Working with foreign (non-U.S.) contractors and freelancers can have significant cost and talent benefits for your company. However, it’s essential to understand the tax nuances related to outsourced work. Obtaining complete W-8 BEN forms is your first step in ensuring that your tax process is compliant for all foreign contractors.

Reporting and withholding taxes for contractors can be complicated enough for American companies working with contractors based in the United States. But when you start working with (and paying) international freelancers or independent contractors, things get even more complicated.

If you work with contractors from other nations, you may eventually need to withhold taxes for and report payments made to these individuals.

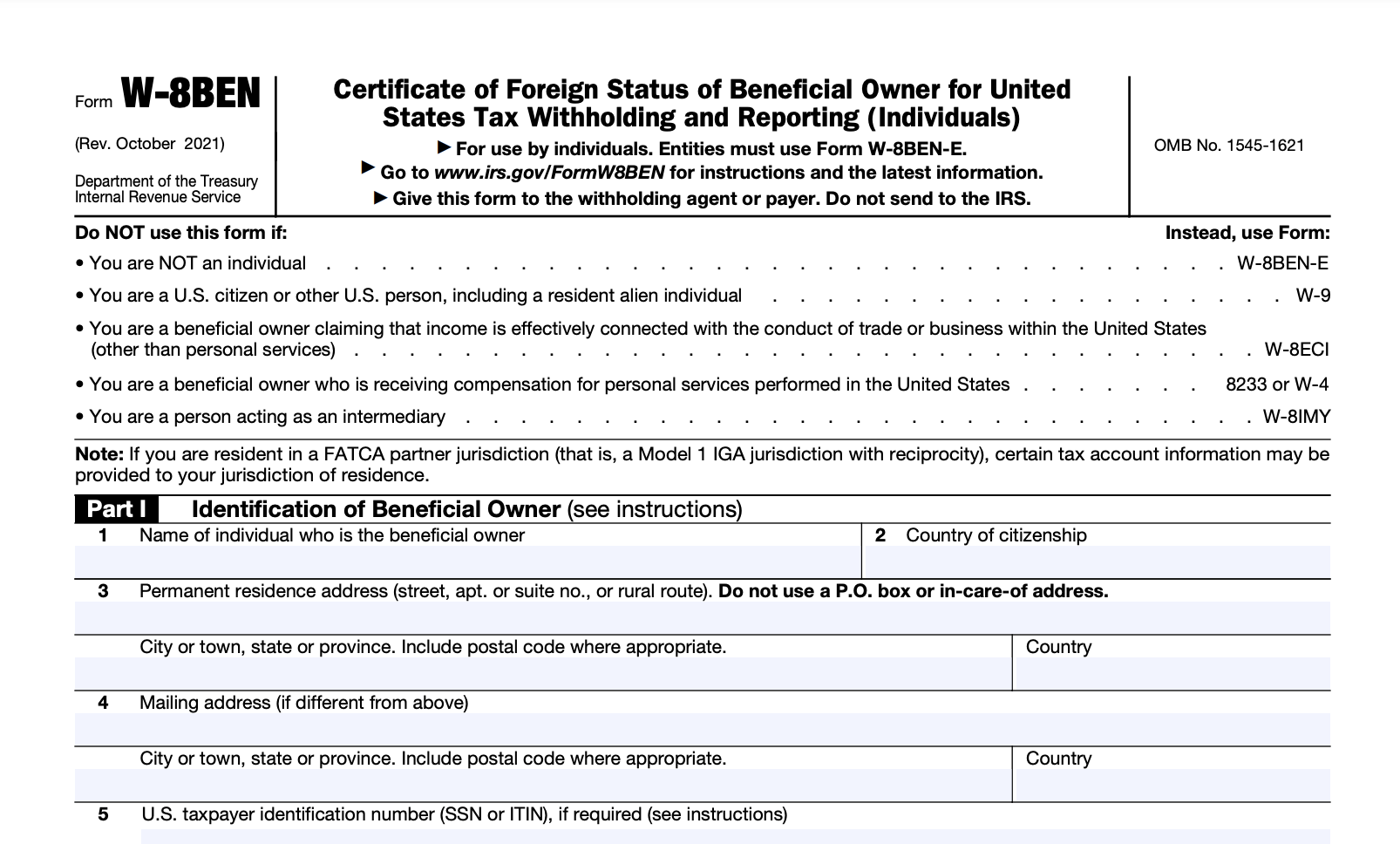

To do this, you’ll need to collect some critical information about them and their country of residence. This is accomplished by having your contractors complete IRS form W-8 BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

Read on to learn everything you’ll need to know about Form W-8 BEN.

This article covers

W-8s Explained

To correctly calculate tax withholdings and report income paid during a given tax year, companies need to have certain information about the employees and nonemployees they are paying. This includes their name, date of birth, address, and Tax Identification Number (TIN).

The IRS produces several standardized forms that companies can use to collect this information, including Form W-4 (Employee’s Withholding Allowance Certificate) and Form W-9 (Request for Taxpayer Identification Number and Certification).

However, W-4 & W-9 forms apply only to U.S. citizens and residents. When dealing with foreign persons or entities receiving payment from an American company, the W-8 series of forms are used. There are five different W-8 forms, each with a particular purpose:

- W-8 BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

- W-8 BEN-E: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

- W-8 ECI: Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States

- W-8 EXP: Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting

- W-8 IMY: Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting

All W-8 forms request a person/entity’s legal name, date of birth, address, U.S. tax information number (TIN), foreign tax information number (FTIN), nationality, and any tax treaty withholding exemption requests.

This information will be used to calculate withholdings on payments and produce a 1042 form (Annual Withholding Tax Return for U.S. Source Income of Foreign Persons) at the end of a given tax year.

Note 1: All foreign persons or entities paid by a U.S. company need to claim an appropriate tax treaty between their nation and the US, or have 30% withholding applied to their earnings. Only valid exemptions claimed on W-8 forms allow this to be reduced.

Note 2: W-8 forms are valid for three years or until any information on the forms has changed.

What is IRS Form W-8 BEN?

Any non-citizen or non-resident who receives income from a U.S. company or client needs to be taxed on that income. In the U.S., income includes many different forms of payment, including:

- Employment income

- Fees for services rendered

- Rent

- Royalties

- Interest or dividends

- Additional fixed gains

Form W-8 BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting) is an IRS-produced form used by U.S. companies/clients to request tax information from foreign individuals being paid as employees, freelancers, vendors, or contractors.

What is the purpose of form W-8 BEN?

The W-8 BEN has several specific purposes:

- To collect the tax information (name, address, date of birth, TIN, FTIN) of the individual

- To confirm the individual’s foreign status

- To confirm the individual as the beneficial owner of the income for which this form is provided

- To confirm the withholding rate for the individual

While noted above that the default withholding rate for foreign individuals and entities is 30%, an individual can complete Part II (Claim of Tax Treaty Benefits) of the W-8 BEN to request a reduced withholding rate or a withholding exemption. They can only do this if they are a resident of a foreign country with which the U.S. has a tax treaty.

For example, in 1980, a tax treaty was signed between the U.S. & Canada. Canadian citizens earning income in the U.S. can request a withholding exemption on those funds. This will reduce their withholding amount to 0%. However, they will need to claim that income to Revenue Canada and pay Canadian taxes later.

Note 1: If a person entitled to a withholding reduction does not request it on their W-8 BEN form, the withholding agent (payer) is required by law to withhold the full 30%. It is then the responsibility of the individual to deal with the IRS to get that money back.

Note 2: W-8 BEN forms are only provided to individuals or sole proprietors. Other business entities, such as corporations or partnerships, must fill out a W-8 BEN-E.

What is the difference between forms W-8 BEN and W-9?

While W-8 and W-9 (Request for Taxpayer Identification Number and Certification) forms are similar in name and function, they are distinct and mutually exclusive to each other.

The main difference between W-8 BEN and W-9 forms is the nationality of the person being requested to complete the form.

- W-8 BEN is exclusively for foreign citizens who do not hold U.S. citizenship or U.S. residency.

- W-9 is for U.S. citizens/residents/entities only. A U.S. citizen would never be required to complete a W-8 BEN form.

Another critical difference between the two forms is expiry.

- W-9 forms never expire.

- However, W-8 BEN forms expire every three years.

Note: W-8 expiry happens on the last day of the third calendar year from the W-8 was signed.

Summing it all up

To recap, form W-8 BEN is used to confirm four things from foreign individuals being paid by U.S. entities:

- Key tax information (FTIN/Date of Birth)

- The individual’s foreign status

- To confirm the individual as the beneficial owner of the income for which this form is provided.

- To confirm the withholding rate for the individual.

With our completely customizable payment onboarding portal and embeddable widget, Trolley can help streamline your W-8 BEN collection process. Our system automatically applies the correct withholding rates to all payments and generates 1042-s forms when it’s time to prepare your tax filings. As a result, you can expect:

- Less administrative work

- Minimal to no errors

- Peace of mind knowing that withholdings are correct and 1042-S forms will be completed, distributed and filed on time.

We welcome you to come back and refer to this guide on Form W-8 BEN whenever you need it!

Simplify contractor tax compliance with Trolley

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.

See Trolley Tax in action: Take the Trolley Tax tour

Book a demo of Trolley’s tax features today >

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.