Managing royalty payments across multiple platforms can be daunting, especially when juggling different payout methods and manually handling data. Trolley’s platform—now with royalty calculator integrations—simplifies the process, ensuring accurate payments, automated workflows, and seamless management of everything from payouts to tax compliance. This guide will take you step-by-step through setting up your royalty calculator integration with Trolley and sending payments.

Paying out royalties can be a complex and time-consuming process, especially when dealing with separate systems for different payout methods such as PayPal, wire transfers, and checks.

The manual nature of this process makes it error-prone, leading to inaccuracies that frustrate artists and rights holders.

These issues can result in an increased number of inquiries to customer service, adding to your team’s workload and delaying future payouts.

But what if you could streamline this entire payout process, ensuring that your royalty payments are accurate, timely, and automated? That’s where Trolley comes in.

In August, we introduced a new integration that allows you to import royalty data directly from your preferred royalty calculator software. By uploading CSV or XLSX files, you can easily sync your royalty calculations with Trolley, making the payout process smoother for both you and your recipients.

Here’s how you can integrate your royalty calculator with Trolley to save time, reduce errors, and ensure hassle-free payments.

What we cover

Your royalty payout workflow

Step 1: Enable your royalty calculator integration

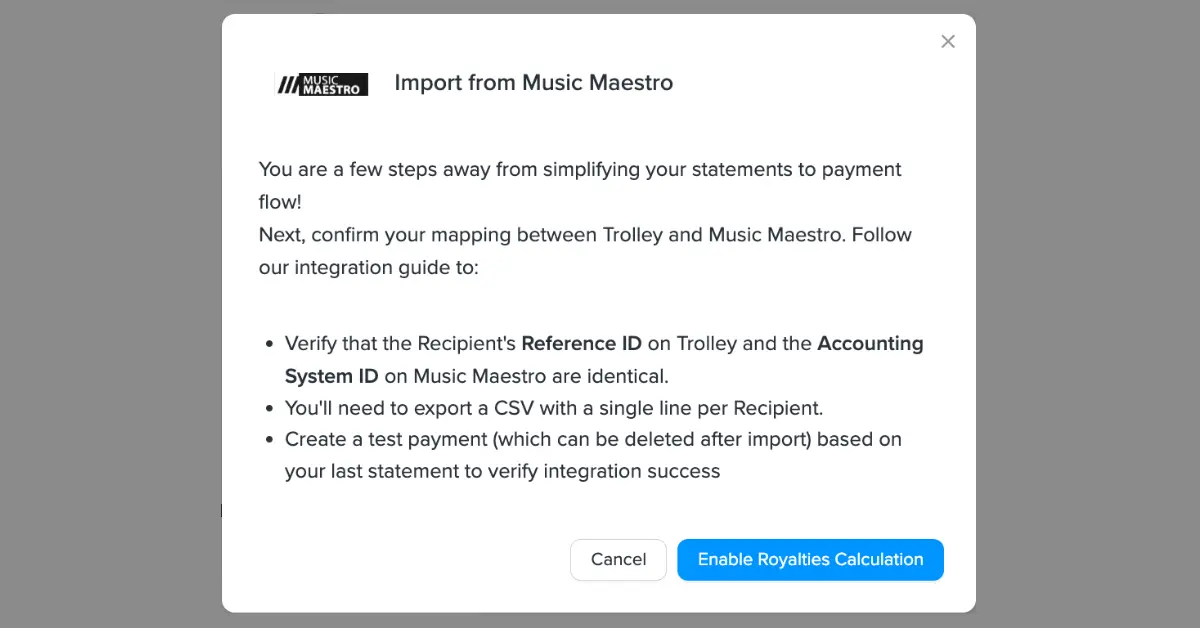

The first step in syncing your royalty calculations with Trolley is enabling the integration with your royalty calculator of choice. We’ll use Vistex’s Music Maestro for this example.

- Navigate to: Settings → Integrations

- Enable your calculator: Find the calculator you use and click “Enable Royalties Calculation.”

Note: You’ll need to ensure that your artists’ Trolley Reference IDs match the relevant IDs on your royalty calculator—in the case of Music Maestro, they’re called Accounting System IDs.

Step 2: Upload files and create payments

After enabling your royalty calculator integration, the next step is to create payments based on your imported data. You can upload data in a CSV or XLSX file, ensuring all payout data is transferred seamlessly into Trolley.

- Go to: Payments → Create Payment dropdown

- Upload files: Select “Upload Vistex file.” This step will pull in the relevant data from your royalty calculations.

Step 3: Generate payment instructions

Once the files are uploaded, Trolley streamlines the next step by automatically generating payment instructions for each recipient.

Since Trolley already knows the payout preferences for each recipient, such as PayPal or bank transfer, it will automatically create a batch payment, eliminating the need for manual input and minimizing the risk of errors.

That’s it! Paying out royalties with Trolley is incredibly simple, and includes some key features we’ll run through next.

Key features of Trolley’s calculator integrations

Merged payments

If you’re paying an artist for multiple types of work, such as royalties and tax-exempt payments, Trolley can merge these payments into one. Trolley handles the tax withholding automatically, ensuring that the correct deductions are made and reflected in the line items. By combining payments, you reduce transaction fees while maintaining full compliance.

Sync with accounting systems

Another advantage to using Trolley is our two-way ERP sync. If you have Sync enabled, payment data will automatically be updated in your accounting software, saving your finance team from manual data entry and reducing the chances of discrepancies.

Tax compliance

Trolley ensures that all payments are fully tax-compliant. Collect recipient tax info at onboarding, automatically withhold taxes on every payout (as required), generate end-of-year recipient statements, and e-file directly with the IRS.

Trust and security

In an industry like music where fraud is a growing concern, Trolley’s robust security features ensure that payments are sent to the correct rights holders, safeguarding your business and your artists. Enable ID verification during onboarding to ensure the veracity of your artists’ identity before you make a payout.

Automated communications

To further reduce the load on your customer support teams, Trolley provides automatic payment status updates to your recipients by email and on the recipient dashboard. Artists and rights holders will be kept informed about the status of their payments, minimizing the need for follow-up inquiries.

Streamline your royalty payouts with Trolley

Simplifying your royalty payouts has never been easier.

With our new royalty calculator integrations, you can now directly import royalty data from leading royalty calculators, streamlining your payment processes and reducing the chance of errors.

This integration is just the beginning as we continue to expand our support for more royalty systems.

Want to learn more about royalty payouts with Trolley or see the platform first-hand? Book a demo or reach out to a member of our team today.