Payouts, compliance, & seller management in one platform

When done in silos, seller management can get complicated and introduce additional risks.

Trolley is the end-to-end platform which simplifies and automates seller-related workflows like global payouts, taxes, and risk management.

Seller payouts trusted by marketplaces

All-in-one platform for seller onboarding, payouts, and taxes

Compliant onboarding: Collect & verify seller info with a white-labeled UI

Communicate account updates directly to sellers

Ingest invoices or bills directly to Trolley and convert them into payment batches

Send global payouts, build custom payment workflows, and sync with ERPs

Withhold taxes where needed, generate & e-file end-of-year tax forms

Flag & stop suspicious account activity with built-in risk management

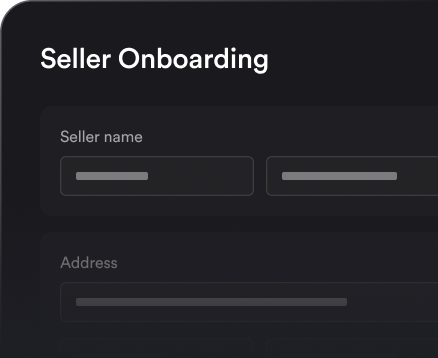

Make onboarding sellers a breeze

Build trust in your marketplace and collect information through a single, streamlined flow. Whether you decide to use Trolley’s white-label portal, API, or embedded widget, it’s easy to collect payee bank and tax information securely.

- Verify payees’ identities

- Collect banking information

- Onboard compliantly with local tax forms

- Rest easy knowing user data is secured and encrypted in-flight and at rest

Own the relationships with your sellers

Stronger relationships are built when you directly own the experience: pay direct-to-bank (bypass third party wallets), provide sellers a real-time account dashboard, and communicate through a secure platform.

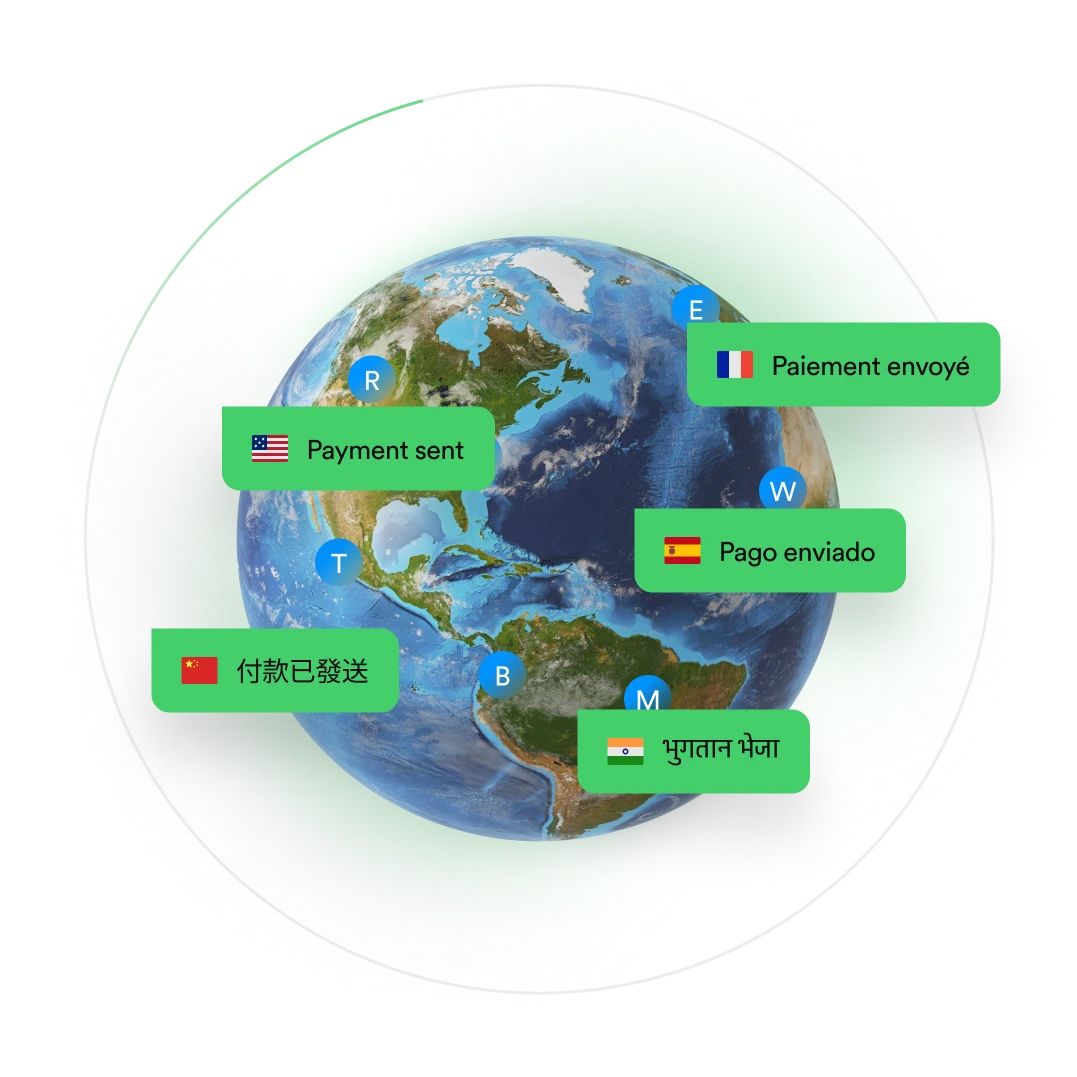

- Auto-translate communications to the language of your sellers choice

- Provide a single dashboard to view payments and tax statements

- Put your brand front and center

Flexible payments to almost anyone, almost anywhere

In a global marketplace, sellers with unique products/services can come from anywhere. Trolley’s payment network spans across 210+ countries & territories, paying out in 135+ currencies—so you can pay deserving vendors around the world.

Pay via:

- Bank transfers (including virtual accounts)

- PayPal

- Venmo

- Checks

- Wire transfers

Automate tax compliance across the US & EU

Don’t let ever-changing compliance rules be the friction that limits your growth. Trolley ensures tax compliance for US-sourced payouts and for EU-based sellers without complications eliminating hours of month-end, year-end work.

Collect all relevant tax info during onboarding and generate signed

Manage withholding exemptions

Withhold taxes automatically on applicable payments

Issue tax forms to your sellers at the end of the year

E-file directly to the IRS or EU jurisdiction

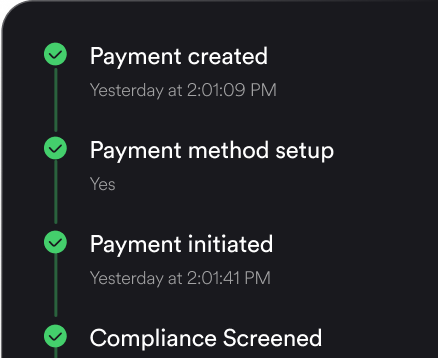

De-risk your marketplace

Growth comes with its own set of challenges: bad actors see opportunities to take advantage of a successful platform. Trolley understands the importance of risk management.

- Verify seller's identity or business documents

- Conduct phone and address verification (aided by real humans)

- Comply with local regulations like DSA or INFORM

- ID and flag potential risks before they occur

- Checks against AML/CFT global watchlists on every payout made

Manage your payout workflows in one powerful platform

Reduce payout cycles by up to three weeks by consolidating your workflows across teams. Integrate our all-in-one solution to pay sellers globally all while taking manual work and risk out of your processes.

"Hold music"?

What’s that?

Trolley has one of the best response times across the industry. Whether it is a payment or a workflow issue, our team is here to make sure you're heard and taken care of. Our customers have reduced their support queues by up to 70% by using Trolley.

- Support available through chat, email, or phone

- Help documentation available on demand

- Account manager to escalate issues

- Dedicated customer success manager and quarterly meetings to accelerate automation (Enterprise only)

Reduce payout times by

Less fees over wallets

End-of-year tax reporting in minutes vs weeks

Save time with an end-to-end platform

Focus on your core workflows and let Trolley handle payouts and compliance. Trolley is built for the internet economy, so you don’t have to choose between scale, speed, and quality.

Embed payouts with a dev-friendly platform

Trolley scales with your business and lets you build a payout experience tailored to your sellers.

- REST API + SDK in multiple programming languages

- Pick and choose what you want, when you want

- Free-forever sandbox environment

- Trigger automatic payouts defined by your rules

- Maintain up-to-date payout data across all your systems

- Build self-serve capabilities for your users

- Set up and automate workflows

Trust & bank-level security baked in at every step

Sleep easy knowing we’re following the highest global standards for managing customer funds and data.

Bug hunt:

Bugcrowd uses Trolley to make daily payments to ethical hackers

Security bugs are almost unavoidable in the swarm of digital interconnectivity. Most businesses lack the focused teams and breadth of experience necessary to find and swat every single digital issue. Luckily, thanks to Bugcrowd, a distributed, international crew of hacker-researchers with diverse backgrounds, experience, and expertise is readily available for hire.

Try the platform that pays over 1.5 million sellers worldwide

Learn why the industry’s best trust Trolley.

Explore our products

Trolley blog

Marketplace payout FAQs

How does Trolley solve the payouts needs of marketplaces?

Trolley lets you simply import seller payment details via csv or API from your existing systems or ERPs, or create payments manually from an intuitive payouts dashboard allowing your team to prepare and automate payments directly to the seller’s bank accounts.

Which payment methods are available through Trolley?

Trolley supports multiple payout methods such as transfers to bank accounts and e-wallets, PayPal, Venmo accounts, wires, or even paper checks. Merchant recipients can login to the white-labeled widget integrated in your platform and change their payment method as required.

How do payouts from marketplaces affect seller taxes?

Depending on the jurisdiction and type of income earned from the marketplace, recipients may or may not be subject to withholding. Trolley has integrated a tax and withholding calculation engine so you don’t have to manually figure out recipient taxes.

How do I prepare tax forms for my marketplace sellers?

Whenever you add a new seller to your Trolley-enhanced platform, Trolley will send them an email to onboard and provide their personal and banking information and sign any required tax forms— based on their jurisdiction.

Does Trolley provide end of year tax forms for marketplace sellers?

If you as a marketplace are subscribed to Trolley Tax, we will automatically generate end of year tax forms for every seller. We will send to your sellers based on their communications preference and can e-file with the authorities on your behalf.

Can I import my marketplace payout history when I join Trolley?

Yes, you can import your existing marketplace payouts into Trolley to consolidate your data. You can also import your seller details so you don’t have to ask them to fill out forms again to collect their banking details.

Are marketplace payouts taxable?

In most cases, marketplace payments are taxable.

The tax implications can vary depending on the nature of the payment, the jurisdiction, and the specific circumstances involved. You can find more information about different types of payouts on the Trolley blog.

It’s essential to consult with a tax professional or accountant familiar with tax law in your jurisdiction to ensure that you comply with all relevant tax regulations and obligations. They can provide personalized advice based on your specific situation.