Ever wondered how streaming services like Spotify and SoundCloud calculate royalty payouts? This guide breaks down how the different payout models DSPs use actually work, how some of the top streaming services calculate their royalty payouts, plus some newly-introduced changes this year.

Streaming services have become the backbone of the music industry, generating substantial revenue and offering unprecedented access to music for listeners worldwide. In 2023 alone, these platforms amassed a staggering $19.3 billion in trade revenue, encompassing more than two-thirds of money earned across the whole recorded music market.

While their impact is undeniable, understanding how Digital Service Providers (DSPs) calculate royalties is a source of confusion for many—especially considering that over the past year or so, streaming services have seen more changes than ever before and have become increasingly differentiated from one another.

This blog will break down how some of the major streaming services calculate royalties, including a slew of recently introduced changes to their models.

Music industry professionals and anyone else looking to gain a better understanding of the state of music streaming, read on.

What we cover

What payout models do DSPs use?

From the start of streaming, two things have remained mostly unchanged: the $9.99 monthly subscription fee and the “pro rata” system of calculating payouts.

In the last year, most global streaming services have raised their monthly subscription prices by at least a dollar, breaking more than a decade-long standstill in subscription costs. Whether DSPs are entering an era of incremental price increases (like other streaming services—Netflix, for example) is yet to be seen.

Breaking down the changes to the pro-rata model of royalty calculation is a bit more complex than a simple price increase. To do that, we’re going back in time, to January 2023.

UMG CEO Lucian Grainge’s 2023 New Year memo to staff included this statement: “What’s become clear to us and to so many artists and songwriters—developing and established ones alike—is that the economic model for streaming needs to evolve.”

Grainge writes, “[To] correct [the streaming payout] imbalance, we need an updated model. Not one that pits artists of one genre against artists of another or major label artists against indie or DIY artists. We need a model that supports all artists—DIY, indie and major. An innovative, ‘artist-centric’ model that values all subscribers and rewards the music they love. A model that will be a win for artists, fans, and labels alike, and, at the same time, also enhances the value proposition of the platforms themselves, accelerating subscriber growth, and better monetizing fandom.”

This set off waves throughout the music industry, as people have hypothesized about what “artist-centric” models entail, and shortly after this announcement, two major streaming services announced partnerships with UMG to make “artist-centric” happen.

To understand how these models differ from the traditional model, we’ll start by explaining the classic pro-rata system.

The pro-rata model

The pro-rata payout system is the traditional model in music streaming, used by Spotify, Apple Music, Amazon Music, and others.

Under this model, all of the net revenue generated from subscriptions and ads is pooled together and distributed in proportion to the number of streams each artist received across the platform, within a specific period and territory. For example, if an artist received 2% of the total streams on the platform, they would receive 2% of the revenue generated. This also means that 2% of the royalties generated by every subscription go to this artist’s music, even if they didn’t listen to that artist at all.

The pro-rata system has been the subject of much criticism over the years, from indie artists and labels to the head of the most profitable company in the music industry. Critics cite the model’s bias toward artists already at the top and argue that it leads to inequitable distribution of royalties, where lesser-known artists with dedicated fanbases receive disproportionately lower payouts.

The user-centric model

Calls for a more equitable distribution model have often centered around user-centric payouts.

Under a user-centric model, the royalties each listener generates are allocated only to the artists whose music they listen to. In other words, instead of pooling all of the royalties together and distributing them based on overall stream share, user-centric models attribute revenue directly to the tracks that each listener streams.

The most well-known platform with a user-centric model is SoundCloud, with its Fan-Powered Royalties—but more on that later.

Artist-centric models

You may have noticed that Lucian Grainge’s call for an updated model used the phrase “artist-centric,” not “user-centric.” Soon after that memo was sent out, UMG partnered with both Deezer and TIDAL to reform their models into artist-centric ones.

According to Music Ally, UMG’s review of the research on the user-centric model raised concerns that switching to user-centric would entail swapping one set of systemic biases from the pro-rata model for another set. For example, two studies found that hip-hop and rap would see a decrease in royalties under a user-centric model. There is also concern that a user-centric model might give more power to the least-engaged music listeners—that the royalties from the most-engaged listeners are spread more thinly than those who listen exclusively to one genre and stream fewer tracks.

Because these systems are so complex, it’s hard to predict exactly how changing models would impact artists across genres and levels of popularity. Any DSP looking to switch up the way royalties are paid out requires backing from the companies who represent the artists on the platform. SoundCloud’s unique community of independent artists uploading their music made it easier for them to make the switch to user-centric, though WMG did sign on as well.

So, what do artist-centric models (plural) look like? Music Ally posits that they might be “an evolution of user-centric rather than a repudiation of it,” more a set of principles outlined by Grainge that can be applied differently by each DSP.

While Deezer and TIDAL worked directly with UMG to make changes to their models, Spotify has been making some changes of its own that reflect the ethos of this call to action (and some that do not).

How do different DSPs calculate royalties?

Now that we’ve outlined the different models streaming services use, we’ll take a closer look at how some of the top DSPs calculate royalties and the changes they’ve made in the past year.

Spotify

Spotify paid out over $9 billion to the music industry in 2023—the highest annual payment from any single retailer. But how were those royalties calculated?

As we’ve mentioned, Spotify uses a pro-rata model to determine royalty payouts, so all royalties go into “one big pot” before being distributed based on streamshare.

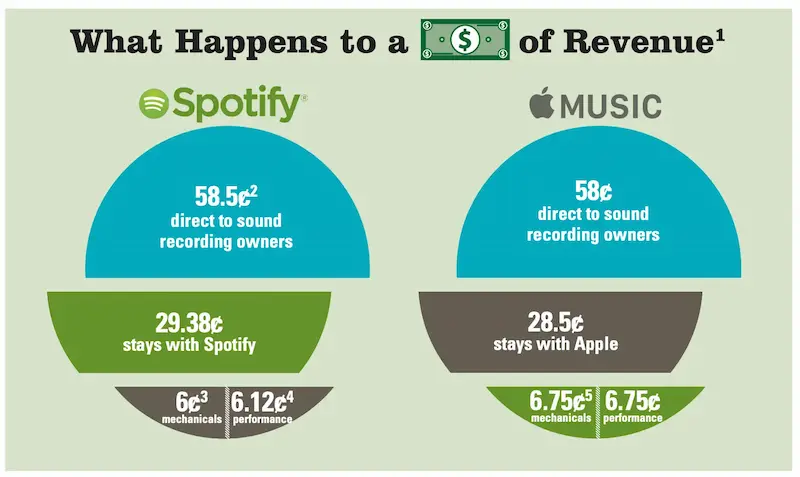

Any track played for 30 seconds or more counts as a stream, and earns two kinds of royalties: recording royalties and publishing royalties. Recording royalties go to the rights holders of the recording itself, usually paid to their record label or distributor, while publishing royalties are owed to the songwriter(s) or owner(s) of the composition. These royalties are paid out to publishers, collecting societies, and mechanical agencies. This is the case for most streaming platforms.

Spotify has been introducing some changes to its payout model since early 2023. In March 2023, CEO Daniel Ek announced that the company would be expanding its Discovery Mode program first introduced in 2020 by making it available directly within Spotify for Artists. This program offers labels and artists more exposure in its algorithm in exchange for a “promotional recording royalty rate”—translated, that means “less royalties.” This controversial program is entirely optional, so only those who sign up for it will receive a “promotional royalty rate.”

In November 2023, Spotify announced a couple of big royalty payment policy changes that took effect earlier this year. First, songs will only generate royalties once they reach 1,000 streams in the previous 12 months, affecting about 0.5% of its library. The reality is that rights holders weren’t accessing royalties for tracks with fewer than 1,000 streams anyway, as the money they generate is below the minimum that many distributors require before making payouts.

The other big change is that “functional noise” or non-music tracks only generate royalties if played for two minutes (as opposed to music content’s 30-second minimum), and they earn a royalty rate at a fraction of the value of music streams, though the company has not stated what that rate is. This push is part of a larger effort to fight fraud on the platform, as they have also introduced per-track fines for labels and distributors when “flagrant artificial streaming” is detected on their content.

The most recent change to Spotify’s payout model came on April 18, 2024, when the company confirmed that it will be treating its Premium plans as “bundles” in the US because they combine audiobooks and music. Reclassifying these plans as “bundles” means that it can pay out mechanical royalties to publishers and songwriters at rates lower than the standard set by the Copyright Royalty Board (CRB) for standalone music subscriptions.

Apple Music

Like Spotify, Apple Music uses a pro-rata system to determine royalty payouts. An Apple news piece published in 2021 states that they have looked at alternative royalty models, but that their “analysis has shown that they would result in a limited redistribution of royalties with a varied impact to artists,” and that changes would “shift royalties towards a small number of labels while providing less transparency to creators everywhere.”

This same article revealed that in 2020, the average per-play rate on Apple Music was $0.01, including label and publisher royalties, though it varies by subscription plan and region. The company also notes that they do not pay a lower royalty rate in exchange for featuring in playlists or algorithmic recommendations.

Apple has made one big change to its royalty payout structure this year, announcing in January that tracks with spatial audio will earn 10% more in royalties, even if users don’t listen to that version. Pro-rata shares for songs with a spatial audio version available on the platform are calculated using a factor of 1.1, while those without it will continue to use a factor of 1. Indie labels have criticized this decision for benefitting those with enough resources to invest in spatial audio recording tech while hurting those who cannot. At the moment, spatial audio adds around $1,000 per song to the production cost, meaning the additional cost of producing a complete spatially optimized album ranges from $10-20k depending on the album length.

SoundCloud

Moving on from DSPs with pro-rata models, SoundCloud is probably the best example of a streaming service with a user-centric model, called its Fan-Powered Royalties (FPR). Technically, it has a hybrid model, where artists can opt in to FPR or remain in the traditional pro-rata model, as discussed in the Rockonomics report released earlier this year.

SoundCloud paired with MIDiA in 2022 to analyze data on their FPR model and compare it to what their payouts would have looked like under a pro-rata model. They found that 56% of the 118,000 artists in the sample who are currently earning under the FPR model are better off than if they were under a pro-rata model, and that FPR makes it easier for artists to monetize their fanbases.

The report critiques the pro-rata system, stating that it “fuels an obsession with ‘share of total streams’, inadvertently incentivising all sorts of strange behaviour, including shorter and more formulaic songs (that are more likely to be consumed somewhere in the background or voted up by playlist algorithms).”

In the Rockonomics report, author Will Page (former Chief Economist of Spotify) calls on all retrospective studies on user-centric payment to be re-evaluated: “Retrospective studies like these that apply user-centric distribution on a pro rata behavioural basis fail to capture how changing the rules changes the game.”

Deezer

On September 6, 2023, Deezer and UMG announced that they were launching the “first comprehensive artist-centric streaming model” together, which launched in France in October 2023. Warner signed on as well, and Merlin joined earlier this year.

Deezer lists four pillars of its Artist-Centric Payment System (ACPS):

- Distinguishing between music and noise

Like Spotify, Deezer has taken a stand against functional audio content—or in their words, “declared war against irrelevant sounds.” Deezer’s language is more intense, and so is their approach to this type of audio content, as it has removed white noise from the royalty pool entirely, and is directing funds “toward genuine artist content.”

- Artist boosts

Artists who get more than 1,000 streams per month from at least 500 unique listeners receive a double boost—in the volume of streams attributed to them, not the royalty amount generated— meaning a boosted market share of total royalties.

- Active streams

Songs receive a boost in market shares when users discover them organically, add them to their favorites, or include them in their playlists.

- User cap and fraud detection

Deezer has placed a 1,000-stream cap on every user to prevent system abuse—in other words, people who stream more than 1,000 tracks a month will be down-weighted in the payouts calculations—and implemented a “robust fraud detection system.”

TIDAL

TIDAL and UMG announced in January 2023, three weeks after Grainge’s memo was sent to UMG staff, that they were teaming up to launch an artist-centric payout model.

Two months later, TIDAL shut down its “fan-centered royalties” model, first unveiled in late 2021, under which royalties earned from HiFi Plus subscribers were paid out based on their individual streaming activity—“up to 10%” of the HiFi Plus subscription fee was paid to artists directly.

For now, TIDAL is using a pro-rata model to determine royalty payouts while the company works with UMG to explore a new economic model.

Determining “per-stream” rates

By now, you know that streaming services do not calculate royalties on a “per-stream” rate. The payouts that artists receive vary greatly depending on how and where their music is streamed and the agreements they have with labels or distributors—whether they are signed to a major record label, an indie label, or they’re independent, and what the stipulations of their contracts are. If you’re looking for more estimates, Manatt broke down some of the math in 2016.

Royalties earned from DSPs with pro-rata models will fluctuate based on the service revenue of that DSP, plus any additional factors the streaming service has implemented, some of which we’ve outlined above.

While online royalty calculators seek to provide an average per-stream rate for DSPs, their calculations can vary widely. For example, I tried three different online royalty calculators in researching this article, all of which gave me different estimates for what someone would earn from 100 streams in the US on Apple Music: $0.50, $0.68, and $1.00.

The point is that there are so many factors that go into determining royalty payouts that it’s impossible to say what a platform’s “per-stream rate” is.

Calculating royalties is complex—paying them isn’t

Regardless of which model you use to calculate royalties, paying them shouldn’t be a hassle. That’s where Trolley comes in.

Trolley handles the heavy lifting of paying artists via payout automation purpose-built for modern music companies.

By leveraging Trolley’s powerful payout API, DSPs can access a massive global banking and payments network to smoothly facilitate print royalty distributions to eligible rights holders—all while upholding tax compliance through integrated reporting capabilities.

Let Trolley deliver your royalty distributions worldwide so you stay focused on bigger goals. Keep your data centralized and connected with Trolley’s end-to-end platform plus ERP sync. Onboard your artists, verify their identities, pay globally, and stay tax compliant, all in one place.

Our real-time dashboard gives your artists the visibility and transparency they deserve, with your brand at the front and center. Plus, recipients can choose the payment methods that work best for them, so you can strengthen your relationships while making tax-compliant payouts to over 210 countries and territories.

Learn why companies like SoundCloud, United Masters, Soundrop, CD Baby, and more trust Trolley to pay over 1.5 million musicians worldwide by getting in touch today.