Protect your platform and payouts

There's a constant pressure for risk and safety teams to be fighting fraud, yet fragmented compliance tools and siloed data make it tough to stay ahead.

Trolley brings risk operations together, ID and business verification, fraud monitoring, and global KYC/KYB compliance, helping your team stop bad actors in their tracks.

Trusted by world-class risk & safety teams

Our flexible platform helps Risk and Safety teams support over 5M payouts, 1M+ tax filings, and 100M+ data syncs every year.

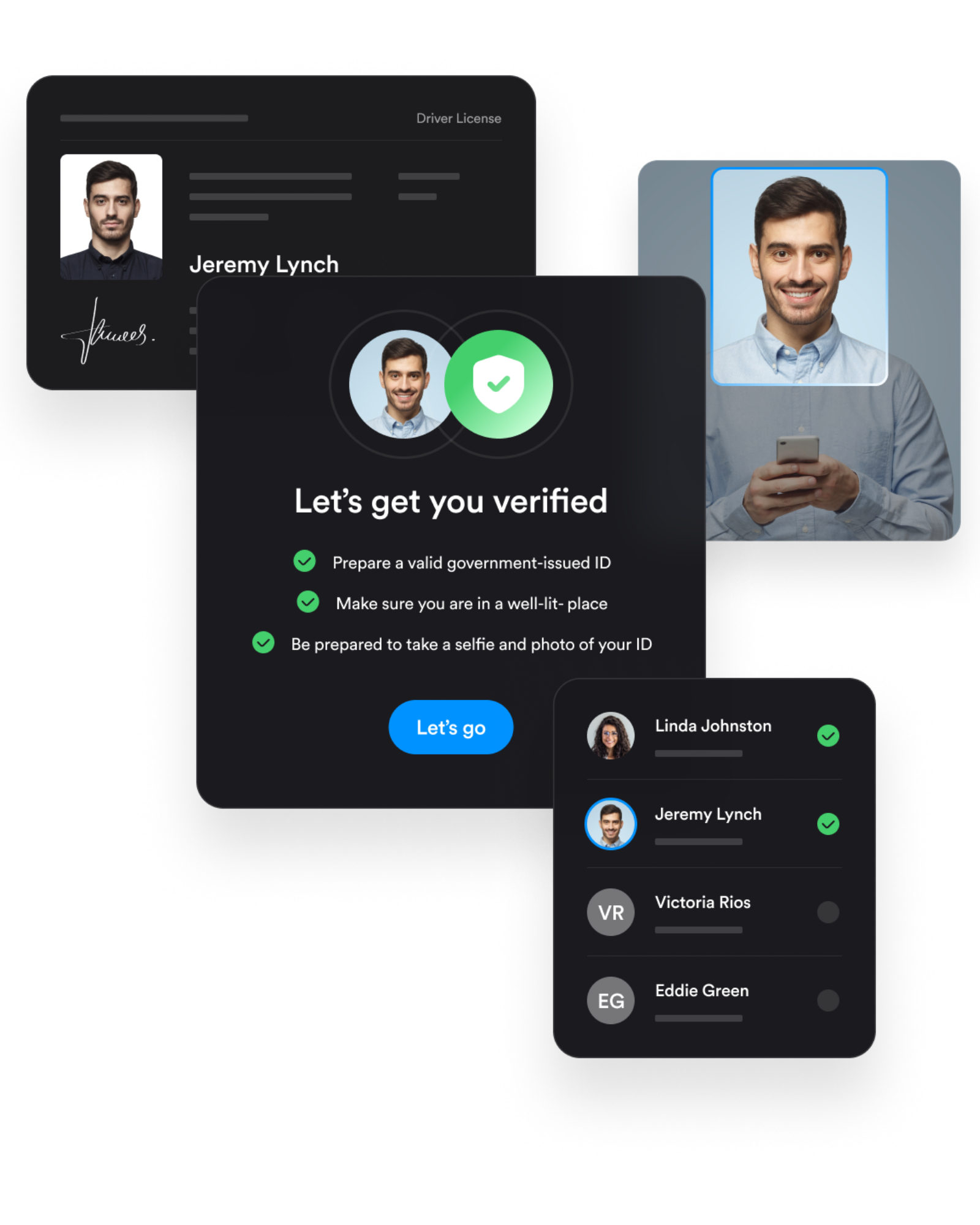

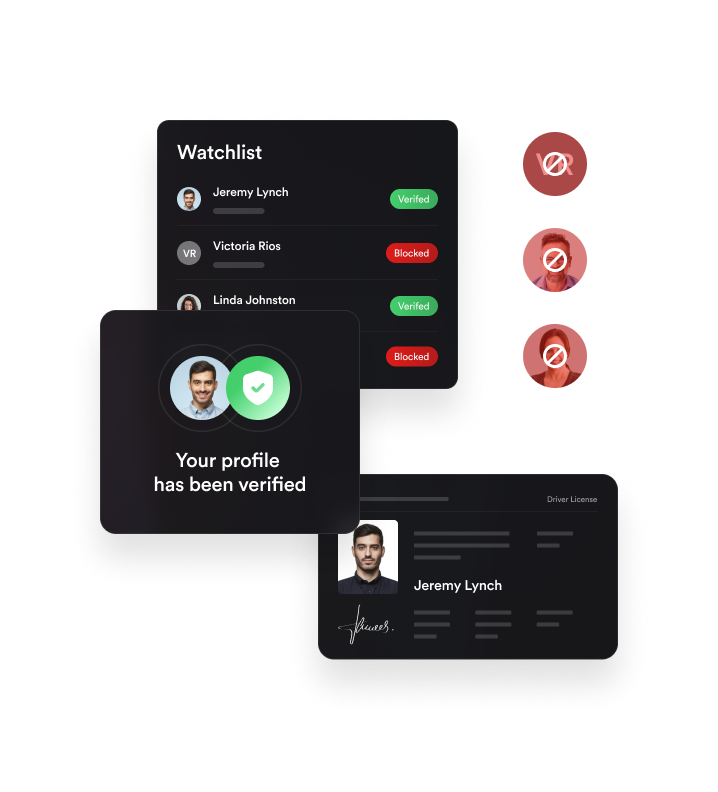

Frictionless recipient verification

Protect your business and build trust by verifying who you’re paying before funds are released.

- Verify recipients with support for passports, driver’s licenses, national ID cards, or other government-issued documents across 200+ regions

- Authenticate businesses by validating registration documents and tax numbers

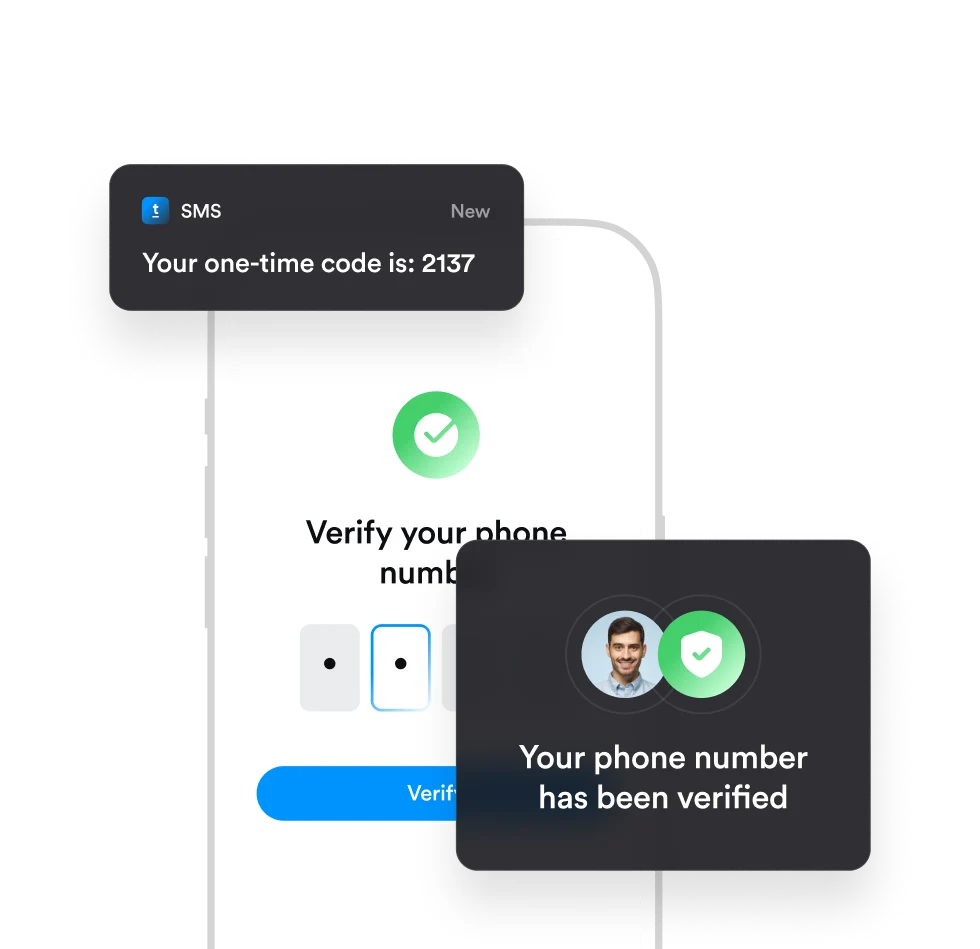

- Enable phone verification with OTP codes

- Ensure users’ ages meet your platform requirements

- Use live image recognition to ensure uploaded IDs match the person submitting them

Proactive risk monitoring & fraud prevention

Stay ahead of fraud with intelligent detection that spots threats before they turn into losses.

- Track suspicious activity such as data inconsistencies, frequent profile changes, or unusual logins

- Build custom workflows to auto-flag high-risk activity and block bad actors

- Centralize data with detailed recipient profiles, including risk status and scores

Built-in risk management

Ensure payouts are safe, compliant, and traceable by verifying transactions before release.

- Screen individuals and entities automatically with AML/CTF checks across global watchlists (OFAC, EU, OSFI, HMT)

- Assign dynamic risk scores to every payout based on screenings and suspicious activity

- Re-verify profiles whenever recipient details change or risk profiles trigger new checks

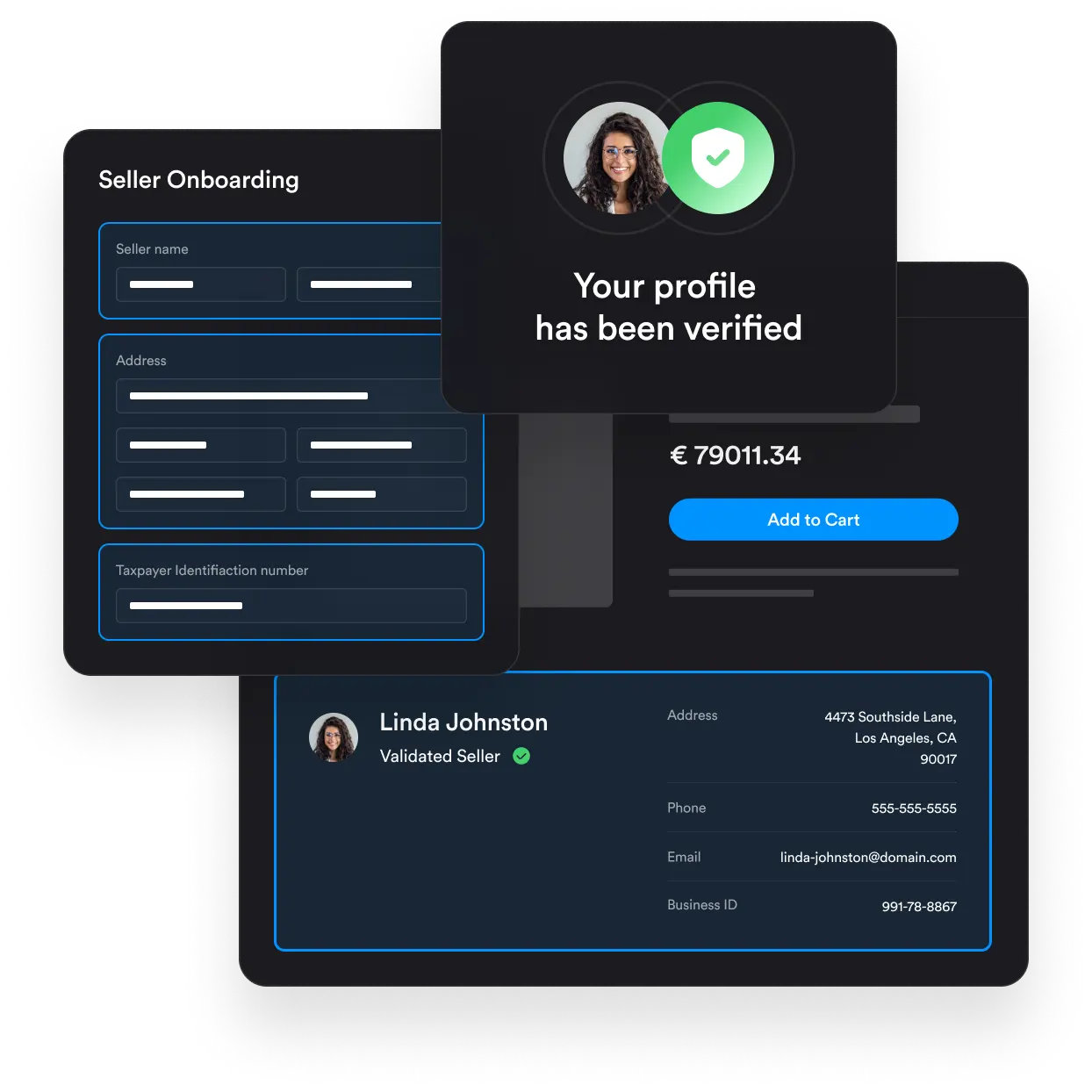

Global compliance automation

Automate multiple compliance processes and reduce the burden of manual reviews.

- Run detailed KYC/KYB checks on individuals and businesses worldwide

- Collect and validate TINs & FTINs across jurisdictions with built-in tax form workflows

- Stay compliant with the DSA, INFORM Act, and other evolving global frameworks

Bank-level security at every step

Rest easy knowing we’re following the highest global standards for managing customer funds and sensitive data.

Adopt the RecipientOps platform built for Risk & Safety teams

Learn why the industry’s best trust Trolley.