The European Union’s latest tax directive, DAC7, which came into effect on January 1, 2023, has introduced new reporting obligations for online marketplaces, representing a significant step towards tackling tax evasion and enhancing administrative cooperation between tax authorities in EU Member States. In this comprehensive article, we provide an in-depth exploration of DAC7, discussing its background, objectives, and the various reporting requirements for digital platform operators.

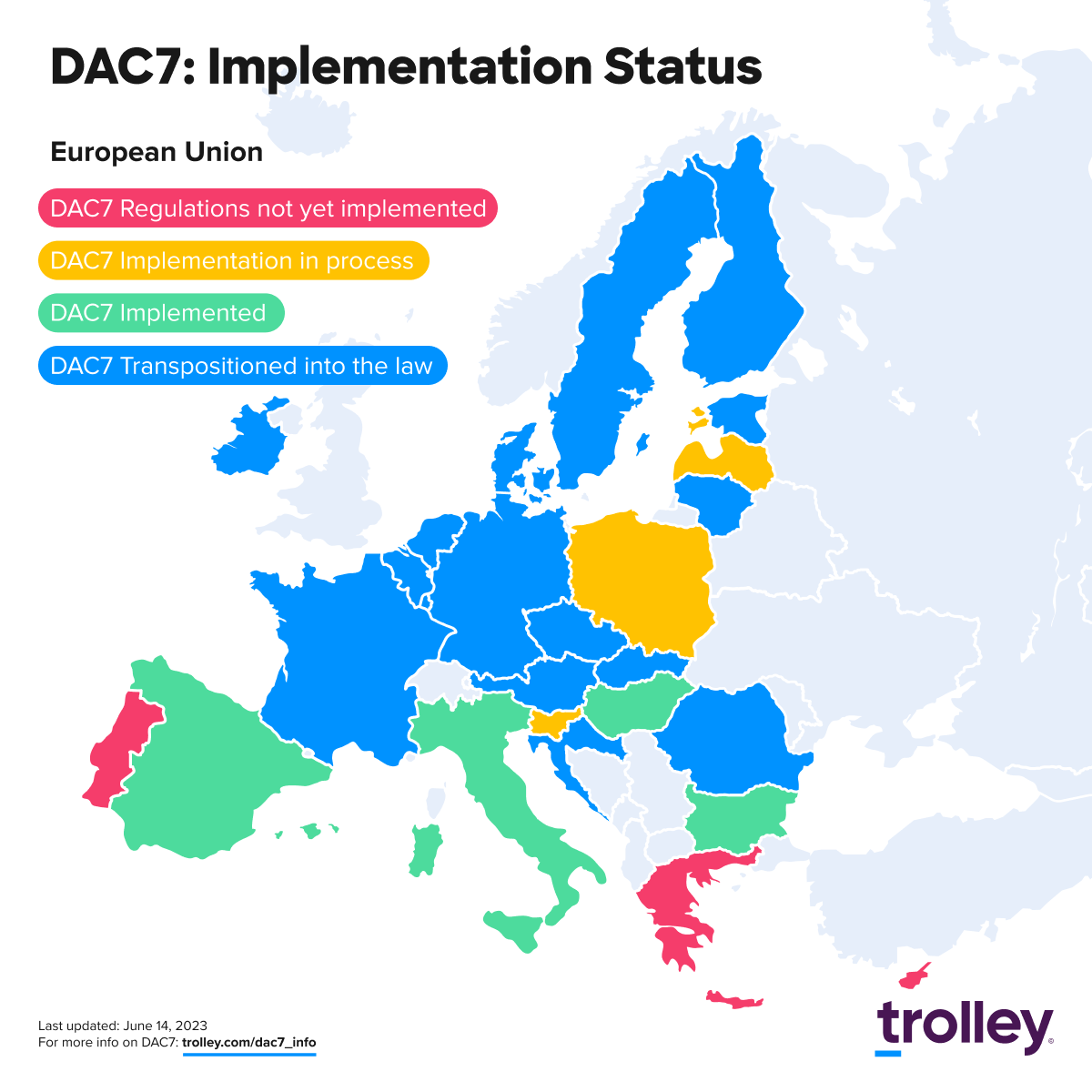

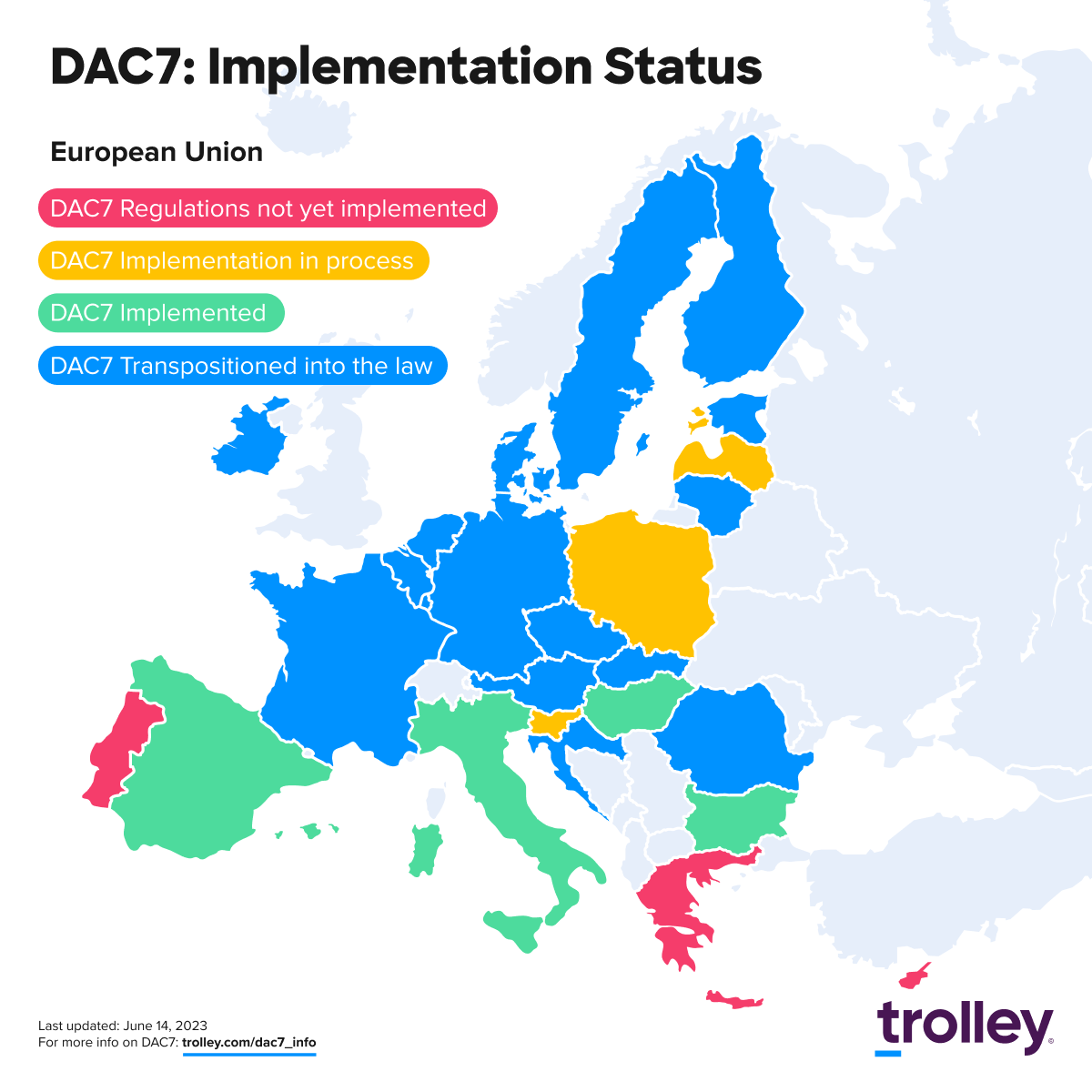

We present an breakdown of the implementation status in each EU Member State, identifying countries that have fully implemented DAC7, those that are in the process of doing so, and those that have received formal notices from the European Commission due to non-compliance or partial compliance.

In addition, we provide a DAC7 implementation timeline, outlining key dates and deadlines relevant to the directive. This information serves as a valuable resource for digital platform operators, as it enables them to better understand the implications and compliance requirements of DAC7.

*Note: Originally published March 14, 2023. Updated implementation/transpositions status for individual countries and the progress map on June 14, 2023. Additional links to guidance documents (Ireland, Luxembourg, Malta) were added on July 14, 2023.

This article covers

What is DAC7?

DAC7, or the Directive on Administrative Cooperation 7, is an amendment to the European Union’s existing Directive on Administrative Cooperation.

Adopted in March 2021, DAC7 aims to tackle tax evasion by enhancing administrative cooperation between tax authorities in EU Member States. It requires digital platforms, such as websites and mobile apps that allow taxpayers to sell goods, offer services, or rent out property or means of transport, to report the taxpayers and their economic activities. This information helps tax authorities prevent tax evasion or misreporting through the use of digital platforms.

Member States were required to incorporate DAC7 into their national legislation by 31 December 2022.

Who needs to report under DAC7?

Under DAC7, digital platform operators are required to report. These operators include websites and mobile apps that allow users to:

- Rent immovable property, both residential and commercial

- Rent any mode of transportation

- Provide personal services

- Sell goods

The reporting obligation applies to platform operators that are either located in the EU or, in the case of non-EU operators, facilitate transactions involving EU-based users or the rental of immovable property located within the EU.

What needs to be reported under DAC7?

Under DAC7, digital platform operators are required to report specific information about the users of their platforms and the transactions facilitated by the platform. This information includes:

- Seller’s name and address

- Country of residence

- Financial details

- Tax identification number

- VAT or business registration numbers

- Consideration paid or credited per quarter

- Any fees, commissions, or taxes withheld

- Address of immovable properties rented (if applicable)

DAC7 implementation timeline

The regulations come into effect on January 1st, 2023. By December 31, 2022, all EU member states must have enacted the directive into law. Below are all the important dates and deadlines:

- March 22, 2021: The European Council adopts the Directive on Administrative Cooperation 7 (DAC7) as an amendment to the existing Directive on Administrative Cooperation (Directive (EU) 2021/514) as a means to tackle tax evasion through enhanced administrative cooperation between tax authorities in EU Member States.

- December 31, 2022: Deadline for EU Member States to transpose DAC7 into their national legislation, incorporating the new reporting requirements for digital platform operators.

- January 1, 2023: DAC7 has come into effect in the EU Member States that have transposed the Directive into their national legislation. Digital platform operators are now required to comply with the new reporting requirements and submit relevant information about their users and transactions to the respective tax authorities.

- January 27, 2023: Member States that have not notified or only partially notified the national measures transposing DAC7 receive a letter of formal notice, requiring them to comply with the Directive’s requirements.

- January 1, 2024: The first exchange of information between EU Member States under DAC7 is expected to take place.

- December 31, 2024: Platform operators must complete the data validation process for sellers who were active on their platforms before the implementation of DAC7.

DAC7 implementation status: Map & list

As of July 14, 2023, the implementation of DAC7 is in progress across EU Member States. Since the deadline for transposing the Directive into national legislation was December 31, 2022, most countries have taken steps to incorporate the new reporting requirements for digital platform operators.

While some countries have transposed DAC7 into national law, others are not as far along. Some have started to adopt DAC7 by launching public consultations or releasing draft legislation. While others are lagging and have not yet implemented the directive as of writing.

The distribution of implementation across Europe is depicted in the map below.

DAC7 Regulations not yet implemented

- Cyprus 🇨🇾

- Greece 🇬🇷

- Portugal 🇵🇹

DAC7 Implementation in process

- Latvia 🇱🇻 – Official source

- Poland 🇵🇱 – Official source

- Slovenia 🇸🇮 – Official source

DAC7 Implemented

- Bulgaria 🇧🇬 – Official source

- Italy 🇮🇹 – Official source

- Hungary 🇭🇺 – Official source

- Spain 🇪🇸 – Public hearing in process. Deadline for the submission of observations is June 30, 2023. Official source

DAC 7 Transpositioned into the law

- Austria 🇦🇹 – Legislation

- Belgium 🇧🇪 – Legislation

- Croatia 🇭🇷 – Legislation

- Czech Republic 🇨🇿 – Legislation

- Denmark 🇩🇰 – Legislation

- Estonia 🇪🇪 – Guidance

- Finland 🇫🇮 – Guidance

- France 🇫🇷 – Legislation

- Germany 🇩🇪 – Legislation

- Ireland 🇮🇪 – Legislation – Guidance

- Lithuania 🇱🇹 – Legislation

- Luxembourg 🇱🇺 – Legislation – Guidance

- Malta 🇲🇹 – Legislation – Guidance

- Netherlands 🇳🇱 – Legislation

- Romania 🇷🇴 – Legislation

- Slovakia 🇸🇰 – Legislation

- Sweden 🇸🇪 – Legislation

Countries receiving formal notices

The European Council adopted DAC7 in March 2021 to tackle tax evasion by enhancing administrative cooperation between tax authorities and requiring digital platforms to report taxpayers and their economic activities. This aims to prevent tax evasion or misreporting through digital platforms.

Member States were required to transpose the Directive into national legislation by 31 December 2022. However, several countries have either not started or only partially completed transposing DAC7 into their laws.

On January 27, 2023, the European Commission issued letters of formal notice to the following 14 states:

- Belgium 🇧🇪

- Croatia 🇭🇷

- Cyprus 🇨🇾

- Estonia 🇪🇪

- Greece 🇬🇷

- Italy 🇮🇹

- Latvia 🇱🇻

- Lithuania 🇱🇹

- Luxembourg 🇱🇺

- Poland 🇵🇱

- Portugal 🇵🇹

- Romania 🇷🇴

- Slovenia 🇸🇮

- Spain 🇪🇸

Are you ready for Europe’s new tax reporting directives?

Curious about what Trolley can do to help your online marketplace comply with DAC7 regulations when paying EU sellers? Learn more about the new DAC7 compliance product, get answers to your DAC7 questions, or follow our step-by-step guide to enable DAC7 features in your account.

What steps has your business taken to prepare for the upcoming DAC7 obligations?

If you have any questions about DAC7, feel free to reach out, and we’d be happy to help!

See Trolley Tax in action: Take the Trolley Tax tour

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.