If you’ve worked with contractors or freelancers for any amount of time, chances are that you’re familiar with 1099 forms. For a long time, the 1099-MISC IRS form was the primary IRS tax form used to report earnings paid to “non-employees,” however that has changed over the last few years, making it important to understand the current purpose of the 1099-MISC form.

Due to the rise of freelance/gig work over the last decade, the US government has made it increasingly clear that reporting this type of employment to the IRS is critical. For example, look at the changes made to 1099-MISC in tax year 2020.

Until 2020 (taxes reported in early 2021), businesses would use IRS form 1099-MISC (Miscellaneous Income) to report payments made for freelance/contractor work. This “catch-all” form basically put freelance income and employment in the same category as rent payments, legal settlements, and winnings.

However, in a move intended to raise the profile of contract, freelance, and other types of nonemployee work, the IRS actually de-retired a form that was last used in the 1980s, Form 1099-NEC, Nonemployee Compensation.

However the 1099-MISC was not retired, and while no longer used to report payments to “nonemployees,” there are still many reasons why a business may need to report 1099-MISC earnings paid out to recipients in a given tax year.

Here’s what you need to know about the 1099-MISC form.

Table of contents

What is a 1099-MISC?

Form 1099-MISC (Miscellaneous Income) is what’s known as an informational return, a tax form produced by businesses that have made payments to others.

Unlike many of the other 1099 forms that have specific purposes, the 1099-MISC form is a sort of “catch-all” form that is used for businesses to report all other payments and incomes that include (but are not limited to):

- Rent payments

- Royalties

- Prizes and awards

- Legal settlements

- Medical and health care payments

Any businesses and services that make miscellaneous payments to individuals or businesses must complete and file form 1099-MISC with the IRS.

1099-MISC Reporting Requirements

Generally, there is a minimum total amount of 1099-MISC payments that business has paid to a single person/organization before they are required to produce and provide a 1099-MISC.

- This minimum is $600 or more in a given tax year

- Note: There is one major exception: Royalties

- The minimum amount of royalties paid in a tax year to trigger the production and filing of a 1099-MISC is $10

There are many exemptions for the 1099-MISC form, such as:

- Corporations (S corporations or C corporations)

- Payments and business travel to employees

- Rent to rental agents

- Merchandise and similar items

Note: Discuss these statuses with your payee during onboarding to simplify your information gathering and reporting process during tax season.

The Importance of Reporting Royalty Payments on Form 1099-MISC

Royalty payments are a common form of income across various industries, including entertainment, publishing, and natural resources. The IRS requires businesses to report royalty payments exceeding $10 in a tax year using Form 1099-MISC.

The threshold for reporting royalties on Form 1099-MISC is relatively low, which means that even small royalty payments need to be documented and reported. This requirement helps the IRS track income generated from intellectual property, natural resource extraction, and other sources.

Royalty payments can come from diverse sources, including:

- Entertainment Industry: In the music industry, royalties are commonly paid for the use of copyrighted songs. These can include mechanical royalties for the reproduction of music on CDs, streaming platforms, and digital downloads, as well as performance royalties for live performances, radio airplay, and online streaming.

- Publishing: Authors receive royalties from the sales of their books, whether in print or digital format. Additionally, photographers, illustrators, and other creators may receive royalties for the use of their work in publications.

- Natural Resources: Companies that extract oil, gas, minerals, or other natural resources often pay royalties to the owners of the land or mineral rights. These payments are typically based on the volume or value of resources extracted.

- Franchise Fees: Franchise operators may pay royalties to the franchisor for the use of their brand, trademarks, and business systems.

- Licensing Agreements: Companies may pay royalties to license intellectual property such as trademarks, patents, or software.

Regardless of the industry, it’s essential for businesses to accurately report royalty payments on Form 1099-MISC to avoid potential penalties for non-compliance. By keeping thorough records and timely filing the necessary tax forms, both payers and recipients of royalties can fulfill their tax obligations and maintain good standing with the IRS.

1099-MISC Filing Deadlines

As a business, you’re responsible for sending a copy of the 1099-MISC form not only to the IRS but also to any person to whom the payments were made. Freelancers and other independent contractors need the information on this form to help them pay their own taxes.

The deadline for sending a 1099-MISC form to their recipients is January 31, but it’s best to send it off as soon as possible to give these individuals enough time to file their taxes.

The due date for filing this form with the IRS is March 1 if you file by paper.

NOTE 1: If you file electronically you have an extra month to file a 1099-MISC. The e-file due date is March 31.

Note 2: The IRS mandates that if you want to email documents, the recipient needs to have consented to receive the form via email, and the consent must have been sent through that same medium. So, emailing Form 1099-MISC requires an email from your vendor saying they authorize email as a method of delivery.

The IRS provides more detailed instructions in their General Instructions for Certain Information Returns guide.

Changes to the use of 1099-MISC for freelancers

Previously to 2020, freelancers would have received 1099-MISC forms from anyone who paid them during a given tax year. However, now the IRS mandates that those payments are reported on a 1099-NEC form.

What is a 1099-NEC?

The 1099-NEC (Nonemployee Compensation) is an IRS form that was re-introduced in 2020 for businesses to report non-employee compensation, such as independent contractor payments.

In general, you must report payments of more than $600 a year on a 1099-NEC form for:

- Independent contractors: Writers, designers, editors, etc.

- Professional services: Accountants, lawyers, consultants, etc.

- Services including payment for materials used for the services

- Commissions paid to non-employee salespeople

For more details, see our article explaining What is Form-1099 NEC?

Note 1: If your contractor is registered as a C corporation or S corporation, a 1099-NEC is not be required for that specific contractor.

Note 2: Employers must fill out a W-2 form for employees on their payroll. It’s important to know the difference between employees & non-employees and properly classify all filings, or the IRS may hit you with some strict penalties.

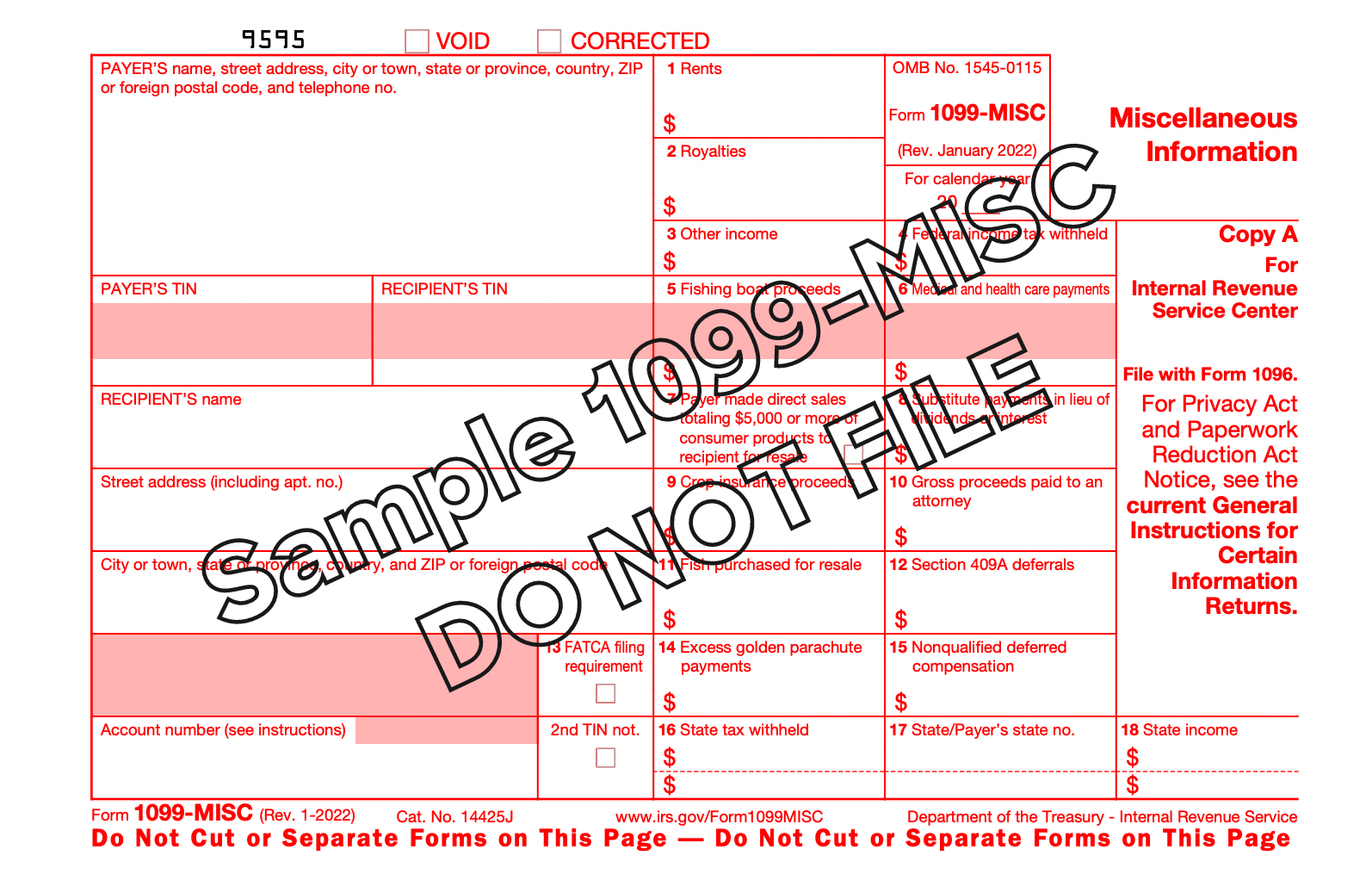

How to complete a 1099-MISC form

To fill a 1099-MISC form, you’ll first need to obtain a copy. You can get a copy of the form directly from the IRS, tax businesses, tax software providers, or other tax services professionals.

When you fill out this form, make sure you have the following information about the recipient:

- Name of the recipient

- Total amount paid

- Address

- Taxpayer ID

Note: This information is gathered when your recipient completes a W-9, Request for Taxpayer Identification Number and Certification. If you think there is a possibility that you may make over $600 in payments to any given recipient in a tax year, it is important to obtain a completed W-9.

Besides your payments, your 1099-MISC should contain your company’s identifying information information, including:

- Name

- Address

- Social security number or employer identification number

The form classifies each type of payment into different categories in boxes. These boxes include:

- Rent (box 1)

- Prizes and awards (box 3)

- Nonqualified deferred compensation (box 14)

Check and fill in each box that applies to you. This information will also help you calculate how much federal income tax you owe that year.

When you fill out a 1099-MISC form, you’ll have two copies: Copy A and Copy B. Copy A goes to the IRS, while Copy B is provided to the recipient of the payment.

Summing it all up

The importance of IRS Form 1099-MISC (Miscellaneous Income) has shifted in the last few years. While it’s not used for payments to contractors any longer, it is still very important for other forms of payment (rent, legal settlements, royalties.)

Trolley can help streamline the entire 1099 process with automated year-end 1099 generation based on payments made through Trolley throughout the year. As result, you can expect:

- Less administrative work

- Minimal to no errors

- Peace of mind knowing that your 1099s will be completed, distributed and filed on time.

We welcome you to come back and refer to this guide on form 1099-MISC whenever you need it!

Simplify contractor tax compliance with Trolley

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.

See Trolley Tax in action: Take the Trolley Tax tour

Book a demo of Trolley’s tax features today >

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.