Meet OECD & DAC7 Reporting Requirements for Your Platform

Don’t let new OECD reporting regulations slow your global expansion. Trolley is the only payouts platform with a reporting solution that meets the growing regulatory requirements in the EU, UK, AU, & NZ.

Top companies rely on Trolley

to meet their global reporting obligations

Grow globally with an all-in-one digital platform earnings solution

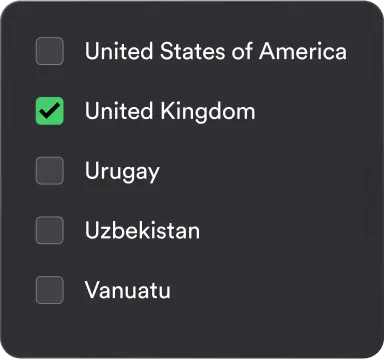

Whether you facilitate the sale of goods, services, transportation, or rental properties, Trolley can help you confidently operate in 30+ countries without needing to build and maintain new income reporting systems.

27 EU Nations

Council Directive (EU) 2021/514 (DAC7)

United Kingdom

Reporting rules for digital platforms

Australia

Sharing economy reporting regime (SERR)

New Zealand

Income reporting rules (IRR)

Digital platform reporting: Trolley's end-to-end process

Whether you facilitate the sale of goods, services, transportation, or rental properties, Trolley can help you confidently operate in 30+ countries without needing to build and maintain new income reporting systems.

Recipient onboarding

Collect and validate TIN, addresses, or any specific info based on jurisdictions. Alternatively, ingest data from your sources using CSV or API.

Recipient communication

Send white-labeled emails in 36 languages. One single dashboard to view tax forms and consolidated income reports.

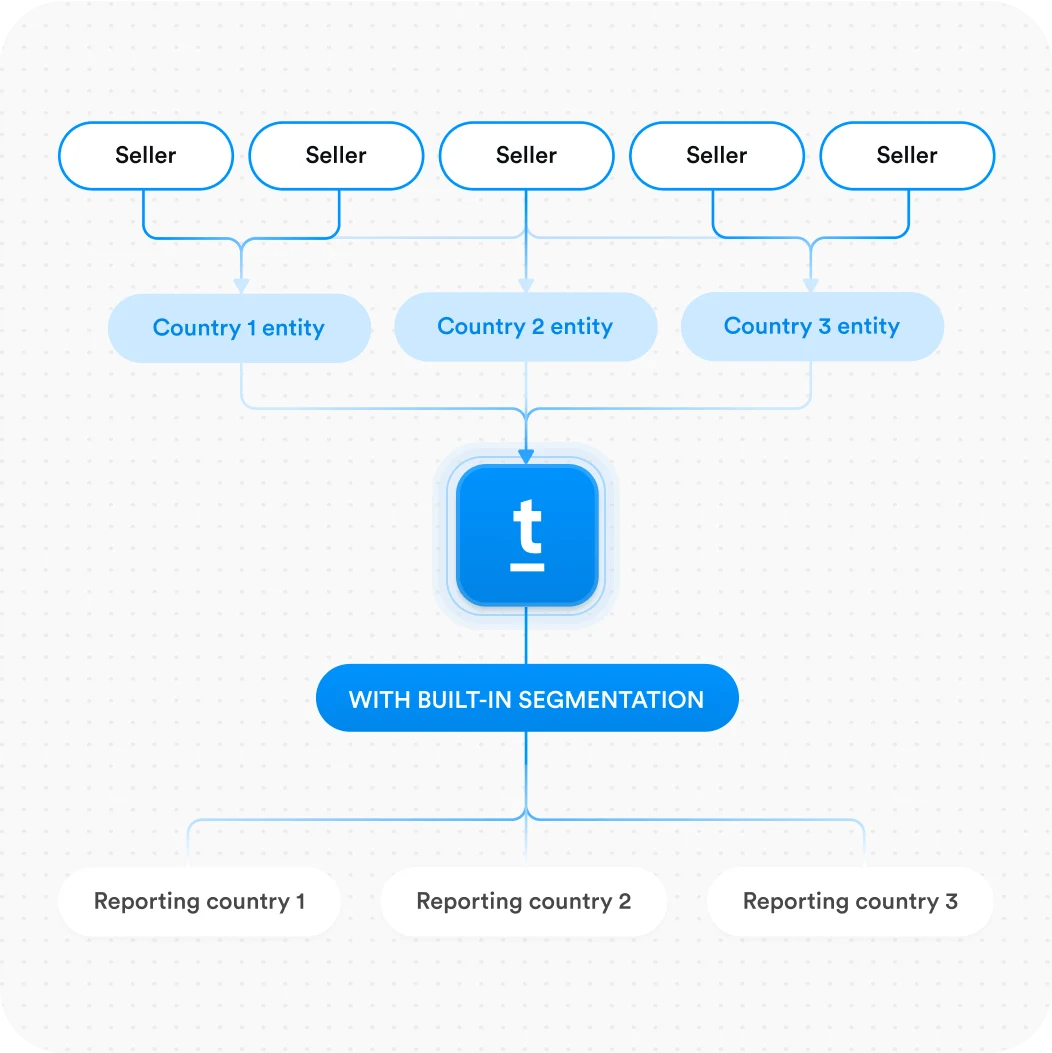

Auto-segmentation

Collect the data needed based on jurisdiction. Avoid under-reporting or duplicate reporting by automatically segmenting recipients.

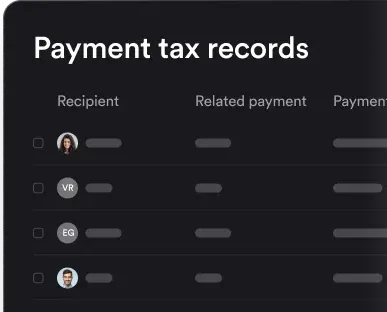

Payment records

Generate payment records throughout the year or alternatively add offline payments through CSV or API. Consolidate data in one click at the end of the year.

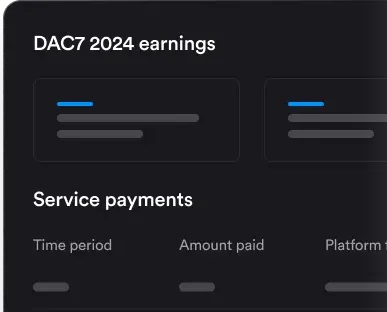

Earnings statements

Generate aggregated income statements in one go and send them to recipients in time for their reporting deadlines.

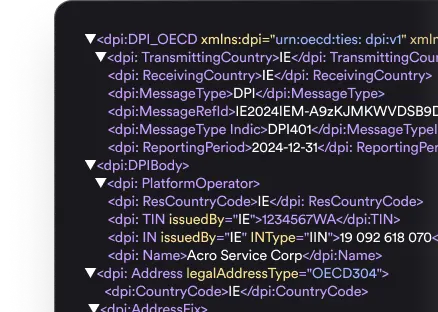

E-file in local jurisdictions

Generate the mandatory XML files ready to upload to the portal of your local reporting agency for annual filing.

Onboarding, Data Collection, and Reporting in One Platform

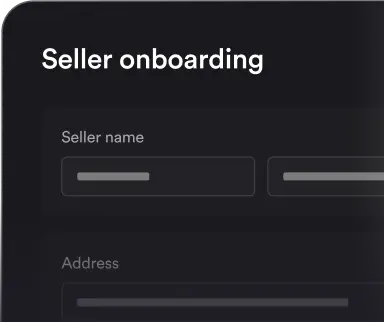

Simplify recipient onboarding and collect tax forms

Collect TINs, business registration numbers, IBANs, addresses, or any other relevant info for various income reporting regimes.

Trolley’s modular widget allows you to surface only those fields required by relevant jurisdictions and auto-fills existing information, leading to a superior user experience.

Couple it with our Pay and Trust product to manage all recipient operations through one platform.

Automate payment data collection

Trolley keeps track of all payments made to a recipient throughout the year and consolidates that data for end-of-year earnings reporting.

If you also make other, offline payments, you can upload that data to Trolley via CSV or API, allowing you to consolidate all payment data from various sources into one source of truth— ensuring accurate data for filing.

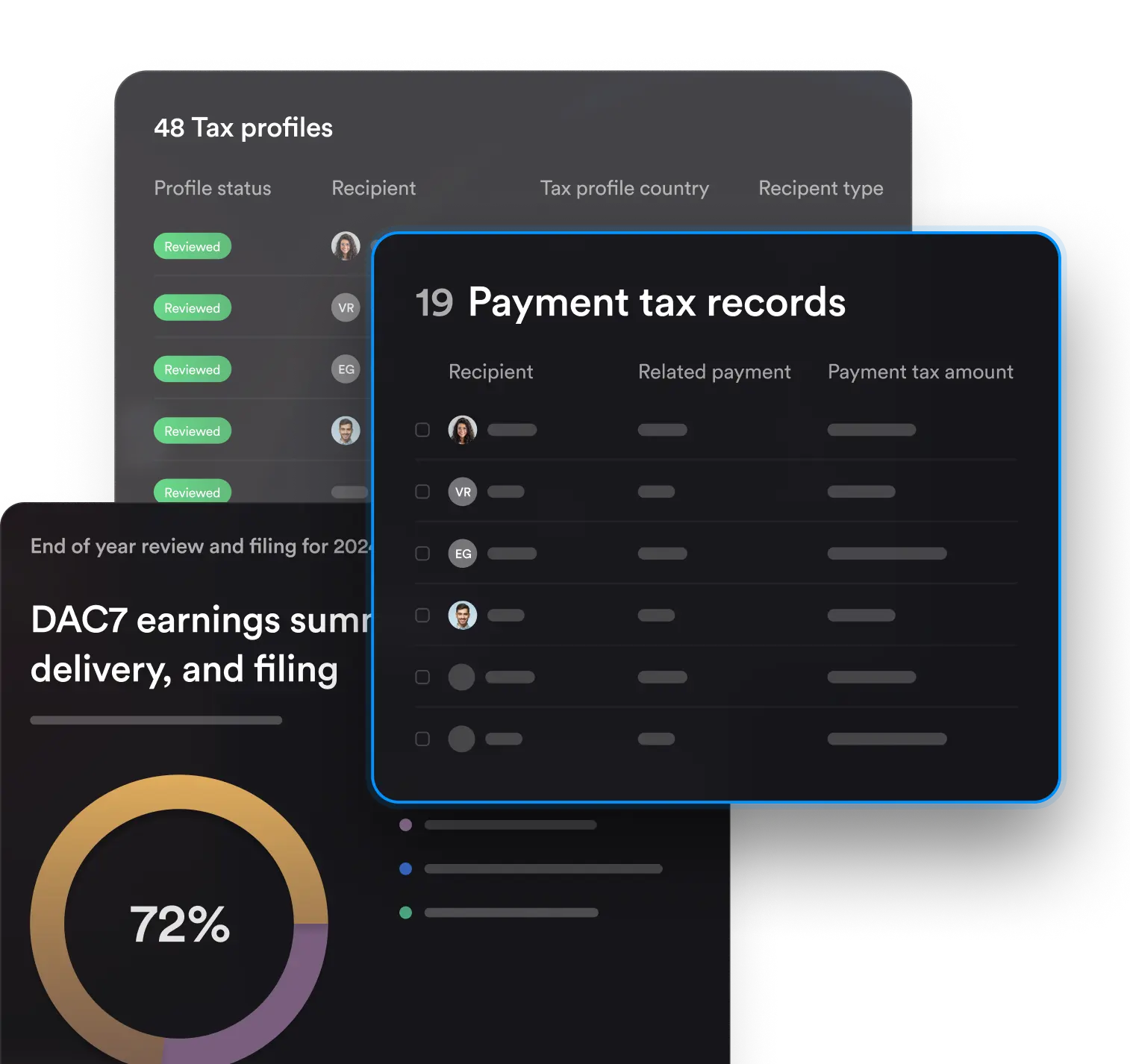

Generate end of year filings in minutes, not weeks

An average tax team takes 4 weeks to generate their end of year reports and statements. Replace complicated processes and form filing with a single, low effort tool.

With consolidated payment and recipient data, filing takes a few minutes with Trolley. Generate XML files for easy upload to respective jurisdictions with a click of a button. Generate and send end of year earning statements directly to your recipients’ inbox.

Non-compliance can get really expensive, really quick

Digital platform reporting compliance may be new, but they bring the same types of risks that other reporting regulations do. Not acting fast enough can put you and your operations under scrutiny.

Streamline teams and workflows in one platform

Supporting all workflows from one platform reduces development overhead as well as allows your finance, tax, and operations teams to collaborate effectively without moving data back and forth via unsecure systems like email or chat apps. Reduce manual work, boost security, and simplify processes using Trolley.

The recipient backbone for your business

From payouts, to tax compliance, to risk & fraud management, Trolley takes care of all things related to paying recipients for your business.

- Collect information & onboard in line with local regulations

- Send payouts to 210+ countries & territories

- Stay compliant with IRS taxes

- Built-in identity, business, phone, and address verification

- DSA & INFORM act compliance

- Accounting integrations and built-in data connectors to automate data flow

- Dev tools and ready-to-go modular widget

The only payouts platform with OECD & DAC7 compliant digital platform reporting built in

Stay compliant, scale globally—Trolley simplifies reporting for your digital platform.