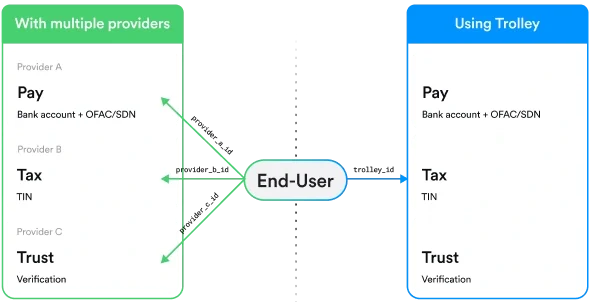

One platform for every payout, tax form, & recipient

Juggling multiple apps, excel sheets, and tax tools drains eats time and drains focus.

Trolley unifies every step of the payout operations process—payments, compliance, recipient communication, and data sync—via one powerful platform.

Payout operations trusted by

world-class teams

Our flexible platform pays 5M+ recipients, files 1M+ tax forms, and syncs 100M+ data points each year.

How Royalty Exchange saves time & avoids errors with Trolley

The flexible platform that finance & AP teams are building powerful payout workflows on

Payout operations you can truly rely on

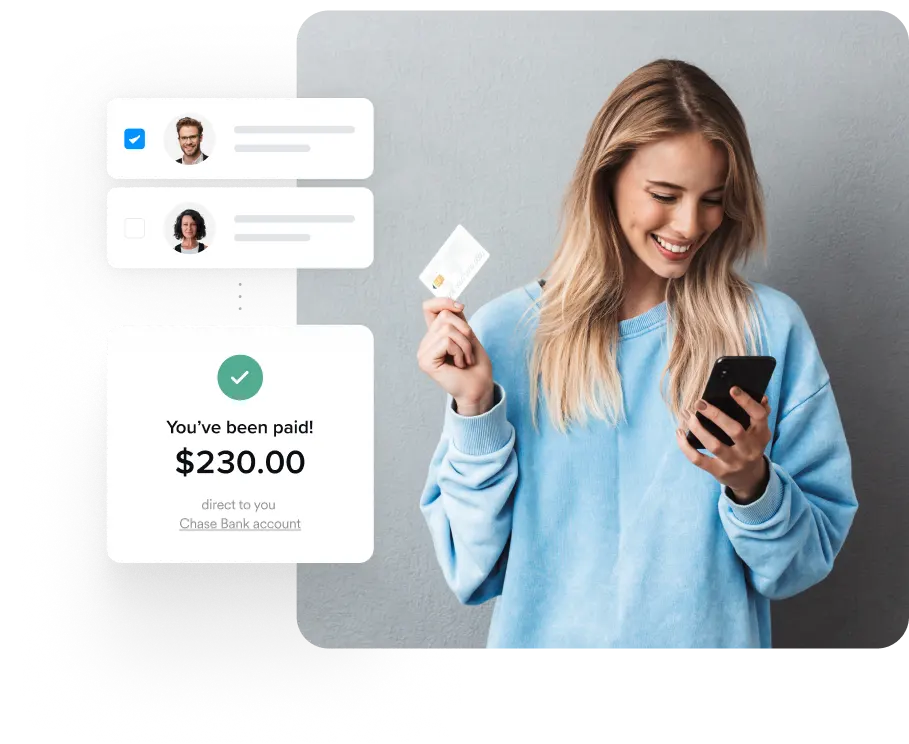

- Payout direct-to-bank in 210+ regions in 135+ currencies

- Consolidate payout methods across bank accounts, wallets, checks, and virtual accounts

- Sync data across ERP, CRM, and reporting tools

Seamless recipient ops & global compliance

- File IRS tax forms for the US and stay OECD/DAC7 compliant across the EU, UK, CA, AU, and NZ

- Onboard recipients with branded, customizable flows and communication

- Verify recipients and manage risk with built-in workflows

Flexible by design

- Mold workflows to your unique business logic

- Customize & setup with no-code quick settings or integrate in your platform using code

- Trigger payments from the dashboard manually, or using CSVs, or via APIs

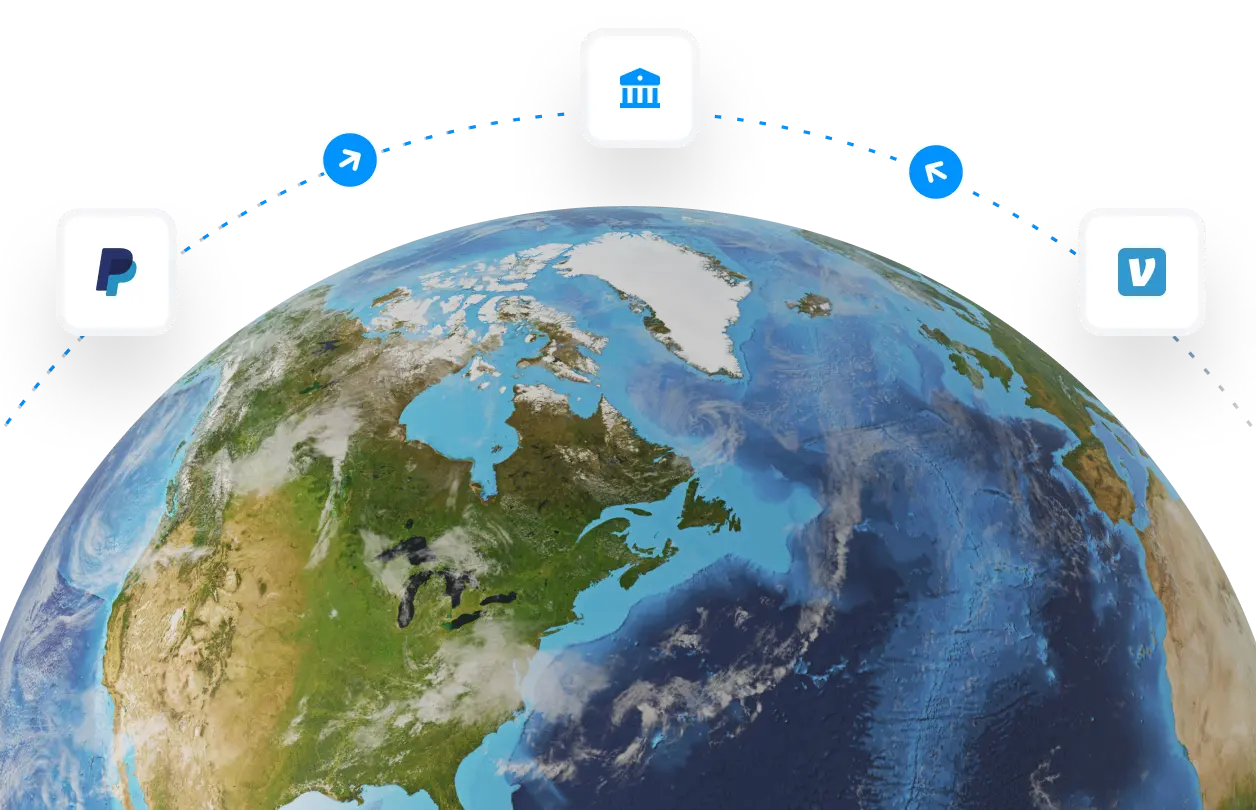

Payouts infrastructure built for global businesses

Scale your payouts to meet recipients wherever they are, whether they bank traditionally, prefer digital wallets, or use virtual accounts.

- Reach your recipients anywhere with direct-to-bank payouts in 210+ countries and 135+ currencies

- Offer flexibility with digital wallets like PayPal and Venmo

- Provide convenient access through virtual accounts like Wise and Payoneer

- Cover legacy needs with paper cheques where required.

Flexible payout workflows designed for finance & AP teams

Gain a true competitive edge with programmable payout operations that adapt to your unique processes.

- Simplify your invoice-to-payment flow with flexible bill creation and draft payments

- Disburse batch payments at scale via dashboard or CSV upload

- Control approvals via customizable workflows

- Ensure oversight with 12 configurable user roles

- Optimize transaction costs your way — split, pass, or absorb

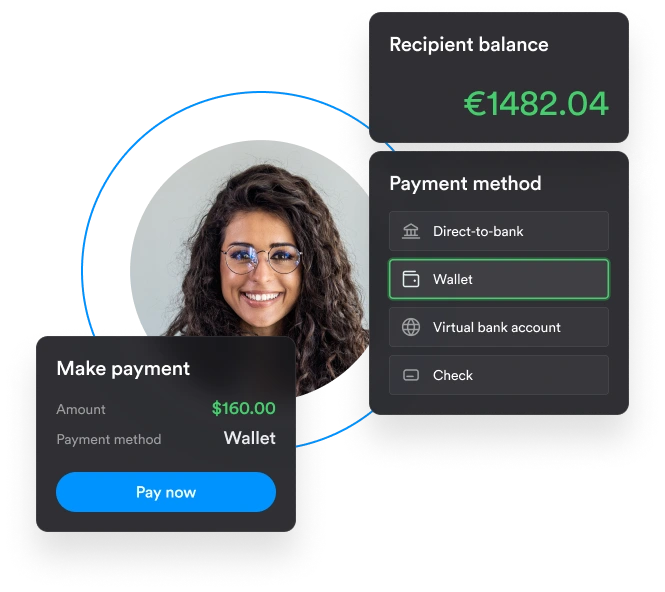

Recipient management at scale

Onboard, collect details, and communicate with recipients in 36+ languages—while cutting down support requests.

- White-labeled emails

- Branded recipient dashboard

- Real-time payment tracking

- Consolidated tax form access

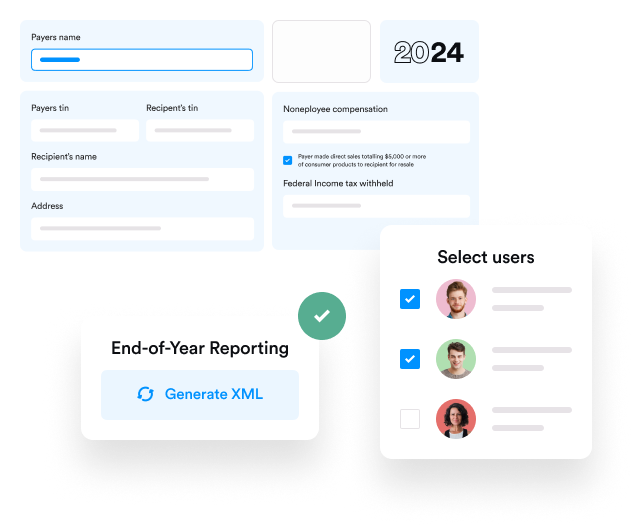

Built-in tax compliance

Automate tax compliance in the US, EU, UK, AU & NZ with Trolley Tax, so your team stays focused on growth.

- Tax info collection at onboarding

- Auto-applied withholding (as required)

- Year-end statement generation

- One-click e-filing

Streamline multiple entities or business units

From flow of funds to payout approvals, recipient management to invoicing—streamline payout operations across all business units, domestic and global.

- Create sub‑accounts to closely manage different entities, teams, or recipients.

- Control flow of funds with customizable rules that match your business model.

- Automate aggregate reporting and compliance for you and your recipients.

- Centralize tax reporting from the main entity and save costs across all business units.

Trust & bank-level security baked in at every step

Sleep easy knowing we’re following the highest global standards for managing customer funds and data.

Try the platform that improves UX and streamlines workflows at the same time

Learn why the industry’s best trust Trolley.