Working with independent contractors can offer great amounts of flexibility, but it can get admin-heavy if you don’t digitize the onboarding and year-end tax processes.

At Trolley, we believe the admin work of managing tax forms for independent contractors should be seamless—automated and digitized—and this article will walk through how we’ve helped other businesses accomplish just that.

First, let’s take a look at what a typical manual process looks like.

Manual Process

Onboarding contractor workers can be summarized in the following steps for most businesses:

- Outbound emails asking for each contractor to complete a Form W-9, Form W-8BEN, or Form W-8BEN-E.

- Handling inbound emails and call about filling out these forms.

- Receiving Form W-9 and Form W-8 as email attachments.

- Reviewing each form to determine if it is properly completed.

- Calculating the withholding rate to apply to to the contractor’s earnings.

- Filing the forms in the appropriate digital folder, or printing and physically filing them in a filing cabinet.

The year end process for generating Form 1099-MISC, 1099-NEC and Form 1042-S typically goes something like this:

- Create a list of all the contractors you paid during the tax year.

- Determine which ones need to be issued a Form 1099-MISC, 1099-NEC or 1042-S.

- Find their Form W-9, Form W-8BEN, or Form W-8BEN-E.

- Copy the details from Form W-9 or Form W-8 to Form 1099-MISC, 1099-NEC or Form 1042-S, respectively.

- Ask the recipient if they would like to receive the form electronically, or via postal mail.

- Send the form to the recipient via the chosen method.

- Send Copy A of each Form 1099-MISC, 1099-NEC and 1042-S to IRS via mail, or use a 3rd party software to create IRS e-file, and filing using the IRS FIRE system.

Digitized Process

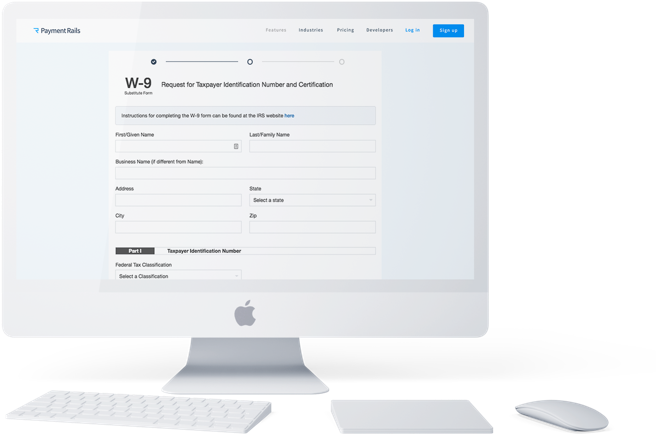

Now, let’s take a look at how Trolley digitizes the processes above. Onboarding contractors would now look something like this:

- Embed Trolley’ white-label Recipient Widget in the contractor-logged-in pages of your application, or send your contractors to our Recipient Portal—a white-label hosted portal that requires no code (and just 5-minutes) to set up. This will ask your contractors for their payout method details and collect the appropriate Form W-9 or Form W-8 data. Built into the substitute digital tax forms are:

- a Wizard to help guide them on which tax form they may need to complete

- Numerous validation rules

- Digital signature capture

- Guidance for non-US persons to correctly claim tax treaties in their country;

- TIN Matching for US person’s SSN/EINs/ITINs, and Foreign TIN validation warnings for non-US persons;

- Alerts for potentially incorrectly completed forms, such as inconsistent address details;

- Automatic calculation of tax treaty withholding rates for all 60+ countries that have tax treaties with the US.

- A simple review interface for you to review and approve tax forms submitted.

- Pay your contractors as many times as you need to during the year using Trolley’s Web Dashboard, CSV Uploads, or APIs.

At the end of the year, the Form 1099-MISC, 1099-NEC, and the Form 1042-S process would look like this through Trolley:

- Login to Trolley and go to your Tax Center.

- Complete your business information for the IRS (3 minutes)

- Review the list of all the contractors you paid, and automatically generate all your Form 1099-MISC & 1099-NEC and Form 1042-S (based on the earnings, withholdings, and data submitted for their Form W-9s and W-8s when they started working for you).

- When you’re satisfied, send the Forms 1099-MISC, 1099-NEC and Forms 1042-S to your contractors by simply clicking a button. This will be mailed or electronically delivered, depending on what your recipient chose.

- Export the IRS e-file from Trolley, and upload it in the IRS FIRE system to finalize your tax filing.

The point is, by keeping your Payments and Tax information on the same platform, you can automate the process and removemany of the manual copy-pasting or exporting-importing tasks.

Since we’re integrated with a mail and email provider, we also automate all the mailing and email of the forms.

Simplify contractor tax compliance with Trolley

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.