- Platform

Global payouts & compliance

Send payouts worldwide and comply with local regulations

Developer tools

Embed payouts and compliance directly in your platform

Support

Access resources to help you use Trolley to its full potential

- Solutions

- Industries

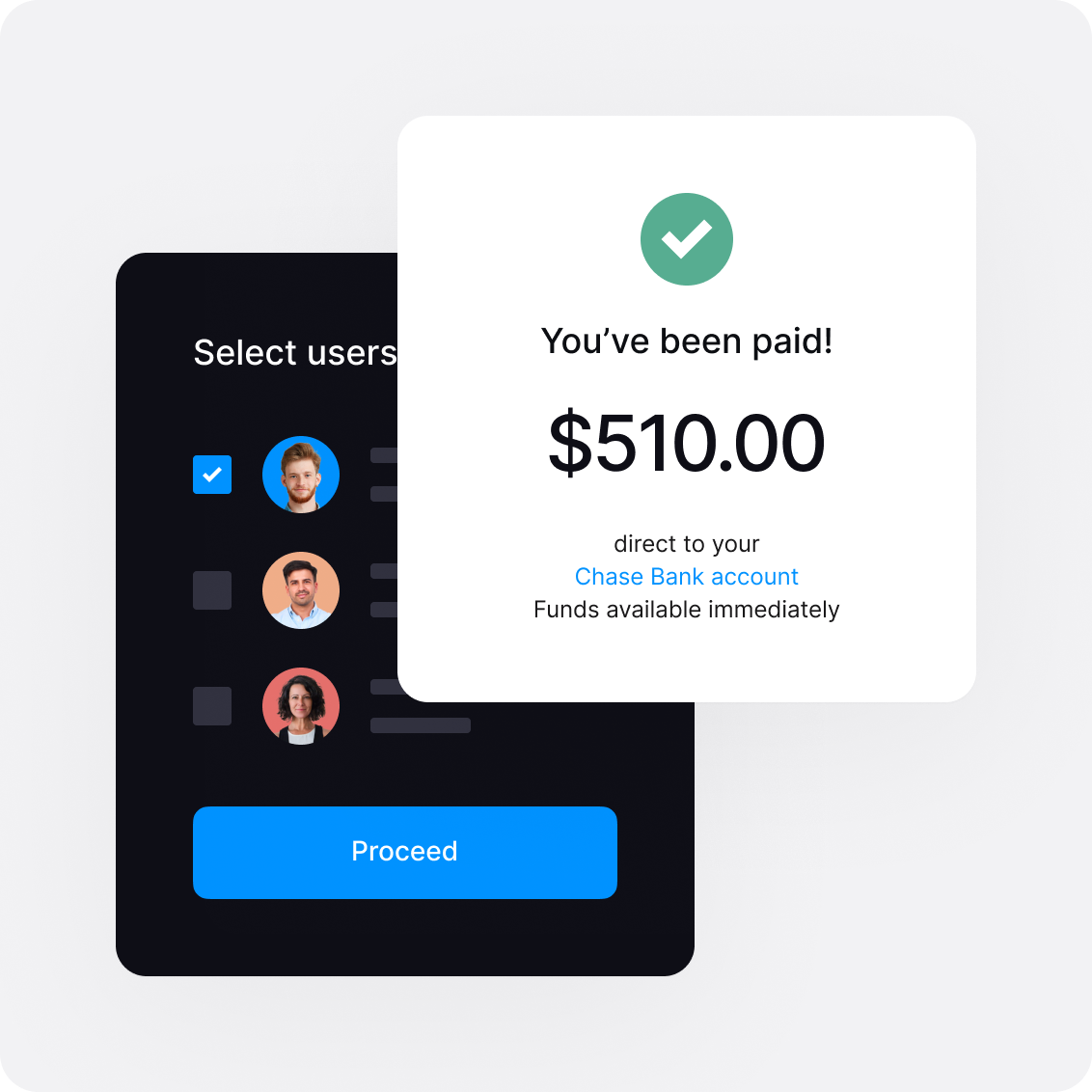

Customer stories

Customer stories

Discover how our customers pay contractors, stay compliant, and fight fraud using Trolley.

- Pricing

- Resources

Our Latest Blog

Our Latest Blog