Trust-powered

payouts

Expedite trust building and drive your expansion by managing fraud, local compliance, and payment risks from a single, streamlined platform.

Build trust and safety on your platform

Providing a fully integrated user

Verify recipient IDs, business details, phone number, address, and tax ID numbers

Identify bad actors with continuous screening based on IP, geolocation, and more

Built-in global AML & CFT screening which flexibly fit your workflows

Step up to the challenge of growing regulations from one streamlined platform

Onboard recipients with confidence

Verify and onboard payees from around the globe with a single tool. Meet the challenges of a growing regulatory framework with superior recipient onboarding, data collection, and verification processes.

- Collect recipient data such as address, business registration number and business documentation

- Verify recipient identity and business documents

- Collect and verify phone numbers

- Collect banking details for payouts

- Onboard tax information and generate signed tax forms for IRS (US) and DAC7 (EU)

- Build a single recipient profile for payouts, taxes, and customer trust

- Integrate verification data via API and webhooks to manage your workflows

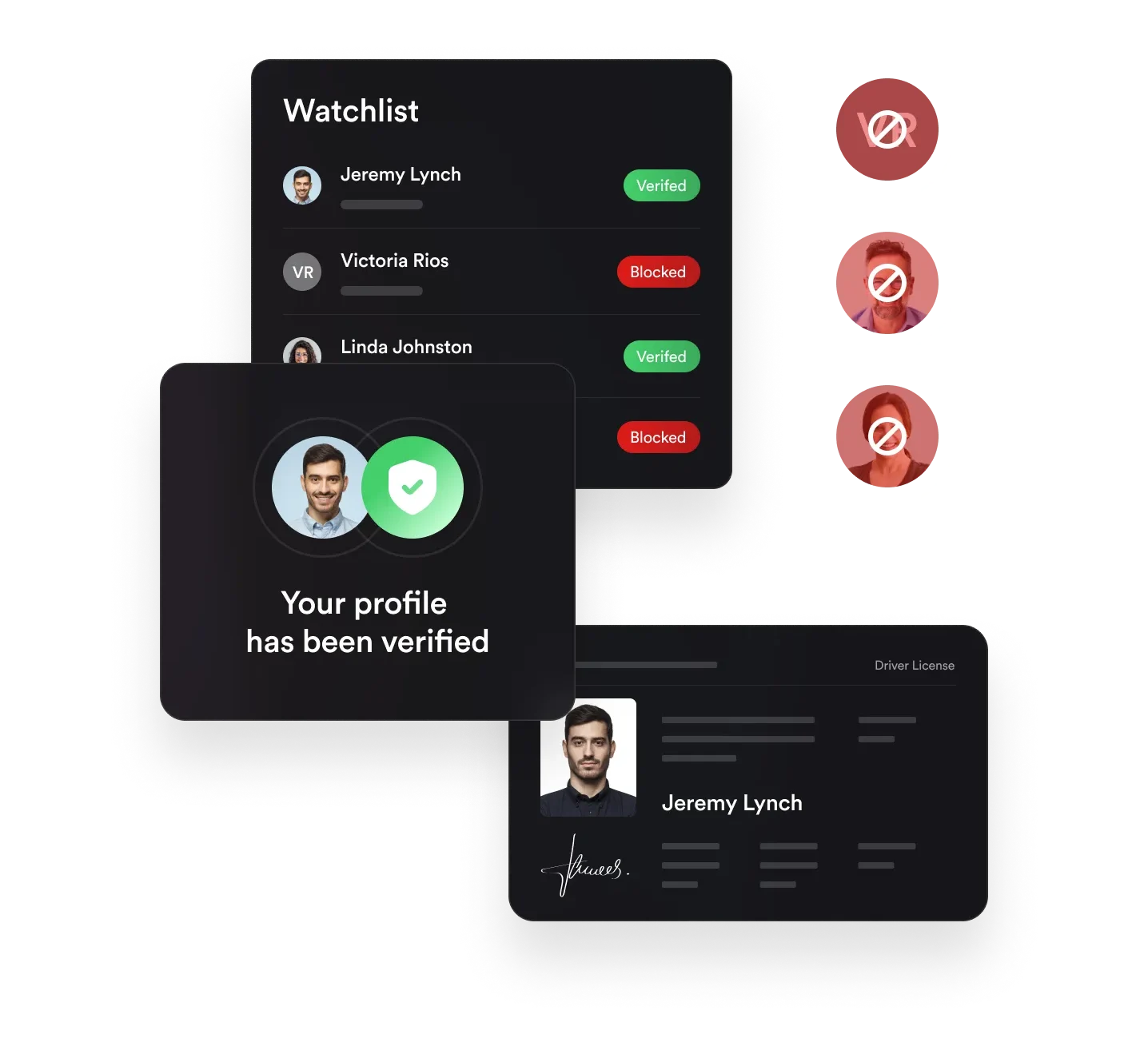

Know who you are paying

When your business is operating at scale, making payments to an unknown email or wallet puts your whole operation and your existing vendors at risk. Whether you work with individuals and/or businesses, Trolley allows you to verify identity and documents through a single workflow and use the same recipient profile for payouts, taxes, and risk management.

Individual verification (KYC)

Business verification (KYB)

Reinforce trust and safety on your platform

Scaling your platform comes with its challenges: as you grow and make more payouts, scammers may seek to profit. Put the tools in place to dissuade and block bad actors.

- Verify the authenticity of your recipients on your platform with a 2-step IDV process

- Continually screen activity like logins, IP addresses, geolocation, and more

- Screen bad actors based on authenticity

- Define workflows based on the level of trust required

- Ensure payouts are going to the right person and account by monitoring account activity

Built-in watchlist screening

Ensure every payment is good to go without having to add additional compliance, Anti-Money Laundering (AML), and Counter-Terrorism Financing (CTF) tools. Trolley has a built-in compliance engine that screens individuals and entities against all the necessary global watchlists (e.g. OFAC, EU, OSFI, HMT).

Trolley assigns a risk score to recipients and enables you to define workflows on how to handle every level of risk.

Seamlessly manage expanding regulations

A new generation of financial compliance regulations, such as the EU’s Digital Services Act (DSA) and USA’s INFORM Act. These are significant steps towards a safer digital environment and Trolley is at the forefront of embracing this change.

Comply with the INFORM Act

Collect, verify, and display seller data with varying requirements based on payment volumes.

Comply with the DSA

Automate seller onboarding and data collection processes with our DSA compliance toolkit.

Trust & bank-level security baked in at every step

Sleep easy knowing we’re following the highest global standards for managing customer funds and data.

The only payouts platform with built-in global compliance

Learn why the industry’s best trust Trolley.