“Superfan” is a definite buzzword in the music industry right now, and there’s a lot of hype around the opportunities for superfan monetization. But what is a superfan, really? And what does superfan monetization actually look like?

Is 2024 the year of the “superfan”?

At the start of 2024, both UMG CEO Lucian Grainge and Warner Music CEO Robert Kyncl’s New Year memos signaled that these two majors will be focused on monetizing superfans in 2024.

This January, Spotify announced they would create “superfan clubs.”

In July 2023, Goldman Sachs projected the addressable market opportunity for superfan monetization at a whopping $4.2 billion, and in 2024, they upped that estimate to $4.5 billion.

It seems like everyone and their mother is talking about superfans right now—but what are superfans, and what is all the hype about?

This article will help music industry professionals and anyone else curious to understand what the superfan phenomenon entails, and what monetization opportunities will be rolled out in the coming months and years.

What we cover

WTF is a “superfan”?

The exact definition of a superfan depends on who you ask, but to get to a definition of our own, we’ll first run through what major players in the industry are saying.

Amazon Music for Artists defines superfans as, “a small, but extremely valuable, subset of your most passionate Fans. On average, these listeners drive almost one third of your total streams, and the majority will continue to listen to your music in the next 30 days.”

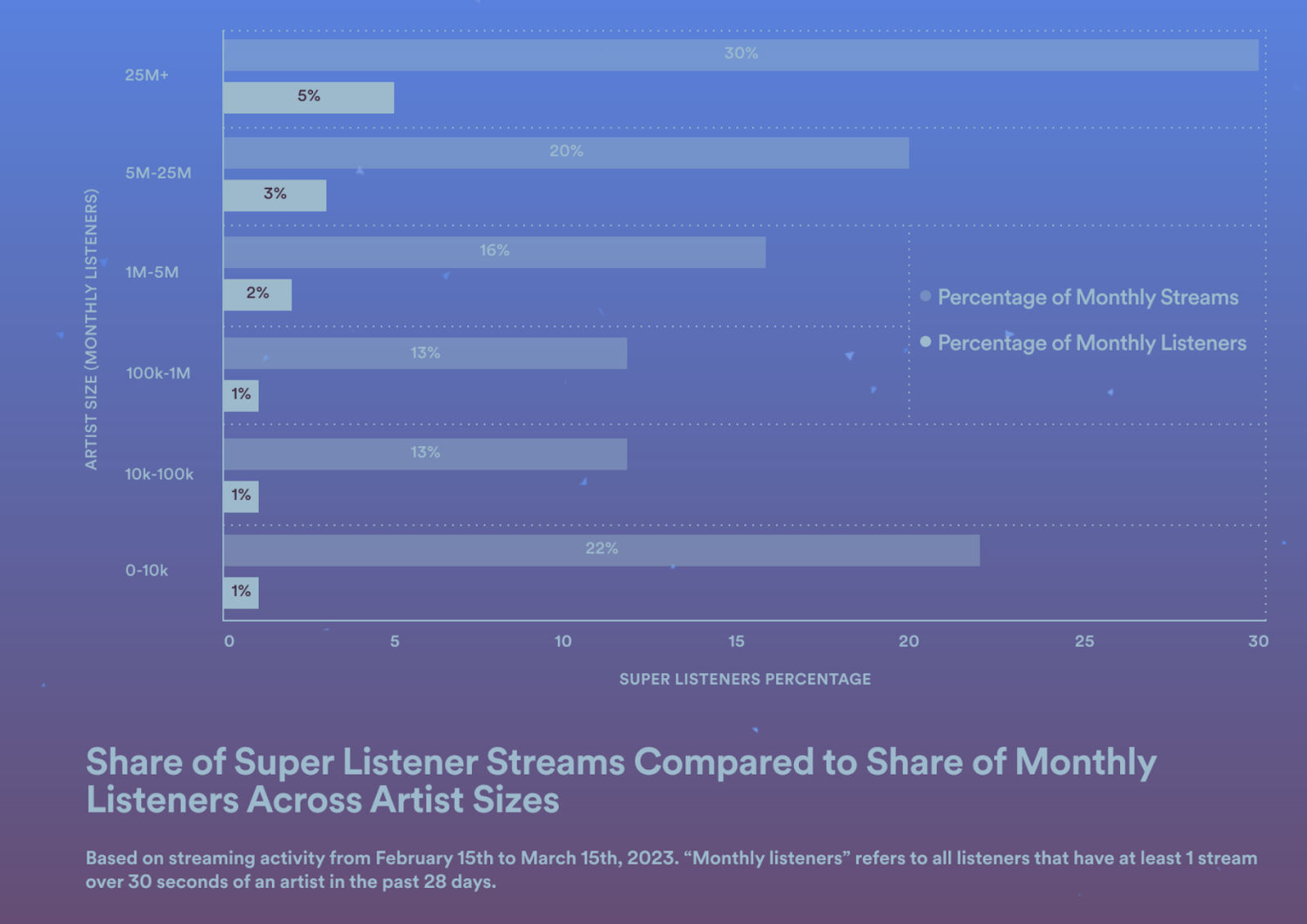

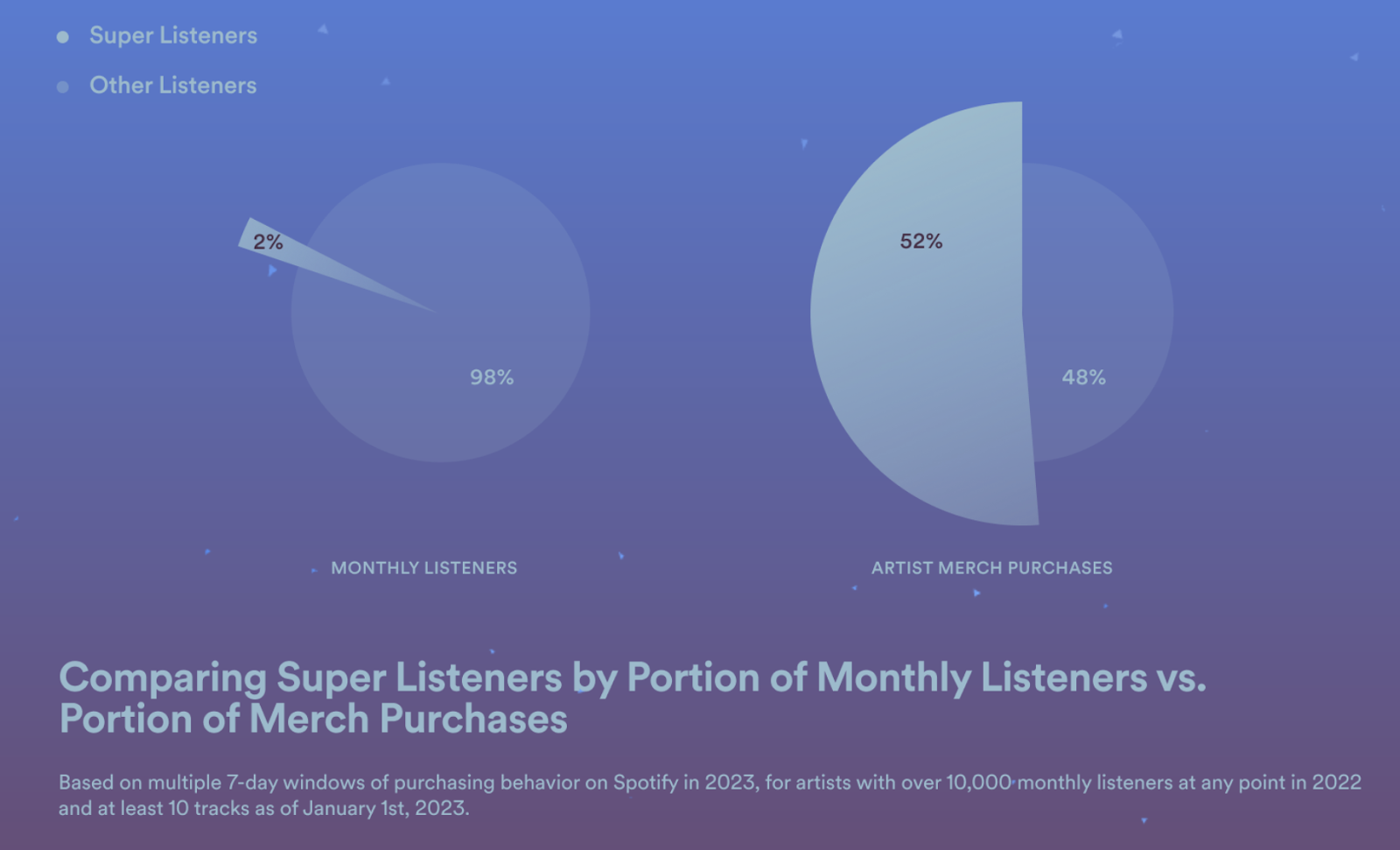

Spotify for Artists writes: “There are fans, and then there are die-hard, listen-on-repeat, buy-up-all-your-merch fans.” While they dub them a slightly different name—“super listeners”—these fans, averaged across all artist sizes, make up 2% of an artist’s monthly listeners but account for over 18% of monthly streams. Oh, and they account for more than half of an artist’s merch purchases.

SoundCloud and MIDiA’s July 2022 report titled “Building a fan economy with Fan-Powered Royalties” compares data on Fan-Powered Royalites (FPR) payouts to what they would have been in a pro-rata model. They found that 56% of the 118,000-artist sample are better off in FPR than under pro rata. Those artists who are better off under FPR received 42% of their income from their superfans—defined here as those who contribute more than 10¢ a month—who only make up 1.9% of their total audience.

Luminate defines superfans as fans who engage with artists and their content in 5+ different ways, and determined that 19% of music listeners in the US can be categorized as superfans. They report that superfans are 54% more likely to be the first among their friends to discover new music and artists, 59% more likely to say they “would like to connect with artists on a more personal level”, and 43% more likely to say they “like to participate in the community or fandom” that specific artists provide. They also spend 80% more per month on music activities than the general US music listener.

MIDiA Research, in their review of the 2023 recorded music market, reported a 4.6% uptick in physical revenues in 2023 after seeing a decline in 2022, which in their words, “reflects an industry strategic shift…The strong growth of physical and ‘other’ revenues in 2023 are the first fruits of the new superfan focus.”

They also point to the 15.5% growth in expanded rights revenue—10% of all global revenues in the recorded music market—as evidence of the superfan shift. This form of revenue is derived primarily from monetizing an artist’s brand through merchandise, sponsorships, and live performances.

The concept of the “superfan” boils down to this:

- Some people are more engaged and invested in the music they listen to than others.

- They are:

- more passionate about the artists they love,

- spend more time listening to their music,

- spend more money on their merch, and

- are more interested in connecting with those artists than the average listener.

- These are the people music companies are looking to drive revenue from, and “superfan” is a convenient label.

This growing influence has reshaped how artists, labels, and platforms think about community and monetization — a shift we explore in our article on how superfans are evolving into powerful revenue-driving communities.

The scale of the superfan opportunity

Goldman Sach’s latest prediction is that the addressable market opportunity for superfan monetization sits at $4.5 billion.

This number assumes that 20% of music listeners are superfans, and that these superfans would be willing to pay double what the average individual is willing to spend on music.

They estimate that 10% of this addressable market opportunity will be achieved by 2025 and that 60% of it will be reached by 2030. This represents $3.3 billion of incremental revenue or a 13% uplift to paid streaming revenues by 2030.

As for what forms this monetization will take, record labels, artist managers, and DSPs are on the hook for experimenting and rolling out, “either new superfans apps or new super premium tiers on existing streaming services.”

The second opportunity—premium subscription tiers—stems from the problem identified in the report that the current streaming model does not distinguish between its users, and therefore does not account for the varying levels of engagement fans have with platforms and artists. The concept of the “superfan” is directly tied to the streaming model payment structure, which after a decade of stagnancy, is changing.

How are the majors monetizing superfans?

Now that we’re clear on what superfans are, and why the music industry is so hyped about the opportunities superfan monetization presents, we’ll explore what avenues a couple of the biggest record labels and streaming services are taking in order to capitalize on it.

Universal Music Group

UMG CEO Lucian Grainge’s 2023 New Year memo to staff called for digital service providers (DSPs) to make the switch to “artist-centric” models, and his January 2024 memo outlines the next focus of his artist-centric strategy: superfans.

Grainge writes: “We are already in advanced discussions with our platform partners regarding this [superfan] phase and will have more to announce in the coming months. In addition, we will be building our in-house capabilities through groundbreaking partnerships that will accelerate our artists’ ability to create experiential, commerce and content offerings for their fans.”

In March, UMG struck a 10-year agreement with HYBE, the South-Korean based company that created BTS and SEVENTEEN, and whose fandom platform Weverse exceeded 10 million monthly users as of July 2023. This deal grants UMG exclusive distribution rights for HYBE’s music for the next decade, and will see UMG invest in Weverse to help expand its growth in North America. Weverse’s artist content includes music videos, teasers, movies, and live streams, and it has a merch shop as well.

Warner Music Group

UMG isn’t the only major focused on superfans. WMG CEO Robert Kyncl’s 2024 New Year note spoke to superfan initiatives the company is working on as well: “Both artists and superfans want deeper relationships, and it’s an area that’s relatively untapped and under-monetized. The good news is that we already have initiatives in flight against most of these areas, and specific projects with momentum behind them.”

One of these initiatives is developing an app for its artist’s superfans, and while we don’t have many details yet, Kyncl says the company’s work on the app is “quite advanced” and that it will launch later this year.

WMG has also invested in the AI-powered superfan engagement platform Fave, which has already attracted several fandoms, including Taylor Swift’s Swifties, the BTS ARMY, and Bruno Mars’ Hooligans.

How are streaming services monetizing superfans?

Music streaming services are uniquely positioned to capitalize on superfan monetization—as “wholesalers” of music, they own artist-to-fan relationships at a scale that even the biggest record labels don’t. We’ll look at a couple of the ways DSPs are leveraging their positions to create experiences for superfans.

Spotify

UMG sees a future where 1 in 5 streamers pays for a “super-premium” tier, and Spotify is the first streaming platform to be reportedly working on a super premium—or in their words, “supremium”—tier. This “supremium” tier will include access to HiFi audio among other features.

The company has also announced that it plans to create “superfan clubs” in a blog post about the Digital Markets Act (DMA) rollout in the EU. They exclaim that they will finally be able to, “communicate clearly with you in the Spotify app about new products for sale, promotional campaigns, superfan clubs, and upcoming events, including when items like audiobooks are going on sale.”.

Complete Music Update writer Sam Taylor posits that these clubs are likely to include paywalled “premium audio content,” and that Spotify will send notifications to alert potential superfans to the existence of superfan clubs and locked content.

TIDAL

TIDAL, a streaming service known for its HiFi audio, has a history of prioritizing the artist-fan connection. Its—now defunct—Direct Artists Payout (DAP) program routed up to 10% of each HiFi listener’s monthly subscription to their most-streamed artist, rewarding artists with loyal superfans.

A month before shuttering the DAP program in 2023, TIDAL announced a partnership with UMG to explore artist-centric payouts.

Speaking about the partnership, TIDAL CEO Jesse Dorogusker points to recognizing and rewarding superfans as part of the focus: “If superfans, super sharers, super discoverers, the people that are the viral loops of music are anonymous, unrecognized and unrewarded, it’s a good baseline, but there’s a lot of room to grow. There are superfans all over the music industry…They’re amazing and powerful and influential. And if we could find a way in music streaming to engage those people, well, then music streaming is just getting started.”

To understand what this means for the future of artist business models, explore our advanced guide on how superfans are becoming communities, platforms, and multimillion-dollar revenue streams.

Pay your superstars with Trolley

Trolley gets your artists paid the way they want to be paid—whether they have 1 or 1 million superfans, no matter where they are in the world.

Trolley handles the heavy lifting of paying artists via payout automation purpose-built for modern music companies.

By leveraging Trolley’s powerful payout API, DSPs can build their own “superfan” payouts logic and access a massive global banking and payments network to smoothly facilitate print royalty distributions to eligible rights holders—all while upholding tax compliance through integrated reporting capabilities.

Let Trolley deliver your royalty distributions worldwide so you stay focused on bigger goals. Keep your data centralized and connected with Trolley’s end-to-end platform plus ERP sync. Onboard your artists, verify their identities, pay globally, and stay tax compliant, all in one place.

Our real-time dashboard gives your artists the visibility and transparency they deserve, with your brand at the front and center. Plus, recipients can choose the payment methods that work best for them, so you can strengthen your relationships while making tax-compliant payouts to over 210 countries and territories.

Learn why companies like SoundCloud, United Masters, Soundrop, CD Baby, and more trust Trolley to pay over 1.5 million musicians worldwide by getting in touch today.