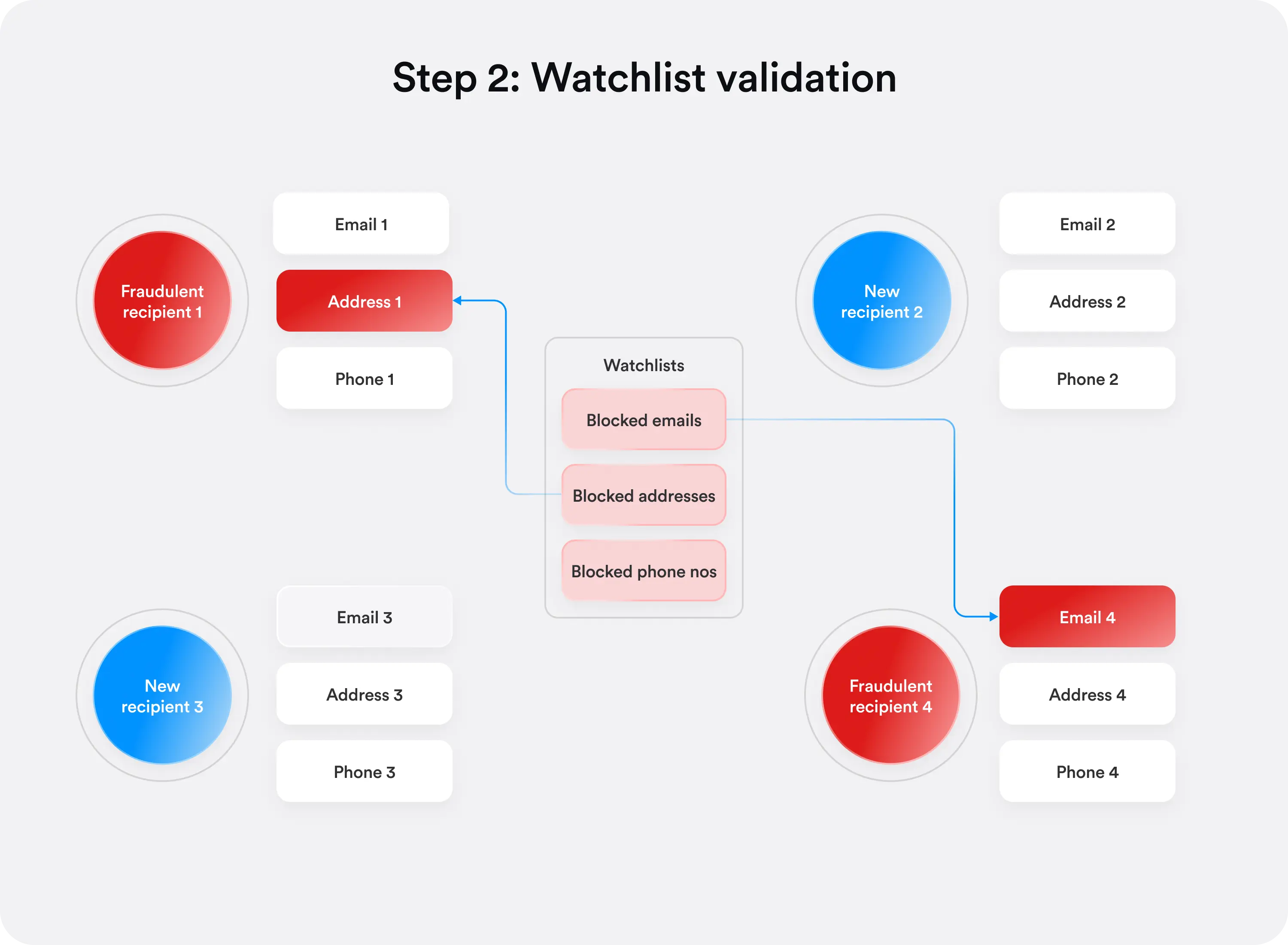

Trolley continuously monitors recipient activity in the background—long before a payout is ever triggered—analyzing live data streams to spot potential risks early.

When it detects something unusual, it cross-checks multiple data points to answer questions like:

- Have we seen these recipient attributes before—even if the name or email is new?

- Are there behavioural flags (like a just-created account suddenly processing high-value payouts)?

- Do these patterns match known fraud tactics—like shared devices, duplicate bank accounts, or recycled payout routes?

- Is the recipient listed on an industry watchlist or flagged through network-wide intelligence?

If something looks off, the system automatically pauses and flags the profile for review. That means you’re catching suspicious profiles proactively, not after the damage is done.

And the impact is already measurable.

During our rollout, Trolley identified over $12.5 million USD in fraudulent payouts over the past year, with an average fraudulent payment size of $3,325.

We’ve seen first-hand how bad actors are infiltrating trusted channels, and we’ve built this tool to help protect legitimate businesses and the merchants, artists, and creators they pay from those same threats.

What’s next (and why it matters right now)

We’re rolling out this feature in phases, starting with customers who have high-volume payouts. If you’re already using Trolley Trust, you can slot this into your workflow with minimal overhaul.

Here’s what you can do now:

- Talk to your Trolley account team about enabling the guard blocklist.

- Prep your ops team by defining review workflows, escalation paths, and key metrics such as flags, blocked payouts, payout delays, and reductions in caught-fraud losses.

- Justify the ROI by mapping out how better payout integrity helps recipient retention, avoids losses, and supports growth.

- Monitor and iterate by using dashboard data to fine-tune thresholds and improve risk-scoring over time.

Because the truth is, fraud doesn’t rest. But with Trolley, you can.

Ready to enable Trolley’s guard blocklist? Talk to our team.