Running payouts at scale requires teamwork, and the right structure to keep things secure, compliant, and efficient.

In this guide, we’ll walk you through how to set up and manage team access and approval workflows in Trolley, so your organization can run payouts with confidence.

Whether your organization handles a few transfers a week or thousands a month, you’ll learn how to:

- Add and manage team members

- Assign roles with specific permissions

- Build approval workflows that fit your company’s review process

Trolley makes it easy to manage access, maintain control, and keep your payout process secure. With user roles and customizable approval workflows, you can build a payout process that mirrors how your team works and adapts naturally to your organization’s day-to-day operations.

Multi-user access: Adding new and managing users

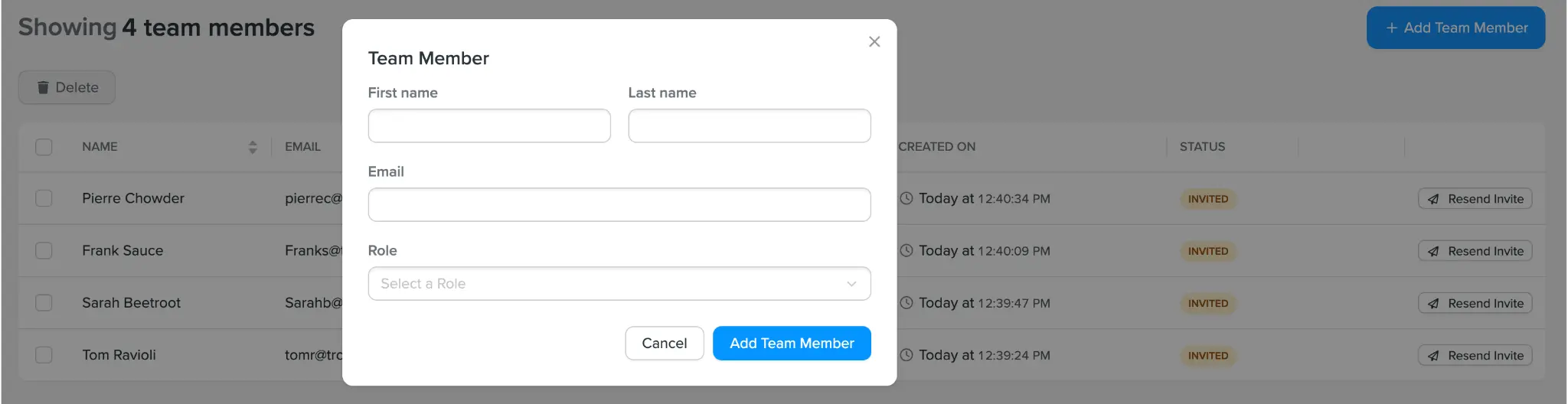

Payout management often involves multiple people: finance managers, developers, and operational staff. Trolley gives you the flexibility to structure access in a way that supports how your team collaborates best. In Settings > Team, you can:

- Invite new users to your Trolley account

- Remove existing users

- Assign roles with specific permissions

To invite a new user, click Add Team Member, enter their name and email, choose a role, and we’ll send them an email invitation to join your company’s Trolley account.

Each new user’s access is defined by their assigned role, so they only have access to the tools and information they need.

From the same dashboard, you can also remove users or update their roles as your team structure changes.

User roles: Refining user access

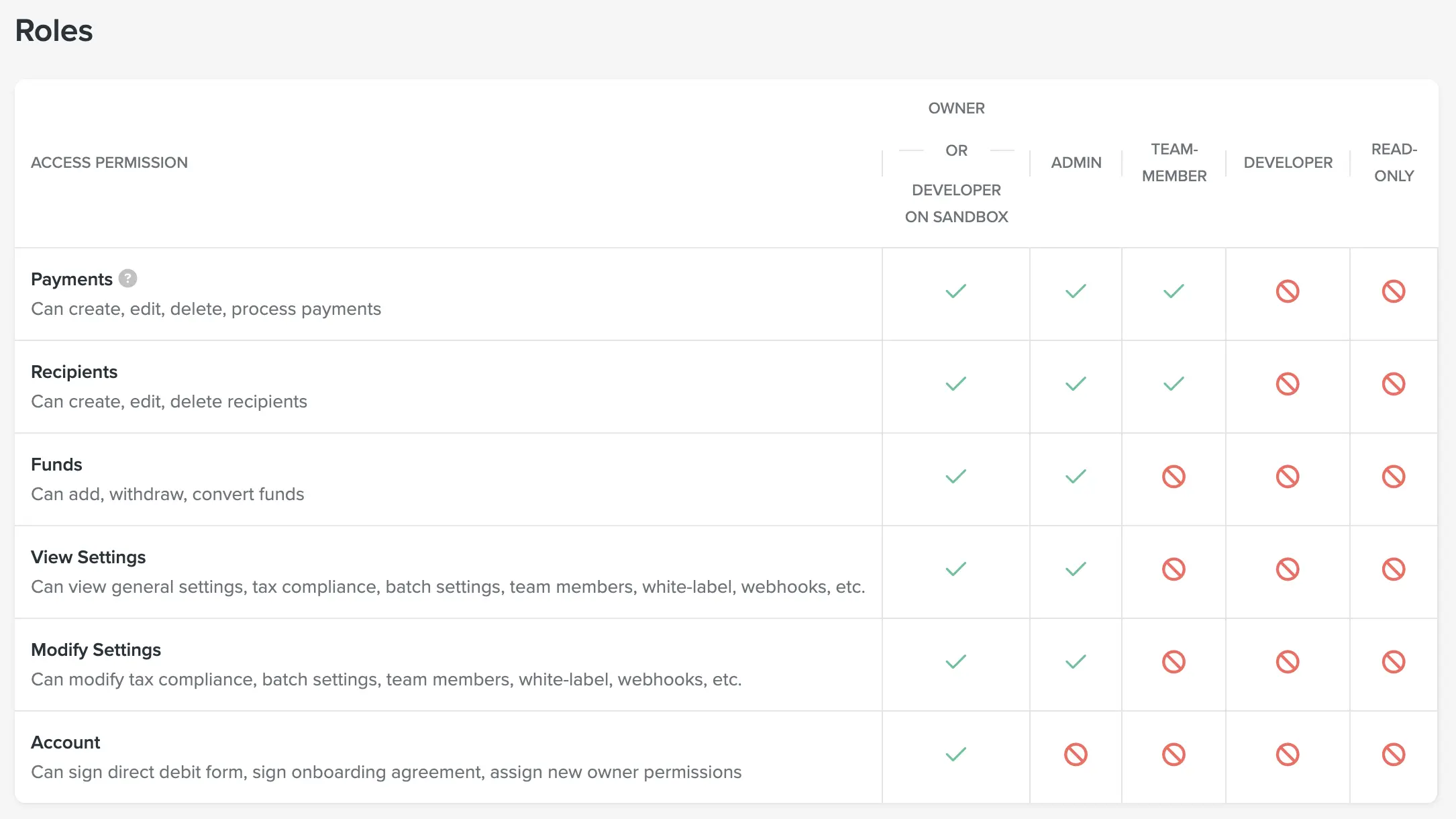

Trolley offers five predefined roles to help you control who can access what. Navigate to Settings > Team > Roles to view or manage these.

- Owner: Has full access to all payment, recipient, fund, and settings functions, including the ability to add or withdraw funds, modify tax compliance or batch settings, manage team members, and assign new owner permissions. This role is typically held by executives such as the CEO or CFO.

- Admin: Has broad permissions to manage payments, recipients, and most settings but cannot create new Admin users or assign owner permissions. Ideal for those managing daily financial operations.

- Developer: Has view-only access to payments and recipients, without edit or approval permissions. Ideal for developers reviewing platform workflows and integrations.

Note: To explore and test Trolley’s features using sample data, developers can use the Trolley Sandbox environment for full access. - Team Member: Can create, edit, and delete payments or recipients but cannot access funding or modify system settings. Best suited for staff who prepare and manage payment batches.

- Read Only: Can view payments, recipients, and reports without editing, approving, or processing actions. Useful for support, reconciliation, or compliance teams who need visibility without direct control.

Building custom payment approval workflows

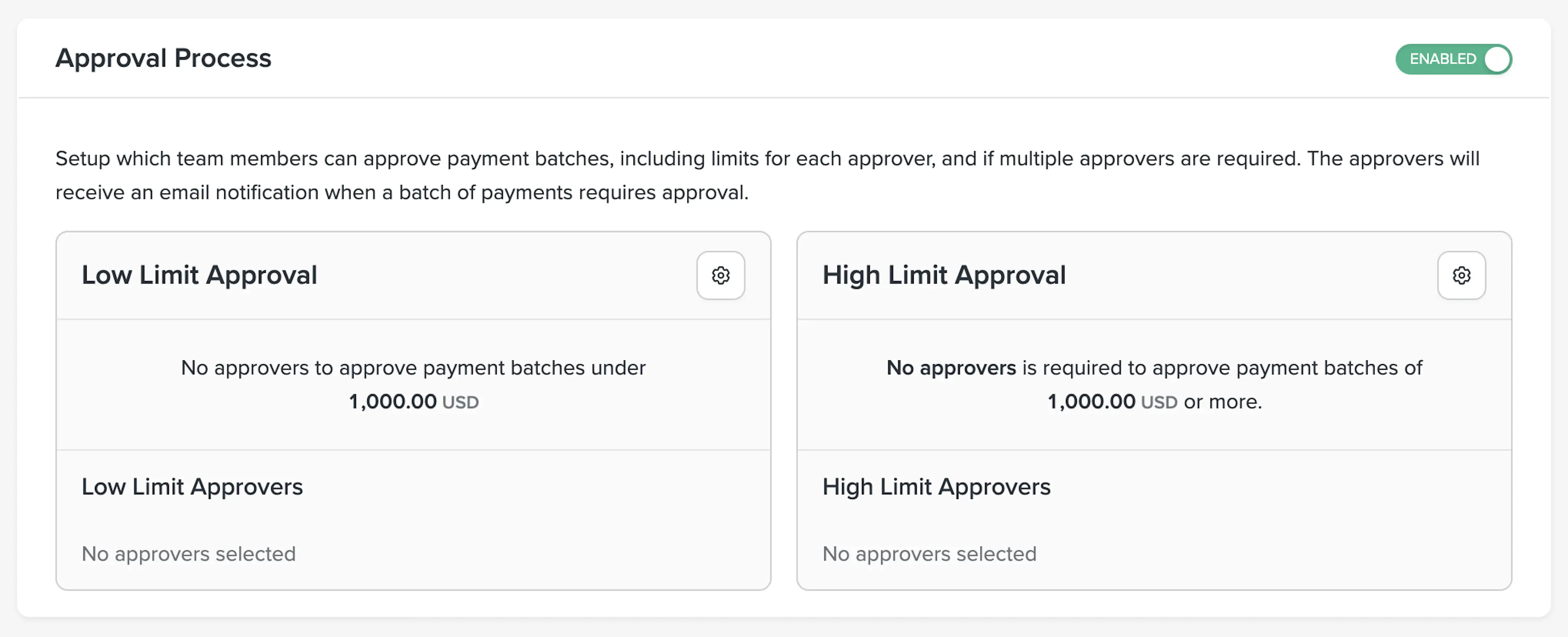

Trolley’s approval workflows let you replicate your internal review and sign-off process directly within the platform. You can require one or multiple signatories to approve a payout before it’s sent, adding structure and security to every transaction.

When a batch is ready for review, approvers are automatically notified via email. Each action—approval or decline—is logged with user details and timestamps, creating a full audit trail.

In Settings > Batch Settings, you can customize workflows based on your organization’s needs:

- Limits: Define thresholds (e.g., payments above $20,000) that trigger additional approvals.

- Assign approvers: Choose which users can approve payments under or over specific limits.

- Approval count: Set how many users must approve before a payment can be released (e.g., 2 of 3 for high-value transactions).

Empower your team to manage payouts securely

Trolley is more than a payout tool—it’s the infrastructure powering how modern businesses move money. From creator platforms and marketplaces to global enterprises, teams rely on Trolley to handle complex, high-volume payouts with transparency and control.

With access to 210+ countries and territories and 135+ currencies, Trolley connects you to a global banking network through a single, unified platform. Approvals, funding, and compliance are all built in, making it easy to stay secure and operational no matter how many payees you support or where they are in the world.

By combining powerful team permissions with customizable approval workflows, Trolley helps you scale payouts without compromising oversight or compliance. Manage your processes, empower your team, and deliver payments faster while maintaining the trust and control your business depends on.