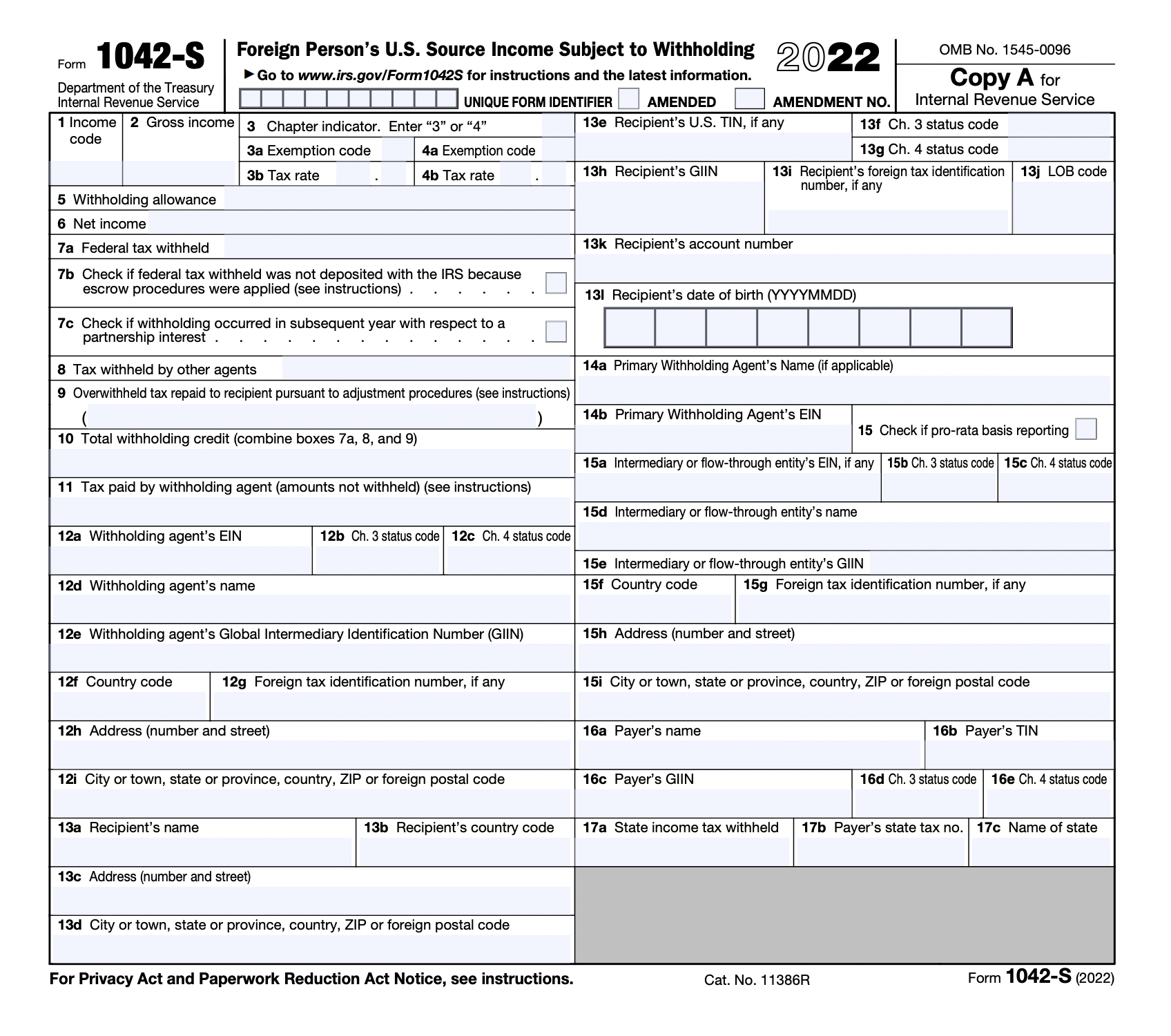

When your company engages foreign (non-U.S.) contractors and freelancers, you take on an obligation to report their earnings to the IRS and withhold the appropriate amount of taxes on each payment. This is recorded and reported each tax year via IRS Form 1042-S. Simply put, if a company based in the United States pays non-US citizens for their services, the company must provide them with a Form 1042-S and file this document with the IRS.

As organizations expand their recruitment efforts outside borders, being prepared to manage the tax withholding requirements when paying freelancers who aren’t U.S. citizens is critical to attracting (and paying) skilled workers from the global talent pool.

In our article “Working with foreign contractors: What is IRS Form W-8 BEN?” we discussed gathering the information required to establish a tax-compliant relationship with foreign contractors. In this article, we dive into Form 1042-s, the key document needed to report earnings paid to non-U.S. workers.

This article covers

What is Form 1042-S?

Even though they are non-citizens, foreigners who earn income in the U.S. or from a U.S. company need to report and pay taxes on those payments.

The company or person making the payment is required to withhold an appropriate amount—based on the tax treaties in place.

- If there is no tax treaty between the US and the country of residence, the general withholding tax rate is 30%.

- Suppose a tax treaty exists between the United States and the payee’s country of residence (for example there was a new tax treaty signed between the United States and Spain in 2019). In that case, the company making the payment can reduce the total withholding tax to the amount noted in details of the tax treaty.

- Then the payee manages taxes with their government instead of with the IRS.

This reporting is done via form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, is an IRS form that belongs to the 1042 series of forms.

No matter their taxable status, Form 1042-S is an IRS form that individuals, corporations, and institutions in the United States must complete at the end of the year to record and report to the IRS the amounts they paid to—and withheld from—their non-citizen, nonresident workers.

The affected parties include,

- Nonresident aliens,

- foreign partnerships,

- foreign businesses,

- foreign estates,

- and foreign trusts.

For example, if a company is situated in the United States and hires a graphic designer in India and a content writer in London, it needs to file Form 1042-S for each employee at the end of the year.

Types of income reportable on form 1042-S

Unlike the 1099 series of forms used when paying a U.S. contractor, each related to particular types of income, a separate 1042-S form is required for each type of income paid as there may be different withholding amounts dependent on the kind of income.

The following are some of the different types of revenue that are reported on 1042-S forms:

- Royalties

- Services conducted in the United States

- Scholarships

- Corporations in the United States pay dividends to their shareholders.

- Real estate earnings

- Income from a pension

- Winnings from gambling

- Interest paid on deposits.

- Premiums for insurance

Form 1042-S does not have a minimum payment threshold. Whether a foreign freelancer is paid $100 per year or $10,000 per year, the IRS still expects a report.

In contrast, only when a company pays a U.S.-based freelancer over $600 must it provide them with a Form 1099-NEC. This is a significant distinction to be aware of if a company hires freelancers both in the United States and abroad.

Who receives a 1042-S?

Even if a company’s payments to their contractors were eventually exempt from withholding tax due to a tax treaty or taxation exception, any U.S. person, corporation, or institution that provides income to non-citizen individuals must file a Form 1042-S.

Nonresidents of the United States who receive money from any source in the United States, including passive sources like interest, should receive and then file a 1042-S for each type of income. The 1042-S form is typically used by:

- foreign-based freelancers & contractors,

- International artists & creatives offering services in the United States,

- international students & postdoctoral fellows at American colleges,

- and employees who are nonresident aliens under a tax treaty.

An organization must a) provide the completed Form 1042-S to the person who received the payments and b) file it with the IRS.

The most accurate way to determine who should receive 1042-S forms from the organization is to verify if those individuals or merchants have submitted a W-9 or W-8 BEN form. The W-8 BEN is an IRS-mandated form used to collect accurate Nonresident Alien (NRA) taxpayer information and document their status for withholding tax and reporting reasons.

1042-S submission & filing deadlines

In general, form 1042-S must be filed with the IRS by March 15 (March 15, 2022, for tax-year 2021), whether on paper or electronically. By March 15, the company must additionally provide Form 1042-S to the income receiver for their personal filing purposes.

Penalties for late 1042-S submission

Unless a company can prove that the omission was due to reasonable cause and not intentional negligence, failing to file complete and proper 1042-S forms for each foreign person the firm pays could result in a penalty.

In 2022, the penalty for filing form 1042-S late (between 1 and 30 days late) is expected to be roughly $50 per form. For forms more than 31 days late—until August 1—the penalty increases to $110 per form. The penalty increases to $280 per form if the firm submits the documents after August 1.

If the IRS finds out the firm didn’t file the forms on purpose, the penalty can rise to $560 per form, or 10% of the total amount of items that must be reported, with no maximum penalty.

To avoid paying the penalty, a firm can ask the IRS for an extension if it needs additional time to file Form 1042-S. The firm must file Form 8809 (Application for Extension of Time to File Information Returns) by March 15 to request more time.

Differences between forms 1042S and 1099 (NEC, K, MISC)

The payee’s residence is the critical difference between the 1042 & 1099 series of IRS forms.

The 1099 series is intended to record and report different types of income & payments, such as Nonemployee Compensation (1099-NEC), Payment Card and Third Party Network Transactions (1099-K), and Miscellaneous Income (1099-MISC), made to U.S. citizens and businesses only.

On the other hand, Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, is used to report income paid to a nonresident whether or not the payment is taxable.

Summing it all up

To recap, form 1042-S is used to report income earned paid to a foreign contractor by a U.S.-based entity. It is critical for both the employer and the contractor as it is the key record to report and file taxes for all payments made throughout the year. It also details the total that the employer withheld from their foreign payees, including handling of tax exemptions and tax treaties in place.

With numerous different tax treaties between the United States and other nations, it is vital for companies working with foreign contractors to focus on developing robust procedures for W-8 collection and validation. They should also promptly produce and distribute their 1042-S forms to avoid late filing penalties.

Trolley removes the heavy lifting and automates the whole international contractor tax process.

With a built-in recipient onboarding portal, recipients can self-complete their W-8 form online, with the data they enter validated by Trolley. Our system applies the correct withholding tax rates to all payments, and when it’s time to prepare your tax filings, you can review all payments made over the past 12 months and generate all of your 1042-S forms from the Trolley dashboard. As a result, you can expect:

- Less administrative work

- Minimal to no errors

- Peace of mind knowing that withholdings are correct and 1042-S forms will be completed, distributed and filed on time.

We welcome you to come back and refer to this guide on Form 1042-S whenever you need it!

Simplify contractor tax compliance with Trolley

Trolley was built to make taxes easy for businesses and the people they pay. From automated W-8 & W-9 collection to the distribution of end-of-year IRS forms, Trolley takes the hassle out of 1042-S & 1099s so you can focus on what you do best.

See Trolley Tax in action: Take the Trolley Tax tour

Book a demo of Trolley’s tax features today >

This article is intended for educational and informational purposes only. Through the publication of this article, Trolley is not offering any legal, taxation, or business advice. We strongly encourage each reader to consult with their relevant lawyer, accountant, or business advisors with respect to the content of this post. Trolley assumes no liability for any actions taken based on the content of this or other articles.