Personally, I say it every spring… “Next year, I’m going to get ahead on my taxes.”

At Trolley, we don’t just promise to improve your tax process; we deliver a better contractor-tax workflow. We aim to help you get your 1099s and 1042-Ss out the door, so you can close out your year. We’re intent on removing the late nights and headaches that pop up every January.

This year we made some key product upgrades that we think will help smooth out your end-of-year tax process:

- Automatically approve tax withholding forms

- If our W-8 BEN/W-9 checking engine sees no issues, you can auto-approve the form

- Edit and fine-tune payment details for reporting purposes

- Re-classify tax records on individual payments to align them with the appropriate tax category

- Access all E-Files you’ve created this year

- Sometimes mistakes happen. Download & re-download your E-Files (and amendment files) or access your complete chronological library of E-Files

- Assign payments to multiple tax categories

- Make fewer individual payments by linking them to itemized multi-category invoices (Beta)

And just FYI: We’re already thinking about the 2022 tax season (for example, we know that 1099-Ks are a big concern in 2022)…

To get started now, login to the Trolley platform. If you’re looking for more details, keep reading or book a demo of any features you think will add value to your payout workflow.

Automatically approve W-8 BEN & W-9 forms

Onboard new recipients with ease by auto-approving tax forms that don’t contain validation warnings by selecting the “Automatically Approve if no warnings” setting.

If our error checking engine doesn’t detect any issues with a submitted W-8 BEN or W-9 form, you can have us approve the form automatically.

This means that Trolley can pay those recipients immediately, form approval won’t eat up your team’s time, and you’ll only be alerted when you need to take action.

Self-edit details of a payment for tax reporting reasons

In the past, when a customer needed the details of a payment—like the category of income—adjusted for tax reporting purposes, it’s meant that they had to make “correcting payments” or request that we jump in and update details for a specific payment manually.

It’s important, the wrong categorization could trigger the production of the wrong type of 1099.

Trolley customers can now self-service this problem, editing payment tax records on processed payments—directly from within the Trolley platform.

Editable fields are:

- Payment Amount

- Tax Withholding Amount

- Tax Withholding Purpose

- Payment Purpose

- Taxable / Tax Exempt

- Payment Date

- Memo

We’ve created a help article for this feature. Check it out.

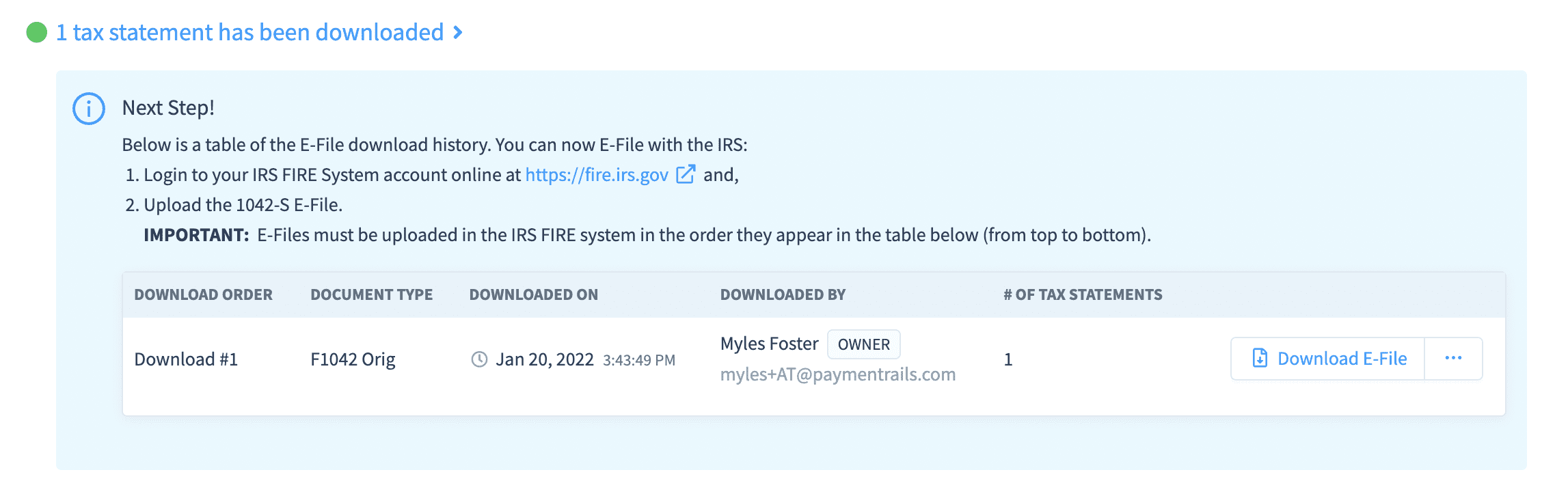

Access all statements and E-Files downloaded

We’ve added a library of all E-Files (original and amended) generated in a given year, a major improvement for anyone who may need to re-file their 1099s/1042-Ss.

Previously, customers would need to request these files, and our engineers would need to pull them manually. Now, from day-one, users can see a list of all E-Files they generate, available for them to download/re-download at their convenience.

Assign single payments to multiple tax categories (Beta)

In the past, payments made from Trolley needed to be assigned to a single tax category. This meant that Trolley sent recipients separate payments for each different type of work (e.g. nonemployee compensation vs royalties). It kept reporting clean but made for an excessive number of payments (with associated fees).

To address this, Trolley is rolling out a new feature, Invoices, that allows users to create “multi-category payments.” Users can now consolidate multiple payments with different tax categories into one payment without sacrificing the necessary tax information. It’s a win-win: our customers reduce the total number of payments sent, but they don’t lose clean end-of-year reporting.

Invoices is currently in beta. Contact [email protected] to discuss joining the beta.

FYI: Our focuses for Tax Season 2022

We know that there are even more ways to make life easier and offer our customers a more robust tax product. Here are some areas we’re investigating* for tax season 2022:

- Helping Trolley with challenges around TINs for US and International Contractors

- Improving FTIN Validation for 100+ countries – meaning we will have formatting-validation improvements across 100+ jurisdictions

- Validating US TINs with the IRS database more frequently

- And more…

- New Forms (1099-K) and Income Code Support

- Our merchants are always asking us to support different income codes and forms.

- There is also a new version of the W-8 BEN and W-8 BEN-E.

- Support for EU Tax

- DAC7 regulations are coming into effect on January 1, 2023.

- Simplified IRS E-Filing

- We’re looking at the IRS’s APIs.

- A one-click E-File will make EOY e-filing faster than ever before.

- We’re looking at the IRS’s APIs.

- Improve Reporting Flexibility

- General availability for the invoices feature

- Adding tax form (W-8/W-9) to tax year mapping

- Improvements to how we report withholdings

*While nothing is locked-down or committed to yet, we’ll keep you updated on the progress of these potential features as 2022 continues.

Want to know what else we’ve been working on? Check out these 5 important updates we made to the platform in 2021.

Simplify contractor tax compliance with Trolley

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.