Global scale brings global complexity—and your payment platform can either help you master it or make things worse.

If you’re a product manager or finance leader building global contractor, creator, or supplier payments into your platform, you’re probably facing one big question: which payout infrastructure is the right fit?

The options all sound similar. Fast payments, low fees, “seamless” automation. But once you dig in, the differences become clear—especially when it comes to compliance, integration complexity, and global coverage.

Selecting the right global payout platform is a strategic decision for businesses managing international payments.

Get it wrong, and your business could face delayed payments in key markets, regulatory fines from misfiled tax documents, or burned relationships with top contractors or creators (see Scaling from 100 to 10,000 Payments: When to Invest in a Global Payout Platform for more on when to upgrade).

Get it right, and you’ll do more than just move money; you’ll unlock a seamless, compliant, and scalable global operation that builds trust with recipients and confidence in your internal teams.

These tools aren’t just for finance. They’re also for product teams responsible for integrating and managing the payment experience. The best platforms help you:

- Reduce manual operations

- Minimize engineering lift

- Maintain compliance at scale

- Offer recipients a consistent, local-friendly experience

In this guide, we leverage our extensive experience in global payout management to detail critical evaluation criteria, present quantitative comparisons, and equip you with key questions to thoroughly vet potential providers.

Looking for a broader perspective on global payout operations?

Download our Payout Platform Buyer’s Guide to cut through complexity with a clear, practical playbook—covering everything from evaluating platform capabilities to aligning cross-functional teams and avoiding compliance pitfalls.

What we cover

- Looking for a broader perspective on global payout operations?

- What makes a great international payouts platform?

- Questions to separate the best payout platforms from the rest

- How the top global payouts platforms stack up

- Global payouts platforms compared: Key capabilities side-by-side

- Trust Trolley to deliver fast, compliant global payouts

What makes a great international payouts platform?

Effective global payouts platforms form essential infrastructure, enabling businesses to scale internationally without friction. Businesses today operate globally from day one, making it critical to choose a payout solution that supports seamless financial operations across borders. The right platform should simplify complexity, enhance operational efficiency, ensure compliance, and deliver exceptional payee experiences.

We’ve identified seven key areas that are essential to evaluate thoroughly when shopping for a global contractor payouts solution:

- Country & currency coverage: Extensive geographic and currency coverage ensures payments reach recipients quickly and efficiently, supporting global business growth.

- Fees & transparency: Clearly outlined platform, transaction, and foreign exchange (FX) fees to avoid hidden costs and ensure predictable budgeting.

- FX rates: Fair and transparent currency conversion rates minimize costs and protect profit margins.

- Automation & payout features: Advanced features like recurring payments, event-driven triggers, error handling, and batch payments significantly reduce manual workloads.

- Tax compliance: Built-in tools for collecting tax documents, managing withholding, e-filing, and compliance with cross-border tax regulations are critical for maintaining regulatory compliance.

- Risk management: Comprehensive identity verification (KYC/KYB), AML screening, and fraud prevention measures safeguard your business from regulatory risks and financial losses.

- API & integrations: User-friendly APIs, SDKs, webhooks, and intuitive integration tools enable rapid and efficient integration, crucial for reducing engineering workload.

Considering these capabilities upfront helps businesses clearly articulate their requirements, enabling productive conversations with potential providers.

Questions to separate the best payout platforms from the rest

As you evaluate potential platforms, ask targeted questions to thoroughly understand their offerings:

Country & currency coverage:

- Can you provide a complete list of countries and currencies supported?

- Do you offer local routing options beyond SWIFT?

- How quickly can you expand coverage if required?

Fees & transparency:

- Can you detail your complete pricing structure, including FX markups, transaction fees, and monthly costs?

- How frequently do your fees change, and how are clients notified?

- Are there discounts available for higher volumes?

FX rates:

- How are your FX rates determined and updated?

- Do you offer any guarantees or transparency tools for FX rate visibility?

- Are historical FX rate comparisons available?

Automation & payout features:

- What specific automation features do you support (batch payments, event triggers)?

- How do you handle payment errors or rejected transactions?

- Can you automate notifications to recipients and internal stakeholders?

Tax compliance:

- Do you automate tax documentation collection (e.g., Forms W-9/W-8)?

- Can your system handle international withholding and reporting requirements?

- Describe your tax filing capabilities (e-filing, IRS, DAC7).

Risk management:

- What processes are in place for identity verification and AML compliance?

- How do you handle flagged or suspicious transactions?

- Do you support ongoing monitoring and periodic compliance checks?

API & integrations:

- Describe your API and integration resources (documentation, SDKs, sandbox).

- What’s your typical integration timeline, and how many developer hours are required?

- Can you integrate with existing ERP, accounting, or CRM systems?

How the top global payouts platforms stack up

We’ve conducted extensive research to help simplify your decision-making. The following comparisons are based on our insights and publicly available information. While we have the most detailed knowledge of our own platform (Trolley), we recommend buyers perform their own evaluation to address specific needs comprehensively.

Trolley

Trolley is a comprehensive global payouts platform designed specifically for businesses needing extensive automation, robust compliance, and broad currency support. It supports payments to over 210 countries and territories, managing 135+ currencies through diverse payment methods including ACH, SEPA, digital wallets, and cheques. Trolley’s transparent pricing structure—clearly outlined monthly fees, transaction costs, and FX markups (~2%)—makes budgeting straightforward.

The platform significantly reduces engineering and operational effort with advanced automation capabilities, enabling recurring, event-triggered, and batch payouts. Compliance is robust, with built-in IRS and DAC7 tax filing support, comprehensive identity verification (KYC/KYB), AML screening, and fraud monitoring. Trolley offers developer-friendly APIs, comprehensive SDKs, and a sandbox environment, allowing businesses to integrate quickly and efficiently, saving substantial developer time.

Trolley’s strength lies in its end-to-end completeness and overall flexibility. An API-first, industry-agnostic platform, Trolley is built to support everything from lean SMBs to complex enterprise payout operations.

Tipalti

Tipalti caters primarily to mid-sized to large enterprises, offering good coverage of 200+ countries and territories and 120 currencies. While the platform supports key payment methods and batch payment automation effectively, its user interface and experience (UX/UI) tend to be older and less intuitive compared to more modern platforms.

Integration complexity with Tipalti can be moderate, and the pricing structure requires direct sales conversations, which can add delays to implementation. Tipalti’s strength lies in enterprise-grade AP automation, making it suitable for businesses with complex accounts payable needs rather than solely payout requirements.

Wise Business

Wise Business provides transparent and competitive FX pricing (~0.5-2% markup) and is effective for simpler, cost-sensitive international transfers. It supports around 70 countries and 40 currencies, but its payout methods and automation capabilities are limited, making it less suitable for businesses requiring extensive operational automation or complex payment flows.

Compliance capabilities within Wise Business are minimal, and it lacks robust tools for tax documentation and reporting. Wise’s developer experience is moderate, with basic API support but fewer SDKs and integration capabilities than more specialized platforms.

PayPal MassPay

PayPal MassPay boasts extensive global coverage (240+ countries and territories, 50+ currencies), offering a familiar and user-friendly interface. However, its fees can be high (2-4% FX markup), and fee structures may be complex, particularly for high-volume payments, impacting budget predictability.

Compliance and automation capabilities are relatively basic, suitable primarily for straightforward payout scenarios. Integration support and APIs are adequate but offer limited customization and fewer advanced developer resources. PayPal MassPay remains a good option for businesses whose recipients primarily prefer PayPal or Venmo, though it may not be optimal for broader or more sophisticated global payout requirements.

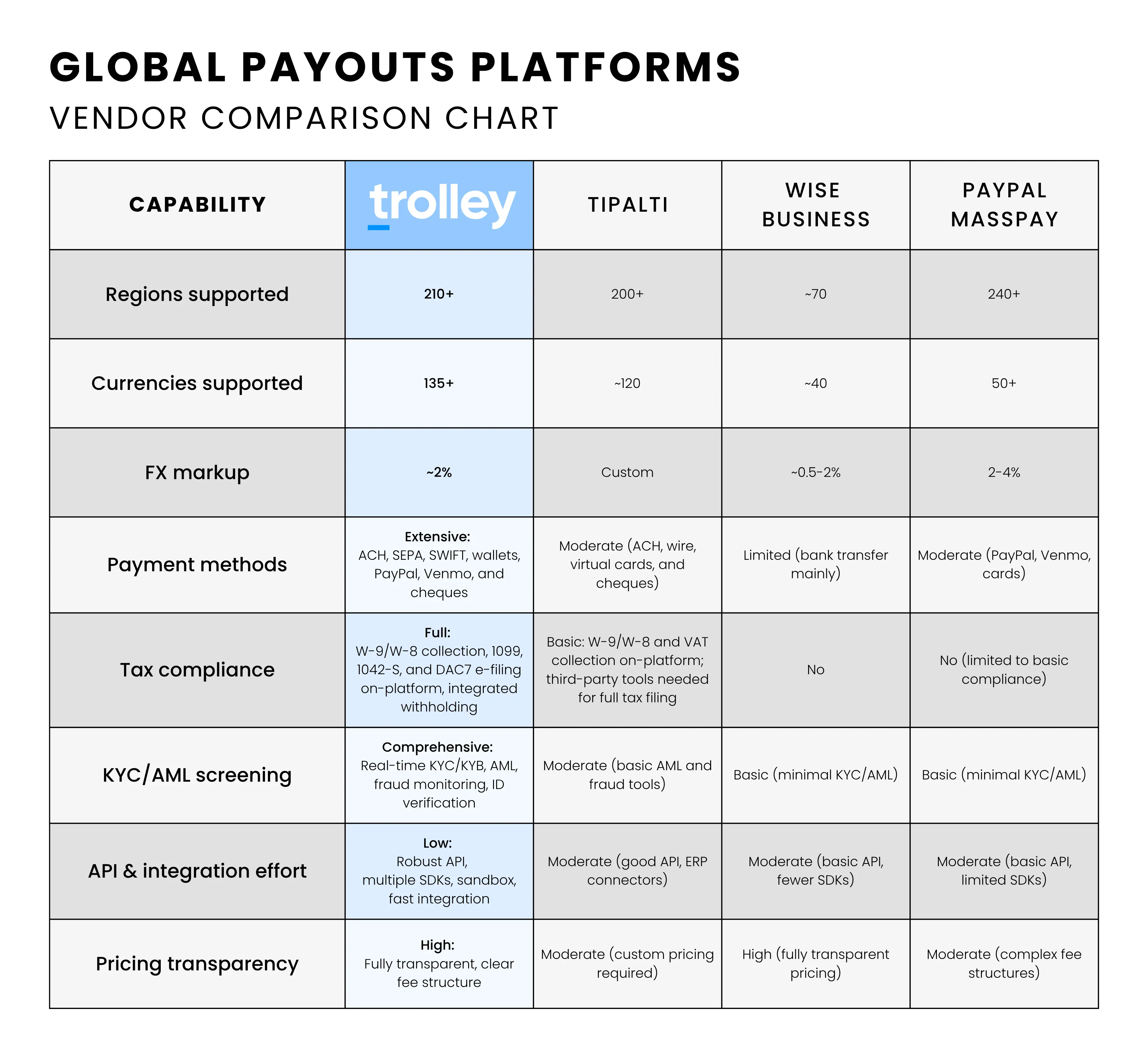

Global payouts platforms compared: Key capabilities side-by-side

Trust Trolley to deliver fast, compliant global payouts

Choosing the right global payments platform is one of the most important infrastructure decisions a scaling business can make. It can profoundly impact your company’s ability to scale internationally, manage complexity, and ensure compliance.

Trolley distinguishes itself by offering extensive geographic coverage, powerful automation, robust compliance and risk management, developer-friendly integration, and clear, transparent pricing.

Ready to transform your global payout processes and scale confidently? Schedule your personalized Trolley demo today or explore our sandbox environment to see firsthand how our platform can meet your global payout needs.

Need even more guidance? Check out our full Payout Platform Buyer’s Guide for a deeper dive.