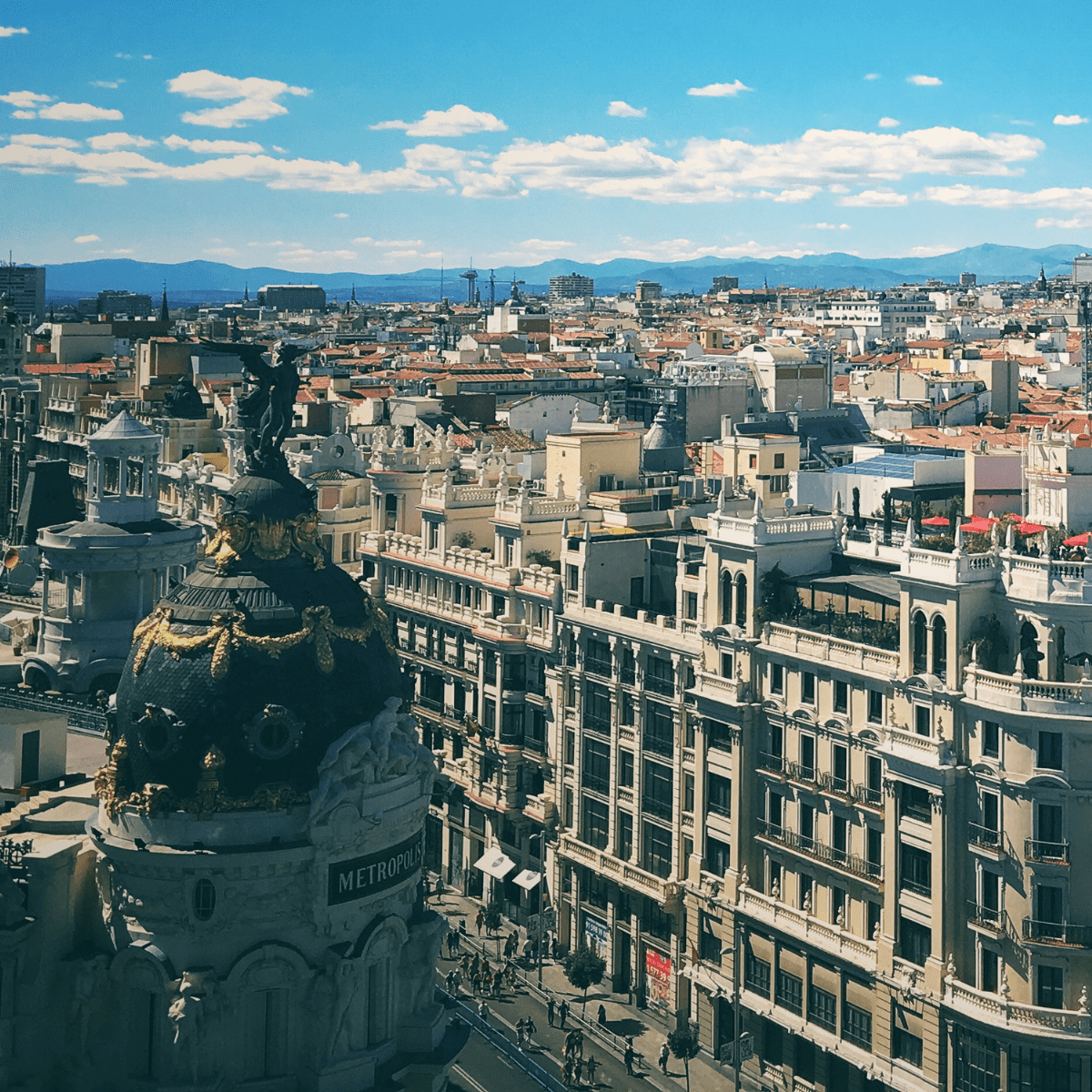

Does Spain have a tax treaty with the US? The answer is yes!

If your US-based business makes payments to businesses or freelancers who are situated in Spain, a new US-Spain tax treaty has recently come into effect on November 27, 2019 which likely changes how your business should handle tax withholding. Let’s see what’s different.

The short version:

If you make royalty payments to Spanish businesses or freelancers, they are now free from source country withholding; the only taxes due are for the country of residence of the payee. Don’t worry, though, Trolley handles it all automatically for you (the payer) in any case.

In a little more detail

The US is one of the few countries where double taxation—taxing both the payer and the payee—for royalty payments is still the case in some instances. While this will likely remain true for US payments to Japan, Switzerland, and Luxembourg, it has recently changed for US payments to Spain so that only the tax in the receiving country needs to be paid.

The good news is that we’ve already updated the core functionality of Trolley to make sure that if you’re making royalty payments from the US to Spain—or Japan, Switzerland, or scores of other countries—you’ll automatically withhold any taxes you need to once your recipient fills out their W-8BEN or W-8BEN-E. This drastically simplifies your end of year filing of 1042-S forms for every overseas freelancer or company that you have a business relationship with.

This treaty also updates how tax withholding for various investment dividends, interest and capital gains is calculated, but that’s not relevant to most businesses. If you need to know more, feel free to check out the original text of the amended treaty here (PDF File).

What kind of royalties are included?

Royalties, for the purposes of the agreement, are payments of any kind received as a consideration for the use of, or the right to use, any copyright of literary, artistic, scientific or other work (including cinematographic films, and films and recordings for radio or television broadcasting), any patent, trademark, design or model, plan, secret formula or process, or for information concerning industrial, commercial or scientific experience.

This means if you’re a US marketplace selling the use of stock photography, artwork, or music, you’ll need to make sure that you’re not withholding tax on payments to Spain anymore from November 27, 2019 onwards.

Or, of course, we’d be happy to help you out with automating that all in Trolley.

Simplify contractor tax compliance with Trolley

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.

See Trolley Tax in action: Take the Trolley Tax tour >

Book a demo of Trolley’s tax features today >

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.