Global Tax Compliance, Handled

Stay compliant in every market. Trolley Tax automates tax info collection, withholdings, and year-end reporting across US, EU, UK, AU & NZ—freeing your team to scale.

Trusted across industries by finance & compliance teams

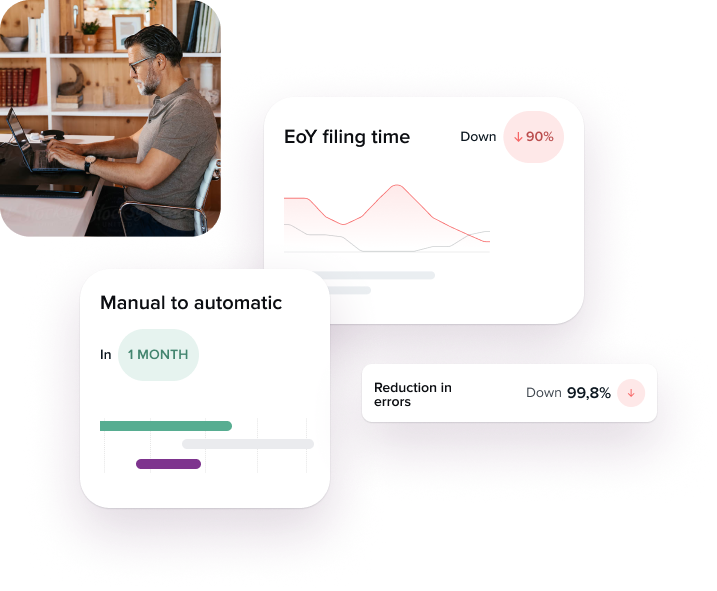

A tax process without the end-of-accounting-period rush

Trolley Tax was built alongside some of the internet’s largest enterprises with the objective of helping their finance and accounting teams stay focused on the big picture—a streamlined end-of-year. As new recipients complete a self-service onboarding process, we gather essential data so that every payout can be managed based on that information. Everything you need for month-end or year-end is ready to go and set to e-file in a few clicks.

Collect recipient tax info at onboarding

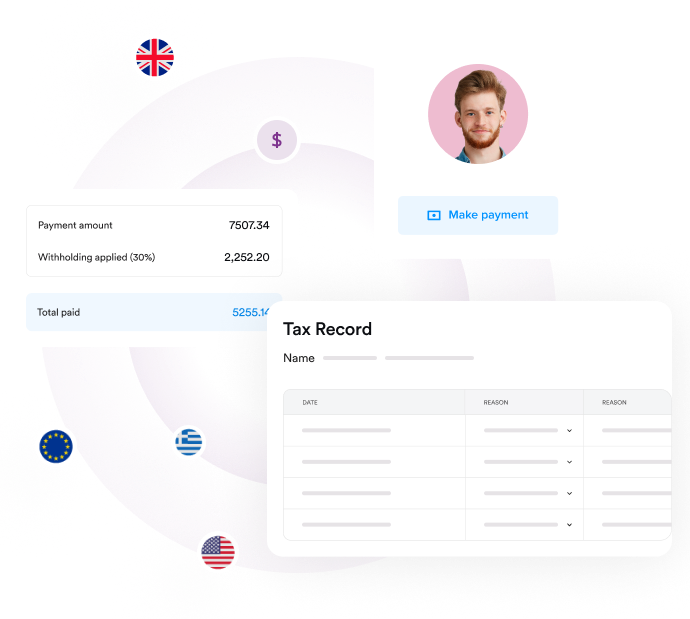

Automatically withhold taxes on every payout (as required)

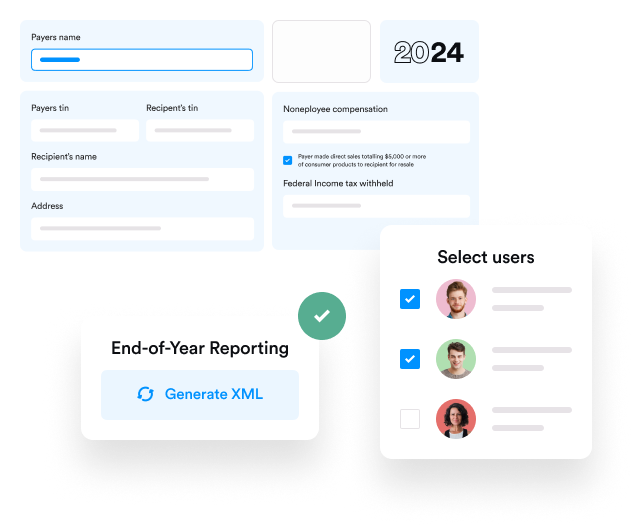

Generate EoY recipient statements

E-file in a few clicks

Make the right choice for global payouts

Cut through the complexity of the payouts decisions process with a clear, practical guide. Learn what to look for, what to avoid, and how to future-proof your payout operations.

What you’ll find inside:

- Key evaluation areas: We list the major categories you should assess in a payout platform.

- Questions to ask vendors: Each section provides key vendor assessment questions for RFPs, demos, and reviews.

- Must-have vs. nice-to-have features: Comparison of essential vs. optional features based on your resources.

- Internal stakeholder checklists: Tools to align finance, product, compliance, engineering, and operations teams.

Grow across geographies without worrying about compliance hurdles

Today’s fast-growing connected business want to scale without geographic barriers. Trolley Tax helps you stay compliant in the US and the EU without any additional work required for your team.

IRS compliance for US-sourced payouts

Keep your friends at the IRS happy. Enhance your process with digital W8/W9 collection, automated withholding, and 1099/1042 e-filing.

Digital platform reporting for EU, UK, AU, & NZ

Grow globally and meet OECD global reporting requirements. Collect required seller data, link payouts to reportable activities, and generate XML files required for all 30 jurisdictions.

We offer a 3-step process that makes tax compliance a breeze

Onboard

Automate onboarding and setup based on geography.

Pay

Generate tax records and automatically apply withholdings if needed.

File

Send recipients statements and e-file directly within Trolley.

Fully compliant digital onboarding

Trolley collects accurate data at recipient onboarding, saving you the high-pressure work of chasing that down in January.

- Trigger jurisdiction-specific tax forms as you onboard new recipients

- Send white-lableled emails that incorporate your brand

- Collect required info including name, residence, and tax ID info

- Auto-validate tax forms

- Obtain signatures and store forms in a digital format

- Automatic re-verification whenever forms expire

Tax-friendly payment process

Trolley automatically builds a recipient tax record and manages compliance on every payment based on recipient data and the reason for payment.

- Automatically withhold taxes as required by jurisdiction and treaty

- Build tax records including payment activity classification on every payment

Low-click end of year filing

Following a simple review and approval process, Trolley makes it easy for you to file with the tax authorities and provide end-of-year information forms to your recipients.

- Manage every year, jurisdiction, and type of tax form through a dedicated tax center

- View and approve consolidated recipient earnings for the year in one place

- View and approve generated tax forms based on approved earnings

- Send tax forms to all recipients digitally or by mail

- E-file in the relevant local jurisdiction

Empower your teams with full automation

Whether you make 100 or 100K payouts a month, Trolley Tax enables you to improve internal accounting and compliance processes as well as remove friction from your recipient's journey.

Send fast payouts, simplify your tax process, and sync your tools with one platform

Let Trolley take care of payouts, so you can focus on what really matters: growing your business.