Scale support, cut tickets, and keep recipients happy

Ops & Support teams spend hours each week managing recipient onboarding, compliance checks, and endless “Where’s my money?” tickets—draining your team’s time and focus.

Trolley centralizes recipient onboarding, communication, payouts, tax, and risk compliance—freeing up your Ops & Support for what matters: scaling globally with less overhead, reducing ticket-driven support costs, and keeping compliance airtight.

Recipient operations trusted by world-class teams

Our flexible platform helps operations teams handle 5M+ payouts, 1M+ tax filings, and 100M+ data syncs every year — without adding overhead.

How NitroPay onboards new publishers in just 20 minutes

“Trolley has allowed us to onboard and automate more of our internal workings, which lets us scale better and focus on our tech, our publishers, and our growth.”

Cody Bye

Co-Founder & Chief Growth + Sales Officer at NitroPay

The flexible platform that Ops & Support teams are using to streamline recipient operations

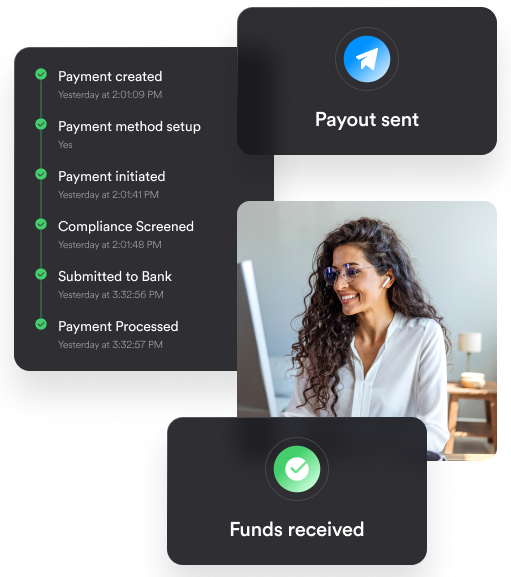

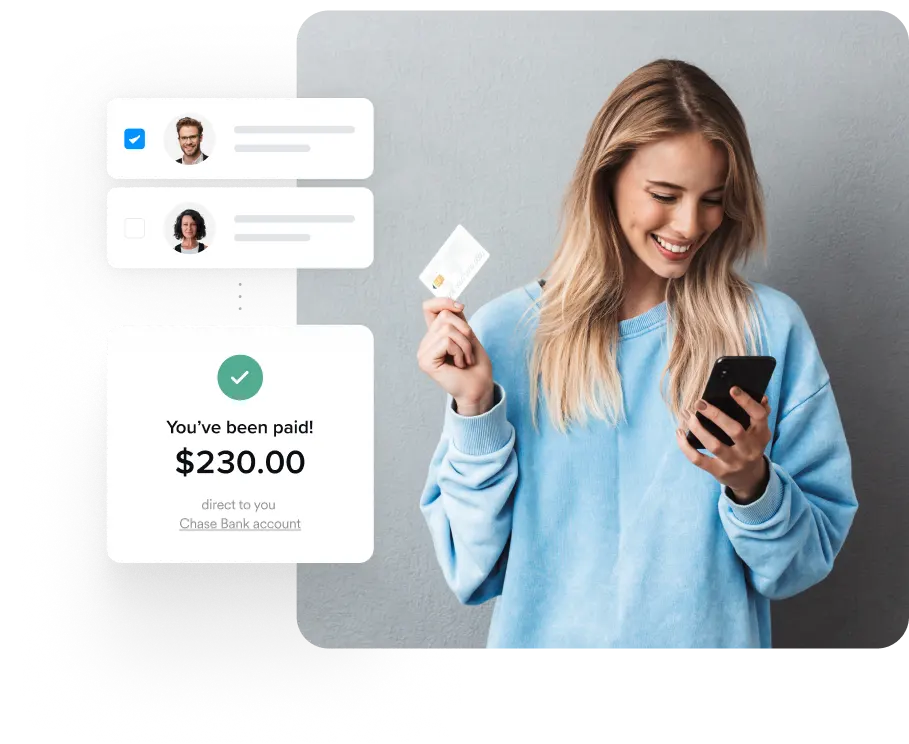

Payout operations that build trust

- Payout direct-to-bank in 210+ regions and 135+ currencies

- Consolidate payout methods across bank accounts, wallets, checks, and virtual accounts

- Access real-time payout status to respond quickly to recipient inquiries

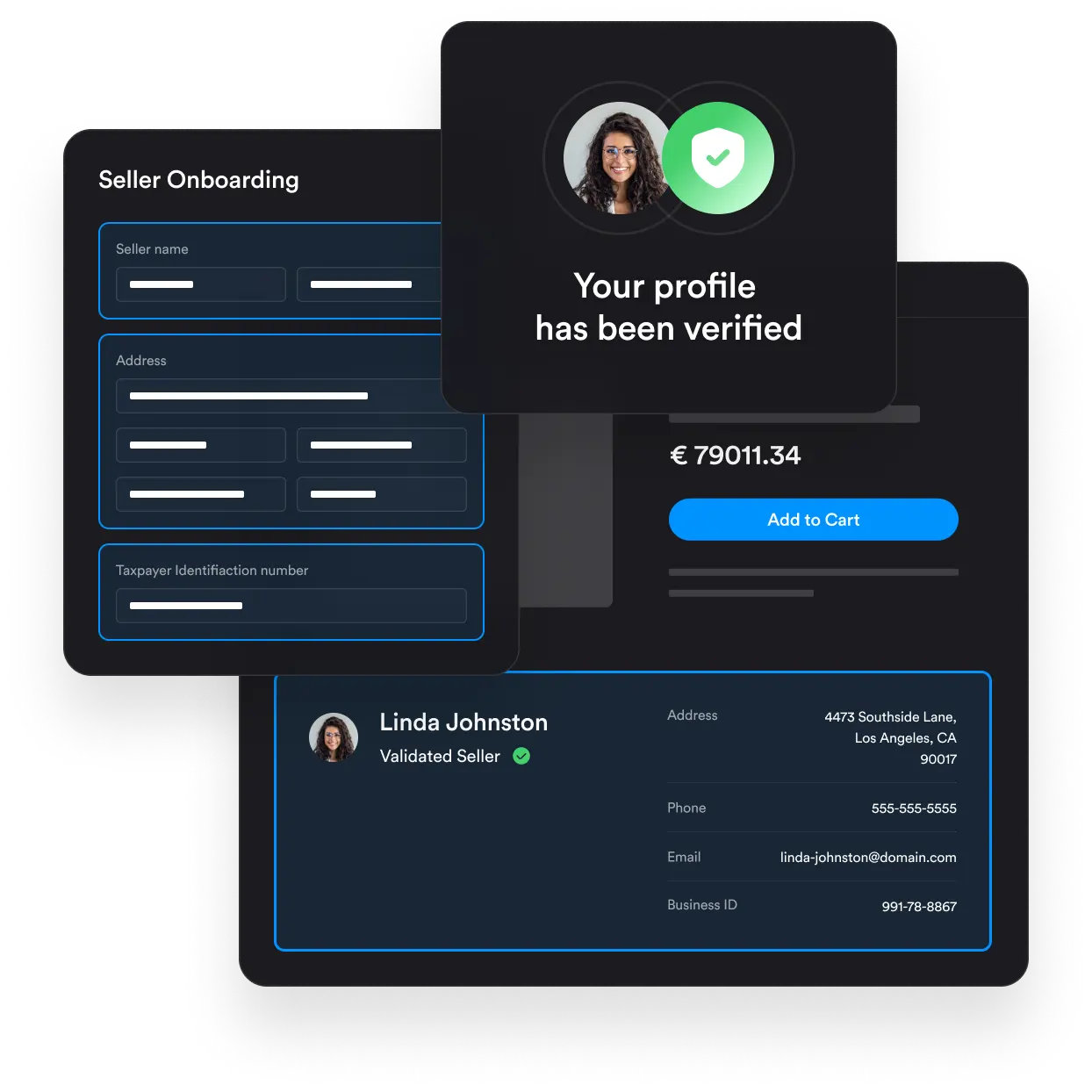

Recipient operations that are simple by design

- Automatically collect tax information and stay compliant with IRS, OECD/DAC7, and global regulations

- Onboard recipients with branded, customizable flows and communication

- Verify recipients and manage risk with built-in workflows

Compatible with your workflows

- Resolve errors quickly with centralized tracking and retry workflows

- Customize & setup with no-code quick settings or integrate in your platform using code

- Scale seamlessly to handle more recipients and payout operations without extra headcount

Recipient operations made simple

Reduce manual effort, prevent support issues before they happen, and give recipients a frictionless onboarding experience—all while staying compliant from day one.

- Strengthen recipient relationships with a modular widget and white-labeled communications

- Automatically collect and verify details including tax forms, payment info, phone number, and address

- Give recipients real-time transparency with access to payout history and tax forms anytime

- Cut inbound questions with automated notifications, emails, and transparent status updates

Payouts infrastructure & workflows

Enable your team to scale payouts, resolve issues faster, and inform recipients without extra headcount.

- Support global payouts to 210+ countries and 135+ currencies with flexible methods

- Automate invoices & batch payments through CSV, API, or dashboard uploads

- Set internal approval workflows to keep operations controlled and compliant

- Resolve failed payouts fast with built-in tools for returns and retries

Trust & risk monitoring from day one

Manage recipient risk from the start; support and ops teams thrive when recipients are verified, risks are minimized, and issues don’t snowball into support tickets.

- Verify recipients upfront with KYC/KYB, ID, phone and address checks during onboarding

- Monitor continuously with account change tracking, login monitoring, and automated re-verifications

- Resolve faster with detailed recipient profiles and risk insights that cut investigation time

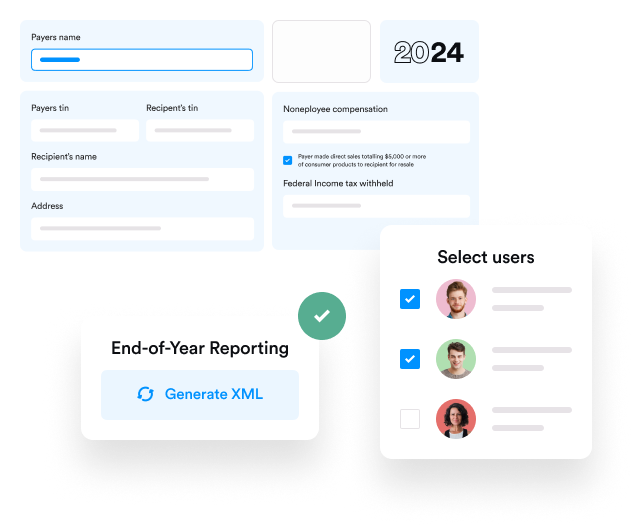

Built-in tax compliance

Automate tax compliance in the US, EU, UK, AU & NZ with Trolley Tax, so your team stays focused on growth.

- Collect and validate tax forms with automated W-8/W-9 capture and global TIN/foreign TIN matching during onboarding

- Build tax records including payment activity classification on every payment

- Generate & deliver year-end tax forms (1099, 1042, and other recipient statements) digitally by mail—ensuring DAC7 & OECD compliance

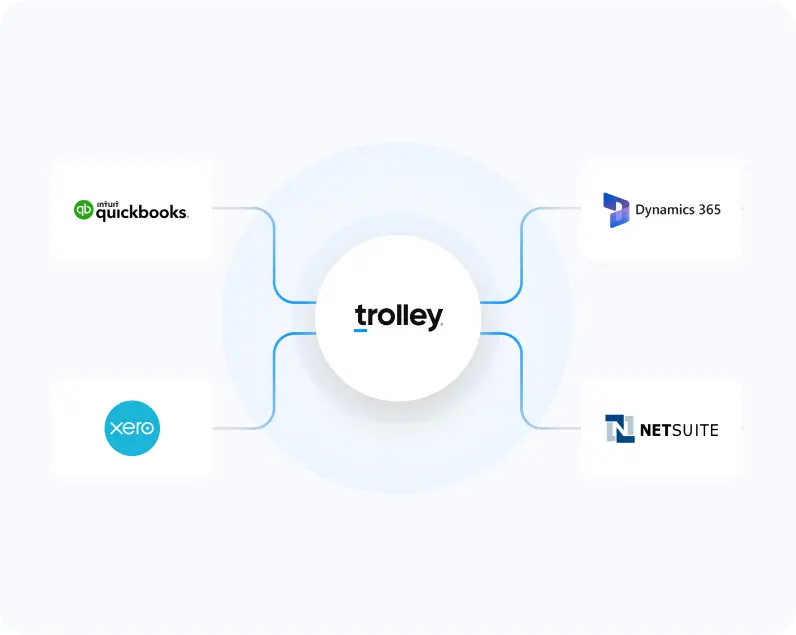

Operationalize data with ease

Keep every payout transparent and traceable by syncing information seamlessly across systems with built-in data connectors.

- Sync and centralize data across payouts and recipients, with full audit trails and recipient records

- Build reports seamlessly by plugging synced data into ERP, CRM, and BI tools for deeper visibility

- Stay accurate & up to date with schema changes and updates that run automatically at your cadence

Trust & bank-level security baked in at every step

Sleep easy knowing we’re following the highest global standards for managing customer funds and data.

Adopt the PayoutOps platform that saves operations & support teams days of work each week

Learn why the industry’s best trust Trolley.