Payouts and tax forms for global freelancers – in one platform

You don’t have to switch between tools – Trolley brings freelancer payouts and tax compliance into one workflow. Onboard and pay freelancers and experts in 210+ regions with 135+ currencies. Automatically generate and e-file tax forms with accurate withholding.

Trolley sends 100,000+ compliant payouts to freelancers & experts each month and e-files 200,000+ tax forms every year.

It’s difficult to manage freelancer payouts and tax forms across different tools

You’re stuck chasing up freelancers for valid bank and tax details.

Automate freelancer payouts and tax forms in one smooth workflow

Onboard and verify freelancers & re-collect details and tax forms when they expire

Manage freelancers via API or Trolley’s modular widget. Your freelancers can use the white-labelled self-serve portal to provide and update information.

- Collect and verify freelancers’ identity, banking details, tax details, addresses and supporting documents. Trolley flags errors like missing information or incorrect formats.

- Generate forms W-9 and W-8BEN for new freelancers. Automatically re-collect forms when they expire.

- Screen freelancers against watchlists. View risk scores, compliant with KYC & AML.

- Payees can track live payment statuses, to reduce support tickets.

- Customize flows to match your brand and UX.

- Use pre-built libraries and integrate with flexible API – built for scale.

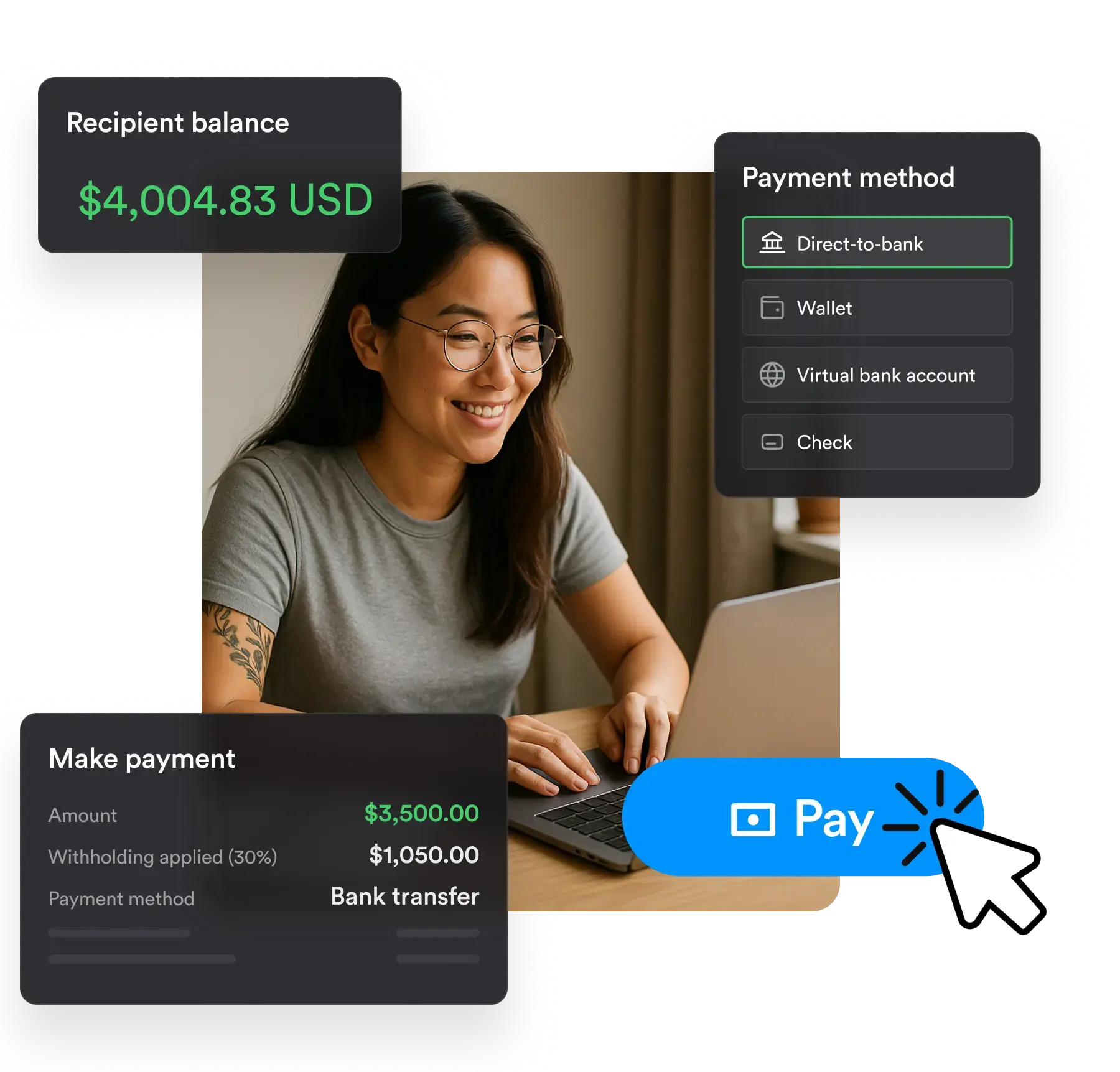

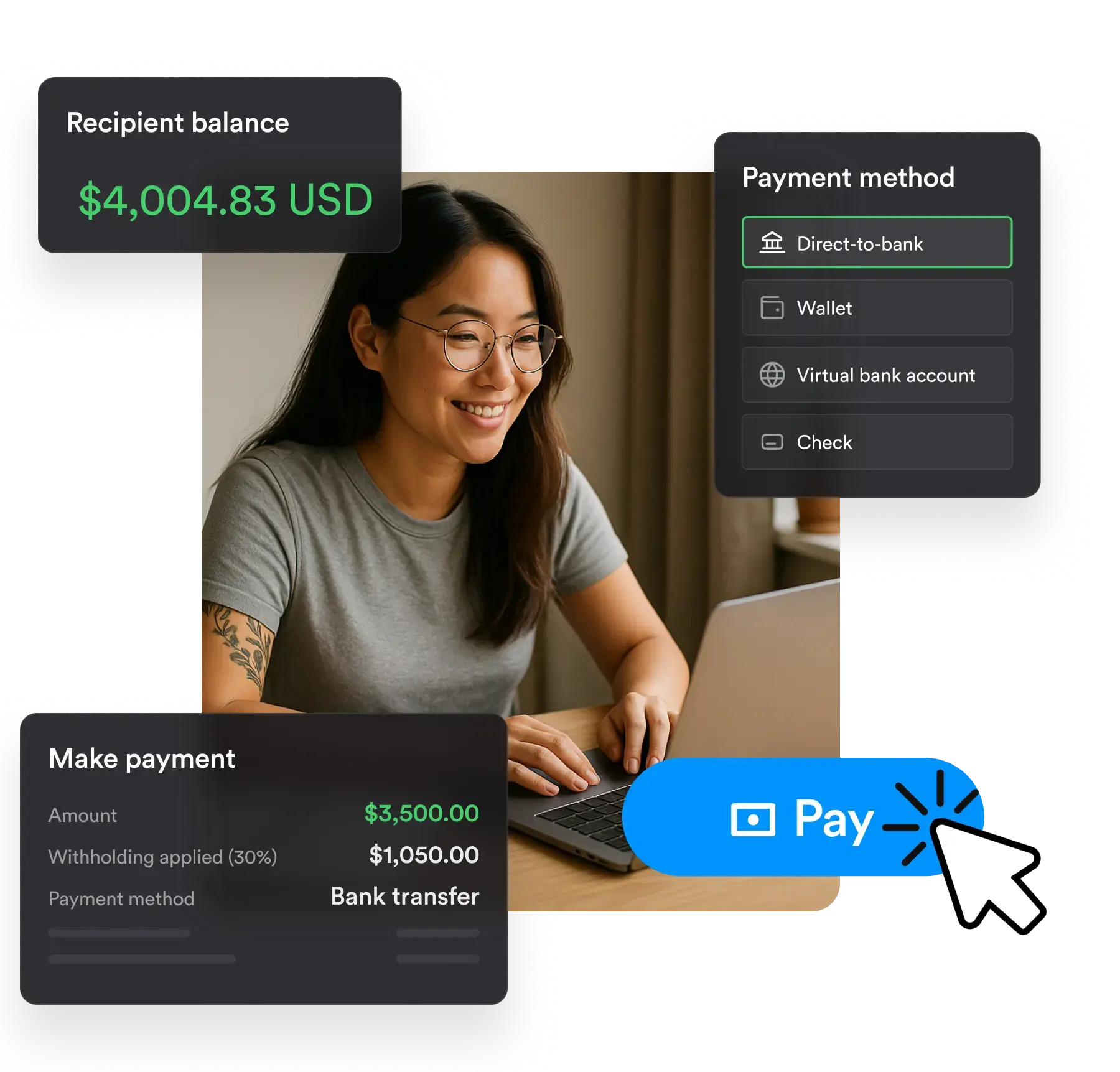

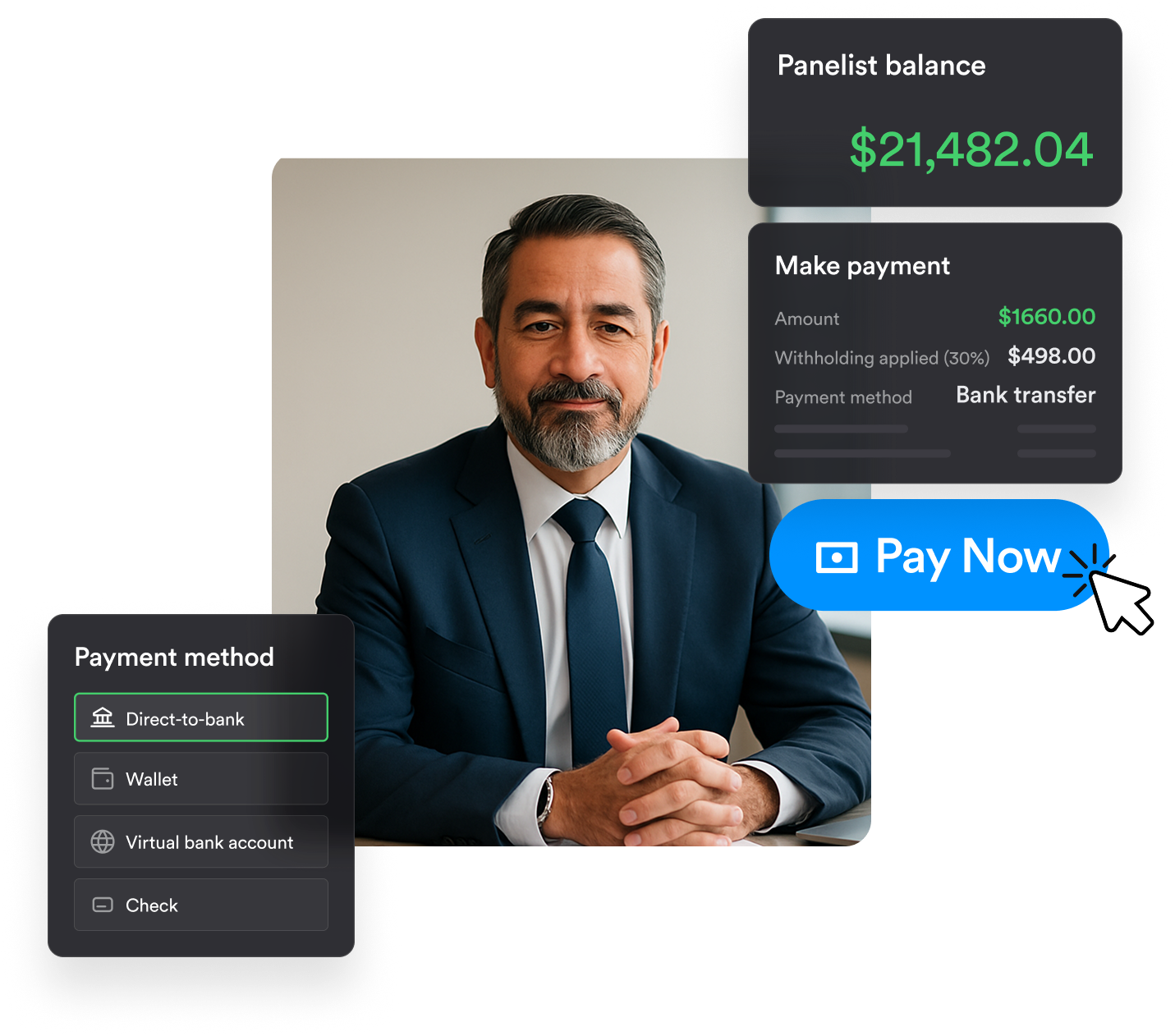

Pay global freelancers in 210+ regions – track and resolve transactions in one place

Keep global freelancers and experts happy with multiple payment methods – no integrations required.

- Send payouts to 210+ countries and territories, in 135+ currencies.

- Offer freelancers their preferred method: bank transfer, SWIFT, PayPal, Venmo, virtual bank account.

- Automate payment schedules. Upload offline payments, including cash.

- Approve payouts through customized workflows and user roles.

- Keep an audit trail – every payout is tracked with status updates, including return reasons and error handling.

Generate and e-file tax forms – build a complete tax record for each recipient

Trolley automatically builds a tax record for each freelancer, updated on every payment. Meet tax obligations wherever freelancers reside.

- Automatically withhold taxes as required by jurisdiction and treaty.

- Generate forms 1099 and 1042-S in one click, tied to freelancer payout records.

- E-file with the IRS directly from Trolley. No exports or extra tools required.

- Meet global tax reporting standards, including DAC7 (EU) and OECD (UK, NZ, AU, CA) model rules.

- Securely handle tax data – no need to store sensitive details internally.

Simplify global freelancer payouts with enterprise-quality features

Sync payout data with your accounting system.

Freelance platform successes: Multilingual Connections

Before

- No process for detecting expired W-8/W-9s — relied on freelancers to provide updated info

- No process for verifying freelancers’ tax details

- Payment provider didn’t sync with Quickbooks. Accountant had to manually download transaction details

After

- Trolley detects expired W-8/W-9s and emails freelancers to update details directly in the platform

- Trolley validates names and TINs with IRS data

- Payouts sync with Quickbooks. Easy to generate reports with full breakdown of payouts, fees, and tax details

Operations Manager at Multilingual Connections

FAQs

How much does Trolley cost?

Payouts start at $49 USD a month.

Trolley’s FX fees are usually 2% above wholesale rates – which is typically lower than banks, PayPal and Payoneer.

Which countries and currencies are available?

We cover 210+ countries and territories. And we offer payouts in 135+ currencies.

Does Trolley integrate with PayPal?

Yes, we offer a free integration with PayPal. We don’t add any fees on top of PayPal’s when you use your PayPal business account.

How does Trolley compare to Tipalti, Payoneer and Deel?

Tipalti is an AP automation platform.

- Flexibility: Unlike Tipalti, Trolley integrates with your existing finance stack without requiring you to adopt a full AP system.

- Built-in tax handling: Trolley can automate your tax reporting and withholding directly in the platform. Tipalti would direct you to a 3rd-party tool for year-end tax exports. This can risk data integrity and create more admin work.

Payoneer is a global payout provider.

- UX: Freelancers must create and maintain a Payoneer account. Trolley offers flexible payout methods, without requiring your freelancers to sign up for a Trolley account.

- Tax handling: Payoneer has more limited capabilities for tax compliance and reporting. Trolley offers built-in W-8/W-9 collection, IRS e-filing, and DAC7 reporting.

Deel is designed for HR teams managing EOR and contractor hiring.

- Payout focus: Trolley doesn’t replace HR or EOR tools. Trolley’s specialty is automating global payouts and ensuring tax compliance.

How secure is Trolley?

Trolley is PCI-DSS Level 1 compliant and follows strict security protocols. We process payments through regulated banking partners and use encryption to protect sensitive data.

Here are more security details:

- Hosted on AWS (SOC 1, 2, & 3 + ISO 27001/27018).

- Trolley uses end-to-end 256-bit SSL bank-level security.

- 2FA required for all users.

- Compliant with GDPR, CCPA, PIPEDA, DPA and the EU-U.S. Privacy Shield Framework.

Switch to Trolley – we’re the compliance-focused payout platform.

Migrate in 3 clear steps:

Step 1: Import your payment data

Use API or CSV upload to import freelancers’ personal and banking details, forms W-8/W-9, past payments and KYC or ID data.

Step 2: Validate and clean up your data

Step 3: Start sending compliant payouts

VP Engineering & Partner, GigSalad

Speed up your payouts research. Ask us anything.

You invest a lot of time when researching a new product. Get answers to your important questions, faster. Like:

- “Can Trolley send payouts to freelancers in Vietnam or the Philippines?”

- “What are your FX fees?”

- “How do you manage IRS reporting requirements for freelancers?”

- “Do you integrate with our accounting system?”

Chat to a Trolley expert on a 30-min Q&A call. We can walk you through Trolley’s capabilities, fees and differentiation from other providers.