Beginning in 2020, the IRS reintroduced Form 1099-NEC. This once-retired form is now being used for reporting compensation paid to nonemployee workers instead of Form 1099-MISC. While there may be confusion around when to use a 1099-NEC vs a 1099-MISC, Form 1099-NEC does clear up how to report income paid to freelancers and independent contractors—a rapidly growing sector of the workforce.

More and more, companies are relying on freelancers, gig workers, and independent contractors as a part of their workforce. The COVID-19 pandemic only underscored this fact; 1 in 10 of American workers started freelancing in 2020, and 75% of them did so to support their financial stability (Upwork, 2020). According to Statista, it’s predicted that by 2028, freelancers will make up over half of the total US workforce.

In the eyes of the IRS, many of these workers are considered “nonemployees.” Despite the name, the importance of their work or their need to pay taxes isn’t affected, and the company or organization paying them for their services has obligations to report any payments as income to the IRS via Form 1099-NEC.

A few things to take away from this article:

- A nonemployee is a freelancer, contractor, or consultant.

- Compensation includes fees, nonemployee director fees, and commissions, including affiliate commissions.

- The deadline for filing is January 31st.

It’s important for all people working with independent contractors to understand 1099-NEC reporting requirements. If you have questions about the IRS’s Form 1099-NEC, Nonemployee Compensation, or filing online, keep reading.

This article covers

Form 1099-NEC Explained

Form 1099-NEC is a Nonemployee Compensation form. This IRS form is used to report a nonemployee’s gross earnings in a given tax year.

Formerly used to report any self-employment income, the 1099-NEC form was retired from use in 1983 and replaced with the 1099-MISC. However, with the rise of gig and freelance workers in the 2010s, and a confusing set of reporting/filing deadlines because of the multi-use nature of the 1099-MISC, the IRS reintroduced 1099-NEC for the 2020 tax year.

Who receives a 1099-NEC? Who qualifies as a nonemployee?

Nonemployees are individuals who do not have an employer/employee relationship with your organization.

Examples of nonemployees include:

- Independent contractors

- Consultants

- Advisors

- Service providers/vendors

- Gig-workers

- Freelancers

While these are the most common examples, this list is not all-inclusive. Any individual or organization who works for your business but is not an employee could be considered a nonemployee.

1099-NEC Reporting Requirements

Payers must complete the form for any nonemployee individual, partnership, estate, or organization who:

- Is not subject to W-2 employment (salaried employees), and

- has been paid $600 or more in cash or non-cash income from your company or organization during the tax year.

What is Nonemployee Compensation?

Now that we’ve defined “who” is a nonemployee, let’s define that “what” nonemployee compensation is.

The easiest way to summarize types of nonemployee compensation is “anything other than wages paid to an employee.” To help, here are a few common types of compensation that will trigger a 1099-NEC.

- Fees for services rendered: The most common form of compensation needing a 1099-NEC is fees for services rendered, such as money paid to consultants, freelancers, or independent contractors.

- Non-employee Director Fees: Fees paid to board members, provided they are not employees, would trigger needing to produce and file a 1099-NEC.

- Commissions: Commissions are payments made for services performed or received in trade or business for which the person is not an employee. Included in this umbrella are affiliate commissions for individuals and web-based companies.

When Not to Issue a 1099-NEC

You are not required to file Form 1099-NEC for employees. You would issue form W-2 instead. Even when dealing with payments made to nonemployees, there are scenarios where you would turn to other similar forms instead of the 1099-NEC.

When to Use a 1099-MISC instead of a 1099-NEC

Previously, the 1099-MISC was the catch-all for paying nonemployees. However, the IRS has reintroduced Form 1099-NEC to clarify an increasingly independent work economy and simplify filing deadlines.

While the 1099-NEC will now be the more common go-to, there are still some situations where the 1099-MISC will be required. The IRS has issued guidelines for issuing a 1099-MISC, including situations such as:

- Royalties: Royalties paid to individuals for services relating to intangible property, including patents, copyrights, trademarks, trade names. If you have a royalty agreement in place, any money paid under the agreement exceeding $10 will trigger the need for a 1099-MISC.

- Rent: If you paid more than $600 to rent office space, machinery, or (if you are a farmer) pasture for grazing your animals, you will need to complete and file a 1099-MISC for that amount.

- Payments to an Attorney: Legal fees paid for an attorney’s services should be reported through a 1099-MISC, not a 1099-NEC.

When to Use a 1099-K instead of a 1099-NEC

11/22/2023 update: The IRS has announced another delay of its Form 1099-K threshold changes. For calendar year 2023, with reporting due in January 2024, the reporting threshold for TPSOs remains at $20,000 in gross amount of aggregate payments and 200 transactions.

The IRS plans to propose a $5,000 reporting threshold for the following year, with the aim of eventually working towards the $600 threshold. This change does not affect state reporting thresholds—many of which are already $600.

Form 1099-K, or Payment Card and Third Party Network Transactions, is used by credit card companies and third-party payment processors to report transactions that they process for businesses.

This could mean Visa, Mastercard or PayPal processing payments for retailers, or it could mean online marketplaces such as eBay, Etsy, or Amazon facilitating transactions. It has been more and more common for some members of the gig economy or businesses to receive payment through third-party network transactions.

It’s important to note that there are very important changes to reporting requirements for Form 1099-K that will take effect in the coming tax years:

Previous to the changes, the threshold for issuing a 1099-K applied only to those persons who had:

- transacted over 200 transactions, and

- grossed a total of over $20,000

- all from payment cards such as debit cards, credit cards, or other third-party networks in the previous calendar year.

While the IRS has declared 2022 and 2023 “a transition period,” and 2024 will ikely see an interim threshold of $5,000, eventually companies will need to file a 1099-K by January 31 if an individual being paid meets the following conditions:

- grossed a total of over $600 (no minimum transaction requirement)

- all from payment cards such as debit cards, credit cards, or other third-party networks in the previous calendar year.

1099-NEC Filing Deadlines

If you need to issue a 1099-NEC, you can file online with the IRS or on paper by January 31st. You will also need to provide the recipient (your vendor) with the payee statement (their copy of the 1099-NEC) by January 31st.

If an organization fails to submit Form 1099-NEC on time, the IRS may assess penalties or fines. Unfortunately, there are no automatic extensions for filing.

To request an extension for filing due to hardship, you will need to request an extension by submitting Form 8809 to the IRS.

How to File a 1099-NEC

If you’ve paid a nonemployee qualifying funds and need to issue a 1099-NEC, there are a few steps to take. The process begins when you engage a new vendor (collecting their tax information via a W-9) and ends, for a given tax year, when you file the 1099-NEC with the IRS and issue a copy to your nonemployee vendor/contractor.

Note: The completed 1099-NEC produces two copies, A & B. You will file copy A with the IRS, and you will issue copy B to the vendor/contractor.

These are some important steps in producing and filing Form 1099-NEC:

Collect a W-9 form

When starting a business relationship with a new vendor, it is important to request their tax information. This is done via Form W-9, Request for Taxpayer Identification Number and Certification.

The W-9 form asks the contractor to provide identifying information, including their name, address, and taxpayer identification number (TIN) to your company.

Looking for more information on W-9s? Read our guide to IRS Form W-9.

File Form 1099-NEC (Copy A) with the IRS

Filing a 1099-NEC is quite straightforward.

You’ll begin by requesting Form 1099-NEC from the IRS. Electronic filing is encouraged on the FIRE system. Make sure your company has an active FIRE E-FILE account with the IRS.

If you will be filing a physical copy via mail, use Form 1096 as your cover sheet. Be sure to complete your filing by January 31st to avoid any penalties.

Issue Form 1099-NEC (Copy B) to the nonemployee

Issuing a 1099-NEC to a nonemployee is equally straightforward.

You can mail the document to the contractor, so long as they receive it by February 1st.

NOTE: The IRS mandates that if you want to email documents, the recipient needs to have consented to receive the form via email, and the consent must have been sent through that same medium. So, emailing Form 1099-NEC requires an email from your vendor saying they authorize email as a method of delivery.

The IRS provides more detailed instructions in their General Instructions for Certain Information Returns guide.

Other 1099 Tax Forms

Aside from the two examples listed above—1099-MISC (Miscellaneous Income) & 1099-K (Payment Card and Third Party Network Transactions)—there are over 20 different forms in the 1099 family. This series of forms are used to record and report that funds has been paid to a taxpayer.

Other examples of forms that fall within the 1099 series are:

- Form 1099-A (Acquisition or abandonment of secured property)

- Form 1099-B (Real estate transactions)

- Form 1099-C (Cancelation of debt)

- Form 1099-DIV (Dividends)

- Form 1099-INT (Interest paid)

There are more than 20 types of Form 1099, which is why it’s so important to know you are issuing or receiving the correct version of Form 1099.

Summing It All Up

IRS Form 1099-NEC has replaced the 1099-MISC as the primary document to report nonemployee income for those earning $600 or more. If you are engaging on-demand workers for freelance jobs, gigs, and independent contracting work, this form will be essential.

We welcome you to come back and refer to this guide on how to fill out a 1099-NEC form whenever you need it!

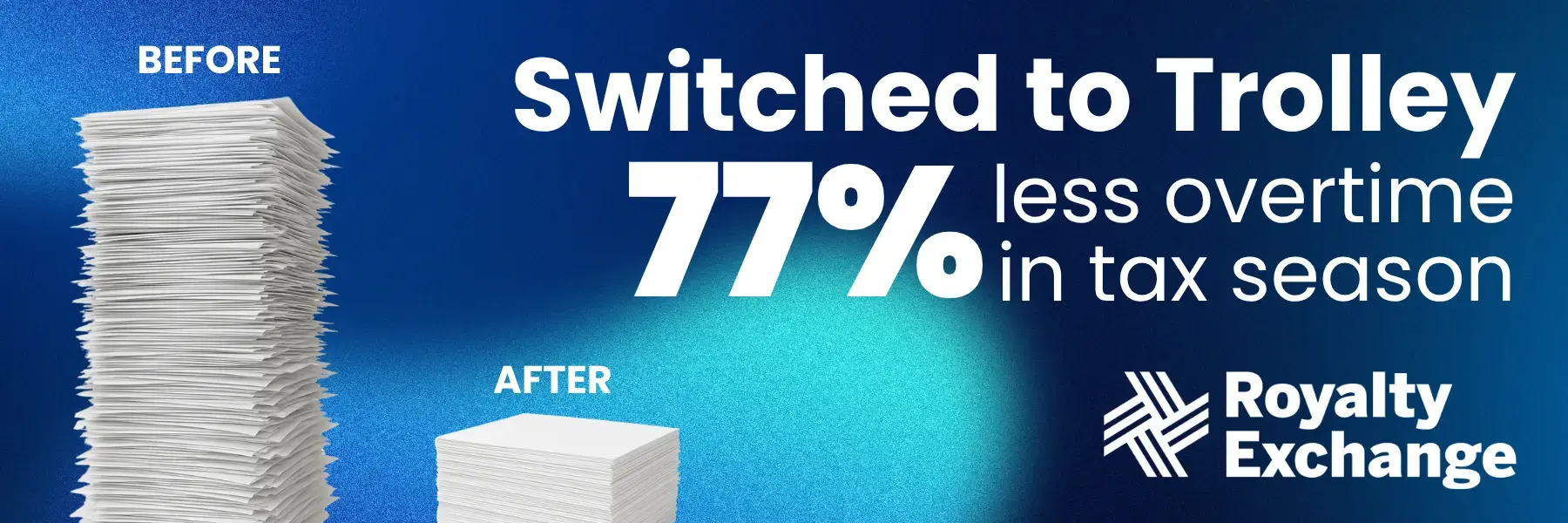

Simplify contractor tax compliance with Trolley

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.

See Trolley Tax in action: Take the Trolley Tax tour >

Book a demo of Trolley’s tax features today >

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.